Summary:

- Exxon Mobil Corporation’s Q3 earnings fell short of expectations, leading to a decline in its stock price.

- The company’s financial performance was impacted by lower energy prices, particularly crude oil.

- Exxon Mobil’s acquisition of Pioneer Natural Resources Company and strong downstream performance offer some positive prospects for future growth.

- The long-term fundamentals for crude oil point to a major supply-demand imbalance that will almost certainly cause prices to increase over time.

- Exxon Mobil boasts an incredibly strong balance sheet and strong cash flows.

ronniechua

On Friday, October 27, 2023, oil and gas supermajor Exxon Mobil Corporation (NYSE:XOM, “ExxonMobil”) announced its third quarter 2023 earnings results. At first glance, these results were quite disappointing, as the company failed to meet the expectations of its analysts in terms of either top line revenue or bottom line earnings. For its part, the market appeared to agree with this assessment as it sold off shares of ExxonMobil following the results announcement. Over the past five days, ExxonMobil has underperformed the global energy index (IXC) largely due to its decline on Friday:

We can see that ExxonMobil did manage to slightly outperform the U.S. Energy Index (IYE) over the period, but ExxonMobil itself is such a large component of that index that its relative performance is not very illustrative. After all, ExxonMobil by itself is 22.06% of the U.S. Energy Index so the two will almost always have somewhat comparable performance.

While the company’s results were clearly not as impressive as most investors would have liked to see, it was not a total loss. Indeed, there are certainly some positive things here. In particular, ExxonMobil is about to gain a significant foothold in American shale with the acquisition of Pioneer Natural Resources Company (PXD) and delivered very strong downstream performance. There may also be reasons to expect that the company’s financial performance will improve over the coming quarters due to the supportive environment for energy prices.

Earnings Results Analysis

As long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from ExxonMobil’s third-quarter earnings results:

- ExxonMobil reported total revenues of $89.303 billion during the third quarter of 2023. This represents a 16.42% decline over the $106.851 billion that the company brought in during the prior year quarter.

- The company reported an operating income of $12.411 billion during the most recent quarter. This represents a 41.21% decline over the $21.109 billion that the company reported in the year-ago quarter.

- ExxonMobil produced an average of 3.688 million barrels of oil equivalent per day during the reporting period. This compares somewhat unfavorably to the 3.716 million barrels of oil equivalent that the company produced on average during the corresponding quarter of last year.

- The company announced an agreement to merge with Pioneer Natural Resources, which is one of the largest independent upstream companies in the Permian Basin of West Texas.

- ExxonMobil reported a net income of $9.070 billion during the third quarter of 2023. This represents a substantial 53.87% decline over the $19.660 billion that the company earned during the equivalent quarter of last year.

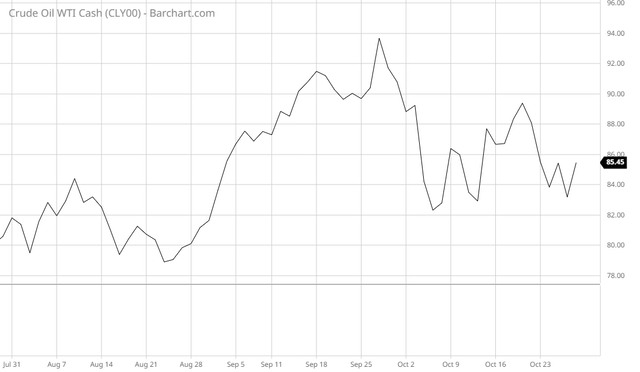

It seems essentially certain that the first thing that anyone reviewing these highlights will notice is that every major measure of financial performance showed weakness compared to the prior-year quarter. As was the case with TotalEnergies SE (TTE), which delivered similar year-over-year weakness, one of the major causes of this was energy prices. As we can see here, crude oil prices were on average lower during the third quarter of this year than they were during the equivalent quarter of last year:

