Summary:

- XOM has declined by -9.4% since our previous Sell rating, with more volatility ahead due to the uncertain WTI spot prices and Powell’s pessimistic commentaries.

- The US SPR inventory continues to dwindle to 350M as well, with lower levels likely being the new normal post-pandemic.

- The oil rally may be over, with analysts projecting a moderation in XOM’s top and bottom line through FY2025, despite the ramp-up in its production output.

- Meanwhile, existing investors can hold on to the dividend aristocrat for its forward dividend yield of 3.54% and fixed dividend raises.

- However, due to the minimal upside potential to our price target, we do not recommend anyone to add here.

HAYKIRDI/iStock via Getty Images

The Oil Investment Thesis Is Less Attractive, With The Hyper-Pandemic Rally Over

We previously covered Exxon Mobil Corporation (NYSE:XOM) in March 2023, ending the article with a sell rating. True enough, it had declined by -7.9% at the time of writing, or -9.4% at its worst. Even so, the gap between the stock prices and declining WTI crude oil spot prices further widened, suggesting more volatility ahead.

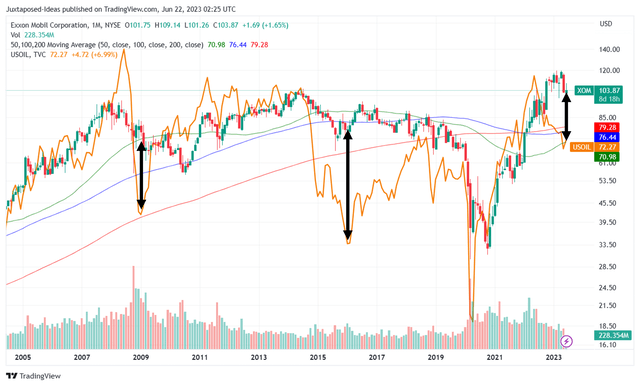

XOM 20Y Stock Price

Given how XOM historically correlated closely to the WTI, the widening gap might be reminiscent of the same cadence in 2015, as the stock maintained much of its optimism as the spot prices cratered by nearly -70%.

However, we doubt that the same case study may apply here, since it may be nearer to the 2008 cadence, with the stock belatedly closing the gap by 2010, before resuming the previous correlation afterward.

OPEC+ and Saudi Arabia’s production cuts seemed to be non-events as well, with the spot prices still in a general malaise compared to the hyper-pandemic heights of $114 per barrel. For now, the former still expects the global oil demand to rise by 2.35M barrels per day or +2.4% YoY in 2023, with the oil spot prices likely supported at $70s due to the total production cuts of 3.66M barrels per day through 2024.

To add more uncertainty to the mix, the US SPR continues to dwindle to 350M barrels by June 21, 2023 (-2.2% MoM/ -30.6% YoY). This is a surprising cadence indeed, compared to the 634.96M recorded by December 27, 2019.

While the US government has previously pledged to refill the SPR by June 2023, it remains to be when that event may actually occur, given their preferred contract prices of between $67 and $72 per barrel, with the WTI trading at $72.48 per barrel at the time of writing.

Even then, we are uncertain where the federal funding may come from. While the debt ceiling has been recently raised again, for the 79th time since 1960, government spending may be tight from henceforth, likely putting the refilling of the SPR to a lower priority.

We believe that the lower SPR inventory may eventually be the new normal after the pandemic, especially due to Powell’s pessimistic commentary about the slower path toward a 2% inflation rate, compared to the 4% reported in the May 2023 CPI.

So, how will these developments impact XOM moving forward?

We suppose XOM may sustain its execution, with it reporting FQ1’23 revenues of $84.18B (-12% QoQ/ -4.3% YoY) and Free Cash Flow generation of $10.92B (-7.6% QoQ/ inline YoY).

