Summary:

- I’ve taken a lot of heat for my call that Exxon Mobil Corporation stock has topped out. Yet, the fact of the matter is “trees don’t grow to the sky.”

- Exxon Mobil stock is down 8.5% after reporting a blowout quarter, the OPEC+ production cut, and China reopening. So what gives?

- In the following piece, I give an update on my current view of Exxon Mobil stock for prospective and current shareholders.

Brandon Bell

Executive summary

I used an old German business proverb, “Trees Don’t Grow To The Sky,” for the title of this article. I feel it suits the current situation Exxon Mobil Corporation (NYSE:XOM) stock finds itself in presently quite well. What does “trees don’t grow to the sky” mean exactly? The proverb is frequently used to illustrate the fact there are inherent limits to rallies in stocks regardless of the underlying growth prospects of the particular company. What’s more, when the move becomes parabolic, as it obviously has with Exxon Mobil, the odds of a pullback become that much more likely.

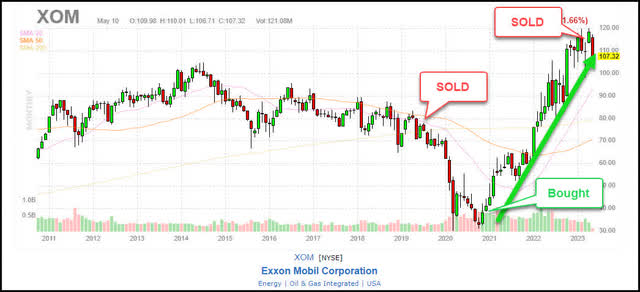

Exxon Mobil Long-term Chart

Exxon Mobil’s stock has made an incredible 250% move off the lows of 2020 to the highs of 2023. When analyzing the long-term chart, it is obviously a parabolic and highly atypical move for Exxon Mobil’s stock. Yet, now, regardless of all the positives, the stock just can’t seem to continue any higher.

Exxon Mobil 1 Year Chart

The stock has been rejected several times now at this elevated level. You most likely have heard of a “Double Top” reversal pattern. Well, this is called a “Multiple Top” reversal pattern which makes the odds of further downside that much more likely. The other technical issue that just occurred today is the fact the stock has just broken below major support at the 200 day SMA. What’s more, there are several idiosyncratic and macroeconomic factors that do not bode well for the stock going forward. In the following sections, I will lay them out.

Successful investing is counterintuitive to human nature

Be Fearful when others are greedy

I have been managing my own portfolio for 30 years now. Through the years, I have seen it all. The one investing pitfall that seems to occur over and over is many tend to buy in at the highs and sell out at the lows. This is due to the fact investing in stocks is completely counterintuitive to human nature. Warren Buffett’s famous line, “Be greedy when other are fearful and fearful when other are greedy,” is a great example of the counterintuitive nature of successful investing.

Buy at the point of maximum pessimism

My other favorite investing icon Sir John Templeton’s line, “Buy at the point of maximum pessimism,” is one of my favorites as well. The time to buy Exxon Mobil was when it was completely out of favor and trading at all-time lows back in 2020. This is not an easy thing to do, though. You have to have courage in your convictions and do your own due diligence to ensure you have an accurate grasp of the actual facts. Here is another proverb for you to pounder regarding the importance of doing your own work: “Believe nothing of what you hear, and only half of what you see.” Let me explain why.

Believe nothing of what you hear, and only half of what you see

This proverb basically means you should not rely on everything that you hear. This is especially important when deciding whether or not to open a position in a stock. In fact, whenever there is a seemingly 100% consensus view that there is nowhere to go but up for a stock, that is actually a huge red flag.

I have to admit, it’s hard to go against the herd in these situations. Furthermore, I don’t blame anyone for jumping on the Exxon Mobil bandwagon as of late, either. Nonetheless, as many of you who have been following me know, I have not bought into the major bullish catalysts that many have been pounding the table with for the past year or so. The three main bullish catalyst have been: China reopening; OPEC+ production cut; and the tight supply/demand equation continuing ad infinitum. The fact of the matter is all these positive catalysts were already priced into the stock at this level. Here is why.

All the good news is priced in

Many times investors get caught up in the hype. When a stock goes on a parabolic move higher, the word gets out. That’s exactly what has happened with Exxon Mobil. All investors hear about is the fact the supply/demand equation will remain tight for the foreseeable future, oil is going to $120 due to the OPEC+ production cuts, and China reopening will further pressure oil’s price from the demand side.

The problem is, all three of these tailwinds have been out there for quite a while. At some point, all the good news gets priced in to a stock. Why do you think the stock is up 250% off the lows? It’s because just about everyone has already piled in. Nonetheless, many investors are blinded by the of thoughts of future profits due to the fact the stock has performed so well for them in the past. This phenomenon always reminds me of a famous line from the poem “The Night Before Christmas” by Clement Clarke Moore:

“The children were nestled all snug in their beds, While visions of sugar-plums danced in their heads.”