ExxonMobil’s financial results are very linked to crude oil prices because this is the primary product that the company produces. During the third quarter, the company’s upstream segment had earnings of $6.139 billion against $9.117 billion for the company as a whole:

| Business Segment | Earnings (Millions of U.S. Dollars) |

| Upstream | $6,139 |

| Energy Products | $2,475 |

| Chemical Products | $249 |

| Specialty Products | $619 |

| Corporate and Financing | ($365) |

| Total | $9,117 |

Thus, the upstream segment accounts for 67.33% of ExxonMobil’s earnings. The upstream segment is the business unit whose primary business activity is producing oil and gas. However, it is weighted more towards crude oil than towards natural gas. During the third quarter, ExxonMobil produced an average of 2.397 million barrels of crude oil per day, which accounts for 64.99% of the company’s total 3.688 million barrels of oil-equivalent average daily production. As such, we can clearly see that crude oil is by far the most important product for the company and thus the price of this commodity has a significant impact on ExxonMobil’s revenues. After all, the selling price of this commodity causes the company’s revenues to fluctuate to an outsized proportion, directly impacting the amount of money that ExxonMobil has available to cover its fixed expenses and ultimately make its way down to profits.

As we can see in the chart above, the price of crude oil has been climbing since mid-July. It has begun to moderate recently though. As we can see here, West Texas Intermediate crude oil spot prices peaked in late September and have been range-bound to declining since that time:

This is largely caused by two factors:

- Fears that the United States will enter into a recession

- A rising U.S. dollar driven by a large fiscal deficit and static money supply.

However, the price weakness for crude oil over the past month is misleading. This is because the supply-demand balance for the commodity is extremely tight. As I pointed out in a recent article, the Organization of Petroleum Exporting Countries plus Russia implemented a series of production cuts that have kept the global production of crude oil from exceeding consumption. Those cuts are in effect until the end of this year, but the organization may decide to keep them in effect for longer than this. However, long-term the price of crude oil will undoubtedly rise.

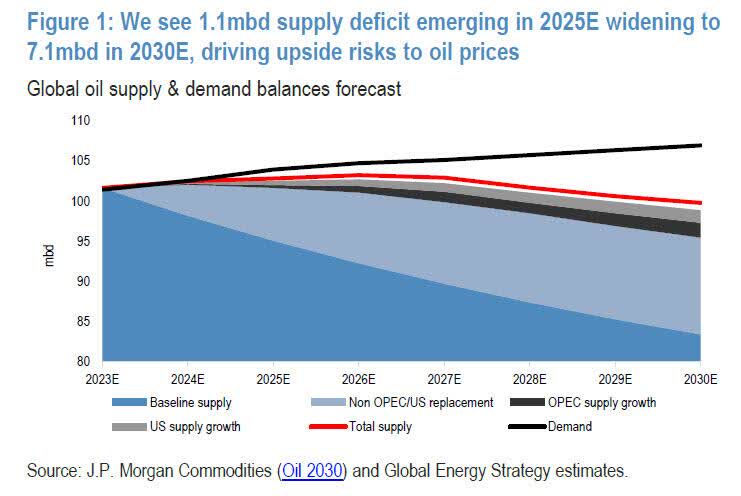

This is because, contrary to popular belief, the global demand for crude oil has not peaked. In fact, it is projected to continue to rise until at least 2030 and possibly through 2045. However, production cannot keep pace with this due to the fact that the energy industry has been underinvesting in production capacity for nearly a decade. Thus, global crude oil production will peak sometime around 2025 and then start declining. JPMorgan (JPM) is currently projecting a 1.1 million barrel per day supply shortage in 2025 that widens to a 7.1 million barrel per day deficit by 2030:

Zero Hedge/Data from JP Morgan Commodities Research

The law of supply and demand states that this should cause the price of crude oil to rise, possibly substantially. It is difficult to predict how high crude oil will go though, since the Organization of Petroleum Exporting Countries will probably not want oil to go above $150 per barrel as prices that are too high will stimulate research into alternative energy sources. At the same time, the international organization does not have sufficient excess capacity to cover a 7.1 million barrel per day shortage so there might be little that it can do to control prices long term. Thus, it seems likely that energy prices will trend upward regardless of what the market may be saying right now. This is obviously good for ExxonMobil.

Acquisition Of Pioneer Natural Resources

ExxonMobil made a very big deal of its pending acquisition of Pioneer Natural Resources during its earnings presentation. In the Q3 earnings conference call, Senior Vice President Neil Chapman said:

As we said with you recently, Pioneer is arguably the best Permian pure play company with the largest undeveloped Tier 1 inventory in the Midland basin. Pioneer’s premier asset base is matched by the quality of its workforce. Its employees are innovative and hard working and possess a deep knowledge of unconventional operations in the Permian. When you combine these attributes with our technology and industry-leading operational capabilities, we’re confident we can unlock far more value together than either of us could do alone.

