Summary:

- Exxon Mobil Corporation’s stock has remained stable due to its high-quality assets, notably Stabroek in Guyana and accelerated Permian output, driving growth and cash flow.

- The company’s projection of continued oil and gas dominance by 2050 supports its long-term viability, despite the rocky road of the energy transition.

- The Guyana and Permian assets are expected to boost production and profitability significantly, with potential reserves in Guyana reaching beyond 11 billion barrels.

- Despite the current full valuation, Exxon Mobil’s strong cash generation and potential for future growth make it a hold, with a watch for price dips to $100.

RichVintage

Introduction

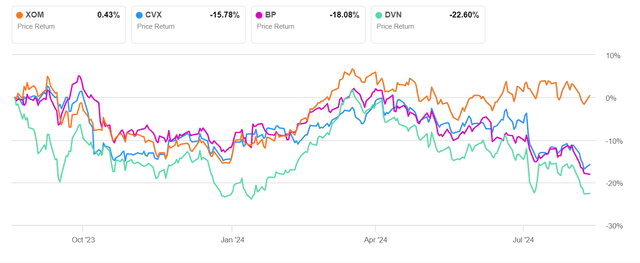

It’s been a tough slog for upstream E&P’s since early in the second quarter, when it seemed, for a brief moment, the oil bulls would run through the streets in 2024. That moment turned out to be very brief, and the effect on many of these companies has been a significant deterioration of their stock price. Not so for Exxon Mobil Corporation (NYSE:XOM)(NEOE:XOM:CA), the stock of which has stayed in a fairly tight range, as the graphic below illustrates.

What is it about the company that has caused them to outperform their direct and approximate peers in the April swoon? I will put forth the argument that it is primarily the quality of their asset base from which they are wringing increasing cash flows with the lowest costs of supply.

ExxonMobil has a couple of key assets that are fueling the company’s growth. Stabroek, in Guyana’s offshore waters, is the first, and is ramping production to the tune of about 250K BOEPD every 18 months. That’s real growth and impacts cash flow and costs of supply. The second is the acceleration of Permian output toward 1.2 mm BOEPD. The Pioneer deal was a smashing success, which gives the company the optionality to rapidly raise production in higher price eras, and flatten it out when prices decline.

In this article, we will review the impact these two key assets have on the company, and determine as to its investability at current prices.

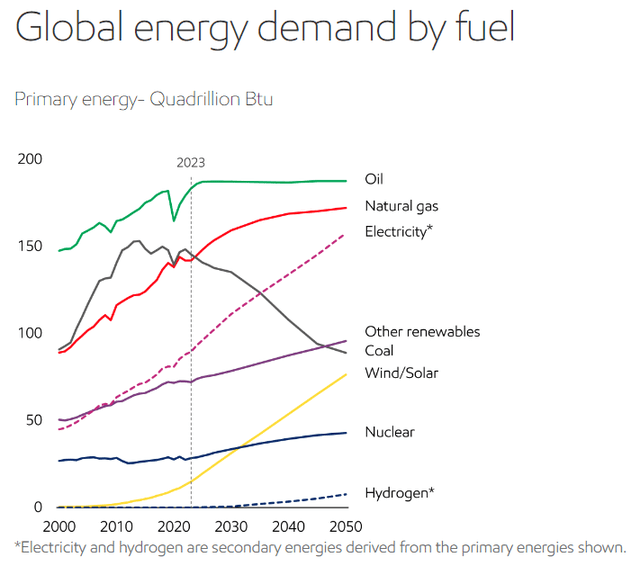

First the case for oil and gas

The company recently released its Global Outlook to 2050. In it, XOM projects a global population of about 10 bn people, a roughly 20% increase from today’s level. It also projects a 15% growth in energy use by that date, as developing nations see growth in their middle class. To achieve this growth, they will reach for easily dispatchable-energy dense fuels. The takeaway from this report is XOM’s expectation that oil and gas will still play dominant roles in the energy mix in 2050. This not a particularly radical view as other organizations, notably the Energy Information Agency, has made similar projections.

I will make a couple of other points about the mix of future fuels before moving on.

First, there is a wide disparity globally as regards energy consumption. The U.S. leads the world in oil consumption-currently 22 bbls per capita. India uses less than 2 bbl per capita. We call that “Energy Poverty.” One of the precepts for oil peaking is that energy poor countries will choose to remain that way. Poor in energy consumption and poor in absolute terms. Those two are related, and you can’t address the former without the latter. Nor is there any sign that energy-poor countries are deciding to remain so. Just the opposite, actually.

