Summary:

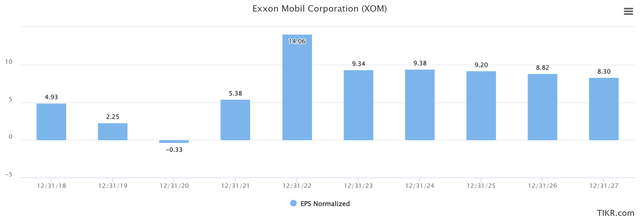

- Exxon Mobil Corporation’s growth is slowing, and it missed EPS and revenue expectations in its latest earnings report.

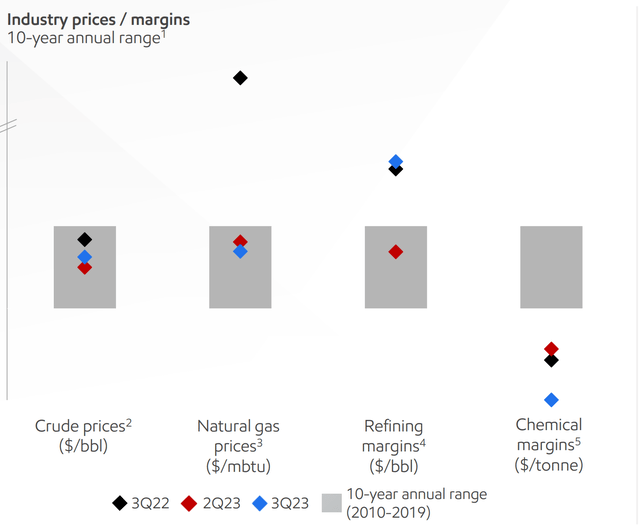

- The company’s margins are returning to the historical ranges, raising concerns about its current valuation.

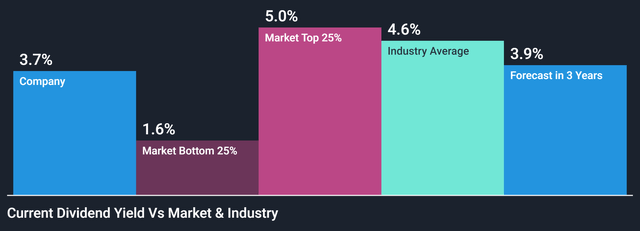

- The dividend yield is not attractive compared to industry averages, making Exxon stock a risky investment in a bearish oil market.

Bruce Bennett

It’s not very often I publish a bearish article, especially in the industry that I love oh so much, but it’s time to consider shorting Exxon Mobil (NYSE:XOM). This is not the first time I have been short the stock. But the rationale behind shorting it is very different this time. As the growth slows, and oil prices sag, it has the potential to be an ugly combination. Exxon missed EPS and Revenue expectations in the latest earnings report, and EPS is expected to continue to regress over the next few years. As we are in a poor oil pricing environment with respect to seasonality, it creates the perfect storm to make some money on the short side in this oil giant.

The Growth Isn’t There

In the last earnings report, we saw Exxon Mobil Corporation (XOM) miss on both revenue and earnings.

- Q3 Non-GAAP EPS of $2.27 missed by $0.09.

- Revenue of $90.76B (-19.0% Y/Y) missed by $1.81B.

The year-over-year drop in revenue was expected given where the price has been this year versus last year. In 2022, the average price of WTI (CL1:COM) was just under $95. So far in 2023 (through September), we are at just over $77. That is going to impact the bottom line for any oil & gas player. The concern here for me is that EPS is forecasted to continue to decrease over the next couple of years.

While I am bullish on oil & gas in the long run, when prices start to slide like they have, there is an opportunity to make money on the short side. Finding companies like Exxon that are expecting to see negative growth are good places to start.

Looking below, we can look at how the company’s margins are fairing. The blue diamonds represent how the company faired in Q3. The grey boxes are the 10-year annual range from 2010-2019. From 2010-2019, the stock was essentially flat at $70. Peaking at $104, the stock rode the rollercoaster over the decade. What I’m getting at here, is that we know the share price set all-time highs of $120 not that long ago. But, with margins coming back into historical ranges, how long can that last? Exxon is currently trading 15% off the highs at $102 and change.

