Summary:

- Exxon Mobil management gives their view of the future and how the company will respond to future challenges.

- CEO Darren Woods emphasizes flexibility and realism in maintaining a competitive edge.

- Shift towards low carbon future that may possibly include oil and gas in various forms.

- Data Centers will use natural gas for energy generation because that is a reliable energy source to generate electricity.

- Many industries will continue to need oil and gas (and products made from them) because that is where the technology is right now.

Jeremy Poland

Exxon Mobil (NYSE:XOM) management went out of their way to define the ongoing transition to the future. That probably has a whole lot more importance than the current earnings release because it defines how management looks at the future to drive the company’s expected earnings. It needs to be as flexible as possible and realistic.

The previous article centered on profitability and gaining a competitive edge. Now the CEO, Darren Woods, is sharing his vision on maintaining that competitive edge going forward.

Low Carbon Future

The quote from Darren Woods, CEO really establishes that Exxon Mobil intends to be around for some time to come while approaching the issue from a realistic basis.

” A serious approach to the transition should focus on moving the world from high carbon to low carbon energy, not simply from oil and gas to wind and solar. The data, science, and economics all support this as fundamentally necessary. Our strategy reflects this reality and since it relies on the same corporate capabilities and advantages under any scenario, it is extremely flexible, delivering strong profitability irrespective of the path society takes.”

The Green Revolution Hits A Bump

We were always going to head towards something more environmentally friendly. But what is coming out is that the solution needed more thought before it was implemented than was the actual case. As a result, some things are becoming obvious about this change to “green”.

” Over time, as it becomes more and more obvious that heavy industry and commercial transportation will not be meaningfully powered by renewables, the world will come to rely more on technologies where we have an advantage, including hydrogen, biofuels, and carbon capture and storage.

This is another quote by Darren Woods during the conference call. I can tell you that out here in California, voters are extremely angry that peak electric rates have now hit $.50 due to all the expenses past and present that the electric utility has been found responsible for. That has gotten voters more than upset and will likely stop the energy transition in its tracks.

At the very least, the state of California needs to rethink what it has for a “green” strategy. Even now, it has come out that the electric grid cannot handle the electric demand for all the electric cars the state wants residents to drive. Those goals are likely to be revised towards the reality that Darren Woods is describing.

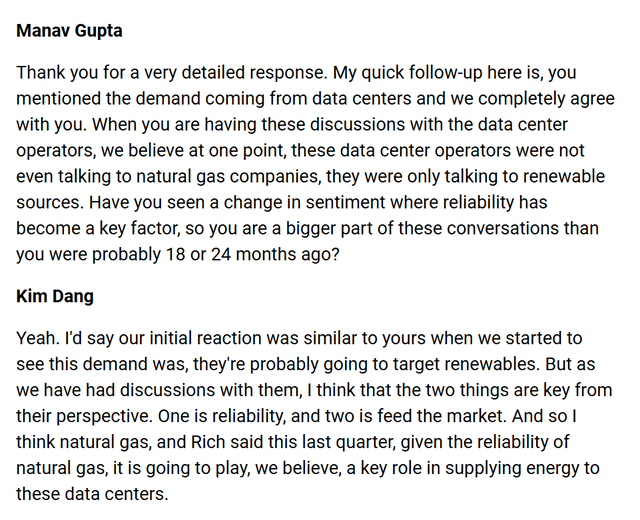

Kinder Morgan Conference Call

Data centers wanted a renewable source for energy. But then they found out reliability was an issue. The conference call demonstrated a shift towards natural gas to generate that electric needed for data centers:

Kinder Morgan Question And Answer About Data Center Reliable Energy Sources (Kinder Morgan Second Quarter 2024, Earnings Conference Call)

Kim Dang is the CEO of Kinder Morgan (KMI) answering the question from an analyst during the second quarter 2024, conference call.

Conclusion

All of this supports the conclusion of Darren Woods, CEO, that the demand for oil will hold steady for some time while the demand for natural gas is clearly expected to grow.

I have published in many articles where CEO’s such as John Hess of Hess Corporation (HES) have repeatedly stated that we are not spending anything close to what is needed to power the green revolution to its goal in the time stated. There is now increasing evidence that the support structure and the technology is not yet there for all the goals as well.