Arjun Murti, a well-known energy commentator and partner at energy analyst firm Veriten, as well as a former Goldman Sachs energy analyst, discussed future energy demand in a recent podcast on his Super-Spiked blog. In the episode titled, “Everyone is Rich,” Arjun posits what the impact to world energy demand would be if everyone was as energy rich as the “lucky” 1.2 billion people that live in the Western World. More specifically, Arjun asks what it would mean for the other 7 billion people in China, India, Asia, and Africa to have the lifestyle that Americans, Canadians, Europeans, and a few other countries enjoy? The answer he comes up with on an absolute basis, 250 mm BOPD, a figure he freely admits that we are unlikely to hit for various reasons, of which renewables play only a minimal part!

Secondly, the “Energy Transition” push to renewable fuels that began a few years ago is teetering more than just a bit. First movers-car companies, state’s deploying wind and solar-battery farms, and utilities tasked with rebuilding the grid to address all this electrification, have begun to press pause or back away from previously announced goals. I will provide a couple of examples to buttress my pro-oil argument here, but I am not going to link-bomb this article. If you need more, they’re out there, find them if you wish.

A little over a year ago, I stepped out of my upstream energy portfolio comfort zone and published a sell-rated article on Ford (F) entitled EV Warning Light Flashing. It was a lot of fun doing that, and as negative articles outpace positive articles in terms of reader interaction, it was one of my more successful outings on this platform. Ford stock then was priced at $11.83 per share, and it now trades at $10.66. So I win, tick the win box on that call. More importantly, the central theme of the article-the shift from ICE cars to BEV’s was bogging down as Ford has made cut after cut in the rollout of their marquee BEV-the Ford F-150 Lightning, has been verified. Here’s a link to some of their more recently announced travails on the road to one BEV to rule them all.

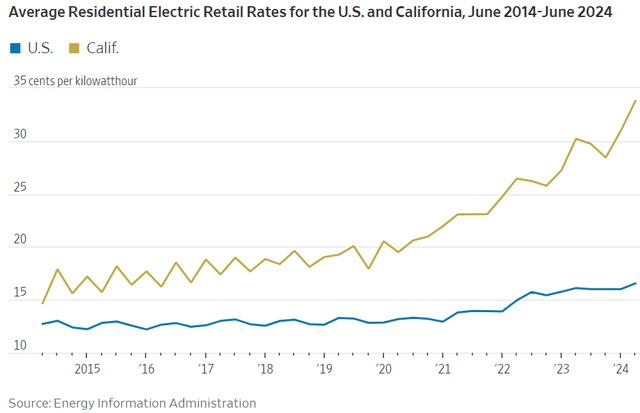

Finally, California has been at the forefront of the energy transition movement. Even 40 years ago, the California Air Quality Management Board gave me a hard time for running a diesel powered pump in a suburban oilfield. It’s only gotten worse-the air I mean, and regulatory control. LA basin air was brown then, and it’s brown today, but that hasn’t kept the regulators from piling on. And it comes at a cost.

Alysia Finley, a member of the Wall Street Journal’s Editorial Board, recently published an article (should be free), “California’s Lights Are Out, and Gavin Newsom Isn’t Home.” In it, she detailed the results of some 130 recent power outages over a hot weekend in September. Ms. Finley writes:

Such is life in California. Los Angeles Mayor Karen Bass blamed Friday’s outages on “extreme heat.” The real culprit: the state’s climate policies. As the Golden State plunges into darkness, the rest of the country could follow. Democrats in Sacramento last year scrambled to keep open the state’s only active nuclear plant and several aging natural-gas plants to prevent power shortages. But their drive to power all things with green energy is straining the grid and people’s pocketbooks to a breaking point.

The article contains a graph that tells a pretty compelling story about the financial pain Californians endure as a result of their state’s notionally ill-conceived green energy push.

California vs U.S. electricity prices (WSJ)

I am glad, regarding my 2000 KWH typical monthly usage, that I no longer live in California. I could not afford to pay the ~$700 bill that would ensue. For now, let’s accept the Energy Transition (really Energy-Addition) is traveling a rocky road.

Now let’s talk about XOM

XOM is a massive, industrial company with numerous revenue streams besides oil production-LNG, chemicals, carbon capture, refining, biofuels, and new ventures in lithium. As great as all of this is, the impact on the stock in the near term in minimal. In the near to medium term, XOM moves with higher or lower oil and gas prices and is likely to perform in lockstep with these commodities well into the future. Darren Woods, CEO, commented pithily in the Q-2 call-

“Later this month, we’ll publish our global outlook, which projects global energy demand 15% higher in 2050 than it is today. We see oil demand holding steady at around 100 million barrels per day in 2050, while demand for renewables and natural gas grows considerably.”

Some may argue that Mr. Woods is talking his book. We would expect no less as the CEO of a company producing ~4.3 mm BOPD of crude oil. That doesn’t mean he isn’t on target. I think it is fair and reasonable for us to assign a solid probability of his being right as we consider an investment in XOM.

