Summary:

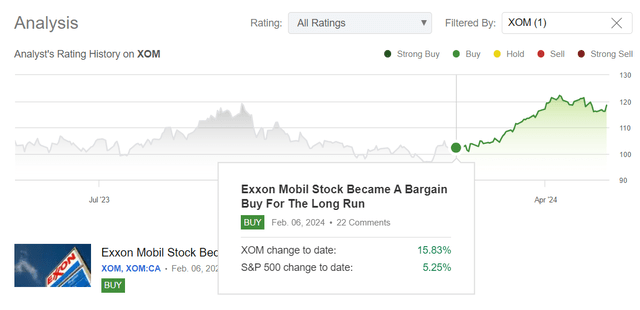

- Exxon Mobil stock has surged by 15.8% since my coverage initiation in early February, outperforming the market’s return by threefold. Does my thesis still hold? Read on.

- Q1 2024 earnings results showed lower earnings due to lower commodity prices, but revenue exceeded expectations. But there were definitely a lot of good things in Q1.

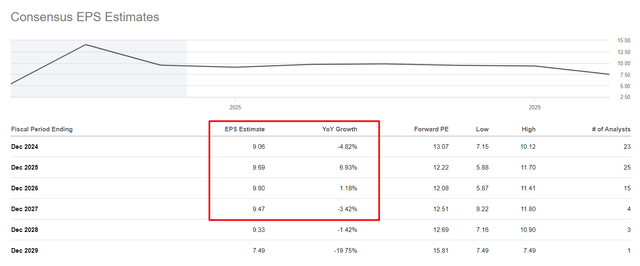

- Wall Street projects only 1.1% annual growth in EPS for XOM, well below the company’s target of 10% CAGR.

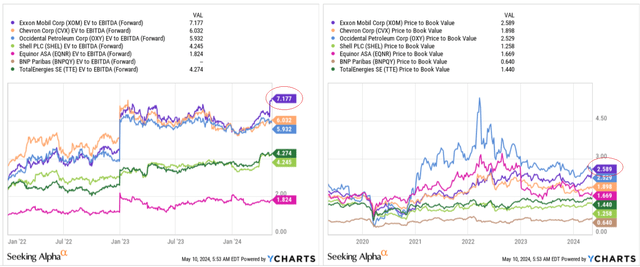

- Skeptics can rightly point to a comparable valuation and claim that XOM is by far the most expensive large-cap O&G company in its peer group.

- I hope management knows what it’s doing – as the largest oil producer in the region, I think Exxon will be able to offset most of the negative effects both in the commodities market and within the merged company. XOM is still a “Buy”, in my view.

zodebala

Introduction

In early February of this year, I began covering Exxon Mobil (NYSE:XOM) stock here on Seeking Alpha, and since then, the stock has surged by 15.8%, outperforming the market’s return by about threefold. Needless to say, I am incredibly pleased with this outcome.

Seeking Alpha, Oakoff’s coverage of XOM

My thesis at the time revolved around Exxon stock being a robust investment opportunity within the O&G sector as the company has maintained strong core earnings and is targeting significant cost savings despite challenges in the industry. High refining utilization rates suggested operational efficiency and robust product demand, while the consensus expectation of strong EBITDA coupled with a favorable EV/EBITDA multiple indicated a potential upside of 43% by the end of 2025.

It’s been about 3 months since my very 1st publication, so I believe it’s necessary to reassess my previous arguments and maybe discuss new developments.

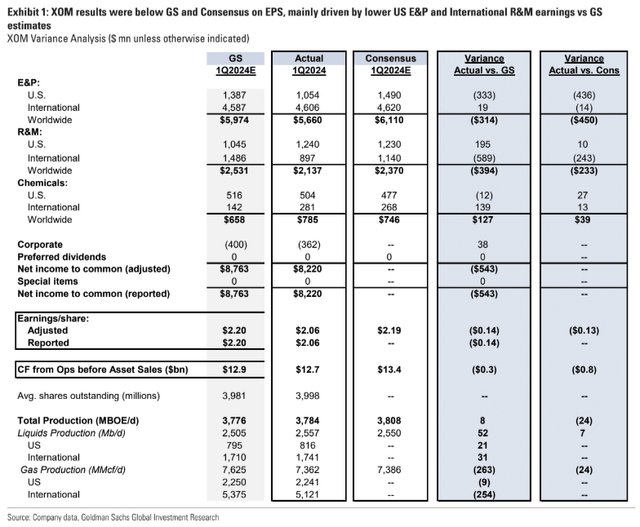

Q1 2024 Earnings Results Review

In Q1 2024, Exxon recorded net earnings of $8.2 billion, or $2.06 in adjusted EPS, missing the consensus estimate by $0.1 or 4.56%. The lower earnings primarily reflected the lower realized commodity prices for crude oil, natural gas, and natural gas liquids (NGLs) as well as the industry’s lower refining margins and seasonally higher costs. However, the revenue of $83.08 billion exceeded the consensus view by 1.93% – that was the first revenue beat for the past few quarters, based on Seeking Alpha data. Further details on how exactly the key financial figures for the first quarter compare to the consensus forecast are shown very clearly by the analysts at Goldman Sachs (proprietary source) in their post-earnings research report:

Goldman Sachs (proprietary source)

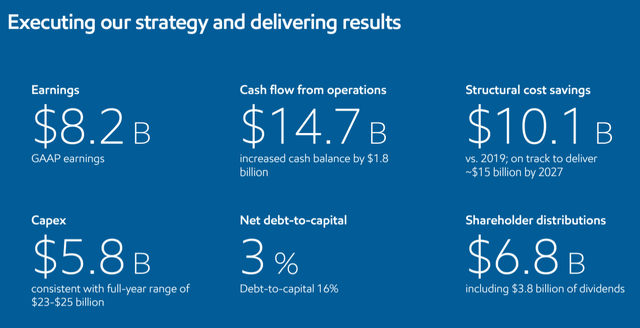

As you can see, both of the company’s key segments have generally failed to meet market expectations – the same applies to general XOM production during this period. But there were definitely a lot of good things in Q1. For example, Exxon generated $14.7 billion in cash flow from operating activities and surpassed a quarterly gross production milestone of >600,000 oil-equivalent barrels per day in Guyana, making a significant investment decision on the 6th major development project. Additionally, the company saw growth in performance chemical sales volumes and achieved a record-breaking first-quarter refining throughput, while also maintaining stellar turnaround performance. At the same time, the company has a fairly low debt burden in terms of net debt-to-capital, which reduces the risks to creditworthiness and liquidity. Compared to the pre-COVID times (FY2019), XOM writes about $10.1 billion in structural cost savings and plans to increase this to ~$15 billion by FY2027 “through reorganization and centralized activities”.

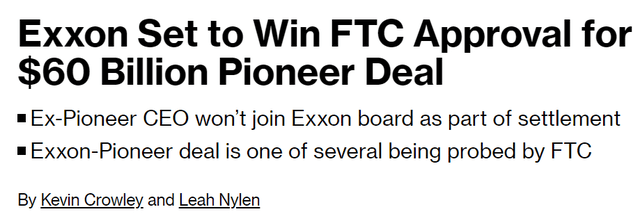

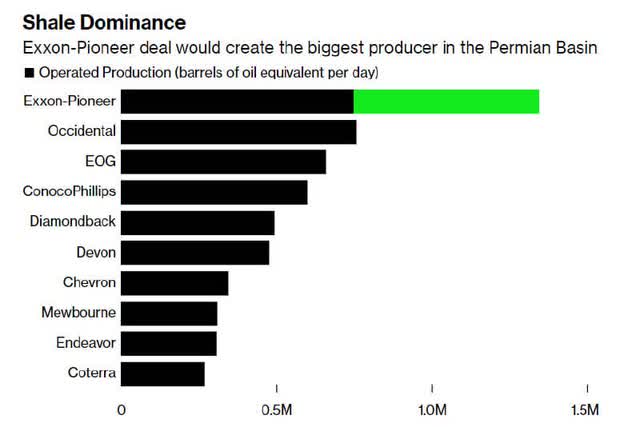

It’s not for nothing that I write that liquidity and credit risks looked lower after the first quarter results – the company is actively preparing for the $60 billion merger with Pioneer. The deal will make Exxon the largest oil and gas producer in the Permian Basin, and the largest oil field in the United States and North America as a whole.

In line with its strategic vision, Exxon is also actively investing in technologies to expand into new high-value and high-growth markets, such as advanced recycling, ProxximaTM, carbon materials, and direct air capture of carbon dioxide from the air. Exxon’s advanced recycling program aims to produce more than 1 billion lbs/year of recycled materials by FY2027, while ProxximaTM converts gasoline components into high-quality products that produce less than half the greenhouse gas emissions of conventional thermoset resins.

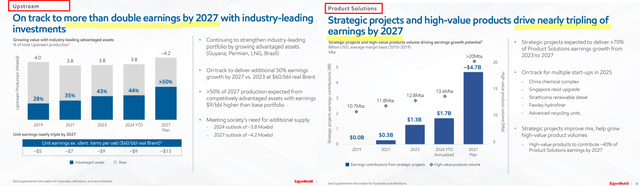

With a combination of, in my opinion, sensible investments in both technology development and the expansion of production through M&A activity, the company is going to achieve a 10% CAGR increase in earnings for the next few years according to the management’s plans. Achieving this target will mean a doubling or even tripling of earnings in selected key business areas:

XOM’s IR materials, Oakoff’s notes

At this point, we come to my current bullish update thesis, the results of which have led me to describe Exxon Mobil as “not as overvalued as you may think“.

