Summary:

- Exxon Mobil’s stock recently hit a new high.

- The market appears to be finally seeing the effects of Exxon Mobil’s growth and income strategy.

- Oil and gas is historically cheap, but it will likely return to historical valuations. Expect Exxon Mobil common stock to lead the way.

Jeremy Poland

Exxon Mobil (NYSE:XOM) common recently hit a new high. Yet, if the articles on the website are reviewed, there are a few “Hold” and “Sell” articles that are fairly recent. That is just excellent for any stock to climb a potential “wall of worry” even if most of the articles are positive. Still, it would appear that most authors are bullish.

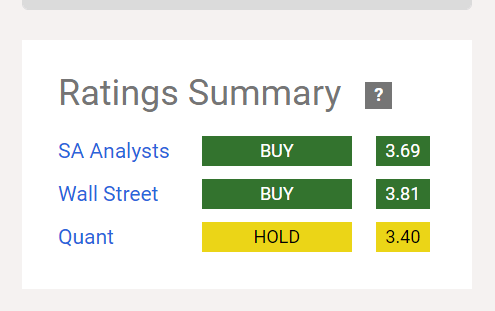

The Quant system summarizes the situation as follows:

Seeking Alpha Website Quant System And Analysts Summary Of Exxon Mobil Opinions (Seeking Alpha Website October 5, 2024)

The quant system itself has a statistical basis. That likely makes the system a trend follower. Sometimes, investors can use fundamental analysis to tell when the quant system will turn positive (or register a buy). Those that can do so successfully can possibly do a little better than the quant system.

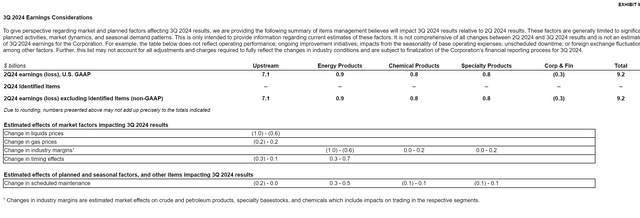

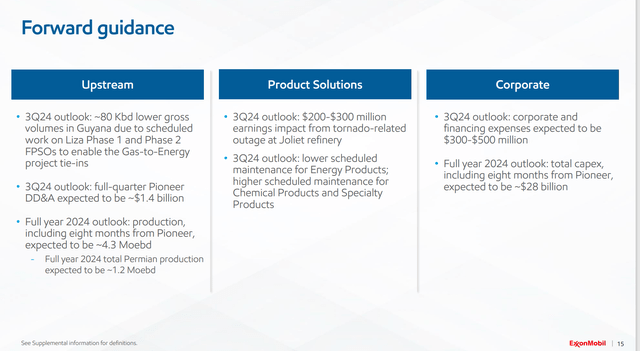

Exxon Mobil Earnings Adjustments Guidance

Recently, the company filed an 8-K that listed the following adjustments that management knew about for the third quarter earnings compared to the second quarter earnings. This is in addition to the things reported in the second quarter presentation.

Exxon Mobil Announcement Of Material Affecting Items For The Third Quarter Compared To The Second Quarter (Exxon Mobil 8-K Filed With Edgar Dated October 3, 2024)

The good news here is that all the adjustments listed are “typical” and do not (at least so far) indicate a long-term problem. This is one of the few companies that has an “early warnings signal” for “hiccups”.

More importantly, the market likely sees the risk of higher oil and commodity prices ahead due to the Mideast situation. That means there is likely a trading situation that has developed while the Mideast tensions rise. The stock could fall back once things calm down and a solution that both sides can accept is reached.

However, the stock price rising is not the news to pay attention to. What should be the attention getter is that the rise hit a new high. Lots of stocks rise all the time on favorable commodity price movements without hitting new highs. This stock was obviously in a position to head into new territory. The Mideast crisis just enabled that stock price movement to happen now rather than a bit later.

Long-Term Outlook

It would appear that the market sees a bright future for the stock beyond the current crisis. So, while the stock may fall back (somewhat) when the crisis is over, that fallback may not last long as other things take over that outweigh some short-term issues.

