Summary:

- As Exxon Mobil is about to report its Q1 2023 results, investors should keep their long-term view and dismiss any quarterly noise.

- Management is now becoming increasingly aggressive in its expansion efforts and should provide more information on that during the quarter.

- Managing higher capital expenditures with certain short-term headwinds for profitability would not be easy to navigate.

halbergman/E+ via Getty Images

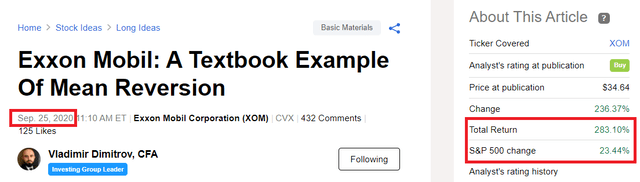

If you bought Exxon Mobil Corporation (NYSE:XOM) back in 2020 when I laid out my investment thesis on the company, then most likely you wouldn’t be bothered by the quarterly fluctuations of the stock.

After all, your total return would be nearly 300% in a matter of two and a half years, while at the same time the S&P 500 increased by less than 25% during the same period.

If you have done this, you would most likely be less prone to making mistakes and inclined to focus on the big picture as opposed to short-term risks and speculations.

Nevertheless, sometimes quarterly results give us some important information and could be very useful when rebalancing our portfolios or judging our asset allocation mix.

More broadly, conditions in the Oil & Gas sector have changed rapidly since 2020. Back then, most market commentators were not very interested in the sector and the narrative was to say the least – pessimistic.

Now the tables have turned and the industry is getting significant attention by investors as conditions have improved. In that regard, Exxon Mobil remains among the best-positioned companies to capitalize on these industry-wide tailwinds.

Exxon Mobil Investor Presentation

I have written extensively on this topic over the years (see here and here), but in the following lines I would like to focus on some key areas that I will be watching as XOM reports its first quarter 2023 results tomorrow.

Aggressive Expansion

As global exploration spending is staging for a recovery and energy security becomes a topic of paramount importance, Exxon Mobil is also entering a phase of increased reinvestment into the business.

I expect the focus to gradually shift from profitability and high free cash flow generation into more M&A deals and increased capital expenditure to capture new opportunities.

The recent news that Exxon Mobil is exploring a deal for Pioneer Natural Resources Company (PXD) only confirms that and illustrates that XOM management is willing to be more aggressive in securing low risk and high return assets.

At present, PXD has a market cap of more than $50bn, which is hardly a small bolt-on acquisition and shows that XOM is seeking scale in the Permian Basin. It also seems that PXD wasn’t the only deal that has been discussed which confirms the aggressive expansion strategy of XOM.

Exxon (XOM) also has discussed a potential tie-up with at least one other company, as it seeks a blockbuster deal in the shale patch, according to the report.

Source: Seeking Alpha

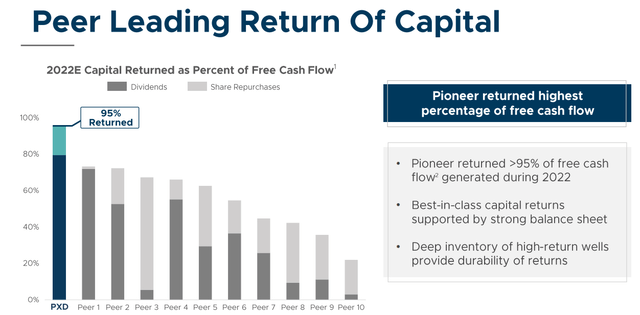

In addition to PXD being the largest oil producer in the state of Texas, the company also excels when it comes to overall return on capital.

Pioneer Natural Resources Investor Presentation

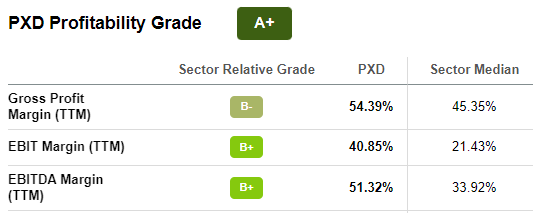

But as a highly profitable business that is also expected to grow at double-digit rates, PXD does not come cheap. Currently, the company trades at 2.5 times its forward revenue which is twice the multiple that XOM has of 1.2 times.

