Summary:

- Exxon Mobil is a buy regardless of short-term oil price fluctuations due to its strong earnings prospects and rapidly diversifying business.

- Structural factors suggest that oil prices will trend higher over the long-term, even if demand peaks soon.

- Exxon has a de-risked balance sheet, multiple growth catalysts, and the ability to use their massive free cash flow to transition towards renewables.

- We believe that Exxon is trading at an attractive valuation and represents the best buy in energy.

TebNad

Thesis

Exxon Mobil (NYSE:XOM) is generating massive amounts of free cash flow. They have done a lot of deleveraging over the past few years and currently have a pristine balance sheet. The company is focused on diversifying their business and has multiple growth catalysts. Management has implemented a robust capital return plan. For these reasons, Exxon Mobil is a buy regardless of where the price of oil goes in the short-term.

Oil Price Fluctuations

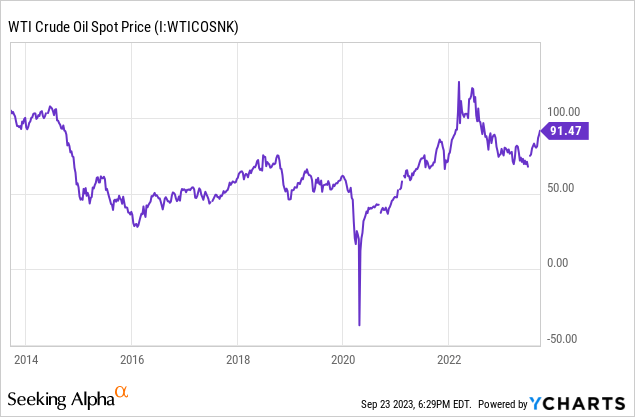

In commodity markets investors and traders tend to overreact to moves in the short-term, whether that be higher or lower. When oil prices are increasing, observers are quick to posit that they will keep rising and eventually reach $200 a barrel or higher. When prices are going down investors are quick to sour on energy names and grow bearish on their earnings prospects (doubly so for the “terminal value of oil is $0″ crowd).

We believe that rather than making investment decisions based upon short-term fluctuations in commodity pricing, investors should look at a business in its entirety and assess whether or not they will be able to grow their earnings power over the long-term and return meaningful capital to shareholders.

Long-Term Drivers of Oil

There are structural reasons why oil prices are likely to trend higher over the long-term, even if global demand peaks soon. The first reason is that while many nations are seeking to curtail their usage of oil, there are many other nations whose usage will increase as they become more industrialized. This should help to stabilize the eventual decline in oil demand.

Another long-term driver of oil prices is the reluctance of some nations to allow new oil and gas projects. This will have the net effect of curtailing supply, which will serve as a structural driver of higher prices going forward.

Importantly, even if oil prices do not go higher from here, as long as those prices are maintained companies such as Exxon Mobil will continue to throw off massive amounts of free cash flow which will be returned to investors or invested into “green energy” initiatives such as lithium mining and carbon capture. Even if the terminal value of oil is close to zero as some proponents of the green economy believe, the present value of Exxon Mobil and other oil and gas companies is certainly not zero.

De-Risked Balance Sheet

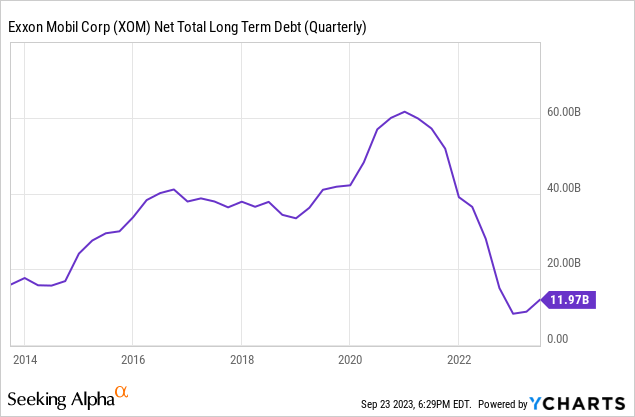

Over the past couple of years Exxon Mobil has massively reduced their net debt from $60 billion in 2021 to just under $12 billion in 2023. The company is in the healthiest financial position they have been all decade and is positioned to benefit from capital expenditures they have made in recent years. With a renewed focus on shareholder returns and deleveraging, the company is the most fundamentally attractive it has been in recent memory (excluding the 2020 panic selloff in the shares).