Last Article

The last article summarized management’s view of the company’s future. Some of that view was independently confirmed when (for example) data centers have largely decided upon natural gas to generate a reliable source of electricity to make those centers run properly.

As much as the “green revolution” aims to reduce oil and gas use, the fact is that we have never, as a world, reduced really any fossil fuel use (except maybe burning wood?). There is simply too much to change for oil and gas to disappear from use when many would like it to happen.

Therefore, the outlook for Exxon Mobil is particularly bright. It has a specialty chemicals division that makes products for the “green revolution” that are every bit a necessary as the more traditional products. This company is adjusting to the future faster than many realize.

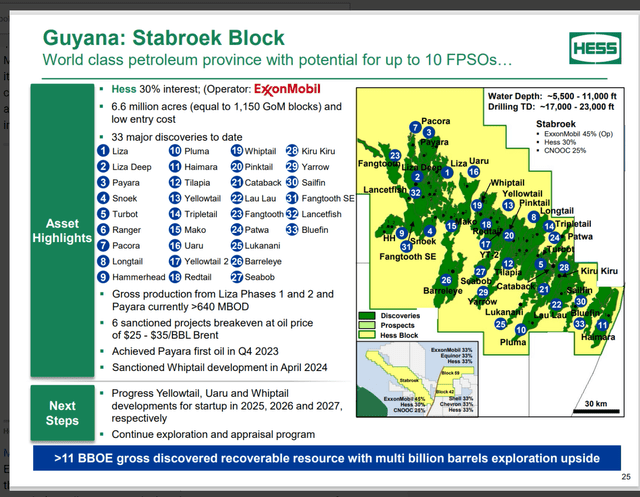

Guyana

Originally, the next FPSO was scheduled to be delivered sometime in fiscal year 2025. That “official timetable” has really not changed in some time. However, the company constructing the FPSO states it should be completed in the fourth quarter. If that optimistic timetable holds, then production could begin a few months earlier than was the original case (although first production is likely still in fiscal year 2025).

Even for a company the size of Exxon Mobil, a roughly 45% interest in 250,000 BOD is an amount that would likely be noticed by shareholders and investors.

Hess Corporation Presentation Of Guyana Discoveries And Sanctioned Projects (Hess Corporation Corporate Presentation May 2024)

In fact, the partnership plans to bring online one FPSO per year beginning in the next fiscal year. In reality, it is probably more like 15 months. But there could well be a time when (even with a $10 billion price tag that this one has) the partners would at least consider bringing on two of these FPSOs in a year. Much of that depends upon how fast Guyana can approve these projects. But supposedly Guyana is anxious for more money, so “therefore the ball is in their court”.

This is one of the few projects that “moves the needle” for Exxon Mobil. It could well represent at least one-third of the company production by the end of the decade.

It should surprise no one that Exxon Mobil is drilling some exploration wells to expand the gross recoverable resource shown in the slide above. This year alone could see seven exploratory wells drilled (give or take based upon ongoing results).

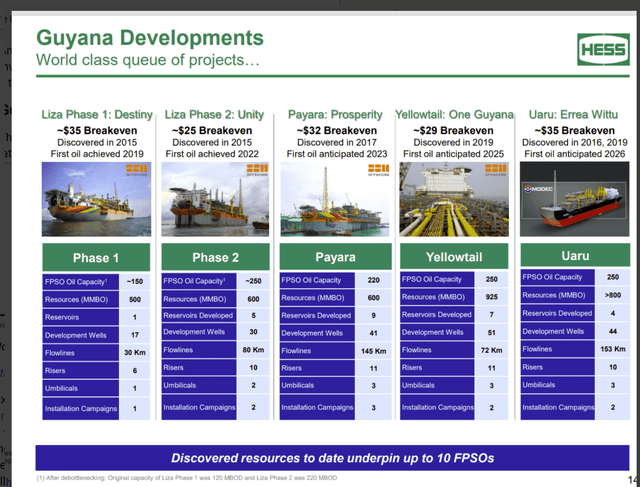

Hess Presentation Of FPSO Summaries For The Guyana Project (Hess Corporation Corporate Presentation September 2023)

Note: Hess has taken this presentation down, so I am referencing an older article instead.

