Summary:

- Oil prices are slowly rising again, with the possibility of reaching $100/barrel due to strong demand and production cuts by OPEC.

- Exxon Mobil Corporation is expected to benefit from higher energy prices, potentially earning a minimum 7% cash distribution yield in 2024.

- Exxon Mobil Corporation stock looks undervalued and deserves a Buy recommendation.

zhengzaishuru

Riding the energy boom in 2021 to late 2022, oil majors such as Exxon Mobil Corporation (NYSE:XOM) and Chevron (CVX) have accumulated record profits. Then, in early 2023 oil (CL1:COM) intermittently dropped to prices below $60/ barrel (WTI benchmark), down from >$110/ barrel in 2022, and the oil bull market was considered to have ended. During the past few months, however, the oil bulls appear to have celebrated a stealth comeback: On the backdrop of stronger than expected economic activity, in combination with a hawkish OPEC, oil is slowly edging once again towards $100/ barrel. Like in the money markets, the mantra “higher for longer” likely also applies for energy prices.

If an investor accepts the thesis that energy prices will remain higher for longer, Exxon Mobil is poised for an extended cycle of strong earnings. More concretely, with oil above >$70/ barrel, I see Exxon sustaining a minimum 7% cash distribution yield in 2024; with likely further upside on an even higher energy prices.

Overall, I consider XOM stock undervalued at 8.3x P/CF and assign a Buy recommendation.

Oil Trade Is Back In Play

The key driving factor for oil prices is strong demand. In 2023, the global economy has been growing at a healthy pace, defying expectations for a recession. This has led to an unexpectedly high demand for oil. Meanwhile, the OPEC group has made the decision to reduce supplies, despite the stronger-than-expected economic activity, and rising oil prices. In fact, Riyadh and Moscow recently announced that they are extending their voluntary oil supply cuts of approximately 1.3 million barrel per day, which were originally slated to expire this summer. This, of course, raised concern that the supply deficit in oil markets will draw down inventory levels, with the International Energy Agency warning that OPEC cuts were “locking world oil markets into substantial deficit.”

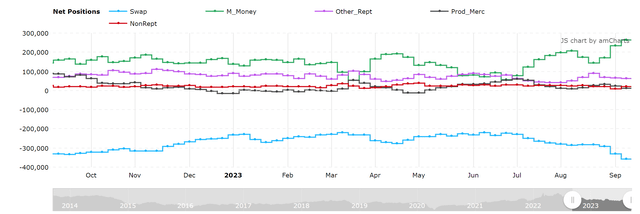

Unsurprisingly, hedge funds and other alternative asset managers have picked up on the demand vs. supply imbalance in the oil markets and added fuel to the price momentum, betting that prices will continue to rise. The latest COT report suggests that managed money long positioning in oil futures is at 12 months high, with the group being long 264 thousand contracts (equivalent to about five days’ worth of global demand).

That said, it is worth considering that oil market look trapped in a self-reinforcing bullish cycle: Production cuts lead to tighter supply, pressuring prices upwards, which in turn attracts increased speculation by investors. Given this momentum, I would not find it surprising if the WTI futures for 2024 delivery close >$100/ barrel by end of this year. This scenario is especially likely when considering that the global economy may accelerate in early 2024 on the backdrop of the first interest rate cuts.

Exxon: Making Big Money …

When oil was peaking in late 2022, Exxon was generating quarterly profits of $18-22 billion, with about $20-25 billion of operating cash flow. In Q2 2023, these figures dropped to $10.5 billion of profits and $9.3 billion of operating cash flow, respectively. So, I see two key benchmark takeaways here:

First, and this is the downside case, if the WTI benchmark remains in the $60-70/ barrel range, Exxon is likely to continue accumulating earnings of approximately $10 billion per quarter. Compared to a market capitalization of about $460 billion, the annualized earnings yield is implied at almost 10% — quite attractive, in my opinion.

The second takeaway relates to Exxon’s operating leverage and operating profitability at higher energy prices. Most notably, if we consider that oil pushes back to >$100/ barrel, then investors may reasonably expect Exxon’s quarterly profits to edge again towards $20 billion, resulting in an annualized implied earnings yield of close to 20%.

… And Distributing Cash To Shareholders

Higher profits for a company do not necessarily equate to higher shareholder returns. For Exxon, however, the equation holds true. Reflecting on the past 24 months, it is evident that the major share of Exxon’s income is allocated to distributing cash to shareholders. And with a net negative financial position of only $12 billion ($41.5 of debt and $29.5 cash), this is unlikely to change going forward. In fact, as long as oil prices remain above $70/ barrel, I strongly believe that Exxon feels comfortable paying out >$30 billion of cash annually, equating to an equity yield of between 7-8%. Notably, my estimate reflects a payout ratio as a percentage of operating cash flow of about 50%, giving Exxon room to invest $15-20 billion a year in CAPEX and paying down the remainder of the company’s net debt position.

For context, in the trailing twelve months Exxon paid about $14.9 billion to shareholders in form of dividends and $17.8 billion in form of share repurchases – compared to $68 billion of TTM operating cash flow and $15.3 billion of CAPEX.

Valuation Implies Upsides

Valuing Exxon, and companies in general, is a slippery exercise. But two considerations might give indications about whether investors are getting a good deal with XOM at $116/ share.

The first argument I would like to discuss is a multiples benchmark. According to data compiled by Refinitiv, it is suggested that Exxon’s historical average P/CF is at about 9.9x, vs. FWD of 8.3x currently. Assuming that XOM will revert back to the historical average, I see about 20% upside in the stock, with a $140/ share implied target price.

Second, I frequently also like to compare equity distribution yields to treasury yields. With XOM’s distribution yield for 2024 comfortably estimated at 7%, vs. the 10-year treasury yield at 4.5%, I argue XOM could easily trade towards $150/ share and still be considered attractive against the risk free rate (incorporating a 325 basis points risk premium, partly offset by a 200 basis points growth discount, equal to nominal GDP growth).

Discussing Downside Risks

While I see the risk vs. reward for investing in XOM most definitely favorable, there are also some downside risks to consider.

First and most obvious, readers should note that Exxon operates in a price-volatile commodities market, with financials levered to crude oil prices, natural gas prices, and refining margins. If prices for crude oil or natural gas fall significantly, it could impact the company’s profitability. Anchored on a rough back of the envelope calculation, I see Exxon as a buy for WTI above $70/barrel, a Hold at $55/barrel, and a Sell for anything below $50/barrel (all estimates in relation to XOM’s current share price of $115/ share).

Second, I would highlight Exxon’s exposure to multifaceted political risks: We should consider that, as an oil major, Exxon’s operations and financials could be impacted by political events, as well as decisions made by governments or regulatory bodies. Political risk can take many forms, including changes in tax policies, trade policies, or environmental regulations. Additionally, geopolitical tensions or conflicts can impact the stability of the regions where ExxonMobil operates, potentially leading to disruptions in production or supply chains. And of course, we should also not forget political sensitivities relating to the west’s relationship with Russia and OPEC, as well as the Ukraine conflict.

Conclusion

In summary, Exxon Mobil Corporation appears well-positioned to capitalize on the resurgence in oil prices, potentially offering strong returns for investors. With robust demand, the company’s profitability is expected to remain solid, and its commitment to distributing cash to shareholders suggests a >7% yield in 2024.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advise

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.