Summary:

- Exxon Mobil agreed to acquire Pioneer Resources in a $60B all-stock transaction, strengthening its production business in the Permian basin.

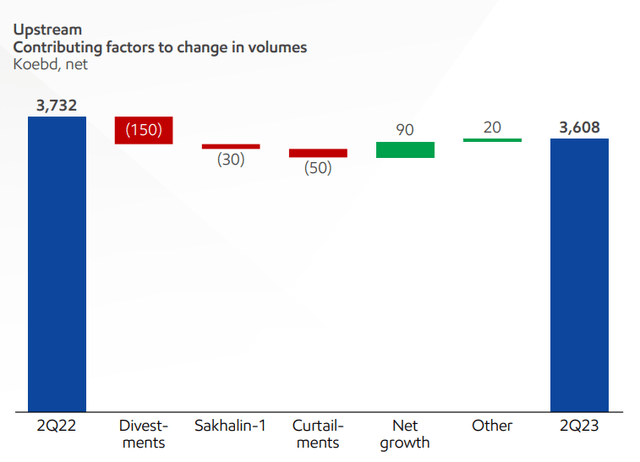

- Exxon Mobil’s production volume dropped in Q2 due to asset divestments, but growth came from Permian and Guyana assets. Permian investments could push Exxon Mobil’s production growth going forward.

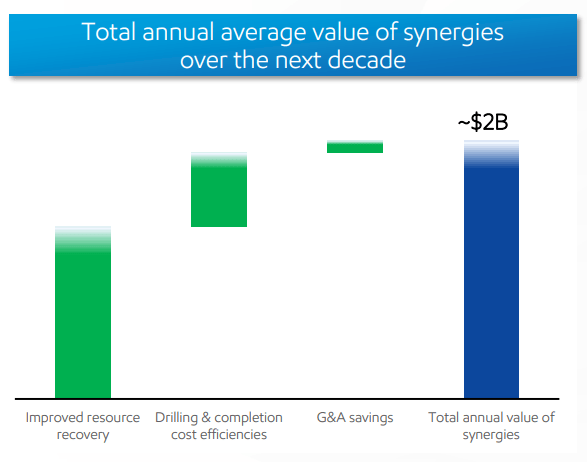

- Synergy effects and cost-savings may result in higher capital returns for investors.

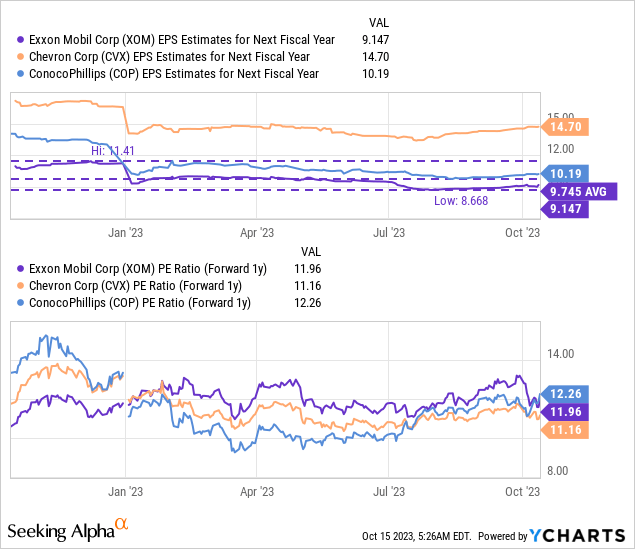

- Exxon Mobil’s valuation is similar to Chevron and slightly higher than ConocoPhillips.

Brandon Bell

Exxon Mobil (NYSE:XOM) last week announced a major acquisition that is set to make a huge impact on the company’s production business, especially in the Permian, a basin that is known for delivering strong production growth and high margins for Exxon Mobil as well as other production companies that have productive assets there. In a landmark $60B transaction, Exxon Mobil will acquire Permian-focused energy company Pioneer Natural Resources (NYSE:PXD) which is set to result in a doubling of Exxon Mobil’s estimated production output in the Permian basin. Considering that the acquisition will further strengthen Exxon Mobil’s core production business and new uncertainty in the Middle East could trigger higher oil and gas prices, I am upgrading XOM from hold to buy!

Previous rating

I previously rated Exxon Mobil a hold due to OPEC+ members, mainly Russia and Saudi Arabia, supporting petroleum prices by announcing major production cuts: Exxon Mobil: OPEC+ Is Coming To The Rescue.

The Pioneer acquisition comes at a time of rising prices as well as new uncertainty related to the conflict in Gaza… which could benefit petroleum and gas prices and also help Exxon Mobil achieve short-term earnings and free cash flow gains. Since I see the acquisition of Pioneer favorably, I believe a rating upgrade to buy is justified.