Exxon Stock May Be Actually Undervalued

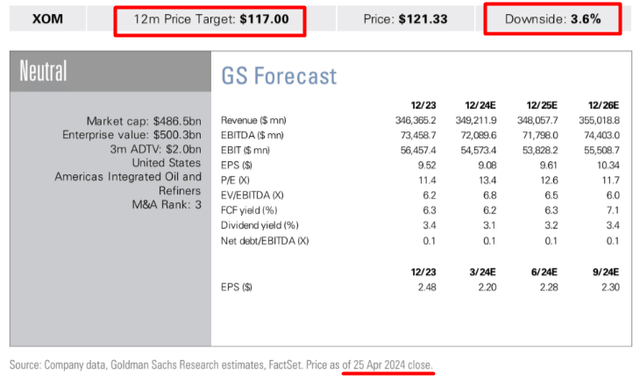

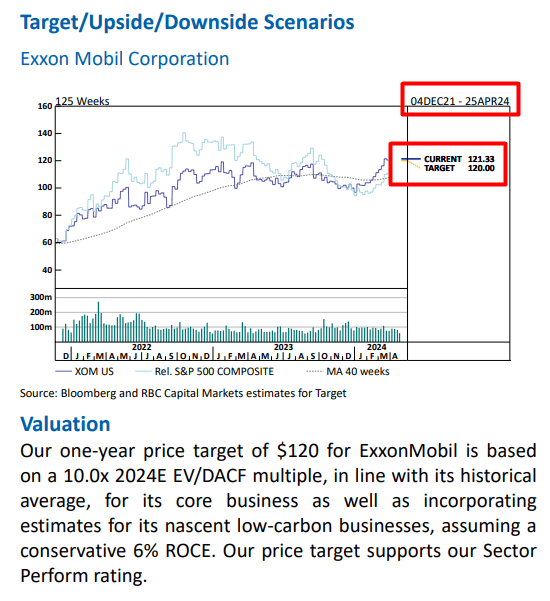

I assume you have often heard that XOM is an overvalued (or at best fairly valued) large-cap O&G stock with little upside potential in the coming months/year. This narrative is shaped by some research papers from major banks, among others – below I present valuation calculations from RBC and Goldman Sachs (proprietary sources) for you to see for yourself.

Goldman Sachs (proprietary source), Oakoff’s notes RBC (proprietary source), Oakoff’s notes

Here, one might wonder why the big banks are forecasting such modest or even pessimistic growth for XOM over the next 12 months. It seems as if they’re fixating on too short-term perspectives and comparative valuations with other companies. In addition, analysts may have doubts about Exxon Mobil’s potential to effectively reduce costs. Management’s plans to increase earnings by 10% annually over the next few years may seem ambitious, but the nearly 9x gap seems too wide.

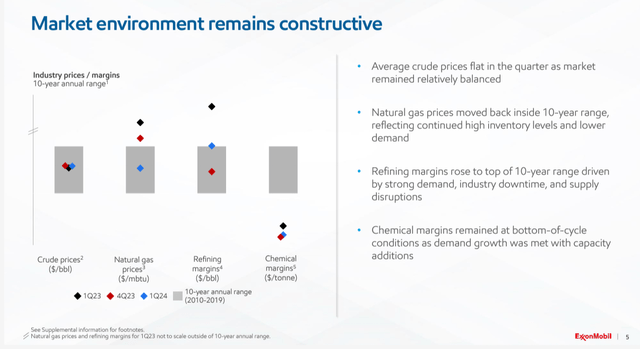

The problem with Wall Street’s calculations, in my opinion, is that they underestimate Exxon Mobil’s longer-term business growth. In many ways, few people believe in the possibility of more sustainable commodity market performance in the future – by which I mean, in particular, the ability of commodities important to XOM to remain in price. However, even against the backdrop of recent macroeconomic problems and fears of an economic slowdown, we see stability in this regard:

In my opinion, it is too early to bury the prospects for the use of oil – the replacement by renewable energy sources is progressing rapidly, but it’s still very early to talk about the complete displacement of oil. I think if there is a correction in the oil market, it probably won’t be of great magnitude. Yes, according to the latest EIA forecast, global oil demand is expected to grow less this year than previously thought and production is expected to grow faster than previously thought, which will lead to a more balanced market. But at the same time, there is no question of any serious demand fall.