We expect synergies of approximately $1 billion before tax annually, beginning in the second year post closing, and an average of about $2 billion per year over the next decade driving double-digit returns. This transaction not only strengthens our current position but it also transforms our portfolio, increasing our exposure to short cycle low cost to supply liquids in the United States. Based on our initial assessment, we expect our combined Permian production to increase to approximately 2 million oil-equivalent barrels by the end of 2027. Downstream, this merger also increases the integration between high value light Permian crude and our premier refinery and chemical footprint on the U.S. Gulf Coast.

Admittedly, some of this may be marketing hype. After all, executives tend to talk up acquisitions to their investors when it is a deal that they want the shareholders to approve. Indeed, it is still not certain whether or not this deal will even go through. As CNN points out, the Biden Administration has been somewhat less friendly towards merger and acquisition activity than some past administrations have been. It may apply even more scrutiny to a deal by a major oil company due to the impact that high energy prices are having on the American economy and the ability of consumers to engage in discretionary spending.

Nevertheless, ExxonMobil’s management is confident that this deal will go through and will benefit shareholders. I do agree that there could be some benefits here as Pioneer is indeed probably one of the best independent operators in the Permian and combining it with ExxonMobil’s integrated energy value chain could ultimately bring some value to shareholders.

At the same time though, Pioneer Natural Resources shareholders may have to sacrifice some things. Pioneer Natural Resources is one of the shale companies that has committed to returning at least 75% of its free cash flow to its shareholders over the past two years. This has caused the company to frequently boast a better yield than ExxonMobil’s 3.60%, which is actually pretty low for the energy sector. The fact that Pioneer Natural Resources’ dividend tends to vary with energy prices makes it act somewhat as a hedge for high energy prices since the dividends will help offset some of the extra money that they would have to pay in their capacity as consumers of crude oil when energy prices get high. ExxonMobil’s dividend does not vary based on the company’s financial performance so it does not provide the same benefit, although its share price will usually increase along with energy prices.

Financial Considerations

As I have pointed out in various previous articles,

It is always important to analyze the way that a company is financing its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. That is typically accomplished by issuing new debt and using the proceeds to repay the existing debt. After all, very few companies have sufficient cash on hand to completely repay their debt as it comes due. This process can cause a company’s interest expenses to increase following the rollover depending on the conditions in the market. That is something that could be very important today since interest rates are currently at the highest levels that we have seen since 2001.

ExxonMobil has long been known for having a remarkably conservative financial structure with minimal amounts of debt. We can see that quite clearly by looking at the company’s net debt-to-equity ratio.

As of September 30, 2023, ExxonMobil has a net debt of $8.3090 billion compared to $207.5330 billion in shareholders’ equity. This gives the company a net debt-to-equity ratio of 0.04 today. That is an incredibly low ratio, to say the least. Here is how ExxonMobil’s net debt-to-equity ratio compares to that of its peers:

| Company | Net Debt-to-Equity Ratio |

| ExxonMobil Corporation | 0.04 |

| Chevron Corporation (CVX) | 0.07 |

| TotalEnergies SE (TTE) | 0.23 |

| Equinor ASA (EQNR) | 0.30 |

| Eni S.p.A. (E) | 0.25 |

As we can see, ExxonMobil compares very well to its peers in this respect. The company’s incredibly low net debt-to-equity ratio should mean that it will not have to worry too much about interest rates or any other problems that come with a high level of leverage. This is exactly the kind of thing that shareholders should appreciate, especially right now considering that rising energy prices are a significant contributor to the high level of inflation that has been forcing central banks around the world to raise their benchmark rates in the first place.

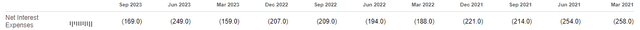

One of the surprising things about ExxonMobil is that its net interest expenses have actually been declining despite the fact that rates have been rising. In the most recent quarter, ExxonMobil had net interest expenses of $169.0 million, which is less than the company was paying back in 2021 when interest rates were a lot lower:

This comes from the fact that the company has been using its strong cash flow over the past few years to aggressively pay down its debt. Indeed, the company’s net debt in the most recent quarter stood at $8.309 billion compared to $59.807 billion in the first quarter of 2021. Thus, the company only has to pay interest on a much lower amount of debt than it had in the past. This obviously more than offsets the fact that the effective interest rates that the company pays on its debt are much higher than they were a few years ago.

