Summary:

- Exxon Mobil Corporation will report its Q3 results on Friday.

- Analysts expect a small revenue decline and a more substantial earnings per share decline.

- XOM stock has outperformed its peers so far this year and has risen while oil prices pulled back. This has made Exxon Mobil somewhat expensive.

jetcityimage

Article Thesis

Exxon Mobil Corporation (NYSE:XOM) will report its third-quarter earnings results on Friday. In this article, we will take a look at what investors can expect from the company, while also taking a look at the macro environment and its impact on oil prices.

Past Coverage

I have written about Exxon Mobil here on Seeking Alpha in the past, most recently in April of this year. I gave the company a neutral rating since then, with shares delivering a total return of 0.3% since — so far, staying on the sidelines has worked out well. With half a year having passed since my last article on Exxon Mobil, and with the company reporting its next earnings results a couple of days from now, it is time for an update.

What Are Analysts Expecting From XOM’s Q3 Results?

Wall Street analysts can be wrong, of course, but their estimates can still make for a solid baseline. When it comes to Exxon Mobil’s third-quarter earnings results, Wall Street analysts are currently predicting revenues of $88.4 billion and earnings per share of $1.90. These numbers would be down 3% and 16% compared to the previous year’s third quarter, respectively.

Looking at how Exxon Mobil fared versus the analyst consensus estimate in the past, we see that the company beat revenue estimates twice over the last four quarters, with two misses. The same holds true when it comes to Exxon Mobil’s earnings per share estimates, as the company delivered two beats and two misses over the last year. There is thus no clear tendency of analysts either underestimating or overestimating Exxon Mobil regularly. Instead, analysts appear to be more or less correct on a net basis, with some quarters being weaker than expected and others being stronger than expected.

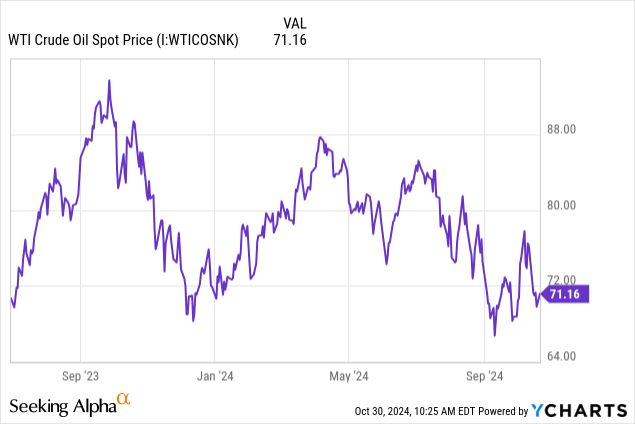

When we take a look at oil prices, it is not surprising that analysts are predicting a bit of a revenue decline:

WTI crude oil (CL1:COM) has been volatile since July last year, but the average of this year’s Q3 was a bit lower than the average over last year’s Q3. The low point from September 2024 was lower than the low in last year’s Q3, and this year’s Q3 high was lower than last year’s Q3 high. With slightly lower lows and slightly lower highs, oil prices were a bit of a headwind for Exxon Mobil (and all of its peers) during this year’s third quarter.

Exxon Mobil has been investing in production growth substantially, which includes the takeover of Pioneer Natural Resources. Production levels will thus be up compared to last year’s third quarter, which will help offset some headwinds of lower oil prices.

That being said, a small revenue decline still seems like a realistic assumption. With lower revenue generation and higher production costs (due to higher production volumes and integration costs for Pioneer Natural Resources), it is not surprising that profits are forecasted to decline on a year-over-year basis when Exxon Mobil reports its results on Friday.

One of Exxon Mobil’s super major peers, BP p.l.c. (BP), has already announced its Q3 earnings results this week. While BP’s revenues came in slightly higher than expected, the company nevertheless experienced a sizeable earnings decline — oil prices being lower than during last year’s third quarter hurt the company. Exxon Mobil’s portfolio is stronger than that of BP. Thus, it wouldn’t be surprising if XOM’s earnings pullback was less pronounced compared to BP, but overall, it seems highly likely that Exxon Mobil will have to report somewhat lower profits with its upcoming earnings report.

Macro Picture

Oil prices were volatile this year, moving between roughly $65 and around $90 per barrel of WTI. Macro developments, including geopolitical crises, play a huge role in that. Very recently, oil prices slumped lower, when it became apparent that Israel had decided against an attack on Iran’s oil infrastructure, instead opting to hit military assets in response to Iran’s previous missile attack. Depending on how things develop in the Middle East (e.g., possible further escalation by Iran), it is possible that oil infrastructure will be hit in the future, however.

China’s oil demand is also a wild card in the foreseeable future. While the country is seeing below-average economic growth right now (relative to its growth rate in the past), and while a real estate downturn hurts consumer sentiment, the potential for increased stimulus spending could drive up oil demand in the future. Whether that will happen is unknown, however.

OPEC+ production levels are also an unknown factor going forward. Another delay in production increases could support oil prices, but the fact that some OPEC+ members have sold more oil than they agreed to has reduced the effectiveness of OPEC+ production cuts. It remains to be seen how OPEC+ decides to operate going forward.