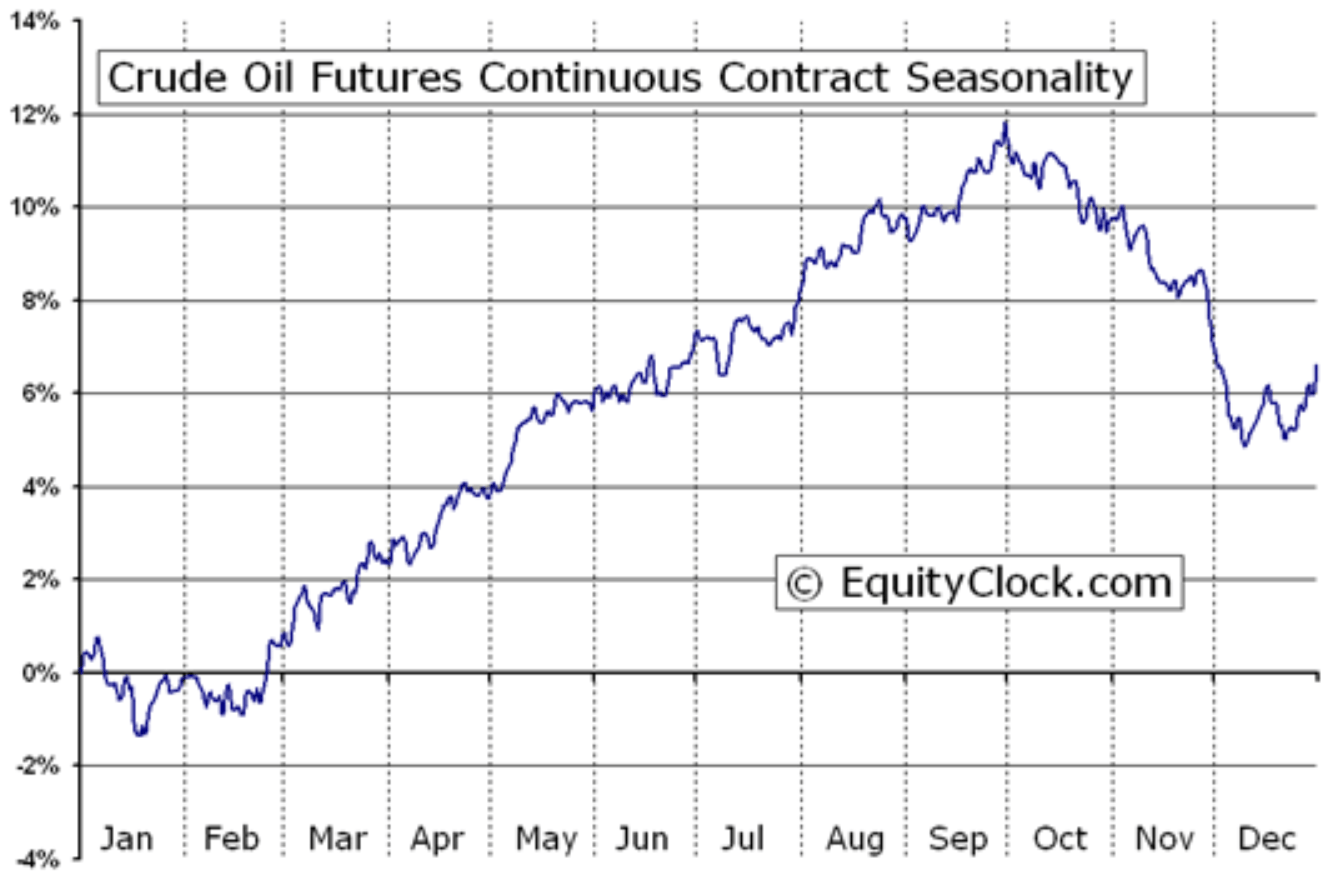

So what leads to Exxon turning around? There’s one thing, and it’s oil prices. The bad news is that we are in the middle of the worst season for oil prices. Looking below, you can see that historically October and November are where we see the price fall. While I do think the world still needs and craves oil, and I do think that in the long-run oil prices will appreciate – that’s not the case right now. There’s money to be made here, and I believe it’s on the short side.

EquityClock.com

The Bright Spot!

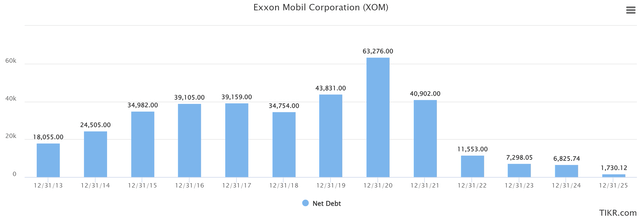

That said, there are things Exxon has going for it. The main bright spot is the general condition of the balance sheet. Looking below, we can see just how low the debt is. It’s expected the leverage ratio will finish the year around 0.1x, which is incredible for a company of its size in the oil & gas industry. For reference, in 2020, it was closer to 5.0x. This is the only thing that causes me hesitation concerning my current position. Thankfully, this is a trend across the industry.

Debt at these levels provides the company with several opportunities to grow. While some are returning cash to shareholders, others are looking to grow by acquisition. If I was a shareholder, I would be disappointed with the lack of “profit sharing” Exxon has done as of late.

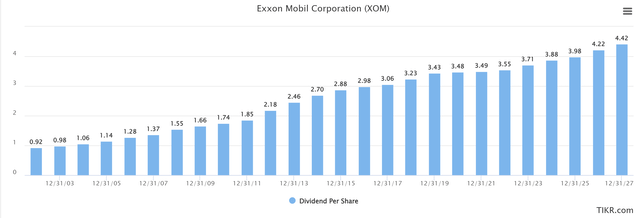

The Dividend Isn’t Enough

Many hold Exxon just simply for the dividend. Frankly, it’s not worth it. Even with the recent increase, and the 14% selloff, it is still only yielding 3.7%. The industry average is 4.6%. If you are after yield, there are better options out there.

