Summary:

- We started our bull thesis on Exxon Mobil back in Oct 2021.

- Our bullish thesis was built around 3 return drivers: Profitability recovery, supply shortage, and attractive valuation.

- After a total return of 100%+ since then, it is a good time to examine these drivers again.

- We felt that all 3 drivers had run their course and recommended investors to take some profit.

- Valuation is still attractive amid an overall expensive market. However, return potential in the near term is limited due to the lack of immediate catalysts.

JHVEPhoto

XOM: Both Price and Profitability have Peaked

Readers familiar with our writings know that we have been long-term bulls on Exxon Mobil (NYSE:XOM). We posted our first bullish thesis on the stock back in Oct 2021 and have maintained our buy rating since then. Our bullish thesis has been anchored around the following 3 return drivers:

- Profitability recovery due to oil price stabilization and travel recovery after the pandemic.

- Supply shortage due to the breakout of the Russian/Ukraine war.

- And very compressed valuation due to the market’s extremely negative sentiment toward energy stocks at that time.

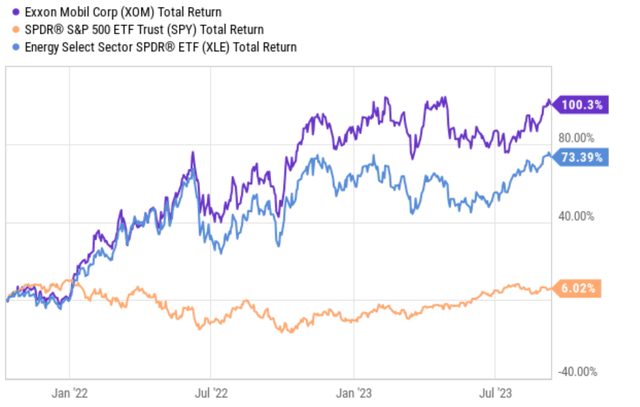

Fast-forward to now, all these drivers worked out really well. The stock has delivered a total return of ~100% since then (see the chart below), outpacing both the S&P 500 Index and also the energy sector.

However, we see that all 3 drivers have largely run their course by now. In the remainder of this article, we will detail the signs showing its profitability has already peaked and the supply-demand imbalance has largely equilibrated. In terms of the valuation, with its prices near an all-time high, it does not offer the margin of safety we’d like to see anymore.

Profitability Already Peaked

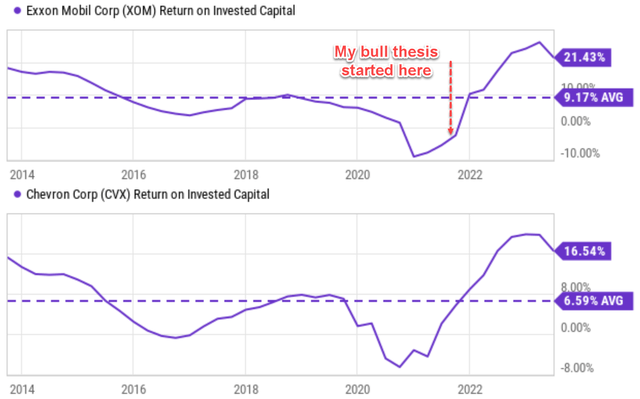

XOM was able to maintain quite respectable profitability, as measured by ROIC (return on invested capital) as shown in the chart below, in the long term. Its ROIC in the past decade averaged around 9.17%, far better than its close rival Chevron (CVX). However, due to a series of headwinds (mostly the breakout of the COVID pandemic and oil price fluctuations), its ROIC nosedived into the negatives toward the latter half of 2021.

And our bull thesis started when we saw signs of its profitability turning a corner, as shown in the chart below. At that time, our thinking was that travel would recover and the Russian/Ukraine situation would lead to a supply-demand imbalance, both helping to stabilize energy prices and boost XOM’s profitability. Indeed, XOM’s profitability staged a perfect V-recovery, as seen shortly afterward. Its profitability surged to about 25% ROIC in early 2023.

However, its ROIC has since then pulled back a little bit to the current 21.4%. I don’t view this pullback as a random fluctuation. I see it as a symptom of the changes in the underlying forces for several reasons. First, the pullback is also observed in other peers, such as CVX. Second and more important, the supply-demand imbalance has largely equilibrated by now, in my view, as detailed immediately below.

