Summary:

- This article upgrades XOM to STRONG BUY due to the combination of robust Q3 results and recent stock price dip.

- These factors have pushed its total shareholder yield to be above 7% when both dividends and buybacks are considered.

- There are some near-term challenges (such as commodity prices and demand outlook).

- However, XOM’s leading role in traditional energy and also its initiatives in alternative energy position it well for long-term growth.

JHVEPhoto

XOM stock: previous thesis and new catalysts

I last analyzed Exxon Mobil stock (NYSE:XOM) with a BUY rating on October, 30, 2024. The analysis was published under a title of “Exxon Mobil Is Both Cheaper And Better Than Occidental Petroleum”. As the title has already suggested, the article explained why XOM offers an appealing package combining both value and quality. To accentuate the package, the article contrasted it with OXY to highlight the following considerations:

Compared to close peer OXY and the overall sector, XOM offers better profitability metrics and balance sheet strength. Yet, Exxon Mobil trades at a lower valuation than Occidental. Both enjoy growth catalysts with their expanded exposure to the prized Permian Basin assets. However, XOM’s greater capital allocation flexibility and better ROCE enhances its ability to capitalize on growth initiatives.

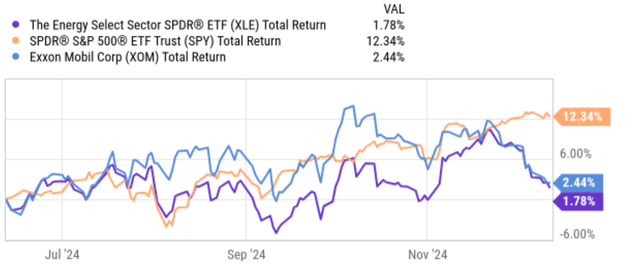

Since then, a few new catalysts have been developing around XOM. In the remainder, I will focus on the top 2 on my list: the updates it provided in its Q3 earnings report (ER) and also the divergence of its stock prices relative to the broader market. To wit, the chart below displays the total return performance of XOM, the Energy Select Sector SPDR ETF (XLE), and also the SPDR S&P 500 ETF Trust (SPY). As seen, in recent months, SPY, representing the broader S&P 500 index, has enjoyed a strong rally with a total return of 12.34%. In contrast, XOM and the energy sector fund XLE, essentially went nowhere, delivering a total return of 2.44% and 1.78%, respectively, in the past 6 months.

Next, I will explain that such a price divergence, when combined with the financial updates provided in its Q3 earnings, has pushed the total shareholder yield (TSY) from XOM to be above 7% – a level too high to ignore. Thus, this article also upgrades my rating on the stock to STRONG BUY (from my earlier BUY rating).

XOM stock: Q3 recap

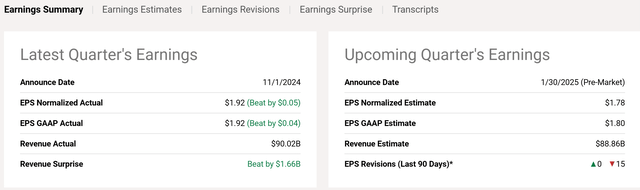

Let me start with the financials reported in its FY Q3, 2024. As you can see from the following screenshot, Exxon Mobil reported its Q3 earnings on Nov 1, shortly after my previous analysis. Overall, the company reported a strong quarter in my view. Reported EPS dialed in at $1.92, both in normalized and GAAP terms, and both exceeded consensus estimates. Revenue for the quarter reached $90.02 billion, also surpassing expectations by $1.66 billion.

Looking into the financial statement closer, a key driver behind the strong performance is the higher volumes from its Guyana and Permian asset bases in my assessment. These catalysts helped to largely offset a tighter refining margin environment and the lower commodity prices lately. Additionally, I think its ongoing cost-saving initiatives are also bearing fruit and should help to counter the margin pressure going forward.

Thanks to the robust profits, the company has plenty of flexibility to invest in growth and at the same time reward shareholders, as detailed next.

XOM stock: total shareholder yield in focus

Since my last writing, the board of directors have announced to boost the quarterly dividend payment by 4%, to $0.99 per share, a clear reflection of the company’s profit performances and healthy balance sheet. Meanwhile, XOM has also repurchased nearly $14 billion worth of stock thus far in 2024. I see good odds for such repurchases to continue over the next several years.

