Summary:

- Exxon Mobil’s strong free cash flow and earnings power, supported by high petroleum prices and OPEC+ price support, make it a top energy investment for 2025.

- The acquisition of Pioneer Resources enhances Exxon Mobil’s Permian footprint, boosting its long-term potential for earnings and free cash flow growth.

- Exxon Mobil’s upstream segment, generating 72% of earnings, saw significant growth in oil-equivalent production in Q3’24.

- Despite risks from potential petroleum price declines, Exxon Mobil’s valuation at 14.5X forward earnings and robust capital returns position it well for future growth.

zodebala

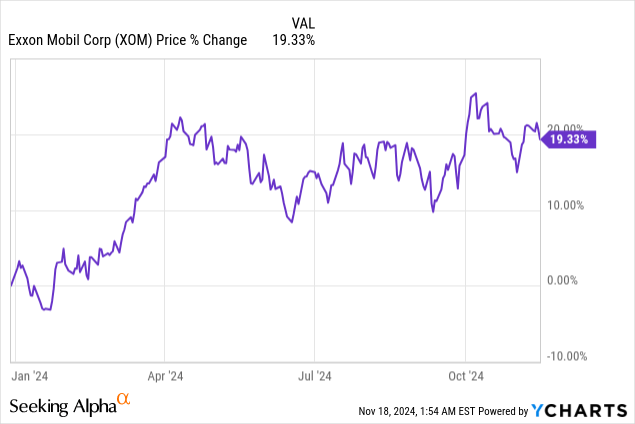

Exxon Mobil (NYSE:XOM) is a large, growing U.S. energy company with considerable earnings power and free cash flow strength. Exxon Mobil generated its highest amount of free cash flow in the last year in the September quarter as the company benefited from realized market prices in the low-$70s. OPEC+ has been highly supportive in 2024 with voluntary production cuts which further supports the value proposition for Exxon Mobil. I believe investors have every reason to remain bullish on Exxon Mobil and with shares trading only at 14.5X forward earnings, implying an earnings yield of 7%, I consider XOM to be in a position to deliver deep value for dividend investors.

Previous rating

I have had a bullish opinion on Exxon Mobil ever since the company announced the acquisition of Pioneer Resources which was a lever for the energy production firm to grow its Permian footprint. In my last work on the energy producer, I mentioned that Exxon Mobil was returning a lot of cash to shareholders:A Capital Return And Dividend Growth Play. The upstream segment continues to generate the majority of earnings for Exxon Mobil and with a positive outlook for the U.S. economy, I believe the energy producer has considerable long term potential to grow its earnings, its free cash flow and its dividend.

Upstream focus and strong free cash flow profile

Exxon Mobil is a diversified energy producer with oil and natural gas operations around the world. While the company owns different revenue streams related to its businesses in specialty, chemical and energy products, the actual oil and gas extraction business remains Exxon Mobil’s bread and butter.

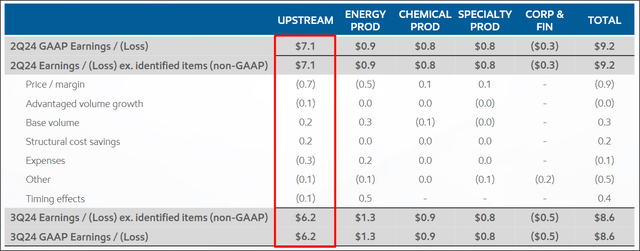

In the September quarter, the upstream segment generated $6.2B in earnings for Exxon Mobil which calculates to an approximately 72% earnings share. Exxon Mobil’s earnings declined quarter-over-quarter, however, due to lower average price for petroleum products: the average price in the September quarter was $72.94 per barrel, showing a decline rate of 9% year-over-year.