Deal terms and strategic implications for Exxon Mobil’s production business

Exxon Mobil agreed last week to acquire Pioneer in a $60B all-stock transaction. Shareholders of Pioneer Resources are set to receive 2.3234 shares of Exxon Mobil for each Pioneer Resources share they own. The acquisition terms imply a takeover price for Pioneer Resources of $253 per-share, showing a 9% premium over the firm’s 30-day volume-weighted average price.

The transaction is transformational in the sense that Exxon Mobil expects to rapidly increase its production in the Permian basin… which is a key growth play for Exxon Mobil. Following the transaction completing, Exxon Mobil projects to double its output to 1.3M BOE/D. The firm has said it expects the closing of the deal in the first half of FY 2024. Additionally, the acquisition of Pioneer is set to add an additional 856,000 net acres in the Midland Basin, further boosting Exxon Mobil’s production outlook: the firm said that it looks to achieve an annual production output of 2 MOEBD by FY 2027.

The deal comes at a time when Exxon Mobil’s production volume has dropped, chiefly because of asset divestments. So the acquisition of new productive assets in a high-potential growth basin like the Permian indicates that Exxon Mobil could see positive production growth going forward. Exxon Mobil’s Permian and Guyana assets provided positive growth, in terms of production, in the second-quarter.

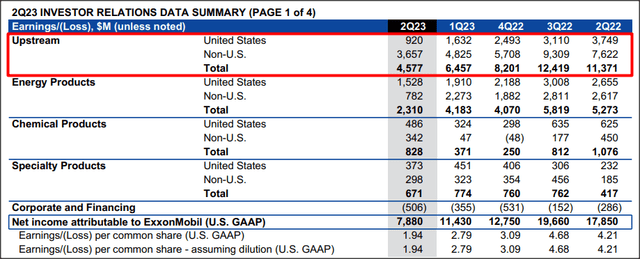

The acquisition strengthens not only Exxon Mobil’s Permian footprint, but its entire core production business which accounted for 57% of the firm’s year-to-date earnings. The remaining earnings were distributed among Exxon Mobil’s Energy, Chemical and Specialty Products businesses. The second-largest business, after production, was the firm’s Energy Products segment which earned $6.5B so far this year and made a 34% earnings contribution year-to-date.

Synergy effects and potential for incremental capital returns

The business combination of Exxon Mobil and Pioneer is also set to drive cost synergies which are expected to amount to $2.0B; which is additional money that could be returned to shareholders over time, either through dividend growth or share buybacks.

Source: Pioneer Resources

Exxon Mobil’s valuation vs. energy rivals

Exxon Mobil is expected to earn $9.41 per-share in FY 2023, implying a 33% decline in earnings compared to the year-earlier period. The decline in estimates is largely driven by weaker petroleum and natural gas prices, compared to the year-earlier period, which have dropped significantly in the first six months of the year.

Exxon Mobil is currently valued at 12.0X FY 2024 earnings while Chevron (CVX) has an earnings multiplier factor of 11.2X. ConocoPhillips (COP) is trading at a slightly higher earnings multiplier (12.3X)… possibly because the firm is more dependent than its more diversified U.S. energy rivals on market prices for petroleum (ConocoPhillips does not own a refinery business). ConocoPhillips is a speculative buy for investors that believe that we are heading for a higher-for-longer oil price environment: OPEC+ Supply Cuts Could Translate To Profit Upside.

Risks with Exxon Mobil

The biggest risk for Exxon Mobil, from a commercial perspective, is that petroleum and natural gas prices decline which would likely lead to significantly lower earnings, free cash flow and margins, especially in the production business which Exxon Mobil is now deliberately strengthening with the acquisition of Pioneer.

Final thoughts

I believe the $60B all-stock deal between Exxon Mobil and Pioneer is a game-changer for Exxon Mobil and transformative for the company’s production business, especially as far as its Permian asset footprint is concerned: Exxon Mobil expects to double its production in the Permian following the close of the transaction and investors may see a return to positive sequential production growth in the all-important upstream business going forward.

Exxon Mobil is also strengthening its core production business which still accounts for nearly 60% of year-to-date earnings for the energy company. The transaction is also said to yield synergy effects which could be used to return more cash to shareholders through dividends and stock buybacks. Increasing fear premiums related to the conflict in Gaza may further benefit large-cap U.S. oil companies. Shares of Exxon Mobil are valued in-line with those of other large U.S. energy companies and I believe the risk profile has now further improved!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.