Big Bucket #1-Guyana

I don’t know of any industry where serendipity plays a greater role than in upstream oil exploration. In the early August, a Bloomberg piece (should be free)by Kevin Crowley discussed how the 2015 Liza discovery well almost didn’t happen.

Guyana’s waters were a Bermuda Triangle-like collection of 40+ dry holes over the years, and XOM management wasn’t convinced that this prospect met their capital allocation criteria. The decision to go forward was also complicated by the fact that XOM’s concession was about to expire. They were nearly out of time to make this call. Read Crowley’s piece for more of the backstory, but the success of Liza, changed the company and the country. Quoting Crowley from the article-

“Today, Liza is the world’s biggest oil discovery in a generation. Exxon controls a block that holds 11 billion barrels of recoverable oil, worth nearly $1 trillion at current prices. The find has transformed Guyana from one of South America’s poorest countries into one that will pump more crude per person than Saudi Arabia or Kuwait by 2027. Guyana is on track to overtake Venezuela as South America’s second-largest oil producer, after Brazil.”

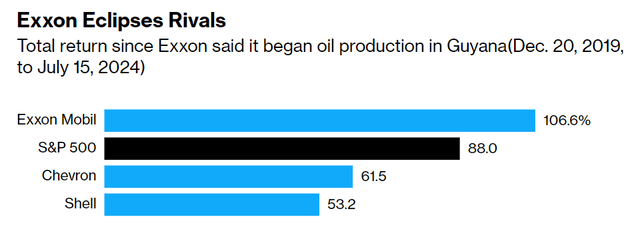

The gamble has paid off. Now with more than 30 discovery wells, 6-sanctioned projects, and current daily production of ~650K BOPD rising to 750K in 2025, the company is growing Guyana production at about 20% annually. This shows up in total return comparisons with key competitors and the overall S&P 500 index, as noted in the Crowley article.

XOM compared to rivals (Bloomberg)

XOM’s success in Stabroek appears likely to continue, as reporting indicates that another two fields could be brought online early in the next decade. The first is Fangtooth-now under delineation drilling, and next is the Haimara discovery. It is potentially number 8 and has new appraisal wells planned for later this year. These two, if FID is reached, could take reserves well beyond the 11 bn BOIP now booked.

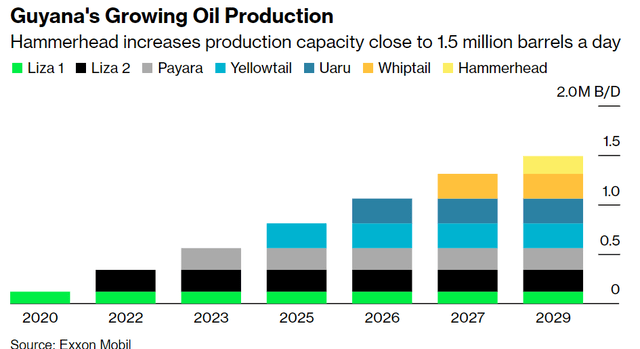

With XOM’s pace of announcing a new project for Guyana every eighteen months or so, the 2.0 mm BOEPD production target seems in reach in the early 2030s.

XOM’s growing Guyana output (Bloomberg)

With supply costs of less than $35 per barrel, Stabroek fits nicely in the low-cost category, assuring profitable production at any likely Brent prices. XOM is obsessively focused on being the low-cost supplier where it operates.

The XOM, CVX, Hess kerfuffle

Chevron (CVX) has fallen behind Exxon in reserves replacement recently, as this OilNow article points out. XOM is comfortably ahead of Chevron with 16.9 bn bbls compared with 11.1 bn for CVX, although off their 2018 peak of ~24 bn BOIP.

Armed with that knowledge, Chevron’s motivation for its takeout offer for Hess, (HES) is obvious. CVX saw an easy way to add on several bn barrels of reserves with its $53 bn offer for HES. Shareholders for both companies approved the deal, but then roadblocks began to emerge.

A December 2023 request from the FTC for more information on the deal has delayed any resolution of the merger. Pending the outcome of Exxon Mobil’s objection to Chevron buying Hess, and with the three judge panel only recently confirmed, recent reporting has a timeline well into 2025 for any resolution. Depending on the outcome of arbitration, the FTC would then take their bite of the apple, certainly pushing any final clearance toward 2026.

The crux of the dispute lies in the interpretation of the Joint Operating Agreement-JOA, that contains a section on the Right of First Refusal-ROFR that governs the disposition of assets run by the consortium. XOM feels that the HES share should be offered to it under the ROFR language in the JOA. Chevron disagrees, and took pains in setting up the deal to provide for HES’ survival as an entity, effectively eliminating the “change of control” provisions of the JOA. Analysts feel the outcome will come down to the arbitration panel’s interpretation of the “intent” of the CVX/HES agreement as regards the asset. M&A expert, James English at law firm Clark Hill Law was quoted in the Reuters article as saying-

“The crux here is whether a change of control even occurred. The three-person arbitration panel which will make the call must decide in part whether to focus on the language in the contract or to delve into Chevron’s intent. “A plain language approach would be very favorable to Chevron, while if you go with the intent, Exxon may have a case,” English said.”