The project has an outsized impact on Exxon Mobil profits because the breakeven point of each FPSO is about as low as it can get for an offshore project that is pegged to Brent prices. That means the prices received are at a premium to WTI pricing and the breakeven is very low. The company wins on a lot of fronts (and so do shareholders).

Management further reported that current production was very roughly around 640,000 BOD. Even though Exxon Mobil expects some downtime (while it hooks up some gas pipeline connections), the next FPSO could easily take the production past 900,000 BOD.

That is going to be some very impressive cash flow for the partners (and Guyana) when the breakeven point for the project is as low as the slide above shows. With a future this bright, a few timing variances and short-term price variances will be overlooked by the market.

Exxon Mobil Forward Guidance Second Quarter 2024, Corporate Presentation (Exxon Mobil Second Quarter 2024, Corporate Earnings Presentation)

Also in the market’s thought process is the benefits of the Pioneer acquisition. Now, that will likely take some time. However, Exxon Mobil is likely to prove to be a far better operator than Pioneer ever was. Should that be the case, then probably at some point next year, the Pioneer acquisition will likely be adding a couple of percentage points (give or take) to the corporate growth rate (along with maybe a big but speculative one-time benefit).

Summary

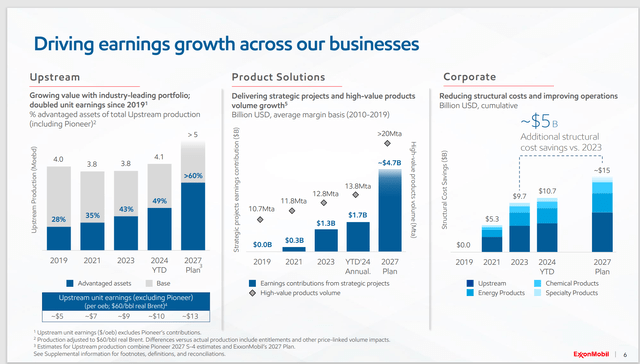

Without going into all the specific projects, the key to growth here is streamlining the company combined with “advantaged asset” growth. That is specific for how the company is going to grow earnings. Now, the commodity price volatility and low visibility can make the growth ride bumpy (to say the least). But it does appear that long-term growth will be the order of the day.

The summary of this idea is shown below:

Exxon Mobil Earnings Improvement Summary (Exxon Mobil Second Quarter 2024, Corporate Earnings Presentation)

Some things like the Pioneer acquisition will speed the process to a growth and income track record. As such, the stock price is really beginning to show the effects of this new strategy by hitting a record high.

There are likely more record highs to come because a growth and income strategy has a better market valuation than does the previous decade of “just sitting there” and really not showing much improvement. This new strategy has taken a few years to become apparent to the market. But the market appears to be finally seeing the effects of the strategy.

Exxon Mobil Common Stock Price History And Key Valuation Measures (Seeking Alpha Website October 5, 2024)

The time to sell is when the stock prices in “the hereafter” for as far as the eye can see. Right now, despite vastly improved prospects over 2015 (for example), this stock is really just getting past the pricing at the beginning of 10 years ago. Oil and gas is historically cheap (and definitely out of favor). It will likely return to historical valuations (at least average valuations) in the future. Expect Exxon Mobil common stock to lead the way.

Personally, I would not consider selling until the story changes or the pricing becomes overly optimistic “by a mile”. But as the chart above shows, we have a long way to go to get to that.

Risks

Commodity prices are very volatile, and the future is low visibility. That can make for a fairly volatile stock price, even if the company we are talking about is very large like this one. A severe and sustained commodity price downturn could materially change the outlook of the company.

Guyana is a bastion of serenity compared to some of its neighbors. That can cause a scare from time to time, which can affect the stock price.

Technology advances could one day change the need for oil in the economy. Right now, there is nothing close to that on the horizon. However, technology advances do not exactly give warnings when they make seismic changes in consumer preferences.

A loss of key personnel is not as material to a company the size of Exxon Mobil. However, there is the reduced possibility that the loss of one or two key personnel could prove to be a major impediment to the company’s bright future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM, HES either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies like Exxon Mobil and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.