Summary:

- Exxon Mobil Corporation completes largest shale patch merger with Pioneer Natural Resources.

- Analysts have mixed opinions on Exxon’s future performance post-merger.

- Exxon’s relentless commitment to cost control and potential for long-term growth make it a solid investment opportunity.

- We rate Exxon as a strong buy at current levels.

Nerthuz

Introduction

The ink is now drying on the biggest shale patch merger of all time. In case memory escapes you, I am referring to Exxon Mobil Corporation’s (NYSE:XOM) purchase of Pioneer Natural Resources-formerly PXD. As of May 3rd, 2024, the two oil giants are now one shale colossus. We were supportive of the merger in the context of what we see developing in shale’s future, and discussed why in a public article last fall. Our updated shale thesis was in another public article if you would like more depth on this topic.

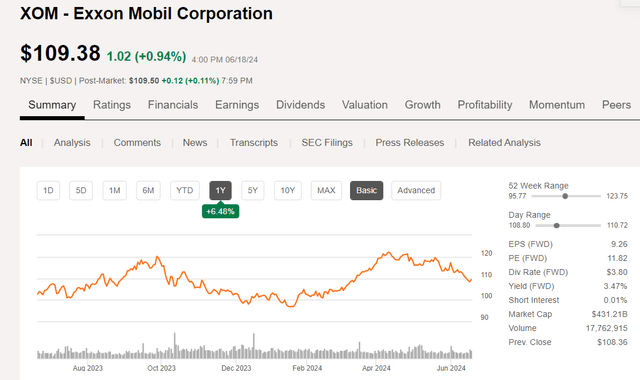

XOM price chart (Seeking Alpha)

We remain bullish on XOM, and think that the value obtained in the merger is not yet reflected in the stock, making the current level a solid entry point or basis for adding.

The analyst community is a little tepid at current levels, ranking XOM as an Overweight. Price targets range from $114-$152, with a median of $131.50. Even if that median figure is correct over the short haul, it represents a decent gain from one of the largest industrial corporations on Earth. And, when packaged with the capital returns that are in the pipeline in the coming decades, investors should carefully consider if XOM meets their investment profile.

XOM has recently gotten a downgrade from Truist’s Neal Dingman. Citing concerns about cash flow yield below peers-(XOM has peers?!?!?), driven by capex allocation to lower performing sustainable businesses, he’s reduced his target from $146 to $124.00. Tipranks has him at 144 out of over 8000 ranked analysts with a success rating of 68%. I think he’s stretched out a bit over his skis on this one, as energy companies are dialing back on some of this “sustainable” stuff. We shall see.

On a technical basis, the stock is still above long-term support at $102, and right on its 200-day SMA. With the turn, we have seen in crude oil prompted by a bullish call by Standard Chartered and the market figuring out what OPEC+ really meant by scaling up production, any thought of XOM hitting the long-term support line in the near term is starting to look pretty iffy. People who want in should probably take the jump, at least with a little bite.

The thesis for XOM now that they have eaten PXD

In this article, we are going to assume you know about Guyana and not discuss it much except to say that it hasn’t peaked yet. It also has breakeven costs in the mid-upper $20’s and can expect Brent pricing. Guyana is a cash flow monster. Ok, that out of the way, let’s review why everybody and their Uncle Eddie is soaking up all the Permian acreage that they can.

The company also participates in other business, refining, chemicals, and dabbles in various sustainable and carbon sequestration businesses. None of those have the impact that upstream E&P operations do, hence the focus of this article.

The shale shell game

Once I completely got my arms around shale, maybe eight years ago, I formulated a set of attributes that would describe the ultimate winners in the shale shell game. Here they are again.

Rock quality-Tier I acreage in the key Wolfcamp A, Bone Spring, Spraberry and Avalon plays. This also drives the top-tier drilling locations the company brags about.

Scale-typified by vast swathes of acreage and lowers unit costs. In the end, low cost of supply trumps everything else as fields mature.

Connectedness-enabling longer lateral sections

Logistics-resources in basin, primarily sand and water

Technology-I initially underestimated the role this would play in leveraging higher and higher well recoveries. Tech-AI led improvements in reservoir description, well designs, and completion intensity, have helped to flatten the trajectory longer than I thought would be the case. Showing that even grizzled, old Fluidsdoc can be surprised occasionally.

Export to marketing hubs– if you can’t move toward refining and processing, there is no value added.