Seeking Alpha

Although the macroeconomic and geopolitical environment would most likely remain supportive, it is usually when companies become too aggressive in their M&A strategies that I hit pause. By saying this, I don’t mean that XOM is now unattractive investment, but rather the following quarters will be pivotal in the company’s strategy and investors should look closely for clues on where the company is headed.

Increased Capital Expenditure

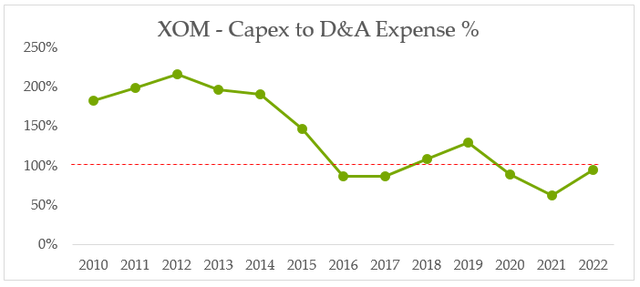

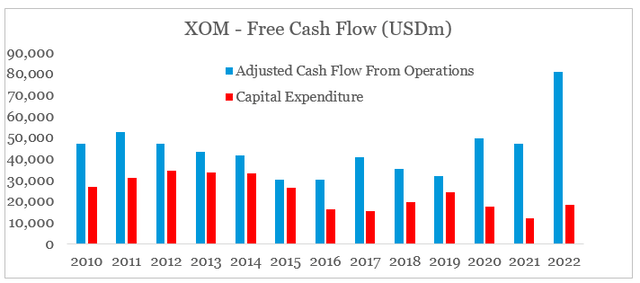

When it comes to the business, Exxon is also near the end of a period marked with relatively low reinvestments into the business and reaping the rewards of the high spend during 2010-14 period.

As we see in the graph below, capital expenditures have been consistently below or at the level of the annual Depreciation and Amortization expense (D&A) since 2016.

prepared by the author, using data from Seeking Alpha

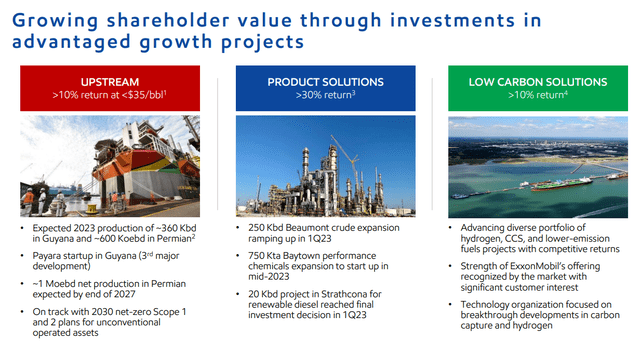

With the market conditions now being favourable, the next 5-year period would most likely see a return to the previously high capital expenditures. In addition to new low carbon solutions, XOM would need to spend more on new developments in Guyana as well as expansion in downstream and the chemicals business.

Exxon Mobil Investor Presentation

At present, management expects capex to increase by 25% to 36% from $18.4bn in fiscal 2022 to $23-$25 billion during the current year.

We anticipate 2023 capital and exploration expenses of $23 billion to $25 billion. This includes investments in the next development in Guyana, and increased spending in US unconventional assets. It also includes advancing our China chemical complex and numerous emission reduction opportunities.