Dividends and Buybacks

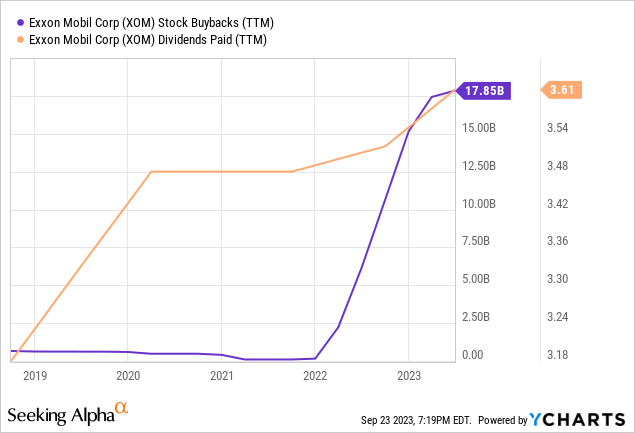

Exxon Mobil appears to have a renewed focus on shareholder returns. The company has been steadily increasing their dividend and has implemented a robust stock buyback plan. We believe that Exxon will continue to reward shareholders with significant capital returns while making incremental investments in growth.

Multiple Growth Catalysts

Exxon Mobil has multiple growth catalysts on the horizon. On the oil and gas front, the company has a massive opportunity in Guyana. At a time when many other large oil and gas companies are curtailing investment in the sector, the management of Exxon Mobil took advantage of the pessimistic environment to acquire and develop oil and gas assets at an attractive price. As Guyana production ramps up Exxon Mobil could financially benefit from both higher internal volume and higher external prices resulting from a constrained supply environment elsewhere in the world.

Another growth catalyst could come from lithium. Exxon Mobil is making moves to get into the lithium space, with the company most recently experimenting with the extraction of lithium from subsurface brine. While some may be skeptical of how well Exxon can do in this business, the company is highly experienced with the ins and outs of commodity economics, from extraction and processing to sale. We have no doubts that Exxon can succeed in the lithium market and their interest is a sign that management is being proactive and positioning their business for the future.

An additional growth catalyst could come from the Denbury acquisition. Exxon Mobil’s pending acquisition of Denbury is expected to close in the fourth quarter of 2023. This will result in the company gaining valuable assets in the realm of carbon capture, utilization, storage and enhanced oil recovery. This acquisition will further diversify Exxon’s business and improve their public image regarding the green energy transition.

Valuation

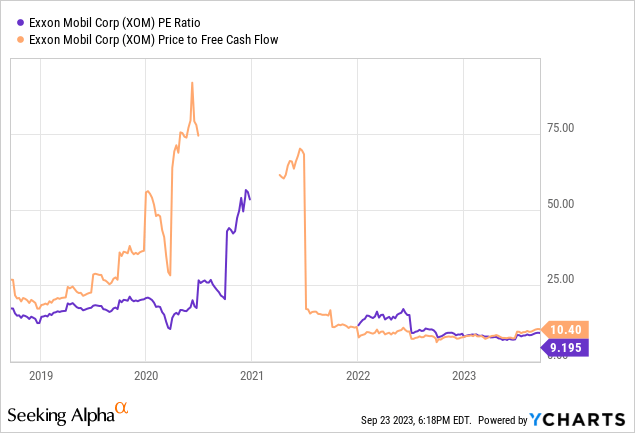

Exxon Mobil is trading at an attractive multiple to earnings and free cash flow. This depressed valuation comes in spite of their pristine balance sheet and the numerous growth catalysts on the horizon. We believe the company should trade at a multiple of 15x trailing earnings, which represents nearly 50% upside from these levels. We believe 15x earnings is reasonable because that is about the average PE of the S&P 500 over the long-term. For high quality, stable businesses that aren’t growing rapidly we view 15x earnings as a conservative valuation target.