What do I mean by “Shell Game?” By virtual of its high natural declines 30% annually in good rock-Tier I, over 50% in less good rock-Tiers II, III, IV, production is a roller coaster. To maintain output levels, you must constantly drill to replace legacy declines. Some of this effect has been masked recently by the incredible technological and efficiency gains the industry has pulled off combined with DUC withdrawal. But as I have noted, the buffer created by tech and DUCs has about run its course, and the pace of drilling presently will soon result in a bending of the production curve.

The industry knows this and has been on a frantic drive to mop up and aggregate Tier I drilling locations through the M&A frenzy of the last couple of years. One by one, the mighty have devoured tasty, smaller morsels in the hope of being one of the shale winners. M&A will grind out cost for the survivors. We’re seeing it already in the reduced rig count, down nearly 200 rigs since late 2022. I don’t want to get too Lord’sy of the Ring’sy here, but eventually, there will be one Permian shale driller to rule them all, and it will be ExxonMobil.

What does the PXD deal mean for XOM?

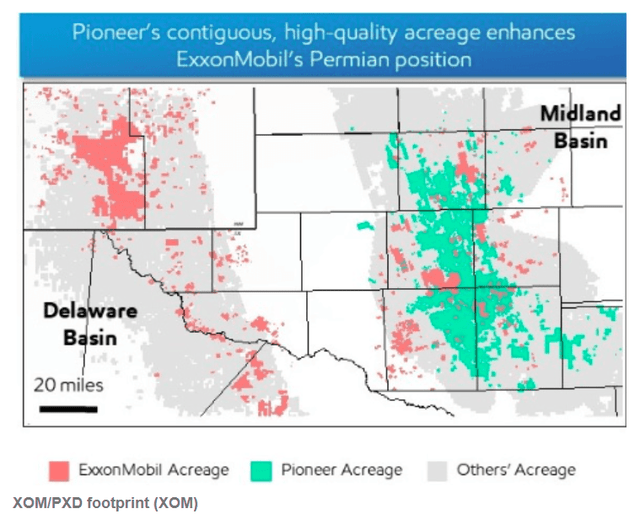

It shouldn’t take much further description to understand the Industrial Logic behind the merger. Without PXD’s footprint, XOM was missing on four out of six of my shale survivor bullet points. The Midland also brings a higher “oil-cut” than the Delaware typically, and XOM’s acreage there is not as good as some we have reviewed. The PXD footprint in the Midland-almost a million acres connects prior XOM acreage making it far more useful, ticking 6 out of 6 boxes on the Fluidsdoc list of attributes.

Here’s a quote that gives us an unusually good look into what management’s plan is-

The transaction is a unique opportunity to deliver leading capital efficiency and cost performance as well as increase production by combining Pioneer’s large-scale, contiguous, high-quality undeveloped Midland acreage with ExxonMobil’s demonstrated industry-leading Permian resource development approach.

The unique, complementary fit of Pioneer’s contiguous acreage will allow ExxonMobil to drill long, best-in-class laterals — up to four miles — which will result in fewer wells and a smaller surface footprint. The company also expects to enhance field digitalization and automation that will optimize production throughput and cost.

PXD’s acreage takes a disconnected position with some good chunks that are widely dispersed, and transforms it into a massive block where if the company wanted to…they could drill 5-6 mile laterals. I can almost see your jaws dropping. 5–6 miles, you say!!!! That’s unheard of.

No, it’s not. Not for XOM. On Sakhalin island, before they pulled out of Russia, XOM was routinely drilling 5–6 miles and sometimes as much as 9-miles. Now, let’s understand the Sakhalin wells bear little relationship to Permian wells. We are talking standalone screen completions in a sandstone reservoir vs. frac-packs in a shale reservoir. Sandstone reservoirs and shale reservoirs are two entirely different “breeds of cat.” That said, there is nothing about shale-fracking that would preclude a nine-mile completion, except perhaps diminishing returns from the toe section of the well. If you have the dirt, the pumps, the water and the sand, it can be done. Resulting, as they note, in fewer wells. Whether it makes sense is another story.

The Permian Play is middle-aged, but XOM drank from the Fountain of Youth

Nothing lasts forever, right? The Permian has been roaring for the last decade. Ten years ago, it was producing 1.4 mm BOPD and 5-BCF/D of gas. Today it’s grinding out 6.1 mm BOPD and 25 BCF/D of gas. The air is coming out of the balloon. There’s a lot left, but it’s price-dependent and in a decade or so, production will fall. Precipitously. It may be entering a shallow decline already, as we have noted. These are the salad days for the Permian, but at the current extraction rate of 2.2 bn BPY there is an end point hanging out there. Probably in the mid-2030’s for most operators.

Exxon Mobil with Pioneer now has 12,000 Tier I and II drilling locations. If they POP 500 per year, they stay busy grinding out a couple of million barrels a day for the next 22 years. Way longer than anyone else in this space.

