Summary:

- Despite recent underperformance, I believe Exxon Mobil remains a strong long-term investment, with the current dip offering a good buying opportunity.

- ExxonMobil’s solid financials, effective debt management, and strategic initiatives in low-carbon businesses and acquisitions support a stable and promising growth trajectory.

- The company’s ventures in Guyana and the Permian Basin, along with its low-cost production, position it well for future profitability and growth.

- Exxon’s high stock multiples are offset by generous shareholder yield (dividend yield + buyback yield) of currently over 10%. XOM looks good on the dip.

- I am sticking to my optimistic view today.

Lanier

My Updated Thesis

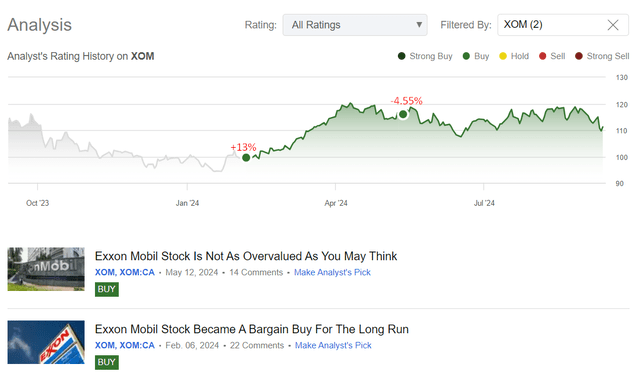

In early February of this year, I began covering Exxon Mobil (NYSE:XOM)(NEOE:XOM:CA) stock here on Seeking Alpha, and since then, the stock’s total return amounted to around 13%, outperforming the market’s return by almost 400 basis points. However, my last “Buy”-rated update from May 2024 aged not so well because since then, the stock has been consolidating and is currently showing -4.55% in total return compared to the S&P 500 (SP500) return of almost 7%.

Seeking Alpha, Oakoff’s coverage of XOM

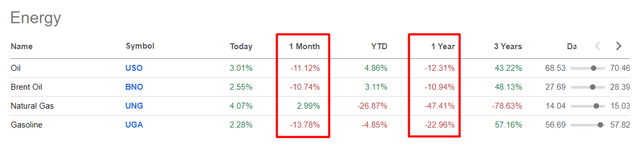

Despite this recent underperformance (likely due to overall commodities market weakness in recent months), I believe that Exxon Mobil remains a great long-term pick for investors interested in the energy industry in general. Moreover, I consider the slight dip in the stock price we saw since May 2024 as a good opportunity to initiate a long position (or add to an existing one).

My Reasoning

Let’s have a high-view look at XOM’s recent financials to better understand its overall condition.

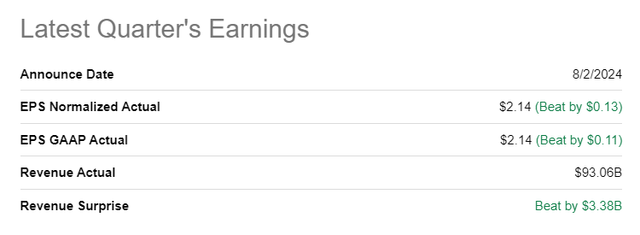

In Q2 2024, Exxon Mobil reported adjusted net profits of $9.240 billion (or $2.14/share), up from $7.880 billion (or $1.94/share) last year; the 10.3% YoY growth in diluted EPS was largely attributed to “higher realized commodity prices and a boost in production” following the acquisition of Pioneer Natural Resources (completed in May 2024). With revenue of slightly over $93 billion, it was more than enough to beat the consensus expectation for the quarter:

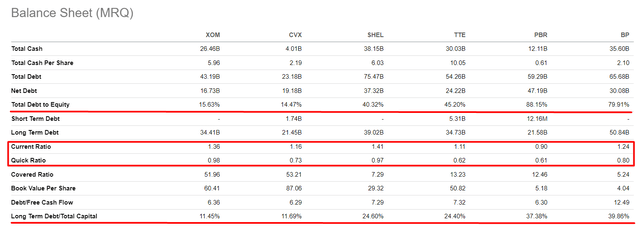

As far as I see it, Exxon Mobil’s liquidity position remains solid, with cash and cash equivalents amounting to $26.46 billion at the end of Q2 (although this is a decrease from $29.53 billion a year earlier). The cash flow from operating activity was roughly $25.2 billion for 1H 2024 – that’s not only $500 million less (or ~2%) than in 1H 2023, which looks good considering the recent price swings in the O&G market.

