Summary:

- Exxon Mobil Corporation may be interested in acquiring Pioneer Natural Resources Company.

- Acquiring Pioneer would be accretive for Exxon Mobil due to the valuation difference and potential synergies.

- The acquisition would strengthen Exxon Mobil’s position in the Permian Basin and provide a use for its cash hoard.

courtneyk

Article Thesis

Rumors have surfaced that Exxon Mobil Corporation (NYSE:XOM) could be interested in buying Pioneer Natural Resources Company (NYSE:PXD). We will look at why this could make sense and how Exxon Mobil would finance such a takeover.

Why Would Exxon Mobil Pursue An Acquisition?

American super majors Exxon Mobil and Chevron (CVX) trade at above-average valuations compared to many other energy companies. This is due to their strong balance sheets and resilience which makes investors see them as safe havens, compared to smaller, more volatile energy companies. This also means that takeovers, even factoring in a takeover premium, can be highly accretive — when a more expensive company buys a less expensive company, that deal can easily add to the acquirer’s earnings per share, for example.

Today, Exxon Mobil is trading at 12x forward net profits, using the current earnings per share consensus estimate by the analyst community. This estimate might be too low, however, due to the recent rise in oil prices. Pioneer Natural Resources trades at 10x forward net profits, using the (potentially too conservative) earnings per share consensus estimate as well.

In other words, Exxon Mobil trades at a meaningful premium compared to Pioneer Natural Resources. If a takeover happens — which isn’t guaranteed, of course — and if that takeover would not require a premium, the deal would be immediately accretive even without any synergies, due to the lower valuation Pioneer trades at, relative to Exxon Mobil.

Of course, a takeover without a takeover premium is highly unlikely, but this example nevertheless shows why acquisitions can be attractive for strong and large energy companies such as Exxon Mobil that trade at a premium compared to many smaller companies in the same industry.

On top of the valuation difference, synergies are another important argument in favor of acquisitions. If Exxon Mobil would acquire Pioneer, a lot of synergies could be captured. There would be advantages when it comes to acquiring drilling services and equipment, for example, as a very large company can place large orders at more favorable terms compared to a smaller company that places smaller orders.

There would also be major redundancies: Starting at the C-level, Exxon Mobil could cut employees and expenses in many areas following an acquisition. Cuts could be made in areas such as exploration, marketing, HR, investor relations, and so on.

Marketing the energy commodities that Pioneer produces could also be a more efficient process if the company was taken over by Exxon Mobil, or Exxon Mobil could use the energy commodities itself across its refineries.

Last but not least, Exxon Mobil has a much stronger balance sheet and can thus access debt markets at more favorable terms. The debt that Pioneer has could be refinanced at lower rates, all else equal, if the company were taken over by Exxon Mobil. This, in turn, would result in lower interest expenses compared to a scenario where Pioneer remains an independent company.

I believe that Exxon Mobil could thus benefit from very significant synergies if it were to acquire Pioneer Natural Resources, which should improve the accretive nature of such a takeover.

A takeover of Pioneer would also strengthen Exxon Mobil’s position in the Permian Basin, where it would become the number one producer if a takeover happens. The Permian Basin is one of the focus areas of Exxon Mobil, where it seeks to expand, as its assets in the Permian Basin are seen as resilient, profitable, and lower-risk from a political perspective. Along with other focus areas such as Guyana, the Permian Basin is where Exxon Mobil plans to grow — a takeover would help a lot.

XOM Buying PXD: Financial Impact

While there is no guarantee that a deal will happen, let’s look at what could happen if XOM were to decide on an acquisition of PXD.

