Summary:

- Exxon Mobil’s stock has gained 10.6% since a bullish article was published in December 2022.

- The company reported a significant drop in earnings due to lower oil and gas prices, weaker refining margins, and increased capital spending.

- Despite a tight oil market until early 2024, Exxon Mobil aims to triple its earnings by FY2027 through strategic projects.

- Exxon Mobil is a “Buy” because of a tight oil market, rising refining margins, strategic efficiency improvements, and attractive valuation with strong free cash flow.

Michael M. Santiago

Introduction

The only time I wrote about Exxon Mobil Corp. (NYSE:XOM) was on December 22, 2023, when the stock was trading at $107.9 and many investment banks began to revise their forecasts for the stock’s future growth potential. At that time, if you recall, oil prices were in a downward spiral after a sharp rise in early 2022 against the backdrop of the war in Ukraine. But the gradual reduction of production by the countries of OPEC did not let oil prices fall too much, and now we are clearly seeing a reversal of momentum:

The balance of supply and demand in the oil market was predicted approximately correctly by most experts, and XOM stock ultimately proved to be the beneficiary, gaining 10.6% since the publication of my bullish article.

As XOM’s share price approaches its spring highs, I think now is the time to re-examine the attractiveness of the stock and try to understand its future growth potential, at least for the medium term.

XOM’s Recent Financials

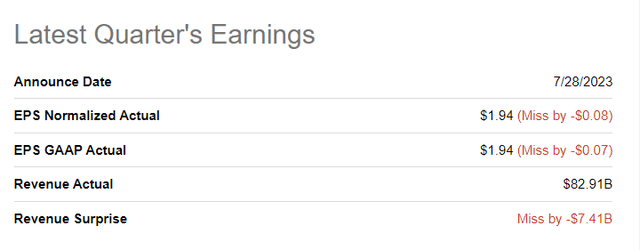

Exxon Mobil reported a significant drop in its 2Q23 earnings, with adjusted net profit at $7.874 billion ($1.94 per share), down from $17.551 billion ($4.14 per share) in the prior year. Lower crude oil and natural gas prices, weaker refining margins, and increased capital spending contributed to the decline. The firm’s revenue decreased by 27% to $80.795 billion (the income from equity affiliates and other income are excluded), so it also missed the market’s expectations.

Seeking Alpha, XOM, Earnings Surprises

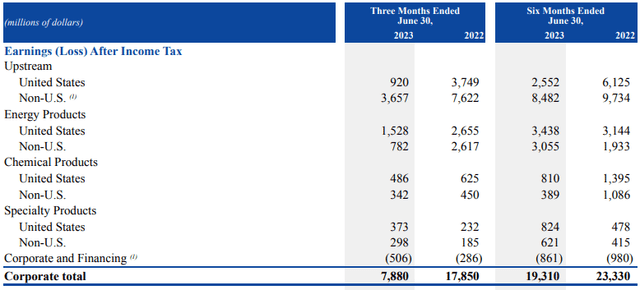

In April 2022, the company restructured, forming Exxon Mobil Product Solutions and centralizing certain groups. It now reports results in 4 segments: Upstream, Energy Products, Chemical Products, and Specialty Products.

The Upstream segment’s profit fell to $4.577 billion due to lower commodity prices and reduced oil-equivalent production. U.S. Upstream profit dropped to $920 million, while non-U.S. Upstream earnings declined to $3.657 billion. The Energy Products segment’s profit decreased to $2.310 billion, primarily due to lower refining margins. Chemical Products reported a profit of $828 million, reflecting weaker industry conditions. In Specialty Products, profit improved to $671 million, driven by higher pricing.

Capital and exploration expenses rose to $6.166 billion: Exxon Mobil aims to invest in promising projects, strengthen its balance sheet, and maintain a sustainable dividend, with an expected 2023 CAPEX between $23-$25 billion.

What Next?

Oil prices got a boost as Saudi Arabia and Russia decided to extend voluntary production cuts until year-end, tightening the market. Morgan Stanley analysts wrote in their recent note [September 20, 2023 – proprietary source], that Brent Crude exceeding $100 per barrel seems stretched, despite strong signals of market tightness, such as rising prices, robust demand, and falling inventories. The market is currently undersupplied by about 1 million barrels per day, mainly due to OPEC’s 1 mb/d cut, led by Saudi Arabia. The analysts expect that Saudi Arabia will maintain its cuts well into FY2024, keeping the market tight until at least early 2024. However, significant price increases are unlikely, with Brent expected to range between $85 to $95 per barrel by the end of 2024.