It is apparent that the normalization in spot prices has contributed to the moderation of its top and bottom line expansion, despite the improved production volume of 3.83M oil equivalent Barrels per day (inline QoQ/ +4.3% YoY) by the latest quarter.

However, investors need not fret since the hyper-pandemic and Russian-war-induced windfall has also allowed XOM to improve its balance sheet tremendously to net debts of $6.5B by the latest quarter (-31.7% QoQ/ -79.4% YoY), compared to the peak level of $41.14B in FQ4’20.

Combined with the $19.62B of shares repurchased over the past six quarters, the management has already retired 174M of shares, or the equivalent of 4% of its shares outstanding at the same time. This is on top of the $14.89B of dividends paid out over the last twelve months (inline sequentially), with the share retirement allowing an increase in its dividends paid out per share by +3.4%.

Unfortunately, we share the market sentiments that the oil rally may already be over, with analysts already pricing in moderation in XOM’s top and bottom line at CAGR of -7.3% and -13% through FY2025, respectively.

This cadence is naturally attributed to the potential normalization of oil prices to the pre-pandemic levels of $60s over the next few years, despite the increase in its production output to 1.2M bbl/day from Guyana and 1M boe/day from the Permian, up by +233% and +78.5% from FY2022 levels of 360K bbl/day and 560K boe/day, respectively.

Therefore, we suppose the optimism surrounding the oil prices has already peaked, with market sentiments likely to moderate from henceforth.

So, Is XOM Stock A Buy, Sell, Or Hold?

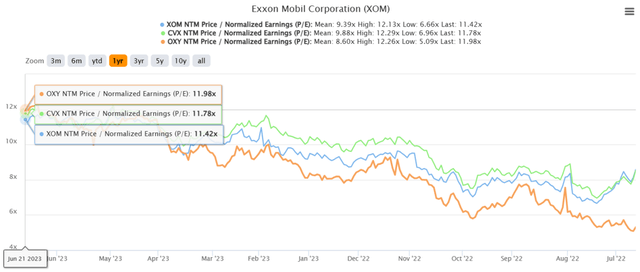

XOM NTM P/E Valuations

For now, XOM continues to trade optimistically at an NTM P/E of 11.42x, against its 1Y mean of 9.39x. The same has been observed with its oil/gas peers, such as Chevron (CVX) at 11.78x and Occidental (OXY) at 11.42x.

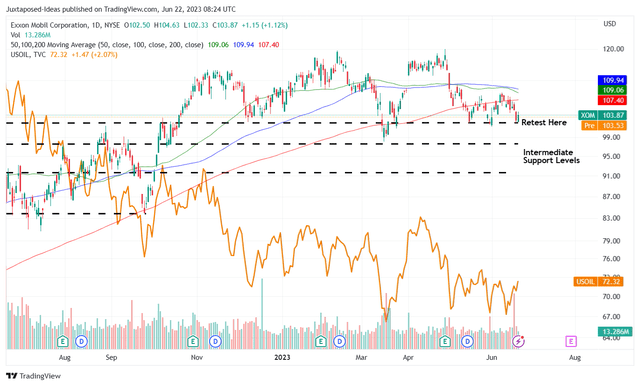

XOM 1Y Stock Price

Then again, despite the recent pullback, there is minimal upside potential from current levels to our price target of $105.86, based on XOM’s NTM P/E and the market analysts’ FY2025 EPS projection of $9.27.

In addition, thanks to the recent market uncertainties, the stock has been retesting its December 2022 and March 2023 support levels over the past few weeks, suggesting more volatility ahead. If those levels are breached, we may see it head to the $90s in the near term, implying an -11% downside from current levels.

As a result, we prefer to rate the XOM stock as a Hold (Neutral) here. Existing investors may continue holding on to the dividend aristocrat, due to the decent forward dividend yield of 3.54% and fixed dividend raises thus far. However, we do not advise anyone to add here, since the payouts may not cover the potential losses from the decline in its stock prices.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.