Summary:

- I am skeptical of overly bullish 2025 forecasts being put out by Wall Street. I have been reducing equity exposure in favor of capital preservation ideas since the November election.

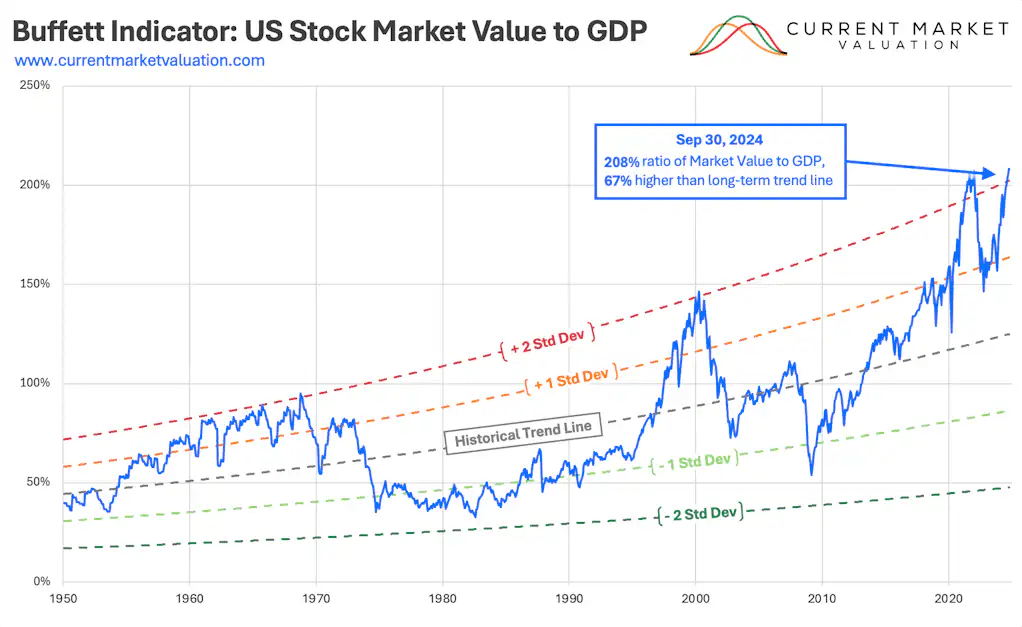

- High valuations, such as the Buffett Indicator at 210%, record price to sales of 3.2x and a near-record Shiller CAPE Ratio of 39x, suggest honest bear market and crash potential.

- Defensive picks like Exxon Mobil, with strong free cash flow and dividend yields, could outperform soon, especially if energy prices rise due to geopolitical/trade war issues.

- Republican political control could benefit major oil companies through tax cuts and environmental deregulation, opening the potential for significant returns despite market volatility.

10’000 Hours/DigitalVision via Getty Images

I know the financial headlines are full of predictions for a great 2025, with President Trump’s election. But, I am not buying it – literally. I personally have been a large net seller in my portfolio since election day, lowering my long market exposure and shifting capital to truly defensive ideas.

With a record reading of 210%+ on total U.S. equity value vs. GDP output (often referred to as the Buffett Indicator, where Warren Buffett has explained this datapoint is crucial in determining long term valuations), the S&P 500’s price to sales ratio skipping above 2021’s all-time high of 3.1x, and the Shiller CAPE Ratio (cycle adjusted P/Es) of 39x also near the most expensive in U.S. trading history, the actual Wall Street outlook for 2025 could be downright dreadful.

Current Market Valuation Website – Buffett Indicator, 1950 to Sept 2024

Multipl.com – S&P 500, Price to Trailing Sales Ratio, Since 2001

Multipl.com – U.S. Stock Market, Shiller Cycle-Adjusted P/E, Since 1871

Any reversion-to-the-mean move in U.S. stock valuations could be crushing at this stage. Tens of millions of investors have yet to experience a lasting economic downturn, as the Great Recession ended 15 years ago (enduring a -50% bear market between the summer of 2007 and early spring of 2009). Further, I am estimating fully 9 in 10 of all investors in America during late 2024 were not playing the market during the massive -40% crash in pricing for the S&P 500 and Dow Industrials between August-October 1987.

Follow me now: if we are about to experience a once every 40 to 50-year panic on Wall Street that pushes the Buffett Indicator back under 100% (as an example), it’s not exactly crazy (open to debate) to model another rapid drop in U.S. equities of -40% to -50% next year. Don’t say it cannot happen. With all the disruptions Trump is promising for the economy next year, I might even float the idea that a market crash is incredibly likely (perhaps starting as early as December 2024).