So, based on the tight market situation until early 2024, XOM has an excellent background for its operational activities, which should become even more efficient in the foreseeable future.

As another group of Morgan Stanley’s analysts wrote a few days ago (proprietary source), the company aims to triple its earnings by FY2027 compared to FY2019, mainly thanks to strategic projects. XOM sets records for oil production in the Permian and achieved record production rates in Guyana. They also completed a significant chemical expansion project in the Gulf Coast. Exxon Mobil anticipates bringing on 2 new projects in the second half of the year, Baytown Performance Chemicals and the Payara FPSO in Guyana, further enhancing earnings potential.

After opportunistically rationalizing and divesting lower-margin refineries over the past few years, Exxon Mobil’s Energy Products portfolio is now 85% integrated with its chemical facilities. In the long term, Exxon Mobil has positioned itself well to take advantage of opportunities in product reconfiguration, particularly in the biofuels, lubricants, and chemicals sectors as the energy transition continues to evolve.

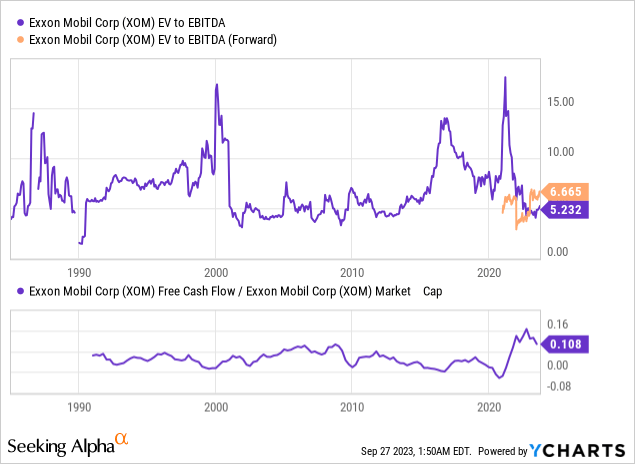

At the same time, we see that the valuation of the company currently looks quite modest: The market sees EV/EBITDA for next year at the ~6.7x level, although the EBITDA margin [TTM by quarter] is currently 21.5%, which is 57 basis points higher than last year for the same period. From a historical perspective in terms of EV/EBITDA multiples, XOM is valued at the low end of the norm but has a very strong FCF that is likely to be even higher due to higher oil prices and is currently over 10% of market cap, indicating serious undervaluation.

In recent weeks, refining margins have improved due to low clean product inventories, strong demand, facility outages, and geopolitical uncertainties, such as reduced Russian exports. Exxon Mobil, with its global refining capacity of about 4.5 million barrels per day, is expected to benefit significantly from these higher margins. Based on current price expectations, there is a ~7% potential upside to Energy Products (downstream) consensus earnings in the second half of 2023 and a ~15% upside to 2024 previous estimates, Morgan Stanley analysts added.

Morgan Stanley [September 22, 2023 – proprietary source]![Morgan Stanley [September 22, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/9/27/49513514-16957992902317078.png)

Let’s do the math together: If the above forecasts come true, or if actual earnings are close to these levels, then at 7.5x of EV/EBITDA we should get a market cap of $533 billion after adjusting for net debt. Then the upside potential from the current price would be 14.38%, excluding the dividend yield of 3.13% (FWD). The expected total return exceeds 15%, so I reiterate my previous buy recommendation.

Risks To Consider

I should mention that Exxon faces several significant risk factors in its operations, so everyone should be cautious when buying its stock.

First, the company operates in a commodity-driven industry, where it has limited control over the prices of its products. This vulnerability to fluctuating commodity prices can impact its profitability and financial performance, as was the case throughout its entire history.

Second, Exxon is engaged in major capital projects, and cost overruns on these projects can pose financial challenges. These overruns can strain the company’s financial resources and potentially affect its ability to meet its investment goals and deliver expected returns to shareholders.

Additionally, geopolitical risks are a concern for Exxon. Operating in countries with a history of corruption and political instability can expose the company to uncertainties that may impact production volumes and returns. However, Exxon’s global presence helps mitigate some of these risks by diversifying its operations across different regions.

Summary Thesis

Despite many obvious risks, Exxon Mobil stock is a “Buy” today even at the high end of its multi-week price range because:

a) the oil market is still tight,

b) refining margins are improving,

c) management is taking some strategically sound steps to improve the company’s operational efficiency; and

d) the stock is quite cheap given the strong FCF levels,

As a result, I expect XOM to be higher for longer – at least until something fundamentally changes.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in XOM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!