We will likely get where we need to go because “necessity is the mother of invention”. But what is called for now is much more realistic planning than what has happened so far.

Exxon Mobil has throughout its history been among those companies that has survived by changing. As was mentioned in the conference call, the company originally began by making kerosene for lamps because that was what was needed. Today, of course, that is not even a significant profit contributor.

This management clearly has a focus on realistic goals for the future to match the cost goals covered in the past. As a growth and income possibility, profits are important. But so is having the products to produce those profits in the future. Right now, the focus and the resources appear to be there. That is no guarantee of success. But it appears to be a darn good start.

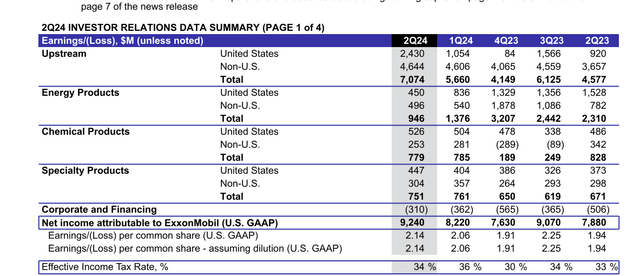

Earnings

Earnings overall appear to be trending up so far.

Exxon Mobil Second Quarter 2024 Earnings Trend (Exxon Mobil Second Quarter 2024, Supplemental Presentation)

The United States upstream part of Exxon Mobil appears to have significantly benefitted from the Pioneer (PXD) acquisition. Management appears ready to raise the expectation of the expected results from that acquisition.

The non-United States upstream most likely benefitted from the new FPSO in Guyana that began production when compared to the previous fiscal year. Exxon Mobil did announce that production in Guyana will be down for a little bit while they hook up some natural gas lines that will be going towards power generation in the future.

It was also announced that the Guyana arbitration will be scheduled for May 2025. The disadvantage of this is that if anyone wants to purchase the Hess interest in Guyana, there should be another scheduled FPSO beginning to produce at the beginning of fiscal year 2025. That is additional cash flow that makes the Hess interest more valuable. A bidding war, if it develops, could prove to be relatively expensive compared to a faster resolution.

Downstream suffered from industry-wide capacity that narrowed margins. Downstream is cyclical as well. During a time like this, investors will likely see the industry shut down older, high-cost capacity. Sometimes those buildings get flattened and eliminated as well. The industry will then add new, far more cost-efficient capacity to replace that when profits recover.

Even though, a new refinery of major proportions has not been built for some time. The effective capacity needed (and then some, usually) is nearly always replaced through these additions. It is one of the reasons margins are low right now.

The last two areas shown above are divisions that are getting the company into the future with “green products” or raw materials needed to produce things needed for the green revolution. There are, of course, other profitable areas emphasized as well. But clearly the company is hedging its bets by developing products outside the usual oil and gas products to meet a profitable future.

Conclusion

The lower carbon future has come up against some present realities. That could change with a technological advance in the future. But we have never in the history of the world eliminated a fossil fuel energy source. Even coal, whose market share is clearly declining, has growing demand. That, of course, is something that the green revolution appears to want to change. However, doing so is now a very expensive proposition that (so far) no one wants to spend enough money on, even if it is very much talked about.

Exxon Mobil management appears to be keeping their future options as flexible as they possibly can to meet the future. When this is combined with past discussions on “advantaged assets” and cost reductions to gain efficiencies, then the complete scenario makes this a very viable growth and income idea. At least for now, the company appears well positioned for the future. Management accepts that the company will have to change to even exist in the future.

Right now, the total return appears to be in the teens for the long term. An occasional acquisition potentially could add a couple of percentage points to the long-term return from time to time.

Risks

There is always the possibility that the future will not need any oil or natural gas-based products in any form. Right now, that is far from the case. The company already contributes a fair number of raw materials and other products to the green revolution. But then again, the future is nearly always a wild card.

The company is subject to the volatility and low visibility of the commodity products that it does sell. Any severe and sustained downturn would materially change the future outlook for the company.

Darren Woods, CEO, has got this company “moving again” after years of “more of the same”. The loss of his services could prove critical to the future of the company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM KMI HES either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies like Exxon Mobil and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.