Currently, with oil trading in the $70 range, it looks like the market is, overall, relatively pessimistic about oil prices. I believe that it is more likely that oil prices rise from here, back to the $80s per barrel, e.g., if China increases stimulus spending or if OPEC+ members start adhering to their quotas. A fall of oil prices towards $60 or even less than that seems unlikely to me, as this would be below this year’s lows. In case we get a recession in the United States, a substantial oil price pullback is possible, of course. However, with GDP growing at a still solid pace of 2.8% in Q3, a recession in the US does not seem particularly likely in the near term.

Presently, the market is bearish on oil, which makes positive surprises more likely than further downside, I believe, although the latter can’t be ruled out, either, depending on how a couple of macro things develop: The war in the Middle East, China’s economy, and so on.

Is Exxon Mobil An Attractive Investment?

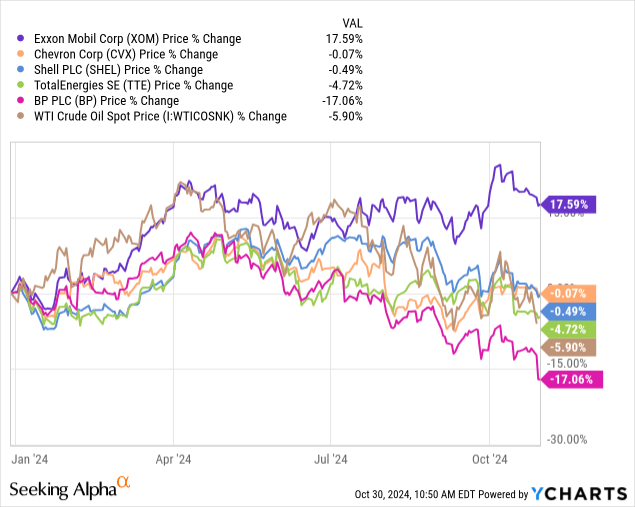

Exxon Mobil has been a strong performer for those who bought shares of the oil giant when they were unloved. This was when, e.g., Exxon Mobil was excluded from the Dow Jones Index, or when shares were very cheap during the initial phase of the pandemic. But from these lows, Exxon Mobil has risen sharply and currently trades close to all-time highs. Recently, Exxon Mobil’s shares have outperformed both oil prices and the shares of competing super majors such as BP:

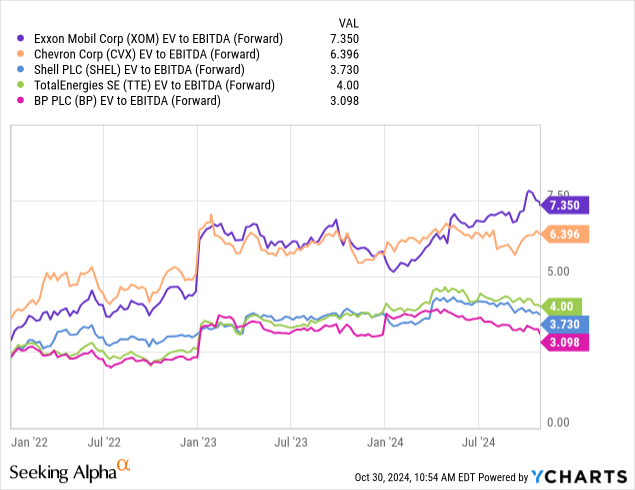

BP was an outlier to the downside so far this year, with Chevron Corporation (CVX), Shell plc (SHEL), and TotalEnergies SE (TTE) moving more or less in line with the price of oil. Exxon Mobil outperformed these massively, which is great news for someone buying shares at the beginning of the year or before. But for someone who thinks about buying Exxon Mobil’s shares today, the past outperformance has made Exxon Mobil expensive, which is why shares now look rather unappealing from a valuation perspective:

Exxon Mobil is the most expensive super major right now, trading at a 16% premium to its closest peer Chevron, and at a premium in the 100% range compared to the three European super majors on an enterprise value to EBITDA basis. Exxon Mobil has a cleaner balance sheet than the peer average, but net debt is accounted for in enterprise value — the fact that XOM still trades at such a considerable premium is surprising. I believe that some premium would be justified over the European super majors due to XOM’s strong position in Guyana and due to XOM’s clearer strategy. However, paying around twice as much per dollar of EBITDA seems a bit excessive to me.

At 15x forward earnings, Exxon Mobil is also not cheap on an absolute basis — this is still an oil company, after all, with substantial capital intensity, exposure to commodity prices and geopolitical risks, and so on.

While Exxon Mobil’s management is strong and while Exxon Mobil has attractive assets, the (comparatively) high valuation makes me believe that Exxon Mobil is not a great investment at current prices. If oil prices climb, XOM could have an upside, of course, but that also holds true for its much cheaper peers. With XOM being forecasted to see a sizeable earnings per share decline when it reports results on Friday, buying shares near all-time highs may not be the best idea.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!