Summary:

- Exxon Mobil Corporation plans to become a leading supplier of lithium for electric vehicles by acquiring land in Arkansas.

- Demand for lithium is expected to triple by the end of the decade, presenting a $40 billion market opportunity.

- Exxon Mobil’s core business remains strong, with plans to increase production and generate strong cash flow.

UniqueMotionGraphics

Exxon Mobil Corporation (NYSE: NYSE:XOM) aka ExxonMobil just announced its planned second act. The company’s goal is to become a leading supplier for lithium in electric vehicles. It’s begun that second act by slowly acquiring 120 thousand acres in Arkansas, which it plans to utilize to produce the lithium for more than 1 million electric vehicles / year by the end of the decade.

Lithium Demand Forecast

Lithium demand is expected to grow dramatically, and ExxonMobil is well positioned to take advantage.

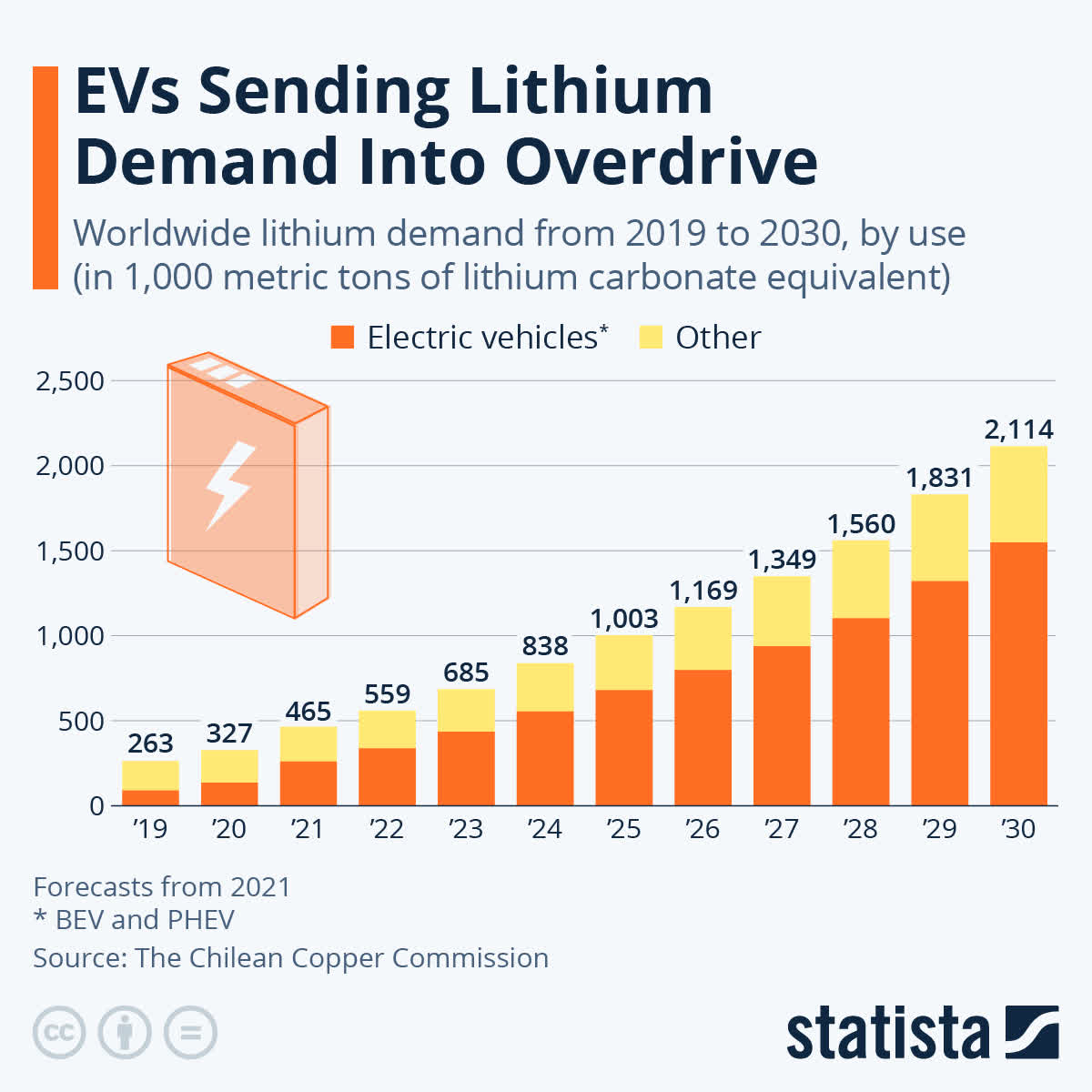

Chart: EVs Sending Lithium Demand Into Overdrive | Statista

Thanks to electric vehicles, which according to some estimates, are scaling up faster than expected, along with growing technology overall, lithium demand is skyrocketing. From this year to the end of the decade, lithium demand is expected to triple to 2.1 million tonnes. For those not familiar with lithium prices that’s a giant market.

