Summary:

- Exxon Mobil investors experienced a selloff after earnings last week. However, buyers returned this week, helping to stage a recovery.

- I assessed that the energy sector and XOM have likely bottomed out and are on track for a decisive recovery.

- Exxon’s venture into lithium extraction has significant disruptive potential and could extend its long-term shareholder value.

- Investors looking to a big oil and gas play with near- and long-term upside are urged to consider Exxon’s scale, deep expertise, and significant resources.

- I make the case for why XOM investors should consider adding more positions. Read on.

Brandon Bell

Exxon Mobil Corporation (NYSE:XOM) investors likely breathed a sigh of relief after the company’s second quarter or FQ2 earnings release last week. The initial selling pressure didn’t gain momentum, as buyers returned this week, aiming to help XOM regain its upward recovery. XOM’s buying sentiments have also been lifted as the underlying crude oil futures (CL1:COM) (CO1:COM) have seen a remarkable revival, with WTI oil futures nearly re-testing their April 2023 highs.

Keen investors should recall that I held a bearish view on Exxon and the energy sector (XLE) from late last year through early 2023. That thesis has panned out accordingly, as Exxon and XLE fell toward their March 2023 to May 2023 lows, hobbled by worries about a potentially debilitating macroeconomic recession. The previous production cut squabbles between OPEC+ leaders Russia and Saudi Arabia added further volatility to the energy markets, worsened by China’s faltering economic recovery.

However, I also reminded energy investors that the bearish momentum was bottoming out in March, as I stressed that “XLE had been forced into deeply oversold zones.” I also added that “bullish technical traders have likely capitulated,” which corroborated my conviction that energy is primed to bottom out. With XOM accounting for more than 20% of XLE’s weightings (largest exposure), energy investors must pay close attention to the sector leader’s stock performance.

As such, I turned bullish in May 2023 on XOM, anticipating that buying sentiments should improve further. While XOM has underperformed the S&P 500 (SPX) (SPY) since then, it didn’t break down its March lows ($98 level), increasing my conviction that buyers are likely accumulating. XOM’s price action is also in sync with the consolidation zone for the crude oil futures from March to late June, before the surge in July we recently experienced.

However, they could have been surprised if Exxon Mobil’s bearish prognosticators relied on its tepid FQ2 release and questioned why XOM didn’t crash further. Investors should recall that the company posted a Q2 miss, which initially weighed on buying sentiments last week. However, the mistake that investors typically make is that they don’t realize that the market is forward-looking. It’s critical to remember that investors usually look forward, not backward. Q2 is already done and dusted, as it ended on June 30.

Investors have already anticipated a languid release ahead of Exxon’s recent results, as XOM topped out in February and April this year. Therefore, I often stressed to members of my service that price action is a leading indicator. In contrast, backward-looking fundamental reports are lagging indicators that likely offer insufficient actionable insights into XOM’s buying sentiments over the next twelve months.

Notably, renowned investor Oaktree Capital Management’s Co-Founder and Co-Chairman Howard Marks emphasized that “consistently profitable market calls cannot be derived solely from macroeconomic forecasts or analyzing company reports.” He added that the “availability of quantitative data and financial statements to everyone means they cannot provide a competitive edge for superior investment performance.” As such, investors must develop an edge to help them “understand prevailing investor psychology,” which Marks accentuated “is crucial for achieving superior investment results.”

While investors don’t necessarily need to use XOM’s price action (which Marks doesn’t use) as a basis, they need to develop tools to discern and assess its buying sentiments to ascertain the risk/reward appeal. Investor psychology is such an essential aspect of cyclical investing that investors relying solely on fundamental analysis fail to consider it.

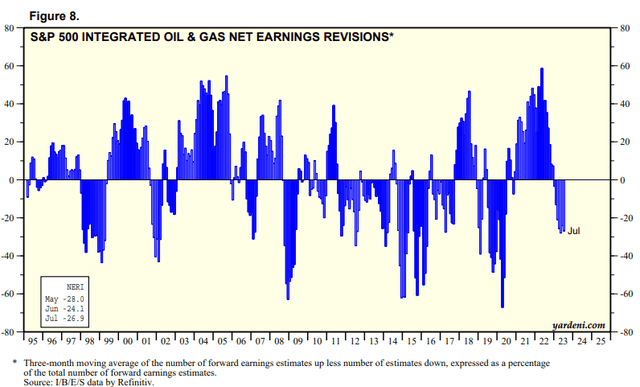

S&P 500 integrated oil & gas net earnings revisions % (Yardeni Research)

My belief is the energy sector has likely bottomed. Energy analysts’ pessimistic estimates corroborate my view. They have been marking down the sector’s earnings estimates through July, after last year’s euphoria, as seen above. Given Exxon’s exposure in XLE, I believe energy investors will likely use XOM as a proxy for a more concentrated energy play, sustaining its recent buying momentum.

Also, Wall Street analysts’ projections suggest that the YoY decline in Exxon’s adjusted EPS should bottom out in Q2 at 53.1%, with lower declines through the second half of FY23. Also, they expect Exxon’s profitability to return to growth by the second half of 2024. As such, I believe buyers who bought XOM’s consolidation through July are likely anticipating a growth inflection in Exxon’s earnings next year.

Given the weak recovery in the first half, Chinese authorities have also stepped up their game to bolster China’s economy further. As such, a combination of fiscal and monetary stimulus is expected to unfold, providing more confidence to energy plays and leaders like Exxon Mobil.

Exxon’s increasing exposure to decarbonization strategies, including carbon capture, is not expected to be earnings accretive in the near term. However, given its massive scale and deep oil and gas expertise, it sets up the company well. Coupled with its healthy cash pile of $29.5B as of Q2, Exxon is well positioned to reach further into lithium mining with extraction techniques that could have significant disruptive potential.

The costs of developing such technology are substantial, as highlighted in a Wall Street Journal or WSJ article in May. Exxon is reportedly targeting “extracting 100,000 tons of lithium per year.” With the company in talks with major automakers such as Tesla (TSLA), Ford (F), and Volkswagen (OTCPK:VWAGY), I believe CEO Darren Woods and his team are confident about their abilities and resources to accomplish the task.

To put things into a clearer perspective, leading lithium miner Albemarle (ALB) had an annualized lithium production capacity of 200,000 tons in 2022. The company expects to raise its capacity to about 550,000 tons at the midpoint by 2030. Therefore, if Exxon can generate 100,000 tons, it’s a significant capacity boost to the industry that would put Exxon as one of the leading players in the market.

Furthermore, extraction could disrupt the traditional lithium mining approach, allowing Exxon to lower costs for the leading automakers, eating into the margins of traditional lithium miners. Morningstar also highlighted the threat from extraction to miners like ALB, articulating that “new supply extraction technologies allow more lithium resources to enter production and drive down operations costs.” With that, Albemarle “would realize lower midcycle prices. The company would also likely put new projects on hold.”

Therefore, I believe Exxon’s lithium extraction endeavor has significant disruptive potential that could help extend its long-term shareholder value, given its massive scale, expertise, and resources. If a big oil and gas company could command my confidence in making this venture successful in the long run, it has to be Exxon Mobil.

Rating: Maintain Buy

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!