In short, the takeaway here is that we do not need to worry very much about ExxonMobil’s debt load. The company is in very good shape.

Dividend Analysis

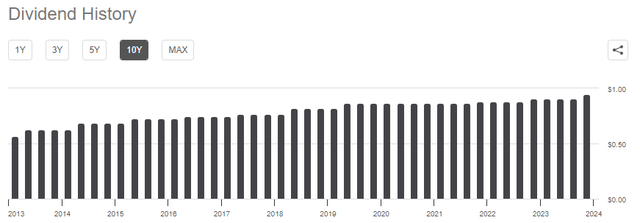

ExxonMobil has long been one of the favorite stocks of dividend investors. The reason for this is certainly not its high yield, as the 3.60% yield is lower than some other energy companies possess. Indeed, it is not very impressive for this sector. Rather, the company’s attractiveness comes from the fact that the company has a very long track record of increasing its dividend on a regular basis:

This is something that is especially attractive in today’s inflationary environment because the dividend growth over time helps to offset the fact that it costs more money to obtain the same goods and services. It also works quite well for those investors who are still building their wealth and are reinvesting the dividends. This comes from the compounding effect as the number of shares owned increases along with the dividend.

As is always the case though, it is critical that we ensure that ExxonMobil can actually afford the dividend that it pays out to the shareholders. After all, we do not want to be the victims of a dividend cut since that would reduce our incomes and almost certainly cause the share price to decline.

The usual way that we judge a company’s ability to pay its dividends is by looking at its free cash flow. During the twelve-month period that ended on September 30, 2023, ExxonMobil reported a levered free cash flow of $30.5649 billion but only paid out $14.8690 billion in dividends over the same period. Thus, the company’s ordinary operations are clearly generating sufficient cash to cover its dividends with a substantial amount of money left over for other purposes.

Overall, it does not appear that we need to worry too much about ExxonMobil’s dividend. The company should not have any real trouble carrying it going forward.

Valuation

According to Zacks Investment Research, ExxonMobil will grow its earnings per share at a 3.00% rate over the next three to five years. That gives the stock a price-to-earnings growth ratio of 3.76 at the current price. This is actually quite expensive for the energy industry. We can clearly see this by comparing ExxonMobil’s current valuation to its peers:

| Company | PEG Ratio |

| ExxonMobil Corporation | 3.76 |

| Chevron Corporation | 0.75 |

| TotalEnergies SE | 0.73 |

| Equinor ASA | 1.11 |

| Eni S.p.A. | N/A |

This does not generally look good for ExxonMobil. As I have pointed out in various previous articles and blog posts, many companies in the energy industry appear to be remarkably undervalued based on their earnings per share growth. However, the opposite looks to be true for ExxonMobil. With that said though, the reason for this is that analysts are projecting that ExxonMobil’s earnings per share growth will be substantially lower than that of its peers. Honestly, I cannot see any reason for that to be the case as the biggest driver of an energy company’s earnings growth is oil prices and no company has any real influence over crude oil prices. Thus, the company may prove to be a better investment than this valuation model suggests.

Conclusion

In conclusion, ExxonMobil’s results were decent although the company did lag its performance from last year. However, the long-term fundamentals remain quite solid here as energy prices are likely to increase over the next several years driven by an imbalance between supply and demand. ExxonMobil is continuing its long history of making strategic acquisitions by attempting to merge with Pioneer Natural Resources. As Pioneer Natural Resources is somewhat better for yield-focused investors and the Federal Government is somewhat unfriendly to big oil mergers right now, it is uncertain whether or not that deal will go through.

Nonetheless, ExxonMobil does not critically need it to succeed, as the company continues to boast a very strong balance sheet and a well-covered dividend. Overall, the company looks like a core holding for any energy investor.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long various energy-focused funds that may hold any stock mentioned in this article. I exercise no control over these funds and their holdings may change at any time without my knowledge.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!