It’s $40 billion at current prices, which thanks to some temporary oversupply, have slumped 70% YTD. That growth spells opportunity.

ExxonMobil Extraction Expertise

One thing that ExxonMobil is really good at?

Drilling for oil. Of course drilling for oil is a standardized process that can be applied to other things. You’re simply digging deep and bringing liquids to the surface, backfilling the reservoir behind it, with a lot of technology. Fortunately, the company found its solution in Arkansas. Underground exists saltwater reservoirs. These reservoirs have plenty of lithium.

The company can use its oil and gas expertise to extract that seawater and generate lithium from it. The company expects by 2030 to be able to supply the lithium for more than 1 million electric vehicles per year. A Tesla battery has 140 pounds of lithium, or ~15 vehicles to the ton. That means ExxonMobil forecasts 60 thousand tonnes of lithium.

At current lithium prices, that’s $1.2 billion in additional revenue, at start of the year prices that’s almost $4 billion.

ExxonMobil Core Portfolio

ExxonMobil’s core portfolio remains incredibly strong, which will support continued returns from its overall business.

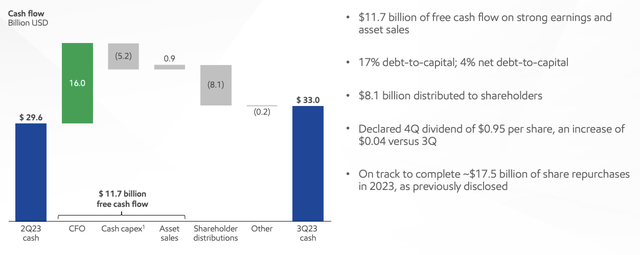

ExxonMobil Investor Presentation

The company recently announced the start-up of its 3rd FPSO in Guyana, bringing production there to 620 thousand barrels / day. It’s targeting 3 more FPSOs by 2027, taking total production to almost 1.4 million barrels / day. ExxonMobil has a 45% stake here, meaning production attributable to the company will be 650 thousand barrels / day by 2027.

That’s almost 240 million barrels / day by 2027, which is billions in reliable profits for the company. The company’s cash flow in the most recent quarter was an astounding $11.7 billion in FCF. That was after substantial cash capex. The company’s FCF growth should be supported by increased synergies with its Pioneer Natural Resources acquisition.

The company’s FCF yield is in the double-digits and that doesn’t count its nascent lithium business or the continued forecast growth. The company has continued to utilize its FCF towards shareholder returns, given its manageable debt, and we expect that to continue. We would have liked to see the Pioneer Natural Resources acquisition be cash based instead of equity.

An Unsolved Problem

The company’s lithium business does still show a risk.

Even with a recovery in lithium prices to where they were at the start of the year, the company’s best case scenario for 2030 is ~$4 billion in annual lithium revenue. The company’s current annual revenue is $350 billion. The company is fortunate that the rapid decline rate of oil and natural gas along with quick returns enables it to cut capital expenditures if needed.

Still, however, the U.S. and China are planning to rapidly ramp up their renewable energy production. Not only is it cost effective at this point, but it dramatically helps the countries with their climate goals. For China, it also enables increased security since they are currently a major oil importer into the country.

While natural gas will be much harder to replace, with its energy density, and there will always be some oil demand from plastic products, etc., this is a big risk to a substantial % of oil demand. ExxonMobil’s volumes remain strong, but long term the company has yet to build a path to replacing its sizable oil and natural gas business.

That could substantially hurt its ability to drive future returns and continue its growth.

Conclusion

ExxonMobil has announced its second act. The company is using its oil and natural gas technology to drill for lithium seawater in a newly built business in Arkansas. The company plans to startup by 2027 and by 2030, the company expects to be producing enough lithium for 1+ million vehicles annually. That could be worth billions.

At the same time, the company’s core business continues to perform incredibly well. The company recently started up its 3rd FPSO in Guyana bringing production to more than 600 thousand barrels / day. That is expected to more than double in the next few years. That growth will result in strong medium term cash flow.

The long-term demand for the company’s products remain a risk, but overall the company can drive strong shareholder returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.