Summary:

- Exxon Mobil is retracing below the $110 level, down -11.83%, now yielding 3.48%.

- Bullish on energy and utilities, XOM returning capital to shareholders, potential for capital appreciation and income generation.

- XOM is well-positioned for future growth, strong financials, attractive valuation, and potential for dividend and buyback growth.

PM Images

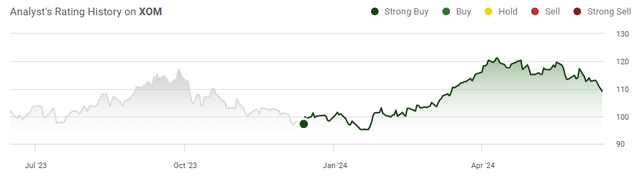

Exxon Mobil Corporation (NYSE:XOM), which is the largest component of The Energy Select Sector SPDR Fund ETF (XLE), making up 26.18% of the fund, is looking attractive again after retracing below the $110 level. Shares of XOM have been in a downtrend since April, as they have declined by -11.83%. Shares of XOM are now yielding 3.48%, and there is no confirmation that the sell-off has concluded as a bottom, which hasn’t been established yet. The last time shares of XOM got caught in a downward trend, shares dipped below $100 before rebounding by more than 25%. I am bullish on energy and utilities going forward as we’re not likely to displace oil and gas anytime soon as the demand for energy continues to grow.

Big Tech is allocating tens of billions toward buying chips from NVIDIA Corporation (NVDA), and as new data center infrastructure is built and brought online, more energy will be required to meet future electricity demands. Big Tech has been front and center, grabbing all the headlines, but XOM has put together several good years after more than tripling since the Fall of 2020, despite trading sideways since the end of 2022. As the rhetoric about eradicating oil and gas continues to disappear, I think more and more people are coming to the realization that our dependence on oil and gas will last multiple decades, and it’s getting easier to own energy stocks.

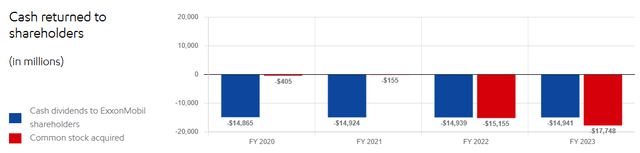

XOM continues to return massive amounts of capital to shareholders by allocating tens of billions between buybacks and dividends annually. I think XOM will be a good candidate for both capital appreciation and income generation for long-term investors who want some exposure outside of tech and can look past an unlikely narrative about ending the utilization of fossil fuels.

Following up on my last article about Exxon Mobil

My last article about XOM was published in December 2023 (can be read here), and since then, shares have appreciated by 11.29% and underperformed the S&P 500 as it appreciated by 16.90%. When the dividend is taken into consideration, XOM’s total return was 13.24%. In that article, XOM’s yield was approaching 4%, and I discussed why I was bullish on the largest component of the XLE when everyone was focusing on the tech sector. I am following up with a new article now that we have more economic data as to why I am still bullish and think shares of XOM will outperform the market in the future.

Risks to investing in Exxon Mobil

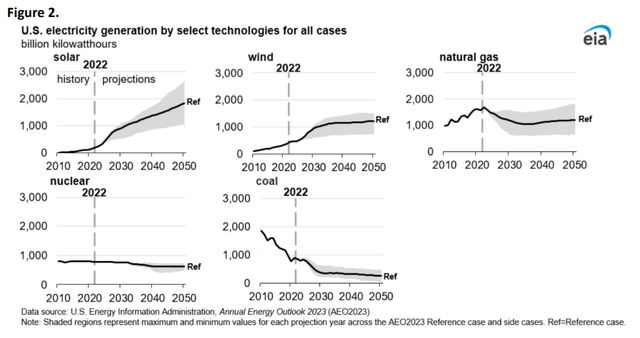

While XOM has an attractive dividend and is one of the largest companies in the world, there are still risks to my investment thesis. XOM’s profitability is tied to the price of oil, and if crude oil futures continue to trend downward, it’s likely to negatively impact XOM’s share price. There are also risks from transitioning to renewable sources of energy such as solar and wind. More solar and wind energy is expected to come online and represent a larger percentage of electricity generation domestically. As more EVs are sold and internal combustion engines become more efficient, the amount of gasoline produced could be impacted due to demand constraints. Depending on the policy focus among policymakers, we could see another push into renewables by offering larger tax credits to deploy solar across residential homes and adopt EV vehicles. This could also impact how much oil and gas is not only produced but sold, as we could see a declining demand across several industries. Investing in XOM is not a sure bet, and XOM needs oil at attractive prices and policymakers to focus on other areas of the economy.