Source: ExxonMobil Q4 2022 Earnings Transcript

This is a significant ramp up in capex and would put an end to the past 3-year period when the company enjoyed a very wide gap between its record cash flow from operations and exceptionally low capex.

prepared by the author, using data from Seeking Alpha

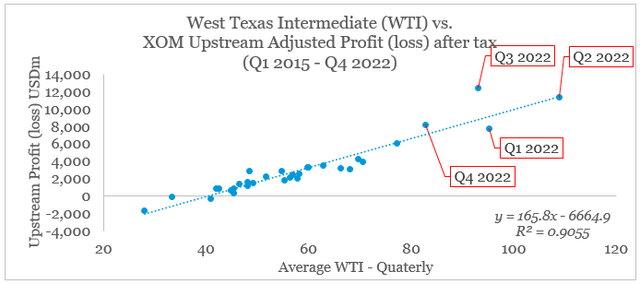

In terms of upstream earnings, the company is already off its record highs in Q2 of 2022 and earnings would most likely normalize in the coming years.

prepared by the author, using data from SEC Filings

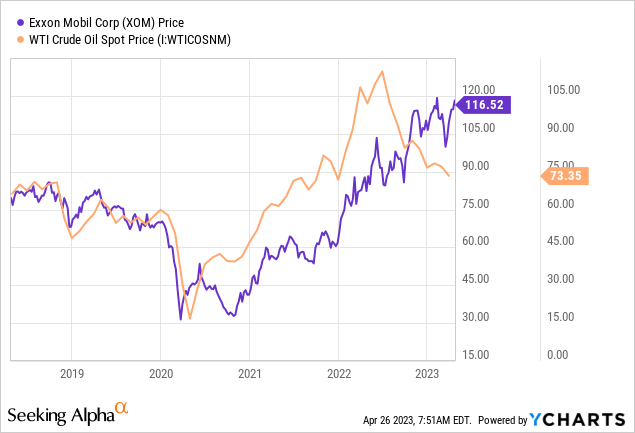

With West Texas Intermediate (WTI) currently at around $74, we already see a gap developing between ExxonMobil’s share price and the price of oil in the short-term.

Of course, we should keep in mind that XOM has reduced costs significantly in recent years, but it seems likely that the record high free cash flow is not sustainable at this point in time.

Deliver an additional $2 billion in 2023 structural cost reductions; meeting $9 billion target versus 2019

Source: Exxon Mobil Investor Presentation

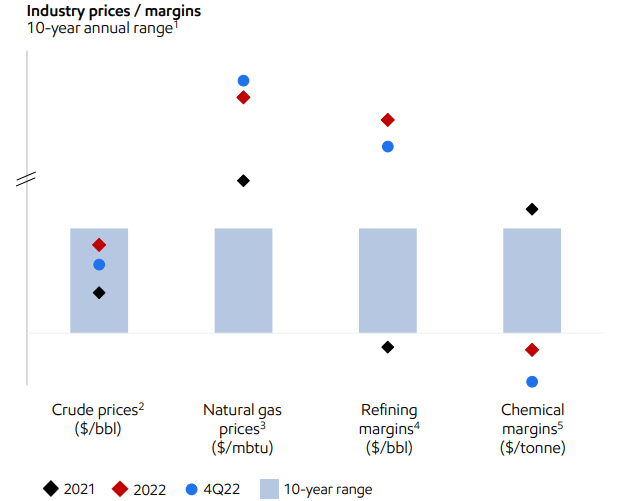

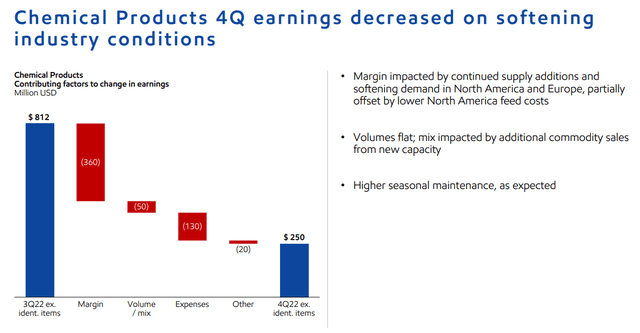

While the upstream business enjoys a favourable environment, the Energy Products and Chemical Products are still facing significant headwinds and investors should look closely for updates on these two fronts.

