Summary:

- Exxon Mobil’s recent financial results have been disappointing, as they missed consensus estimates on both top and bottom lines.

- The miss on numbers came after a couple of years of great growth for Exxon. These growth spurts have now subsided.

- Exxon has taken several steps to address growth going forward – and based on these, I expect Exxon to keep delivering strong shareholder returns.

Joe Raedle

Investment thesis

Exxon Mobil Corporation (NYSE:XOM) went from making in excess of $250 billion of revenue in 2019 before the COVID pandemic and suffered greatly during the pandemic. Revenues fell to about $178 billion in 2020. The year after saw a strong rebound as the effects of the pandemic subsided, and then followed the war in Ukraine which pushed oil prices higher still. These effects combined saw Exxon turn over a record $400+ billion in 2022.

Recently, however, things have soured some. Revenues are down against last year (TTM), and so is net income. Year-to-date, the stock has followed suit and is down slightly. Further, the pressure is on for Exxon to transition its business as the world grows more and more concerned with sustainability. This leaves a couple of key questions to answer: Can Exxon keep up its decades long history of increasing its dividend, and will it keep growing despite of the headwinds? If it can, the current valuation of ~11 times earnings sure seems attractive.

Based on my walk-through of Exxon’s expansions efforts – particularly in its downstream segment – and a combination of cost-cutting efforts and continuing its policy of strong shareholder returns, I conclude that Exxon can turn things around and again establish a path of growth with shareholder rewards to follow.

I’m issuing a Buy rating for Exxon Mobil.

Exxon’s recent financial results (Q3) and future outlook

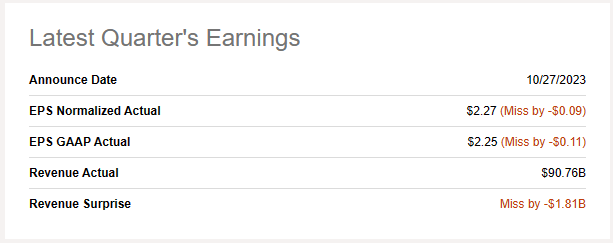

Last time Exxon reported their financials, they missed consensus estimates on both top and bottom lines:

Seeking Alpha

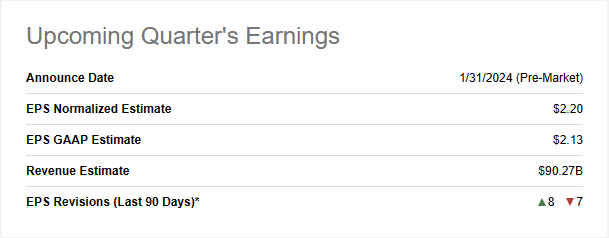

For the upcoming quarter, Exxon is expected to do slightly worse on an EPS basis than they were last quarter:

Seeking Alpha

In other words, it appears the general consensus is that Exxon’s strong growth following COVID and the Ukraine war is starting to wear off. That wouldn’t be surprising given how there’s a certain cyclicality in oil and the industry tends to respond to a lot of macroeconomic factors.

But Exxon has taken several steps to grow its business lately. These include a major expansion of its Beaumont, Texas, refinery. The expansion includes increased capacity, including the ability to produce an additional 250,000 barrels per day (primarily diesel). The total capacity at that plant is now in excess of 600,000 barrels per day (BPD) and allows Exxon to take greater advantage of the oil supplies from the Permian Basin. This is significant because of the way Exxon has designed its business: Exxon is a so-called “integrated” operator in the oil and gas industry. This means it operates across all levels of the value chain: It holds upstream assets (facilities that actually produce oil and gas), midstream assets (such as pipelines that move oil and gas), and downstream assets (refining and chemicals). When expanding in one area, Exxon compensates for loss in another. This approach should help Exxon grow its top and bottom lines – and shareholder distributions – over time, even if losses occur in other areas, such as the upstream business.