As mentioned earlier, I have been short on Exxon before. Once, back in 2020 right before the big crash. A big part of the reason I picked Exxon then, was the fact of how committed they are to paying their dividend. While many see that as a positive, I will never understand why a commodity-based company would want to set such an odd precedent. If they were yielding 7 or 8%, okay, I could understand. They have trapped themselves into this cycle where they can never cut. As soon as they do, the stock will plummet. Their dividend history is impressive, without a doubt. I have no doubt the company will get through any sort of turbulence and manage to continue to pay the dividend.

Let me be clear. I believe the dividend is 100% secure. As we saw years ago, they will go into debt to cover it if need be. But, thanks to a few years of really strong cash flow, I don’t foresee that happening anytime soon. But, because of the unwillingness to cut, in a bear oil market, the dividend becomes a risk. It doesn’t pay enough to stick around and wait it out.

What Does The Price Say?

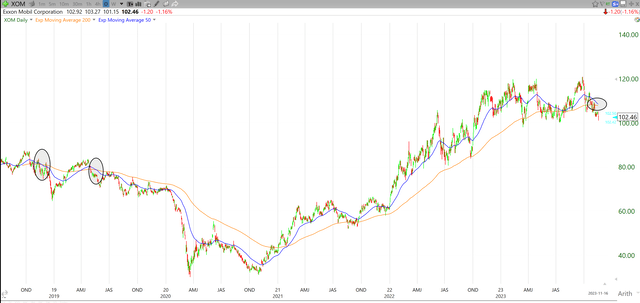

Diving into the technical side of things, they match the fundamental story. The first thing I want to point out that is worth keeping an eye on over the next few days is the 50-day moving average and the 200-day moving average crossing over. Since 2018, there have been 2 bearish crosses. Both saw the stock dive rather hard. One of which led us to the Covid crash in early 2020. We have had a close call a number of times since, but with the stock trading well below the 200-day moving average, we need a rather strong bounce next week for this to be yet another bounce.

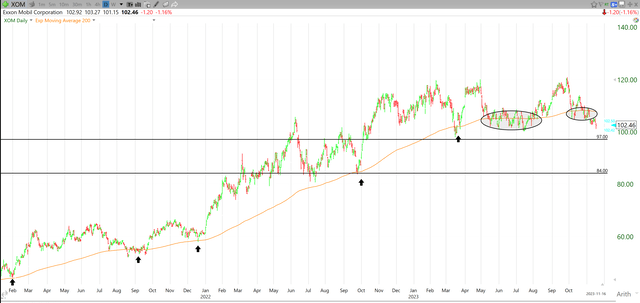

Just how low could we go? I would be looking for $97, and then, if that dam breaks, $84. The main reason for my current bearish stance on Exxon (concerning technicals) is the 200-day moving average. We can see below that there has been tons of support from it over the last few years. Including a period of indecision earlier this year, and then another just days ago. But, the stock couldn’t get back above it.

With respect to the two levels, we can see there have been lines of support and resistance over the last couple of years. Stocks love to find old levels of support, and Exxon is no different. Let’s not forget that we are in a historically poor time for oil prices concerning seasonality and Exxon loves to follow oil prices. If you choose to buy this dip, just be aware of how the commodity prices will affect the stock.

How Am I Playing This?

As you’ll notice, I have published several bullish articles on other oil & gas companies lately. As mentioned, I remain bullish long-term on oil & gas. But, I also remove emotion from the equation and play the market as the data leads me to. I have multiple long positions in mid/small-caps, with a short on Exxon. An over-weighted pair trade if you will. I do not expect to be in this short position for the long term. If I owned Exxon and believed in the oil & gas story, I would be looking for a company that is going to return cash to me at a quicker rate. This will at least allow you to get paid to wait.

My long positions include:

Meg Energy (MEG:CA), Nuvista Energy (NVA:CA), Athabasca Oil (ATH:CA), Tourmaline Oil (TOU:CA), Whitecap Resources (WCP:CA), and Tamarack Valley (TVE:CA)

Wrap-Up

In short, this isn’t a long-term play. At least I don’t anticipate it being one. I will hold the position until I am stopped out. My current stop is at $114. As I mentioned, I have long positions in several Canadian players to offset this trade. I remain bullish on oil & gas in the long run, but the outlook for Exxon is far worse than the companies I own. And a few of them return cash to shareholders at a much better rate. Keep an eye on the oil price and watch how Exxon reports in the next quarter, as another miss could be the start of an ugly trend. The industry will continue to be very volatile, and I have no doubt that Exxon will have its day again, it’s just not it right now. It’s been a great run.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.