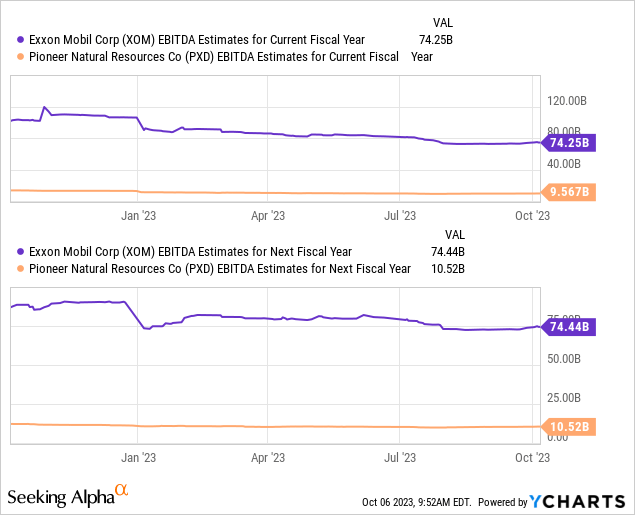

Exxon Mobil is forecasted to generate EBITDA of $74 billion this year, while PXD is forecasted to generate EBITDA of $10 billion in 2023. For next year, Exxon Mobil is expected to generate comparable EBITDA, while Pioneer is forecasted to see its EBITDA grow by 10% to $11 billion.

If XOM were to acquire PXD, this deal would, in all likelihood, require a premium. If XOM were to pay 20% more than the current share price, the market cap of PXD would be $63 billion, and its EV would be $68 billion. XOM would thus pay a forward EV multiple of around 6, which is far from a high valuation — and which does not yet account for synergies. If synergies allowed Exxon Mobil to cut expenses by $1 billion following a takeover, PXD’s EBITDA would climb to $12 billion, which would reduce the takeover multiple to around 5.7 — this would be considerably below Exxon Mobil’s own valuation, making the deal highly likely to be accretive. If there is a takeover and if the takeover is smaller than 20% — e.g. 15% — then the deal would be more accretive, while a deal would be less accretive if the takeover premium is higher than 20%.

If XOM were to pay for the acquisition in stock, it would have to issue around 590 million new shares (assuming a 20% takeover premium). Its share count would thus grow by around 15% from the current level of around 4 billion shares. But EBITDA would grow by 16% (assuming $1 billion in synergies), thus XOM’s EBITDA per share would increase. The deal would thus be accretive.

XOM could juice returns further by adding debt to the financing equation. If the company were to acquire PXD at a 20% premium in a 50% stock, 50% cash deal, things would look like this:

XOM would have to issue around 300 million new shares and would have to issue $32 billion in new debt to pay for the cash portion (assuming no cash on the balance sheet is being used). This would make the share count rise by around 8%. Assuming new debt costs XOM 7%, the debt load would add $2.2 billion in pre-tax expenses, while the after-tax cost would likely be in the $1.7 billion range due to a tax rate of around 25%.

In other words, by increasing its share count by 8% and by adding $1.7 billion in net interest expenses, XOM could add PXD’s $11 billion in annual EBITDA to its own, or $12 billion if $1 billion of synergies are captured, which would make for a 16% boost to company-wide EBITDA. Thanks to Exxon Mobil’s strong free cash generation, the debt in such a deal could be paid off quickly — combined, the two companies would generate around $50 billion in free cash flow, which means that it would take less than one and a half years to pay down all deal-related debt even if the company uses just half of its free cash flow for debt reduction while using the remainder for shareholder returns.

Takeaway

Exxon Mobil has an above-average valuation and above-average balance sheet, which makes it a natural acquirer. The company has shown in the past that it likes to make deals, including earlier this year, when it acquired Denbury Resources.

If Exxon Mobil were to acquire Pioneer Natural Resources, such a deal would, I believe, be accretive, even factoring in a takeover premium, due to the synergies that could be captured. A takeover would also strengthen Exxon Mobil’s position in the high-value Permian Basin, where the company plans to expand further.

Last but not least, it would give Exxon Mobil a use for its massive cash hoard — if the cash is sitting on the balance sheet, it isn’t generating a lot of value for shareholders.

A deal is far from guaranteed, and buying solely due to speculating on a deal is risky, I believe. But Exxon Mobil looks like it is poised for a major deal eventually, and Pioneer Natural Resources seems like a very solid target — large enough to move the needle, yet easily stomachable by a giant such as XOM.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!