XOM’s downside is pretty limited in this process, in my estimation. The valuation of the stake held by HES is a closely guarded secret, but a trillion-dollar valuation has been put on the 11 bn worth of reserves already booked. Hence, the “Trillion Dollar Baby” in this article’s title. Depending on which estimate you use for the percentage ascribed to HES’ 30% as part of the CVX bid-60-80% according to experts cited in the Reuters article, it’s not hard to imagine a significant payday for XOM. One that perhaps might flow to shareholders.

ExxonMobil has several options for success in the case in arbitration. They could make a counteroffer for the HES stake, bid for a fraction of it, or take compensation from Chevron. I think perhaps XOM wants to prove their argument as much as bleed CVX. In that scenario, their demands may be moderate. Mike Wirth, CEO of CVX, has a history of walking away from bidding wars. If it gets too pricey, CVX would just take their $1.72 bn break-up fee from HES.

We won’t spend anytime handicapping the outcome of this dispute. As I noted, XOM’s downside is limited. A lot will come down to how the single word-intent, is interpreted.

Big Bucket #2-The Permian

The mechanics of the Pioneer merger are in full swing here in Q-3. The company has put a significant number on the bulletin board-$2 bn, in cost savings that will accrue from the merger annually. In a Bloomberg article, CEO Darren Woods noted that these savings will come from improved technology and extraction-fracking and cube development techniques, as well as the logistics advantages the merger provided in terms of lateral lengths and materials sourcing. XOM projects costs of supply at $35 per barrel from the Permian.

For full year 2024, XOM projects daily Permian production of 1.2 mm BOEPD across their 1.4 mm acre position in the basin. The company has a target of increasing Permian production to 2.0 mm BOEPD by 2027, implying a growth rate of 20% a year. Potentially another trillion-dollar baby.

Risks

All investments come with risk. It’s our job as analysts and investors to highlight them, and XOM has a couple that should be noted.

Commodity pricing is paramount. Below $70 per barrel for crude and $80.00 for Brent, multiples are likely to compress. As we are bullish about the company’s long-term prospects, we beseech anyone sitting on the fence about “protecting profits,” to dump their shares on the market. We suspect there will be ready buyers.

There is always political risk with the super majors. When the climate crowd discusses bad ol’ oil companies, they generally mean XOM. Thus far, no real damage has been done, and indeed there are indication oil and gas companies have had enough of “taking it on the chin.” A company we reviewed favorably a while back, Energy Transfer (ET), has gone on the offensive and sued Greenpeace — a climate activist organization that has made a multi-decade career out of bedeviling oil companies. A WSJ article noted that Kelcy Warren, CEO of ET, had the enviro advocate on the ropes-

The pipeline magnate’s company, Energy Transfer, is behind a lawsuit that Greenpeace says could bankrupt the environmental group’s U.S. affiliate. A courtroom victory, which some Greenpeace officials fear is likely, would be a coda in the nearly decade long battle between the two sides over one of Warren’s signature projects: the Dakota Access Pipeline.

As a lifelong oily, I will shed no tears for them. Go Kelcy!

Your takeaway

XOM is likely fully valued at current prices. The EV/EBITDA is 7.65X, and the flowing barrel stat is $116K per barrel. Analysts rate the stock as Overweight with price targets ranging from $110-157.00 per share. The median is $130.00.

Investors looking for well covered shareholder returns, should keep an eye on the company, however. XOM is generating free cash at the rate of about $26.5 bn annually on a TTM basis. In 2023, the company distributed $8.1 bn in dividends, and repurchased $16.3 bn in stock and trades at an attractive free cash yield of ~6.8%. The company beat EPS estimates by ~5% in Q-2, and estimates have been raised for Q-3 to $2.14 per share. If they come in with a beat, we could certainly see a move higher toward the midpoint of estimates.

All of that said, I think we have to call XOM a hold at current prices, given the spongy outlook for WTI (CL1:COM) and Brent (CO1:COM) currently. In this environment, I will monitor for a decline back toward the $100 level at which I might take a position.

In my view, oil and gas have many decades left to play a role in the energy economy. As such, the premier company in the upstream cohort deserves a place in every energy investor’s portfolio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in XOM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not advice to buy or sell this stock or ETF in spite of the particular rating I am required to select in the SA template. I am not an accountant or CPA or CFA. This article is intended to provide information to interested parties and is in no way a recommendation to buy or sell the securities mentioned. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to do their own due diligence before investing their hard-earned cash.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.