Summary:

- XOM is down compared to 9 Dividend Kings that I highlighted as potential Buys back in late October 2022.

- I provide a broad view of XOM using a Strengths, Weaknesses, Opportunities, Threats Analysis (or “SWOT”) for investors.

- I conclude with notes about why Holding XOM is rational and I provide a price where I’d consider a small trim of XOM in favor of 9 Dividend Kings.

bymuratdeniz

Quick Update

Back in late October, I discussed the possibility of selling Exxon Mobil (NYSE:XOM). When I wrote that article, I was certainly not saying that XOM was a “Sell” or anything like that. Here’s exactly what I said:

All of that said, this article isn’t about buying XOM. This article isn’t about holding XOM, either. To be clear, right now, I rate XOM a strong Hold, given the macro environment, but I’m not sure it’s a Buy.

This article is about possibly selling some XOM. I wouldn’t think of telling you to sell all your XOM. Yet, now might be a time to start “taking profits” as they say, and moving your winnings.

Since writing that article XOM is down about 2%. So, roughly speaking, we’re in the same position as we were back then.

The purpose of this article is to provide a broader view of XOM to see if the call I made earlier, with respect to the potential trimming, is still relevant. In short, what is the current situation? Before we go there, and in reference to my previous article, here’s the list of Dividend Kings we looked at:

- AbbVie (ABBV)

- Altria (MO)

- Universal Corp. (UVV)

- 3M Co. (MMM)

- Leggett & Platt (LEG)

- Canadian Utilities (OTCPK:CDUAF)

- Stanley Black & Decker (SWK)

- Black Hills Corporation (BKH)

- Kimberly-Clark (KMB)

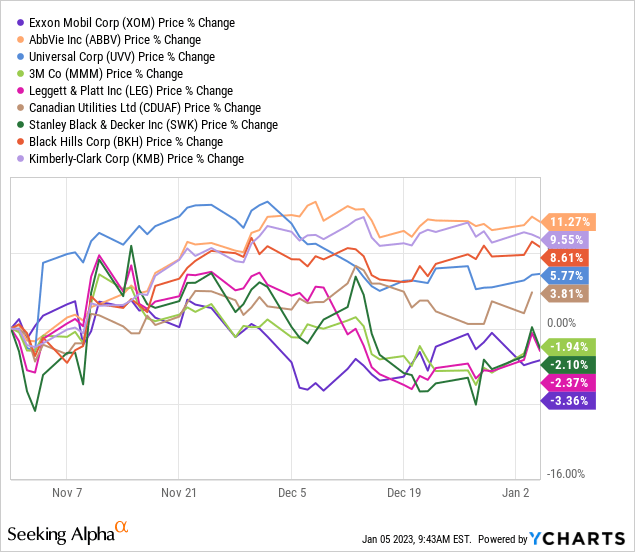

And, for the sake of completion, here’s how they have done in the last 10 weeks, give or take:

Listen, I didn’t exactly ring the bell at the top, and this isn’t a victory lap. Well, fine, it’s a small victory lap. But, this is only about 9-10 weeks and as long term investor, this is still noise. At the same time, the numbers are the numbers and XOM is the worst performing stock of the entire pile so taking some profits would have been rational and successful.

One last thing before moving on. My call on XOM right now is quite simple and I’ve already said it previously:

Again, I’m not saying XOM is a Sell. I rate XOM as a Hold. Instead, I’m saying that maybe you’re holding on to a ton of profits and there’s a chance XOM could swing the other way. Why not at least consider companies with a higher starting yield and higher five-year (and 10-year!) dividend growth?

Now, let’s press forward!

Exxon Mobil SWOT Analysis

So, a SWOT analysis is a tool used to evaluate the strengths, weaknesses, opportunities, and threats (SWOT) of a business or organization. It is often used as a strategic planning tool to help a business or organization identify its internal and external factors that can impact its success.

As an investor, I’m a planner. And, I’m very interested in how XOM might be thinking about the future as well. There are four pieces to the analysis:

- Identifying the business’s strengths, which are its internal characteristics that give it an advantage over its competitors.

- Identifying the business’s weaknesses, which are its internal characteristics that hinder its ability to compete effectively.

- Identifying the business’s opportunities, which are external factors that the business can take advantage of to grow and succeed.

- Identifying the business’s threats, which are external factors that could negatively impact the business.

That’s enough of an overview. Let’s go!

Three Key XOM Strengths

-

Diversified portfolio: Exxon Mobil has a diversified portfolio of assets that includes oil and natural gas exploration, production, and refining, as well as petrochemical and chemical manufacturing operations. This diversification helps to mitigate the risks associated with relying on a single product or market.

-

Strong financial position: Exxon Mobil is one of the largest and most profitable companies in the world, with a strong balance sheet and a history of steady cash flow. This financial stability enables the company to invest in long-term projects and weather economic downturns.

-

Experienced management team: Exxon Mobil has a seasoned management team with deep expertise in the energy industry. This team is responsible for developing and executing the company’s strategy, and has a track record of delivering strong results.

Three Key XOM Weaknesses

-

Dependence on fossil fuels: Exxon Mobil is heavily dependent on fossil fuels, particularly oil and natural gas. This reliance exposes the company to risks associated with the increasing focus on renewable energy sources and the potential for regulatory and policy changes related to the use of fossil fuels.