Exxon Mobil Investor Presentation

This, however, does not mean going into rabbit holes and looking for short-term updates on profitability in different segments, but rather looking at how Exxon’s management is going to balance the need for higher reinvestments into the business as earnings are peaking.

Limited Upside From Here

How a company is priced also matters a great deal on how the market reacts to quarterly earnings surprises both on the upside and on the downside.

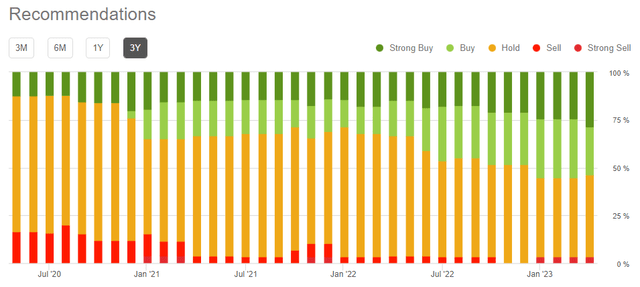

Wall Street Analysts, for example, have been becoming increasingly bullish on XOM (see the graph below just as the upside appears more and more limited. On the contrary, back in 2020 it was quite hard to find an analysts with a buy rating on Exxon.

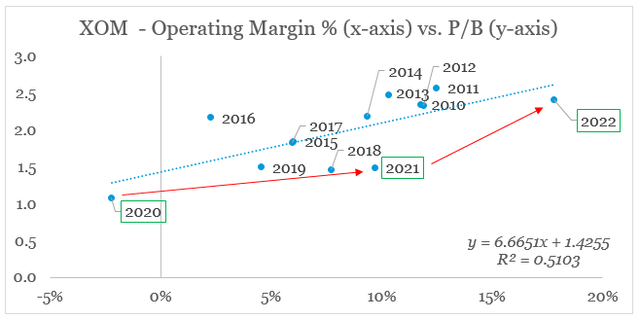

When looking at margins, Exxon does not appear to be overvalued at the moment, as long as it could sustain its record-high profitability during the upcoming cycle.

prepared by the author, using data from Seeking Alpha

However, any further upside is largely limited and the market is now likely to react more negatively on worse than expected quarterly results than it is to reward shareholders with high returns if the opposite happens.

In terms of shareholder distributions, Exxon’s management expects to ramp up share repurchases to $35bn in the two year period from 2023 to 2024. This is significant, but not materially different from the more than $15bn already spent in 2022.

We’ve demonstrated our commitment to a reliable and growing dividend and further sharing our success through the share repurchase program with up to $35 billion in cumulative repurchases in 2023 and 2024.

Source: ExxonMobil Q4 2022 Earnings Transcript

Last but not least, XOM now offers a dividend yield of barely above 3%, which is not very attractive in relative terms as I recently showed. Moreover, short-dated Treasuries now offer much more attractive yields and the gap between the two has switched from a highly positive one to a negative one.

Investor Takeaway

Exxon Mobil is well-positioned to thrive within the current environment since management did not deviate from its long-term strategy during the market downturns in recent years. Although this might sound exciting, investors should not forget that further upside from here would be increasingly hard to achieve given the need for higher reinvestments into the business. Having said that, long-term investors should not deviate from their strategy and should use the upcoming quarterly results as a guide on how Exxon’s management is going to navigate the current cycle.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the Oil & Gas space?

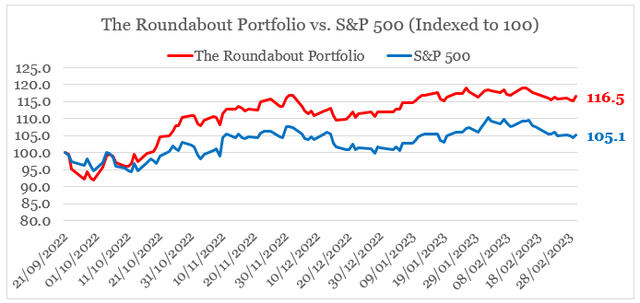

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.