I did mention the utility of using ProShares Short S&P 500 ETF (SH) here last week, to quickly reduce your net-long exposure, with high cash yield and daily compounding advantages working in your favor during a market downturn phase. So, besides high cash levels and direct hedges to a life-changing bear market for the typical retail investor, where else can you hide?

I absolutely suggest owning defensive names that have a history of outperformance during bear markets. Blue-chip stocks with stable operations during recession, selling necessary products for consumers and businesses alike, usually with above-average dividend yields, are the variety I am talking about.

Next, contemplate other building economic forces. Geopolitical trouble in the Middle East could still spike the crude oil price in 2025, which has typically been a key trigger in the past for both recessions and sliding equity quotes.

Then, when you factor in the positive Trump/Republican effects of bullish tax code changes for Big Oil, alongside the real possibility a trade war with Canada/Mexico could curtail energy supplies to the U.S., you can easily make the case oil company exposure should be part of your portfolio.

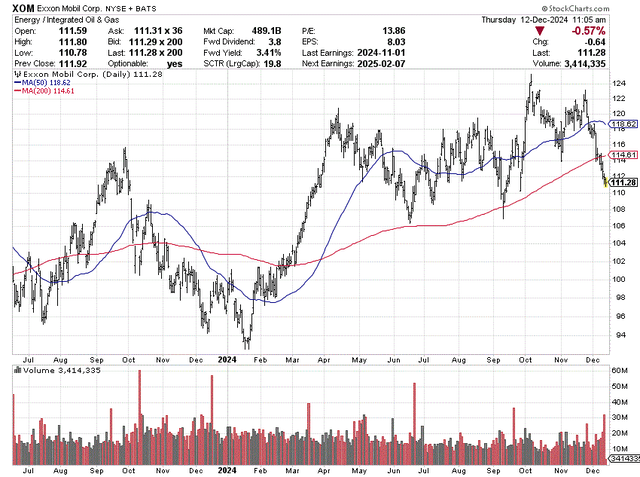

My investment conclusion: when you add all of these factors together, I believe Exxon Mobil (NYSE:XOM) may be sitting in one of the top buy positions for new capital, set to widely outperform the U.S. stock market generally and other large caps specifically over the next year or two (either falling less in percentage terms or rising faster).

My last XOM article (a bullish take) was published in July 2023 here. Since that effort, shares have generated a total return of +14%. Not a bad result under normal market trading conditions over 15 months, but a clear laggard vs. the equivalent S&P 500 total return of +35% (centered in Big Tech names).

While XOM has not beaten the high-flying Magnificent 7 leaders during 2024, the future for shareholders, “relative” to this insanely overvalued group is likely much brighter than conventional wisdom pretends to think. For contrarians, income investors, hedgers, oil/gas bulls, and those hunting for defensive positions to accumulate, I believe Exxon Mobil may approach the “must own” category in coming weeks. Let me explain why.

StockCharts.com – Exxon Mobil, 18 Months of Daily Price & Volume Changes

StockCharts.com – Nearby Light Crude Oil Futures, 18 Months of Daily Price & Volume Changes

StockCharts.com – Nearby Natural Gas Futures, 18 Months of Daily Price & Volume Changes

Wall Street vs. Exxon – Bear Markets

The company ranks as one of the best “defensive” stocks on Wall Street, with an amazing history of flight-to-safety capital inflows when stresses become overwhelming in the economy and financial markets.

And, if you believe we are now headed for all kinds of macroeconomic trouble from Trump’s disruptive policies (everything from using the military in the streets of major U.S. cities to chase down illegal immigrants, to tariffs on the rest of the world causing a collapse in foreign investment capital for America, to mass layoffs and stalled income raises at government agencies leading to a chill in overall consumer spending, to reduced business tax rates ballooning the already out-of-control federal spending deficit), playing defense into early 2025 with your portfolio may be the only reasonable course of action.

First buddy, Elon Musk, even warned voters a week before the election, that if all the policy changes being talked about behind closed doors were enacted, the U.S. would absolutely experience a recession next year. If you don’t believe what I am saying, listen to him, not the psychobabble boom-times talk on CNBC or in the Wall Street Journal over the past month.

Below are past examples of how Exxon has zigzagged during troubled times for the S&P 500. The basic conclusion is XOM has a proven track record of beating the market, when equity investments generally come under severe selling pressure.

Exxon Mobil (Exxon before the merger) did outperform the S&P 500 in 6 of the last 7 bear market (greater than -20% index declines) and/or recession instances since the mid-1980s. Only the once-in-a-lifetime oil bust during the 2020’s pandemic closures around the world created the circumstances for a weakened XOM chart.