-

Environmental concerns: Exxon Mobil has faced criticism and legal action related to its environmental impact, including the pollution of air and water, and the greenhouse gas emissions associated with its operations. This has damaged the company’s reputation and could lead to increased costs and regulatory scrutiny.

-

Limited diversification: While Exxon Mobil has a diversified portfolio of assets, it is still heavily focused on the energy sector, which can be subject to volatile market conditions and external factors such as geopolitical tensions and natural disasters. This limited diversification could make the company more vulnerable to market disruptions.

Three Key XOM Opportunities

-

Growing demand for energy: As the global population and economy continue to grow, there is likely to be an increasing demand for energy, which could provide opportunities for Exxon Mobil to expand its operations and increase its revenue.

-

New technologies: Exxon Mobil has a strong research and development program and is actively exploring new technologies, such as carbon capture and storage, that could help the company to reduce its environmental impact and improve its operations.

-

Emerging markets: Exxon Mobil has a significant presence in many emerging markets, such as China and India, which are expected to be major drivers of global energy demand in the coming years. The company’s strong brand and experienced management team could give it an advantage as it seeks to capitalize on these growth opportunities.

Three Key XOM Threats

-

Increased competition: Exxon Mobil faces intense competition from other large oil and gas companies, as well as from smaller, more agile firms. This competition could lead to lower profits and market share for the company.

-

Regulatory and policy changes: Exxon Mobil is subject to a wide range of regulations and policies related to its operations, including those related to the environment, health and safety, and corporate governance. Changes to these regulations and policies could have a negative impact on the company’s bottom line.

-

Public perception: Exxon Mobil has faced significant public scrutiny and backlash over its environmental record, particularly in relation to climate change. This negative perception could lead to boycotts, protests, and reputational damage, which could impact the company’s ability to attract customers and investors. (And, some internal turmoil; not just public.)

Looking Forward

As I built this SWOT, the one thing that struck me is that XOM’s story hasn’t changed much. That is, over the years, I’ve seen and heard the same things over and over. That’s partially because XOM is a mature company in a mature market. But, it’s also true that XOM deals with commodities and volatility. So, there’s a certain “heart beat” in terms of profits, criticisms, and the like. However, the key is that the patient is alive and well.

The SWOT analysis did nothing to put fear in my heart. It also didn’t give me any warm and fuzzy about the future. I’ll keep this part simple. The strengths and opportunities I’ve explained above are excellent. And, the weaknesses and threats are real. But, there’s a balance, with a nice tilt toward growth and increasing dividends in the face of headwinds and adversity. Works for me.

So, what comes next? I don’t have a crystal ball. However, I feel strongly that XOM’s past tells us something about its future. Consider this little history lesson, which could be very useful if you’re a new XOM investor.

-

Exxon Mobil is the result of a merger between Exxon (formerly known as Standard Oil of New Jersey) and Mobil (formerly known as Standard Oil of New York) in 1999. Both companies have a rich history in their own right. Exxon traces its roots back to the formation of Standard Oil in 1870 by John D. Rockefeller, while Mobil was founded in 1911 through the dissolution of Standard Oil. In other words, XOM has a track record.

-

Exxon Mobil has been consistently ranked as one of the largest and most profitable companies in the world. It is a dominant player in the global energy industry and has a strong presence in many countries around the world. Strong, dominant, and XOM has a moat.

-

The company has a long track record of innovation and has made significant investments in research and development, including the development of new technologies and processes that have helped to improve its operations and reduce its environmental impact. Although it’s in an “old” business, XOM continues to innovate and handle adversity.

-

Exxon Mobil has faced controversy and legal challenges related to its environmental record, including its role in climate change and the pollution of air and water. The company has also been the subject of public protests and boycotts over its environmental practices. This will continue but this is also business as usual much like we see with tobacco companies.

Wrap Up

Normally, I write articles that are loaded with charts and graphs. I like pretty things. Besides, we all know that a picture is worth 1,000 words. But here, I’ve taken the time to provide a broad perspective so that we, as XOM investors, know what we’re really buying, what we’re facing. That said, the satisfying news is that it’s “same old, same old” going forward. No radical changes.

Furthermore, as I’ve stressed a few times, XOM is a Hold. Well, I’m not buying here. But, I’m not selling either. If we get up around $115 or so, I’ll start to think about a small trim, and I’ll take my own advice and look at those Dividend Kings I mentioned above, and that I’ve written about before.

As a quick final note, I look forward to hearing from you. I’ve provided three Strengths, Weaknesses, Opportunities, and Threats. I feel that these are the biggest and most important, but perhaps I’m wrong. Throw your hat in the ring and let me know if I’m right, or wrong. We’ll all benefit from your wisdom.

Disclosure: I/we have a beneficial long position in the shares of ABBV, MO, MMM, SWK, XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Best-of-Breed Growth Stock Ideas Targeting Oversized Returns

If you’re thinking about “bottom fishing” for high quality, beaten down growth stocks, then perhaps it’s time to look at Growth Stock Renegade.

Join today for less than $2 per day. And when you join, I’ll instantly share my actively managed growth stock portfolio.

Right now is the perfect time to subscribe because it’s affordable for any budget. Plus, there is a 14-day FREE TRIAL.

(You are fully protected by Seeking Alpha’s unconditional guarantee.)