The Supply-Demand Imbalance has Largely Equilibrated

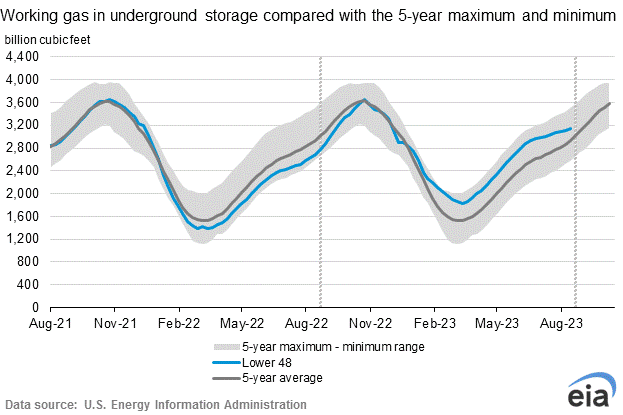

A few key factors kept supply and demand out of balance in the energy past for the past 2-3 years. The top ones in my mind are: A) years of underinvestment in basic energy infrastructure, B) the breakout of the Russian/Ukraine war, C) the global shipping congesting limiting the shipment of LNG (liquefied natural gas), and D) colder-than-normal winter temperatures resulting in higher natural gas consumption than normal (say the five-year period between 2017 and 2021).

All these factors have largely renormalized and found at least a temporary equilibrium point by now, with the exception of D. Weather is just weather and can always change randomly. As a result, you can see from the chart below that natural gas storage now sits above the historical average by a good margin. For readers unfamiliar with this chart, it shows the working natural gas inventory in the lower 48 states in underground storage. The units are a billion cubic feet. The grey area means the range – the difference between the max and min averaged over five years. The thick black/grey line is the running average. And the thick blue line shows the current level. As seen, for the latter part of 2021 and throughout most of 2022, the inventory has been struggling below the average. But starting early 2023, the inventory has been building up and stayed steadily above the average.

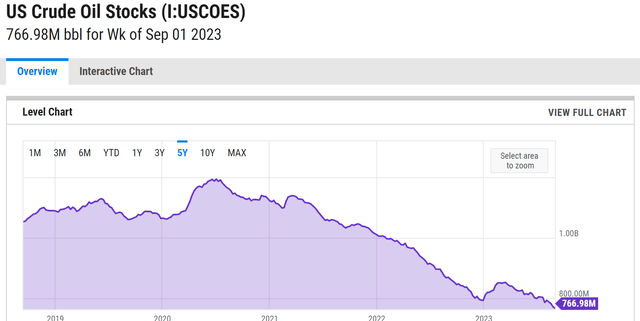

Crude oil stock is still near a multi-year low (see the second chart below). However, I anticipate its turning point is coming soon because of the changes in the fundamental forces mentioned above.

Valuation Offers No Margin of Safety

Trading at a TTM P/E in the single digit (9.05x as of this writing), the stock is still cheap comparatively amid an overall expensive market. However, its valuation no longer offers any meaningful margin of safety in my view.

For a cyclical business such as XOM which pays steady dividends in the long term, the dividend is a much better measure of its economic earnings (than accounting EPS). As a result, dividend yield is a much better valuation metric (than P/E) in my view. As shown in the chart below, the stock was yielding about 5.8% when we started our bull thesis, far above its historical average. But now, the situation is the opposite. Its yield is not only below the historical average but also at the lowest level in at least 5 years.

Other Risks and Final Thoughts

There are other considerations surrounding the stock, both in the upside and downside directions. Some of the upside catalysts include its clean energy initiatives, which ought to ramp up and bear fruit in the long term. I anticipate capital spending in the alternative energy arena, notably renewable diesel fuels and hydrogen, to accelerate in the years to come. Management also controls costs effectively, in the way I see things. Through structural reorganization and operating efficiency improvement, annual expenses have been lowered by $7 billion compared to 1-2 years ago. Lastly, as mentioned earlier, its profitability as measured by ROIC is still at a very competitive level even if it pulls further back when compared to its own historical average or its close peers.

However, my overall feeling is that the issues mentioned above will be the dominating forces in the near term, say the next 2-3 years. To recap, its profitability has already reached a peak (at least temporarily for the next few years). The supply-demand imbalance seems to have found a new equilibrium. From the supply side, the sector has reinvested heavily in the past 2-3 years to boost production. From the demand side, the world was forced to either reduce consumption or find alternative sources as the Russian/Ukraine situation drags on. As such, XOM might still be a good investment in the long term (all upside catalysts mentioned above are long-term oriented), but I expected return potential in the near term to be very limited due to the lack of immediate catalysts.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.