2022 Interest Rate Spike & Bear Market

YCharts – Exxon Mobil vs. S&P 500, Total Returns, Jan 2022 to Dec 2022

2020 COVID Pandemic & Recession

YCharts – Exxon Mobil vs. S&P 500, Total Returns, Jan 2020 to Dec 2020, Recession Shaded

2011 Treasury Downgrade Crisis

YCharts – Exxon Mobil vs. S&P 500, Total Returns, Jan 2011 to Dec 2011

2007-09 Great Recession

YCharts – Exxon Mobil vs. S&P 500, Total Returns, Jan 2007 to Mar 2009, Recession Shaded

2000-02 Technology Bust & Recession

YCharts – Exxon Mobil vs. S&P 500, Total Returns, Jan 2000 to Dec 2002, Recession Shaded

1990-91 Persian Gulf War Recession

YCharts – Exxon Mobil vs. S&P 500, Total Returns, Jan 1990 to April 1991, Recession Shaded

1987 Stock Market Crash

YCharts – Exxon Mobil vs. S&P 500, Price Changes, Jan 1987 to June 1988

Stronger Valuation Than Most U.S. Equities

Remember, Exxon Mobil does run one of the most conservative balance sheets in large-cap America, with very little net debt. At the end of September, XOM held $26.9 billion in cash vs. $34.7 billion in financial debt; $94 billion in current assets vs. $70 billion in short-term liabilities; and, tangible assets of $462 billion vs. $185.5 billion in total liabilities. All of this is matched against trailing 12-month cash flow of $56.5 billion and after-tax earnings of $35.1 billion. I grade the balance sheet as “A+” vs. the oil sector, which generally carries considerable amounts of debt.

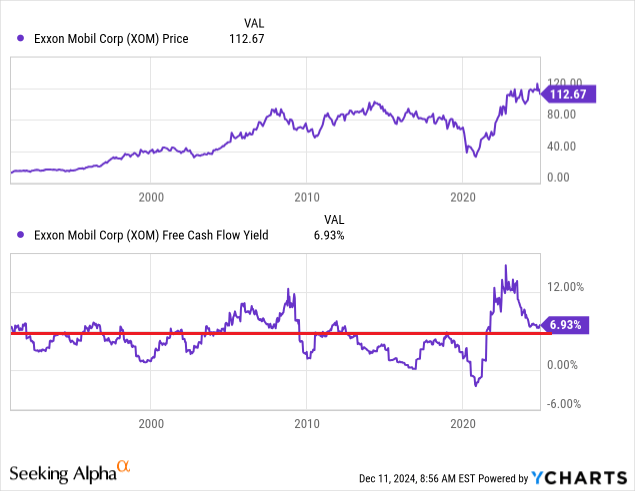

Below is a graph back to 1986, highlighting some basic fundamental valuation ratio changes for this upstream and downstream operating giant. On price to tangible book value of 1.84x and cash flow of 8.3x, we can argue XOM shares are on the lower end of its average valuation range (albeit just slightly undervalued).

YCharts – Exxon Mobil, Price to Tangible Book Value & Sales, Since 1986, Recessions Shaded

My question is where else can you find a sector leading investment (for size and asset quality), with an A+ balance sheet, priced “under” long-term norm ranges of value? Believe me, it is incredibly difficult to locate another similar setup. With the S&P 500 trading at valuation premiums 100% beyond where they should be (pumped by wild stock speculation, all-time high citizen participation, excessive fiscal deficit spending, and record Federal Reserve money printing since 2020), Wall Street is essentially sitting at its most expensive apex in the nation’s history.

The free cash flow yield story is also quite compelling today, even with low (inflation-adjusted) pricing for both crude oil and natural gas. Exxon’s almost 7% trailing FCF yield is actually higher now than its long-term average under 6%. Below is a graph comparing XOM’s price to the prevailing FCF yield back to 1991. I have drawn a red line at the 6% level. While not a guarantee of immediate trading profits, it’s statistically better to own XOM when the free cash flow yield is above 6%, than below. (Notice FCF yield was consistently under 6% between 2013-20, the worst period to own XOM in recent memory.)

YCharts – Exxon Mobil, Price vs. Free Cash Flow Yield, Since 1991

Dividend Income

Exxon Mobil is also a dividend aristocrat, paying a rising dividend over the decades. Going back to the Standard Oil days, Exxon has perhaps the greatest long-term dividend record over the last 150 years of any company traded on Wall Street! For sure, the consistency of the dividend, with regular raises, is in the same league as Johnson & Johnson (JNJ), Coca-Cola (KO), and Minnesota Mining & Manufacturing (MMM).

