Summary:

- Exxon Mobil’s purchase of drilling rights for lithium production in Arkansas could open up a high-margin growth opportunity to mitigate the structural decline in its oil and gas business.

- XOM sellers inflicted pain on holders recently as China’s nascent recovery fizzled out, putting a second-half revival increasingly at risk.

- Exxon Mobil must instill confidence in its investors that it has sustainable projects to create new earnings growth drivers, such as lithium mining.

- XOM’s valuation is not cheap but is also no longer overvalued, creating an opportunity for dip buyers to add more shares.

JHVEPhoto

I highlighted in my previous article on Exxon Mobil Corporation (NYSE:XOM), suggesting investors consider taking profits and cutting exposure, as its valuations then didn’t support continued outperformance.

XOM sellers delivered a crucial blow as it topped out in February, but buyers jumped at the opportunity to buy the steep pullback toward its March lows.

However, the initial positive reaction to the additional OPEC+ output cuts has fizzled out as investors focused on the tepid recovery of China’s economy.

Exxon Mobile reported a pretty robust Q1, as adjusted EPS rose 36.7% YoY to $2.83. In addition, its commitment to achieving a $9B reduction in costs should bolster buyers to support bullish sentiments as it navigates a slowdown moving ahead.

Furthermore, its target to complete its $35B stock repurchase authorization by 2024 could see investors defending steep pullbacks with confidence as Exxon Mobil executes its capital allocation astutely.

Notwithstanding, investors should note that Wall Street estimates suggesting a steep slowdown in earnings growth through the rest of the year shouldn’t be understated.

Accordingly, Exxon Mobil is projected to report an adjusted EPS of $2.37 in FQ2, down nearly 43%. In addition, Wall Street estimates indicate that investors should anticipate a further decline in adjusted EPS through FY25, likely reflecting a normalized underlying market.

Despite that, Exxon Mobil’s massive cost advantage and scale efficiencies could deliver upside surprises to these estimates, coupled with its cost-reduction program.

Hence, the critical question is whether Exxon Mobil could deliver more upside potential to its medium-term earnings forecast, supporting buying sentiments for XOM? It’s an important consideration as structural oil demand is expected to top out and decline subsequently, even though “it is not expected to happen in the near future.”

Exxon Mobil also made its case recently, arguing that it’s “highly unlikely that the world will achieve net-zero carbon dioxide emissions by 2050.” Moreover, the company stressed that the IEA net-zero emissions scenario would “require a degradation in the global standard of living that society is unlikely to accept.”

However, XOM holders still need to contend with the possibility that the company’s growth drivers will likely weaken over time as the world moves toward a renewable future.

Despite that, the company “has plans to invest $17 billion in carbon emissions reduction and low-carbon technologies.” Hence, Exxon Mobil is working to diversify its reliance on oil and gas in the medium term, although the efforts are still nascent.

Could the company bolster investors’ confidence that it has a robust earnings growth driver in the medium term to mitigate the structural impact on its core earnings?

The Wall Street Journal reported an exclusive over the weekend, highlighting that the company “purchased drilling rights to a significant portion of land in Arkansas with the aim of producing lithium.”

I believe it’s a significant move because lithium demand is expected to continue growing significantly to meet the underlying drivers of renewable energy.

The company reportedly paid $100M for 120K gross acres “in the Smackover formation of southern Arkansas.” The region is said to contain enough lithium deposits to “power 50 million electric vehicles.”

I assessed it as a highly significant development for Exxon Mobil, as it leverages its expertise in oil and gas in lithium mining. Moreover, given the EV supply chain’s current reliance on China’s dominance, it has tremendous potential to help secure crucial lithium supplies for the US.

Morningstar’s estimates indicate robust structural growth in lithium demand through 2030. It projects “lithium demand to grow at nearly a 20% annual rate from around 800,000 metric tons in 2022 to over 2.5 million metric tons by 2030.”

It could help Exxon Mobil open up another opportunity for a strong and sustainable earnings growth driver in the medium term, which has likely not been reflected in the current analysts’ estimates.

The company has not publicly declared its ambitions in lithium mining. However, I see this as a noteworthy development to bolster its capabilities into the potentially high margin and earnings accretive lithium projects while remaining relevant with the renewable energy transformation. Therefore, I believe the company seems ahead of the curve in navigating the structural oil and gas decline, helping underpin the conviction of investors about its long-term future and improving buying sentiments.

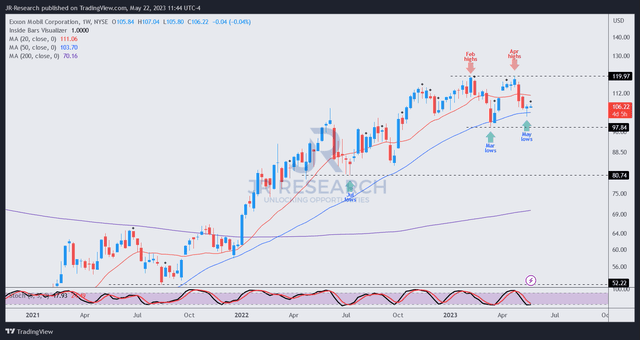

XOM price chart (weekly) (TradingView)

XOM’s valuation is not cheap. It’s rated by Seeking Alpha Quant with a “D”+ grade, even though it has pulled back markedly from its April highs.

Its forward-adjusted P/E multiple of 11.1x is also well ahead of its peers’ median of 7.6x (according to S&P Cap IQ data).

Therefore, investors considering buying at the current levels must have a high conviction of its medium-term earnings growth potential.

Notwithstanding, I assessed that dip buyers returned confidently last week, helping to stanch the recent decline from its April highs.

Hence, buyers have continued to use steep pullbacks to get into XOM, which could undergird its ability to navigate toward a higher high. Despite that, investors should note that XOM has a significant resistance zone at the $120 level that it failed to break through in April.

Hence, if the resistance continues to hold robustly, a potential trend reversal against XOM holders could be in store, suggesting caution. As such, taking a considerable margin of safety from that level to add exposure is encouraged.

Rating: Buy (Revised from Sell).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!