Summary:

- Exxon Mobil stock has outperformed the market despite relatively weak oil prices, justifying my previous bullish thesis.

- Exxon has significant upstream assets to capitalize on as it lifts its production capacity, even if oil prices remain in a range.

- I assess XOM’s recent surge as justified, as the market was too pessimistic about its earnings growth prospects.

- A potential breakout above XOM’s $120 level could prove decisive, bolstered by heightened Middle East tensions.

- I explain why the market has likely reflected these developments, as it’s forward-looking. Waiting for a more attractive buying opportunity seems wise.

zodebala

Exxon: Outperformed The Market Despite Facing Weak Oil Prices

Exxon Mobil Corporation (NYSE:XOM) investors who ignored the pessimistic sentiments in the relatively weak oil prices (CL1:COM) (CO1:COM) and loaded up on XOM have likely benefited from its recent outperformance. Bolstered by the recent surge attributed to heightened geopolitical tensions between Israel and Iran, investors are likely betting on a potential growth inflection, lifting Exxon’s earnings in the second half.

In my previous Exxon article in June 2024, I upgraded the stock, assessing that the market had turned too pessimistic about its earnings and cash flow potential. I also indicated that the company’s production capacity should be boosted as it integrates its Pioneer acquisition. My bullish thesis has played out convincingly, as XOM outperformed the market and surged to a new all-time high last week.

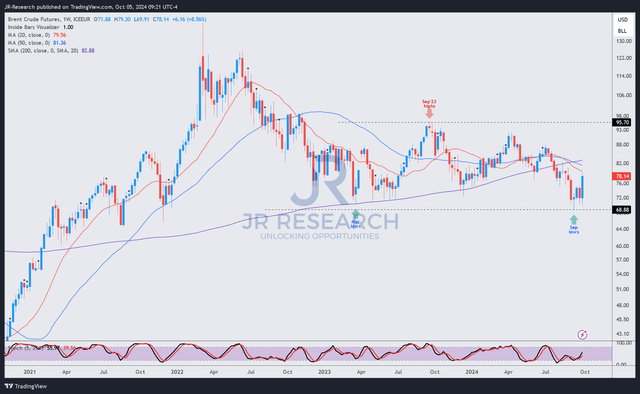

Brent crude futures price chart (weekly, medium-term) (TradingView)

The Brent crude oil futures price chart has remained in an increasingly bearish bias, which likely surprised bearish energy investors, as they anticipated more downside on XOM. Despite that, I assessed the critical support zone as just under the $70 zone, which remains well-supported, possibly affording more earnings visibility for Exxon Mobil’s upstream earnings potential. As a result, XOM’s recent surge has likely demonstrated that investors should stay focused on its earnings profile as it raises production capacity, capitalizing on its cost-advantaged upstream assets in the Permian Basin and Guyana.

Exxon: Can Continue To Do Well Unless Oil Prices Crash

As a reminder, Exxon highlighted the record production levels delivered in its Q2 earnings release in August 2024. Accordingly, the company notched a surge in Permian production to 1.2M boe per day, lifted by its Pioneer acquisition. As a result, the leading integrated oil company has managed to bolster its earnings profile as it expands production in higher-margin opportunities. Therefore, it corroborates the company’s confidence in delivering its medium-term outlook of achieving cumulative surplus cash between $80B and $140B through 2027. Exxon’s conviction is predicated on oil price stability hovering between $60 and $80 a barrel, while attaining refining and chemical margins aligned with its 10Y average.

Given the intensified geopolitical headwinds and the OPEC+’s hesitance to lift its near-term production, near-term sentiments in XOM have been bolstered. As a result, I assess that the market has likely reflected higher earnings optimism as we head into Q4. The improved buying sentiments are noteworthy, given the expected Q3 earnings impact on Exxon, attributed to lower liquids prices and weaker refining margins. Hence, investors have likely shaken off Q3’s potential earnings variability, suggesting a more robust forward outlook could be in store.