The United States is producing record amounts of oil, and I think the future landscape sets up well for Exxon Mobil

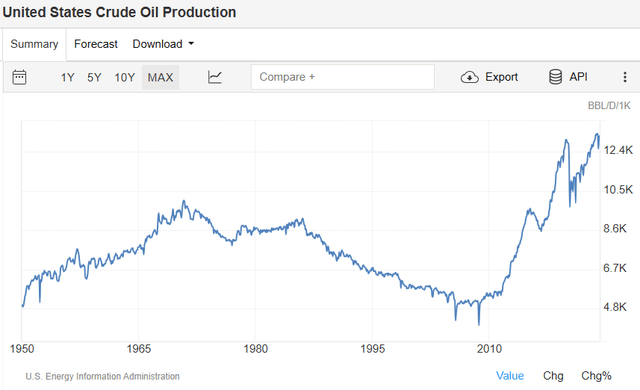

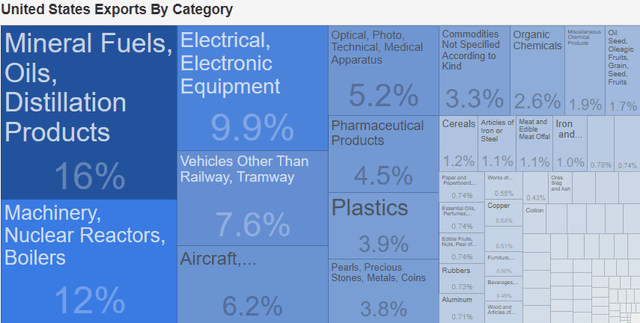

Despite the risks of investing in XOM, I believe there is a strong bull case than a bear case. The decades of declining oil production in the United States are long gone. From December 1970 to September 2008, the United States went from producing 9.94 million bpd of crude oil to 3.97 million BPD. Over the past 15 years, crude production has skyrocketed, and the United States has become the largest oil and gas-producing country in the world. In March 2024, the United States was producing 13.18 million bpd of crude, and the country’s production is operating at historical highs. Even at the height of the pandemic, the United States was still producing more than 10 million bpd, unlike during the financial crisis when production fell to under 5 million bpd. Oil and other distillation products accounted for 16% of domestic exports in 2023, generating $323.17 billion from global trade. The combination of higher oil prices and higher levels of production are bullish for XOM and its counterparts as they are able to drive more revenue to its top line and, ultimately, larger amounts of EPS to its bottom line.

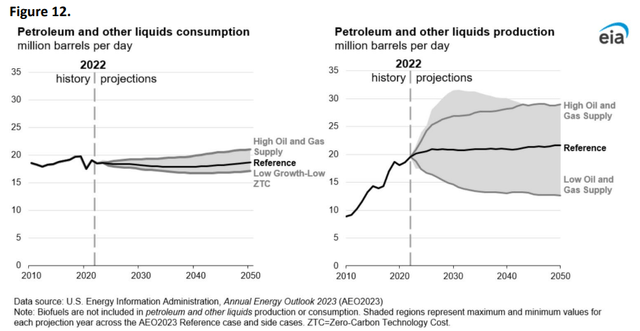

Trading Economics Trading Economics

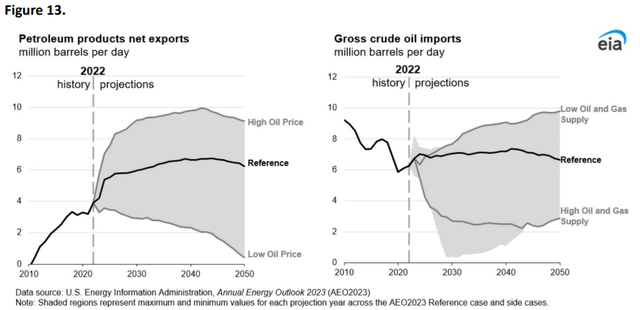

The EIA expects in their reference cases that production of petroleum and other liquids will remain stable through 2050, which sets XOM for several decades of large production numbers. In a high oil and gas demand scenario, XOM could see tremendous growth as the production range increases by 5-10 million bpd. From a consumption aspect, in the EIA reference case for the United States, consumption of petroleum and other liquids goes sideways while the range base on the baseline skews more toward a higher utilization rate rather than a lower utilization rate. I care more about production than domestic consumption because of the global demand for American energy. Production is expected to remain high because of the increased exports due to the growing demand in global energy. The United States is expected to remain a net exporter of petroleum products through 2050, and depending on how large the demand grows from developing nations, we could see a scenario where American energy exports significantly increase for an extended period of time.

The oil and gas landscape is set up well for XOM and other American energy producers. I am pro-renewables despite being bullish on the American oil and gas industry. When I make my investment decisions, I look at the data rather than the noise coming from the political landscape. The reality is that oil and gas touch our lives, no matter how green we try to be. Hydrocarbons are the building blocks for many items, including plastics, and critical throughout manufacturing and transportation. I think that we’re going to see an increase in demand that will take increased levels of renewables and traditional fossil fuels to fulfill. Based on the production and export productions, I think there is a multi-decade runway that is bullish for XOM. The other important aspect to remember is that just because these productions are out to 2050, that doesn’t mean that in 2051, the global dependence on oil and gas will vanish. It’s going to take a long time for this to occur, and the wind-down process could take several decades after 2050 to accomplish.