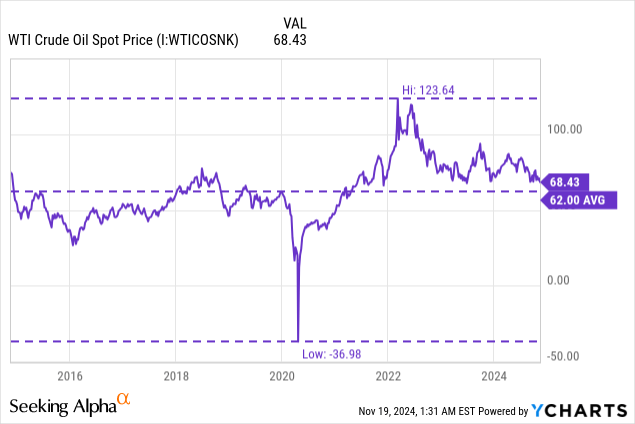

Petroleum prices have corrected lately, but are still high in a historical context. WTI petroleum is still trading above the 10-year average price of $62 per barrel which makes upstream-focused energy investments like Exxon Mobil very much attractive from a pricing and earnings point of view.

While earnings fell due to lower average petroleum prices, Exxon Mobil is seeing strong growth in its production base which is due to growth in the Permian as well as due to the acquisition of Pioneer Resources… which closed in the second-quarter. Exxon Mobil acquired Pioneer in an all-stock transaction, valued at $59.5B, last year with the express purpose to boost its liquids production in the Permian. The acquisition doubled the firm’s production volume in the Permian to 1.3M MOEBD and Exxon Mobil has laid out its plan to grow this production to 2 MOEBD by FY 2027. In Q3’24, Exxon Mobil’s Permian production exceeded 1.4M MOEBD for the first time ever.

In the September quarter, Exxon Mobil had a total oil-equivalent production of 4,582 koebd, showing 24% year-over-year growth. This growth comes mainly from the company’s liquids base, which saw 33% year-over-year growth in the third-quarter.

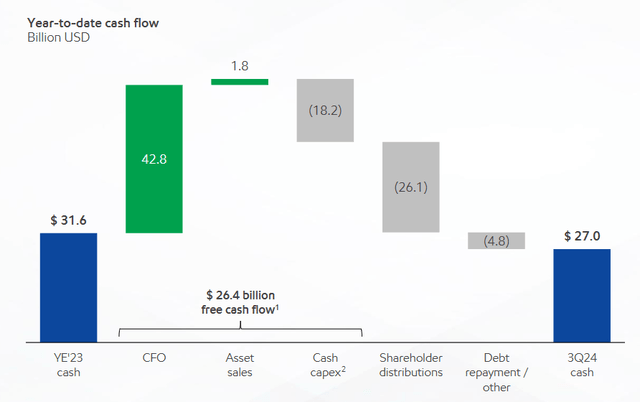

What ultimately underpins Exxon Mobil’s value for investors is the company’s significant free cash flow strength. In the third-quarter, Exxon Mobil earned $11.3B in free cash flow, compared to just $5.0B in the previous quarter (+ 126% Q/Q). Compared to the year-earlier period, however, Exxon Mobil’s free cash flow dipped 3.4%, mainly due to lower average petroleum prices. Free cash flow is obviously an important metric for any company, but especially for Exxon Mobil because the energy firm is returning a lot of money to shareholders via dividends and stock buybacks.

|

Exxon Mobil |

FY 2024 |

FY 2023 |

||||

|

$B |

Quarter 3 |

Quarter 2 |

Quarter 1 |

Quarter 4 |

Quarter 3 |

Y/Y Growth |

|

Cash Flow from Operating Activities |

$17.6 |

$10.6 |

$14.7 |

$13.7 |

$16.0 |

10.0% |

|

Proceeds from Asset Sales |

$0.1 |

$0.9 |

$0.7 |

$1.0 |

$0.9 |

-88.9% |

|

Cash Flow from Operations and Asset Sales |

$17.7 |

$11.5 |

$15.4 |

$14.7 |

$16.9 |

4.7% |

|

PP&E Adds / Investments & Advances |

($6.4) |

($6.5) |

($5.3) |

($6.7) |

($5.2) |

23.1% |

|

Free Cash Flow |

$11.3 |

$5.0 |

$10.1 |

$8.0 |

$11.7 |

-3.4% |

(Source: Author)

In the first nine months of the year Exxon Mobil generated a massive $26.4B in free cash flow of which it returned 99%, in the form of dividends and stock buybacks. Exxon Mobil increased its stock buyback program to $50B at the end of FY 2022, due to a sharp upside move in petroleum prices related to Russia’s invasion of Ukraine. The energy producer also plans to repurchase a total of $19B this year. I expect Exxon Mobil to announce a new stock buyback authorization either in the fourth-quarter of FY 2024 or in the first quarter of FY 2025.