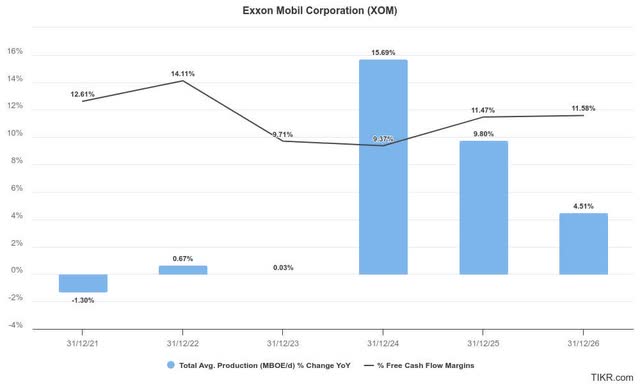

Exxon Mobil profitability estimates % (TIKR)

As seen above, Exxon’s free cash flow profitability is expected to remain robust, even as it bolsters its production profile through 2026. Hence, it should provide XOM substantial valuation support unless oil prices are expected to be hit markedly.

However, given the robust jobs report, I assess that the threat of an economic downturn has likely been lowered markedly. Moreover, a more dovish Fed through 2025 should underpin a more bullish economic outlook, bolstering the consolidation in oil prices. As a result, I assess that Exxon should be able to deliver robust earnings guidance through 2026, as oil prices could stabilize within the range promulgated in its recent update.

Notwithstanding my optimism, investors should be wary about rushing into XOM as they attempt to take advantage of the worsening geopolitical situation in the Middle East. Given the anticipated surplus production capacity, whether the potential oil supply disruption could worsen remains to be seen. Hence, investors must be wary of turning too optimistic about XOM’s earnings growth prospects.

XOM Stock: Valuation Less Attractive But No Sell Signals Assessed

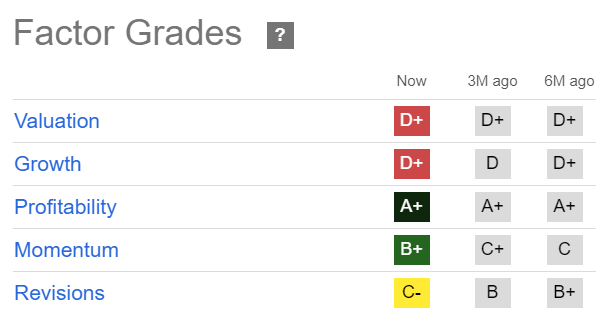

XOM Quant Grades (Seeking Alpha)

As seen above, XOM’s buying momentum has improved markedly over the past six months (from a “C” grade to a “B+” grade), underpinning my bullish proposition.

However, XOM’s forward adjusted EPS multiple of 15.3x is more than 25% over its sector median, suggesting relative overvaluation. In addition, Wall Street’s revisions have also been mixed, justifying caution on XOM’s outlook.

Despite that, I’ve not assessed red flags in XOM’s price action, suggesting investors should consider selling and reallocating exposure.

Is XOM Stock A Buy, Sell, Or Hold?

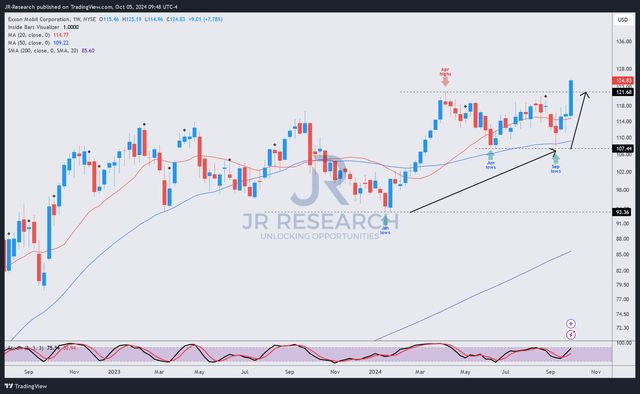

XOM price chart (weekly, medium-term, adjusted for dividends) (TradingView)

As seen above, XOM’s price chart paints a markedly different directional bias from what we observed in Brent crude. XOM buyers have helped the stock regain its uptrend momentum, underpinned by significant dip-buying at its January, June, and September 2024 bottoms.

In addition, XOM’s potential breakout above the $120 level could prove decisive, corroborating its uptrend continuation thesis. However, I assess that optimism has likely been baked into its valuation, lowering XOM’s risk/reward appeal at the current levels.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!