In our opinion, Exxon Mobil represents the best buy in the energy space.

Price Action

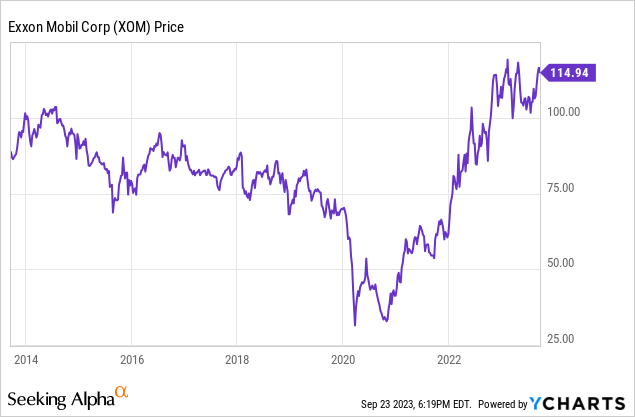

Exxon Mobil has rallied hard from their 2020 lows and is up a reasonable 4% year to date. Investors looking at this chart may be dismayed that the stock is trading at nearly the same levels as it was ten years ago. We believe that the stagnation of Exxon’s share price was the result of sector economics that are unlikely to return, namely the combination of excessive capex and lackluster oil prices observed during the prior decade.

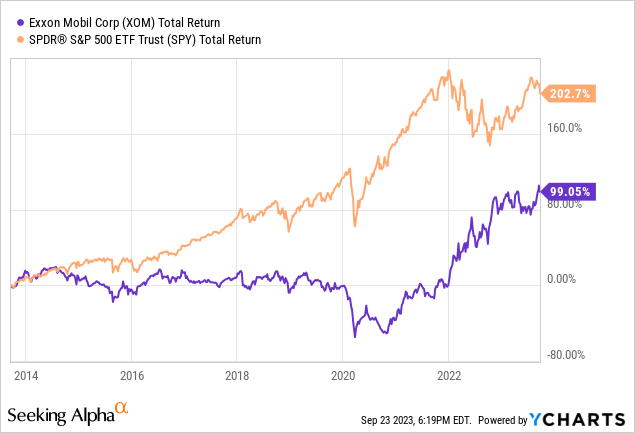

On a total return basis Exxon Mobil doesn’t look nearly as bad. While the company has trailed the S&P 500 over the past decade, this was due to overinvestment in the sector. Companies are now more disciplined when it comes to capex, and are placing an increased importance on shareholder returns. It seems plausible that Exxon could outperform the S&P 500 over the next decade as investors begin to reap the rewards of the prior decade’s investment cycle. Management is spending billions a year on dividends and share buybacks, so it seems that investors will at worst get a 3% dividend yield while they wait for buybacks to eat away at the share count.

Risks

There are some risks to the bull case for Exxon. A potential risk is litigation surrounding Exxon’s alleged concealment of the harmful effects carbon emissions have on the climate. We will leave political pundits to comment on the merits of any such lawsuits, the main takeaway for investors is that the government can sue anyone for any reason, and only time will tell what the financial impact will be (if any).

Another risk to Exxon is the potential for them to be unable to diversify their business, which could become a problem if oil prices significantly declined and remained at a low level for an extended period of time.

We view the overall risk/reward of Exxon Mobil as being very attractive at this time.

Key Takeaway

Regardless of where the price of oil goes over the short-term, Exxon is trading at a fundamentally attractive valuation. With low net debt, a rapidly diversifying business, and multiple growth catalysts on the horizon investors are looking at a significantly de-risked company. Management’s focus on returning capital to shareholders means that investors are getting paid to wait for the bull thesis to play out.

Thanks for taking the time to read this article!

Today’s question for the comments is: Do you believe Exxon is the best buy in energy, or do you believe that title belongs to a different company?

Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

UFD Capital Value Fund, LP has long exposure to XOM. UFD Capital, LLC manages a hedge fund and does not provide investment advice to anyone else. Nothing contained in this article is investment advice or financial advice of any kind and investors should do their own research and consult a professional before making financial decisions. Nothing contained in this article should be interpreted as a solicitation to buy or an offer to sell securities.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.