OPEC+ has also proven to be highly supportive of petroleum prices, as the organization agreed to cut production and extend those supply cuts repeatedly. Continued price support from OPEC+ members, mainly Russia and Saudi Arabia, would go a long way in providing additional support for Exxon Mobil’s free cash flows.

Exxon Mobil: a bargain trading at a 7% earnings yield

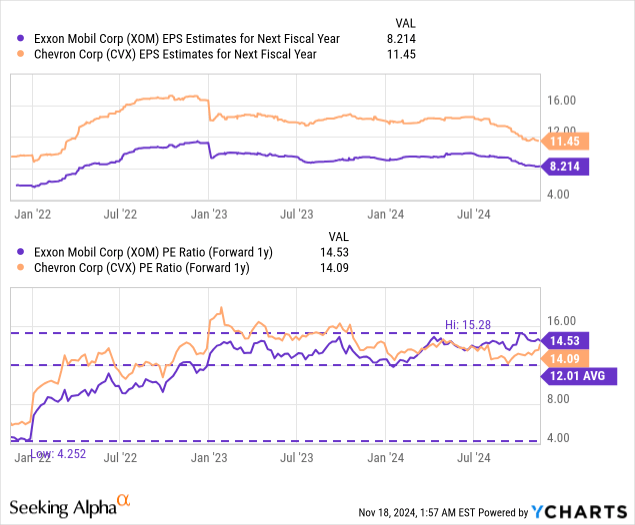

Exxon Mobil is growing, seeing enormous cash inflows due to high petroleum prices, and the company is returning a ton of its cash to shareholders. Exxon Mobil’s closing price on Friday was $119.31 which implies a forward (FY 2025) earnings multiplier of 14.5X… implying an earnings yield of 6.9%. Exxon Mobil has traded, historically speaking, at a lower earnings multiplier: in the last three years, the average forward P/E ratio has been 12.0X.

Chevron, which I also like because of its capital return potential, is priced at a price-to-earnings ratio of 14.1X, implying an earnings yield of 7.1%. Both companies are seeing elevated free cash flows and are diversified in their businesses. In my opinion, Exxon Mobil is the best large-cap, diversified U.S. energy firm that investors can buy simply because the company generates the largest amount of free cash flow. Exxon Mobil also has a record of growing its dividend over a long period of time, which makes shares attractive especially for dividend investors.

For those reasons, I believe Exxon Mobil could trade at a forward price-to-earnings ratio of 15.0X which, at a current FY 2025 consensus estimate of $8.21 per-share, calculates to a potential fair value in the neighborhood of $123 per-share. However, the real reason why investors want to buy Exxon Mobil relates to the company’s consistent dividend growth over the years, which I expect to continue for many years into the future.

Risks with Exxon Mobil

By far the biggest risk factor for Exxon Mobil is a potential decline in petroleum prices, which is what is single-handedly driving the company’s earnings and free cash flow growth. Upstream-related earnings represented approximately 72% of the company’s earnings mix in the September quarter, so a decline in average prices makes Exxon Mobil’s shares vulnerable to a correction. What would change my mind about Exxon Mobil is if the company saw a serious decline in its free cash flow or scaled back its stock buybacks.

Final thoughts

Exxon Mobil has seen a 19% increase in its share price year-to-date and yet, the energy producer is looking very well-positioned for growth: the energy company reported $11.3B in free cash flow in the third-quarter, which was the highest quarterly amount earned in the last four quarters. Exxon Mobil is also growing its production, including in the fast-growing Permian Basin. Shares of Exxon Mobil continue to trade at an attractive valuation multiplier, and a 7% earnings yield, and with the quarterly dividend set to rise going forward, I feel very comfortable owning Exxon Mobil.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM, CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.