I suspect many who recently bought in prior to the latest earnings and after the OPEC+ production cuts had “visions of sugar-plums” for sure. One Seeking Alpha commenter on my last article stated XOM stock was going to $250. Yet, the fact of the matter is, all that good news was already in the stock. The trick to making great investments is to find a stock that is not well covered and in the news. You buy it before the word gets out that it is a great company. Or, buying into a stock when its trading at the “point of maximum pessimism,” not when everyone is in love with it. The other issue that has arisen is the fact that the three major catalysts everyone has been raving about don’t seem to be playing out as expected.

Things aren’t always what they seem

Often you will hear something and think to yourself, that’s has to be true. Yet, as the proverb, “Things aren’t always as they seem,” states, certain situations might seem likely to produce a certain outcome, yet, often turn out to be something completely different.

Over 1 million BPD OPEC+ production cuts not all they are cracked up to be

Let’s take the OPEC+ production cuts for example. When it was first announced, all everyone was talking about was how this was going to take over a million barrels per day off the market. Yet, the fact of the matter is, I highly doubt this to be the case. OPEC+ doesn’t have the control it used to over its members. Plus, countries like Russia and Iran are raising production rather than cutting. On top of this, some of the cuts were already built in to certain member’s production levels, so the actual cuts was most likely not over 1 million barrels in the first place.

China reopening has turned out to be a dud

Based on the fact China’s growth had a nice rebound in the first quarter, many expected the second quarter to continue the trend. Nevertheless, according to the National Bureau of Statistics:

“While the first quarter had “made a good start,” domestic demand remained “inadequate” and “the foundation for economic recovery is not solid yet.”

The bottom line is the China demand story has not come to fruition as of yet. All of these waning demand side factors, coupled with the odds of a recession growing by the day, have caused oil’s price to drop precipitously even after the OPEC+ production cut and China’s reopening.

Oil 1 Month Chart

Now, let’s wrap this piece up.

The wrap-up

All these developments point to the fact that the supply/demand equation is not permanently locked into a tight relationship. I expect the cyclical boom and bust cycle to continue. Now, where the rubber really hits the road for me in regards to making a buying decision, is the current dividend yield. Let’s have a look.

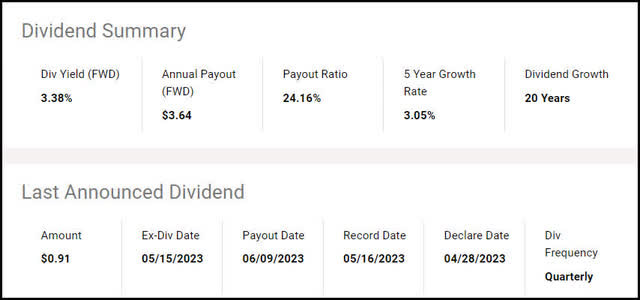

Exxon Mobil’s Dividend

Seeking Alpha Dividend Summary

Exxon Mobil’s dividend yield currently stands at a paltry 3.38%. In the current environment, where you can get a 4-5% risk free yield in a money market account, I see no reason for prospective investors to put principle at risk with the stock as these elevated levels. If you are a long-term shareholder and in retirement, I am not telling you to sell out, though. Everyone’s objectives are different. All I am saying is, I expect Exxon Mobil Corporation stock to continue lower for the foreseeable future.

My thoughts on Exxon Mobil Corporation are for informational purposes only. Please use this information as a starting point for your own due diligence. Those are my thoughts on the matter, I look forward to reading yours.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

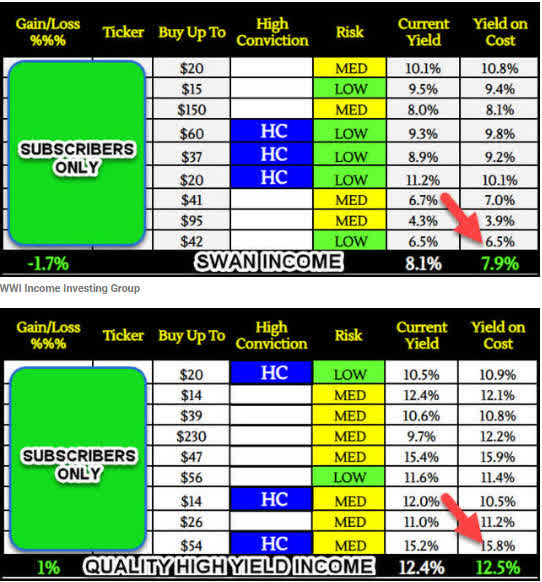

Join the #1 fastest growing new Income Investing Group! Our SWAN and High Yield Income Portfolios are substantially outperforming the market!

We have opened up an addition 50 Charter memberships at the legacy rate! Memberships are going fast with 30 new members already signed up! We have 17 FIVE STAR reviews in the first few months!

~ Quality High Yield Income – Current Yield – 12.5%

~ SWAN Quality Income – Current Yield – 7.9%

~ High Quality Growth

~ Ultra-High Growth

Join now for top income buys, timely macro insights, and a lively chat room! A portion of the proceeds are donated to the DAV (Disabled American Veterans).