The XOM that I know

I have worked with XOM on a number of projects over my time in the oilfield. From California in the ’80s on Platform’s Hondo and Habitat, to Wildcat’s in Brazil, to the Jansz-lo field in Australia in 2014… I could go on… wait, I almost forgot my GoM field work with XOM in the Grand Isle area. Ok, I’ll stop. Wait…there’s Beryl Alpha in the North Sea on the Mobil side in the ’90s. Now I’ll really stop.

One thing that stands out pretty clearly in all of those experiences, is their relentless commitment to cost control. If you did something for X on one well, the XOM supervisors would insist you do for X-10% on the next well. I am not talking necessarily about unit costs, although that was certainly a component. What I mean is figuring out ways to minimize your time on critical path, reduce waste, and enhance safe operations. Safety pays! And, that mindset is made to order for fields in which you will be drilling hundreds of wells per year. It’s a repetitive task, why redesign every one? There isn’t a reason.

Figuratively speaking, if company X is Simul-fracking-frac 3, and wirelining 3, XOM will Quadro-frac-frac 4 wireline 4. If company Y is drilling 15,000′ laterals, XOM will drill 30,000′ laterals. This will drive hundreds of thousands in cost per, well, out of the total cost. I am not necessarily saying these exact numbers will play out, but XOM will do whatever it takes to be the low-cost producer. The best breakevens I’ve seen for the Permian are in the low $30’s. XOM has forecast costs of $35 per barrel in the announcement. There is no reason, with the scale with which XOM will be operating, this doesn’t get into the $20’s. Maybe the low $20’s.

Key parts of the deal

XOM shelled out $59 bn for PXD. For that, they got P-2 reserves of 2.2 bn BOIP, and production that more than doubled their standalone output, and brought their daily output to 1.3 mm BOEPD. PXD was running EBITDA between $10-12 bn a year, so with that revenue consolidated to the balance sheet, and at $75-80 WTI, for Q-2, 2024, XOM should add another $2.5-3.0 bn per quarter, depending on oil prices.

The merger was a stock swap which created no new debt, and in the grand scheme of things only minor dilution to existing shareholders. Essentially, 233 mm shares added to their existing float of 3.99 bn common shares outstanding. Meh.

Risks to the thesis

Admittedly, as strong as XOM is, they are not OPEC+, pumping ~38 mm BOPD, and eager to reclaim some lost market share in 2025. I think they will be cautious about, as Brent is right where they want it. But you never know with those fun-loving sheikhs. They have flooded the market before, and if 4-5 mm BOPD came on the market in a short period of time, XOM shares would suffer. That’s a risk that’s difficult to quantify, though, so you should just be aware of it.

If WTI sags back into the $70’s, for any extended period of time due to inventories rising, shares of XOM could stagnate or decline. I don’t see them going much below the 200-day SMA, but you know the oil market….

They could screw it up. Despite the generally high opinion I hold of XOM and its operations skills, there is always the possibility they miss the target in the Permian, or extraneous factors come into play to derail their anticipated success. Murphy is alive and well. Stuff happens.

Your takeaway

Not every big deal works out. Some just take time. XOM was pilloried in the market, and perhaps rightly so, for the XTO deal in late 2009. Who knew then, that in 2010 gas would drop from $8.00 MCF to $2.00 MCF, and sometime sub-zero at WAHA occasionally? In the fullness of time, XTO may still shine as LNG and AI sop up more and more gas.

I think the PXD deal was and is a winner for XOM, and its shares do not reflect the full value of the transaction. In an $80 WTI environment at worst case, XOM has a field margin of $45 per BOE. That’s $21 bn per year at current rates, and potentially higher if production rises toward 2.0 mm BOE per day. Higher oil prices? Perhaps or perhaps not, as we’ve noted that’s somewhat out of their control.

But, we don’t need higher prices for XOM to absolutely rain cash in the coming decades. Over the last year, where oil prices fluctuated between the upper $60’s and $90, that XOM covered capex, debt, the dividend, and share buybacks. That’s a business on a solid footing in any category. We expect more of the same in 2024.

I think XOM is a buy at current levels and if WTI remains above $80, shares should certainly rally from current levels toward the mid-range of analyst estimates. I think the company is a strong buy for investors looking for long-term growth and rising income for as far as the eye can see.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in XOM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not advice to buy or sell this stock or ETF in spite of the particular rating I am required to select in the SA template. I am not an accountant or CPA or CFA. This article is intended to provide information to interested parties and is in no way a recommendation to buy or sell the securities mentioned. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to do their own due diligence before investing their hard-earned cash.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.