The EIA now expects total world crude oil and liquid fuels production to rise by 970,000 barrels per day (bpd) to 102.76 million bpd this year, compared with its previous estimate of an 850,000 bpd increase.

World oil and liquid fuels consumption is now expected to grow by 920,000 bpd this year to 102.84 million bpd, slightly smaller than the 950,000 bpd growth forecast by EIA in the April update of its STEO.

I believe the company’s expectations for a 10% annual growth in net income are supported by the steady rise in global oil consumption.

First, according to forecasts from OPEC, oil-producing nations anticipate continued growth in consumption until 2045, despite predictions from some environmental activists of a decline and the potential demise of companies like Exxon Mobil.

OPEC expects world oil demand to reach 116 million barrels a day (bpd) by 2045, around 6 million bpd higher than expected in last year’s report, with growth led by China, India, other Asian nations, and Africa and the Middle East.

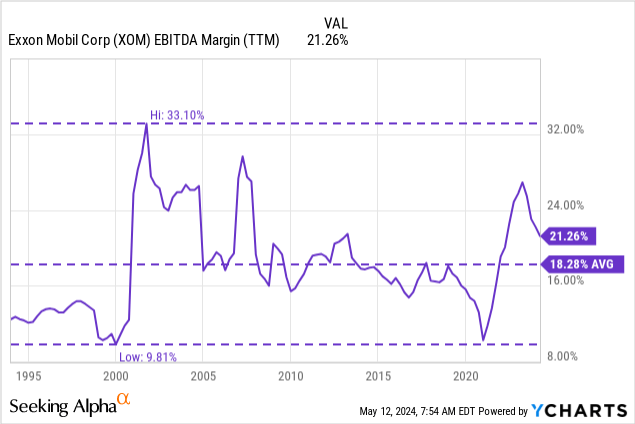

Source: Reuters, emphasis added

Second, if we look at the profitability of the company over the last 30 years, we see that the current EBITDA margin is average and not alarming. I think there is still room for improvement as the company hasn’t yet reached its peak margins given the current economic strength and emerging markets’ dynamics. I don’t see any significant catalysts that could push the EBITDA margin below 18-15%. The integration of Pioneer’s assets should go smoothly according to management. But even if we disregard management’s forecasts and assume that margins fall to average levels, I still see no good reason to expect a significant decline in sales and earnings per share. With increasing production volumes, both sales and net earnings per share should remain relatively stable.

Given a more balanced market without sharp price declines, all these points should theoretically support XOM’s initiatives to further reduce costs and integrate new assets – all for the sake of the targeted 10% annual earnings growth.

But Wall Street strongly doubts this. Look at the earnings estimates – over the next 4 years, XOM is only projected to grow earnings per share by 1.1% per year, which is 9 times below the company’s target. Again, the gap in expectations here looks unusually large.

It is this sharp discrepancy between what the company is aiming for and what the market expects of it that I believe leads to mispricing – XOM stock could actually be undervalued if the management’s plan is implemented at just 50% of the target.

Given the positive factors I described earlier, my opinion differs from Wall Street’s and is more bullish for the long term: I believe in thinking beyond the consensus in this case.

Risk Factors To Consider

Exxon Mobil has some risks that could prevent higher growth and which cannot be explained by my today’s reasoning. The most obvious risk is the high valuation. When I explain why I think XOM is undervalued based on the discrepancy between its true growth potential and Wall Street’s growth projections, skeptics can rightly point to a comparable valuation and claim that XOM is by far the most expensive large-cap O&G company in its peer group:

Exxon, akin to its peers, operates in a commodity industry where product prices are beyond its control. The company operates in countries characterized by corruption and political instability, but its widespread presence mitigates the risks associated with individual countries. In addition, Exxon faces transaction risks related to its acquisitions, particularly Pioneer Natural – I cannot be certain that Exxon will be able to successfully integrate Pioneer’s assets into its structure and that this acquisition will not result in increased costs and a disconnect from the company’s strategic plans for earnings growth.

Your Takeaway

Although XOM’s Q1 2024 earnings didn’t quite meet expectations regarding EPS, there were some bright spots, such as impressive project milestones in Guyana. Still, Wall Street is only expecting a meager 1.1% growth in EPS annually over the next 4 years, well below Exxon’s ambitious target of 10% CAGR. In my opinion, this suggests that the market may be underestimating XOM’s potential, undervaluing it despite its seemingly high valuation multiple as of today. The acquisition of Pioneer Natural is fraught with uncertainty: the question is how smooth the integration process will be and whether it’s in line with Exxon’s long-term growth targets. But I hope management knows what it’s doing – as the largest oil producer in the region, I think Exxon will be able to offset most of the negative effects both in the commodities market and within the merged company.

I reiterate my previous “Buy” rating today.

Good luck with your investments!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.