Another interesting approach Exxon is taking is it’s reconfiguring existing assets to produce biofuels. This of course is partly in response to growing demand for such fuels, but also in part to address climate concerns which are putting Exxon’s (former) business model under pressure. By doing so – instead of building new plants – it is my expectation that Exxon saves on future capital expenditures (capex) as Exxon can “reuse” existing facilities. It should also help Exxon meet the demands of the future.

Further, Exxon is developing solutions within advanced recycling, including an ability to reduce plastic waste by reusing the plastic waste at petrochemical facilities to make other projects. Recycling capabilities like this can help Exxon supply its operations with low-cost supplies.

Exxon doesn’t rely on just expansion, though: Management has taken steps to cut costs in several areas across the business.

In addition to organic growth, Exxon follows an opportunistic approach to M&A activity. Recently, Exxon announced one of the largest mergers in the history of the oil industry when they decided to merge with Pioneer Natural Resources in an all-stock transaction at an enterprise value of $60 billion+. The move will strengthen Exxon in the Permian Basin and elsewhere, and is seen as a major consolidation of the industry – a consolidation which recently continued with Chevron Corporation’s (NYSE:CVX) purchase of Hess Corporation at a similar valuation.

Another source of growth on an EPS level for Exxon is the ongoing share repurchase program. For the first 9 months of 2023, Exxon spent a staggering $13.1 billion on repurchases of the common stock. The current buyback program was announced on December 8, 2022, and authorizes management to repurchase up to $50 billion of common stock. The emphasis on buybacks came after a few years of more or less idle activity in that area, whereas preceding 2015, Exxon followed a policy of continuous activity in the field of buybacks. Going forward, I expect Exxon to remain focused on growth through buybacks, not least because of its strong cash flows and the recent strong price decline.

If we turn to look at Exxon’s debt – seeing as debt is just about the only thing that could kill a great company – that’s one area we’d like to not see growing. Exxon has increased its long-term debt quite substantially for the past 10 years: From ~$6.5 billion in 2013 to ~$34.8 billion now (numbers from Seeking Alpha). But if we look at long-term liabilities in total, the impression is quite different: Total long-term liabilities have gone from ~$166 billion in 2013 to ~$165 billion now. Therefore, Exxon has in reality kept its total liabilities quite steady over the years. With free cash flow generation of almost $38 billion (TTM), Exxon appears fully capable of handling its debt, so I don’t see this as a major risk to Exxon’s growth prospects going forward.

Risks

Exxon like several of its peers has been subjected to shareholder activism over environmental concerns. I see these developments as the biggest challenge to Exxon going forward. It is, after all, concerning the very nature of what Exxon does, and why it’s important to the customers it serves.

In 2021, Exxon lost a shareholder vote that saw representatives of activist investors unseat two board members only to install two of their own. Other than direct confrontations like this, Exxon faces a general and growing concern over climate change and the effects that the oil industry has on that.

As much as the oil industry is still vital to the global economy, there’s a persistent emphasis in much of the world to transition from fossil fuels to renewables. Exxon has taken several steps to address the issue, including setting goals to lower emissions from their activities. When Exxon announced the Pioneer deal, they also stated they would accelerate Pioneer’s ambition to reach net zero emissions from the Permian Basin activities – now expected to reach net zero by 2035 instead 2050.

Several outside factors could either speed up or slow down the process of transitioning to renewables. The outcome of the 2024 US presidential election, for instance, could have an impact on the issue.

Key takeaways

After a sluggish 2020 due to the COVID pandemic, Exxon enjoyed a double sprint of growth from the post-pandemic recovery and the increased demand for non-Russian oil and gas after the onset of the war in Ukraine.

Those growth sessions are over, but Exxon has taken steps to keep growing: They are expanding existing facilities to meet current demands, transitioning existing facilities to produce biofuels and meet future demands, cutting costs, and taking advantage of the decline in the share price to increase EPS through buybacks.

Because of the steps Exxon is taking, I believe they can maintain their position in the investment community – one that is known for generous shareholder returns and a steadily increasing dividend.

For the reasons stated above, I rate Exxon Mobil stock a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.