Why I think XOM is attractive after the recent share price retracement

As a shareholder of XOM, I am always looking for good entry points to add to my position. XOM has always been looked at as an income generation machine due to its large dividend payments, but it’s been so profitable that it’s been buying back stock hand over fist. During the 2022 and 2023 fiscal years, XOM repurchased $32.9 billion worth of shares as they lowered the number of shares outstanding by 268 million or -6.32%. This is very bullish for shareholders because XOM believes one of the best uses of its cash rather than doubling the amount of capital it allocates toward the dividend is to repurchase its shares. This increases the ownership each investor shares represents and helps increase their EPS as XOM’s income from operations is spread across fewer shares.

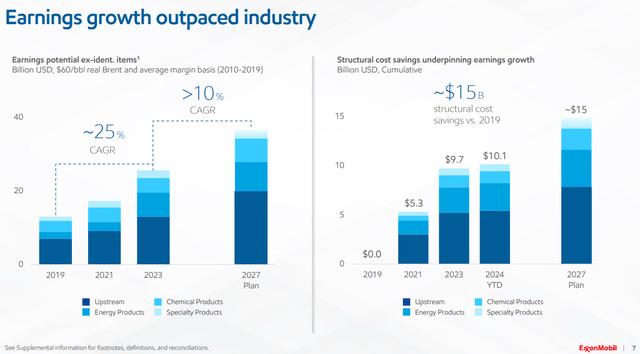

Currently, Brent is sitting around $82 per barrel, and XOM’s projections are based on the $60 average level from 2010-2019. XOM is projecting that it is on track to grow its earnings by a 10% compound annual growth rate (CAGR) through 2027 off of a $60 crude baseline. XOM is continuing to grow its portfolio in optimal areas such as Guyana, the Permian, and Brazil, which should allow them to add 50% in additional earnings growth by the end of 2027. XOM is expecting to produce 3.8 Moebd in 2024 and grow this to 4.2 Moebd in 2027 to meet society’s need for additional fossil fuels to fulfill the global demand for increased energy. As XOM’s structural costs decline, its competitively advantaged assets are likely to generate an additional $9 of earnings per barrel, and 50% of its production in 2027 will come from these assets.

It’s hard for me to agree with a bearish case for XOM, considering they have generated $335.35 billion in revenue over the trailing twelve months (TTM). XOM has delivered $106.87 billion in gross profit, $6769 billion in EBITDA, $32.11 billion in free cash flow (FCF) and $32.8 billion in net income from its top line. XOM is operating at a 31.87% gross margin and has an FCF yield of 9.58%. In Q1 of 2024, they generated $8.2 billion in earnings and $14.7 billion in cash from operations. Their structural cost savings initiatives have exceeded $10 billion in Q1 2024 compared to where they were in Q1 2019, and XOM is working toward its goal of $15 billion in cost savings to help drive higher EPS by 2027. XOM is projecting it will grow earnings by at least $12 billion from 2023 through 2027, which will lead to substantially higher EPS in conjunction with its structural savings. This will set the stage for more buybacks and continued dividend growth going forward.

XOM is one of the few companies that is a Dividend Aristocrat, with a long history of growing their dividend at an average annual rate of 5.8% over the past 41 years. XOM is trading at 11.85 times 2024 earnings as they are expected to finish 2024, having delivered $9.20 of EPS. This places their dividend payout ratio at 41.30% of their 2024 projected earnings, which leaves a lot of room for future dividend increases and buybacks. XOM has $33.32 billion in cash on hand, with another $40 billion in long-term investments. XOM only has $30.43 billion in long-term debt, which puts it at a liquidity-to-debt ratio of 2.41x, as it can eliminate all of its debt today without touching its long-term investments or utilizing any future profitability. In the TTM, XOM generated $67.69 billion in EBITDA, so it is well-positioned to meet its debt obligations while returning a tremendous amount of capital to shareholders in the form of buybacks and dividends.

Conclusion

At the June FOMC press conference, Fed Chair Powell indicated that the consensus estimates were that rates would finish in 2024 at 5.1%, 4.1% in 2025, and 3.1% in 2026. While rate cuts are coming later than many had expected, they are just around the corner, as we are 2 weeks away from the 2nd half of 2024. As we enter a rate-cutting environment, I think that more people will look to companies like XOM as a place to generate income because capital is less likely to stay in money markets, CDs, and T-Bills as the risk-free rate of return becomes less attractive. When rates start to decline, it will become more attractive for businesses to borrow capital to expand, and that should be another bullish tailwind for XOM. I think investors are going to look at XOM trading at less than 15 times earnings as a strong investment, considering their future earnings growth, dividend growth, and buyback potential. I think that the current retracement in XOM’s share price has made it very attractive again, and it’s trading at a good level for long-term investors to get interested again.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.