YCharts – Exxon Mobil, Annual Dividends Paid, Since 1987, Recessions Shaded

The 3.44% trailing dividend doesn’t sound like much. But, if the payout is raised by 10% yearly with the help of rising energy prices, a 4%+ yield in two years, 5% yield in less than four years, 6% yield in five and a half years, and 7% in seven years will be a winning income producer for your brokerage account.

Plus, compared to the near record low dividend yield of 1.2% on the S&P 500 (only 1999-2001 was lower), Exxon’s upfront cash distribution proposition is almost 3x better than the overall U.S equity market. Outside of the 2020-22 pandemic period, this 3x relative yield story would be a modern record high for XOM shareholders!

YCharts – Exxon Mobil, Dividend Yield vs. Equivalent S&P 500 Distribution Rate, Since 1994, Recessions Shaded

Final Thoughts

The election of President Trump is definitely good news for the oil giants based in America, as less regulation and red tape for new drilling and production efforts inside our borders could be on the horizon. In addition, tax cuts for corporate America (some possibly targeted at energy names) could put extra income into Exxon Mobil shareholder pockets.

A secondary election-based bonus is a trade war could actually benefit Exxon Mobil’s extensive U.S. operations. At the end of 2023, 40% of proved crude oil reserves and 65% of natural gas assets were located in the United States (per 2023 10-K filing), before the Pioneer Natural Resources acquisition was completed earlier this year. The next largest concentrations for reserves and production were found in the Asia and Australia regions of the globe.

Just yesterday (December 11th), Canadian leaders threatened to cut off oil exports to America in a protracted trade war. If President Trump throws the NAFTA free-trade agreement out the window, there will be new pressures on oil/gas prices to rise around the world, including the U.S. In the end, it’s possible electing Trump will prove something akin to a self-inflicted COVID situation for the world’s supply chain.

Exxon management has committed itself to increase U.S. oil/gas production, particularly in Texas over the last decade. The Pioneer acquisition (merger) also adds exposure to natural gas prices, coming off all-time inflation-adjusted lows earlier in 2024.

MacroTrends.net – U.S. Natural Gas Prices, CPI Adjusted, Since 1997, Recessions Shaded

2025 guidance out yesterday by management is estimating fully 30% of company oil/gas production will originate in the Permian Basin (mostly Texas), on the Pioneer merger.

Exxon Mobil – 2025 Guidance, December 11th, 2024 Presentation

In my opinion, it is quite probable rising natural gas prices in America (pumped by AI-data center energy demand) will be the “unexpected” incremental driver of future Exxon profits.

Exxon Mobil – Expanding Data Center Gas Demand, December 11th, 2024 Presentation

Summary Forecast

Investment capital has a history of flowing into Exxon Mobil during dramatically weaker market periods, including an all-out stock market crash in 1987. Defensive trading characteristics, a super-desirable balance sheet, with robust 7% free cash flow generation and 3.4% dividend yield (3x the available S&P 500 index rate today), make XOM an intriguing buy candidate, even during the most overvalued U.S. market condition ever.

My summary of the pros and cons, risks and reward, is decent/stable upside of +10% to +15% total returns annually would be appropriate under a normal economic backdrop, assuming limited Wall Street losses next year and somewhat flat energy pricing.

YCharts – Exxon Mobil, Analyst Estimates for 2024-26, Made December 11th, 2024

Definitely, the potential for outlier gains is real, regardless of market direction if energy prices rise rapidly during 2025 (from either a strengthening economy now widely expected by investors or a supply shock from the Middle East or a trade war mess). In other words, +30% to +50% total returns over less than 12 months remain a distinct possibility. Given a major jump in crude oil over $100 a barrel, with natural gas prices above $5 per MMBtu, EPS in the $12-13 area similar to 2022 would be reality again.

However, my baseline forecast is a major Wall Street implosion and recession from disruptive Trump changes is approaching fast. The good news is Exxon Mobil may hold up far better than the S&P 500 average selection, given a wicked selloff phase on Wall Street generally. Even more likely, Exxon could be preparing to run circles around Big Tech names for total return performance, similar to 2000-02’s original Dotcom-centered technology bust.

If you can stomach some volatility next year, Exxon should come out of any Trump-induced recession stronger than it entered (vs. the oil/gas industry). While short-term losses of -20% to -40% are possible in a market crash scenario, I trust this company will be an intelligent place to hide, in a worst-case scenario for America’s economy.

I rate Exxon Mobil shares a Buy and own a moderately-sized position. Honestly, outside of gold/silver assets and a handful of small-cap turnaround ideas, XOM is part of a small subset of defensive stocks (20 or 30 ideas in total) I am reviewing for purchase currently. Until the smoke clears on what President Trump actually changes for policy in Washington DC during late January and February, I plan on treading lightly for buy orders.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.