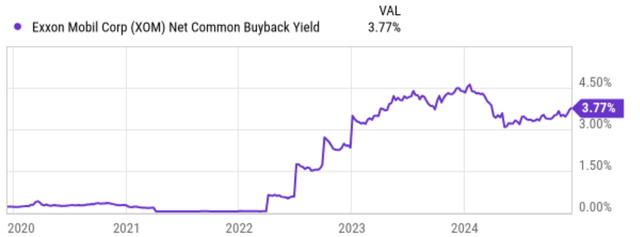

These shareholder rewards, when combined with their price divergence relative to the broader market, have now pushed its total shareholder yield above 7%. Most investors focus more on dividend yield. But dividend is only one mechanism of shareholder returns, and other mechanisms (such as buybacks and debt reduction) are just as important (or even better when tax consequences are considered).

At its current price and with the recent dividend hike, the stock now features a cash dividend yield of 3.54% on a FWD basis. In terms of buybacks, the chart below displays the net common buyback yield for XOM in recent years. As seen, the buybacks remained relatively minor until 2023. Since then, the buybacks accelerated substantially and reached 3.77% as of the last quarter under XOM’s current market cap. Thus, the sum of cash yield and buyback yield already exceeded 7% (around 7.3% to be exact).

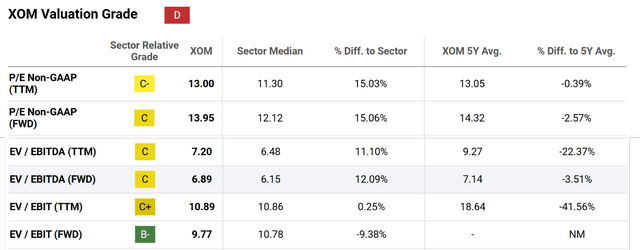

In the meantime, the company is managing its balance sheet very effectively in my view. As a reflection (or result – depending on your perspective), the company’s valuation is far more attractive in EV-based metrics (enterprise value) than accounting P/E ratios. For instance, its P/E (Non-GAAP and TTM) is about 13x as of this writing and it is essentially on part with its 5-year average. FWD P/E paints about the same picture.

However, when measured in EV/EBITDA and EV/EBIT ratios, the picture changes considerably. For example, the EV/EBITDA (TTM) is about 7.2x and this is about 22% discounted from its historical averages. The discount is even larger in terms of EV/EBIT ratio as seen (more than 41% on a TTM basis).

Other risks and final thoughts

Besides strong TSY and also attractive valuation, the company is also well-positioned for long-term growth in my view. I expect traditional oil and gas operations (upstream and downstream) to remain as the top income contributors for the years to come while the company accelerates its alternative energy businesses. Notable examples in the latter category include its initiatives on hydrogen, carbon capture & storage, lithium battery, and electric vehicle solutions. The expansion of data centers also provides a secular growth catalyst. As a latest example, XOM is designing a natural gas fired power plant to help meet the power demand from data centers. The powerplant aims to deploy the carbon capture & storage technologies just mentioned so it can “capture more than 90% of its own carbon emissions” (see this The New York Times report for more details).

On the negative side, the commodity prices environments remain challenging as aforementioned. Judging by the latest OPEC projection (details quote below), the prices are likely to remain under pressure in the near term. These challenges are likely to translate into margin headwinds for XOM.

Seeking Alpha news: OPEC on Wednesday lowered its forecast of oil demand growth for this year and next for a fifth straight month. The cut was the cartel’s biggest reduction to the 2024 outlook yet after its members agreed to prolong curbs on production. The Organization of Petroleum Exporting Countries lowered projections for consumption growth in 2024 by 210,000 barrels a day to 1.6 million barrels a day. It has cut estimates by 27% since July.

All told, I see the headwinds to be only temporary and see an overall favorable return/risk curve in XOM under the current conditions. As argued in my earlier article, XOM offers a well-rounded investment package combining value, profitability, and balance sheet strength. The new catalysts since my last writing (primarily the latest financials reported in Q3 and the stock price divergence) have pushed the total shareholder yield to about 7.3%. This is too high to ignore and thus results in my upgraded rating to strong buy. Finally, as a disclosure, I don’t own XOM share and my exposure to the energy sector is provided through Chevron (NYSE:CVX). Many considerations presented here for XOM are also applicable to CVX and our thoughts on some of the more unique features on CVX were detailed in this recent article on CVX.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.