Seeking Alpha data, Oakoff’s notes

Exxon kept effectively managing its debt, as evidenced by a reduction in the debt/market cap ratio to 13.5% from 16.7%. Debt-to-equity remains way lower compared to some peers, while liquidity ratios such as current and quick ones are exceeding the median significantly, according to Seeking Alpha Premium data:

Seeking Alpha data, Oakoff’s notes

I believe Exxon Mobil’s effective debt management ensures a strong balance sheet that supports its strategic initiatives. Exxon Mobil’s expansion into low-carbon businesses and the strategic synergies realized (and planned) from recent acquisitions should keep the balance sheet stable, even if the current slump in crude oil prices continues for some time.

At the latest Barclays 38th Annual CEO Energy-Power Conference, the CEO noted that the firm is currently concentrating on carbon capture and storage (CCS), hydrogen, lithium extraction, and renewable fuels. Notably, the Baytown hydrogen project in Texas is set to become the world’s largest low-carbon hydrogen production facility by 2029. So the management recognizes a global trend towards decarbonization and is working to make XOM’s business more resilient and less dependent on crude oil in the coming years. Exxon’s efforts on this front not only enhance the company’s revenue potential but also align with its long-term vision of sustainable growth and innovation in the energy sector, in my view.

However, it would be foolhardy to write off oil – it’s clear to me that “black gold” will not lose its influence on the global economy for many years to come. According to Goldman Sachs, oil demand will not peak until 2034, meaning that despite the “massive adoption of electric vehicles” and the “green energy transition” that is everywhere (at least that’s what I hear most of the time), real experts do not see a bleak outlook for the oil and gas industry for at least a decade.

Goldman Sachs Research forecasts, in its base case, oil demand to peak at 110 million barrels a day by 2034. In a scenario with slower EV adoption, oil demand could keep increasing towards 113 million barrels a day by 2040. [emphasis added]

Keeping this bullish outlook of oil demand in mind, I think we shouldn’t ignore XOM’s ventures in Guyana and the Permian Basin.

In Guyana, the serendipitous discovery of the Liza oil field in 2015 has transformed the company significantly, indeed. Despite initial skepticism due to the region’s history of dry wells, Exxon Mobil’s decision to proceed has paid off over the past few years: The Liza field is now considered the world’s largest oil discovery in a generation, with Exxon Mobil controlling a block containing 11 billion barrels of recoverable oil, valued at nearly $1 trillion at current prices, SA fellow analyst Fluidsdoc cited Kevin Crowley’s article on Bloomberg (dated August 2019). I can’t help but recommend both articles – please have a look for a better understanding.

So this field discovery has positioned Guyana to become a major oil producer, potentially surpassing Venezuela by 2027. Now Exxon Mobil’s operations in Guyana are expanding rapidly, with current production at ~650,000 barrels of oil per day (BOPD) and expected to reach ~750,000 BOPD by 2025, growing at an annual rate of 20%, which is a lot. The company’s low-cost production, with supply costs under $35 per barrel, should theoretically ensure profitability even if the current WTI/Brent prices keep fluctuating further.

Speaking of the Permian Basin, Exxon Mobil is capitalizing there on its new merger with Pioneer, projecting significant cost savings and production growth. The merger is expected to yield ~$2 billion in annual cost savings through improved technology and logistics. As we know, Exxon Mobil’s Permian production is projected to reach ~1.2 million barrels of oil equivalent per day (BOEPD) this year, with plans to increase this to ~2.0 million BOEPD by 2027. The company’s extensive acreage and efficient extraction techniques position it as a low-cost producer, with supply costs also at $35 per barrel.

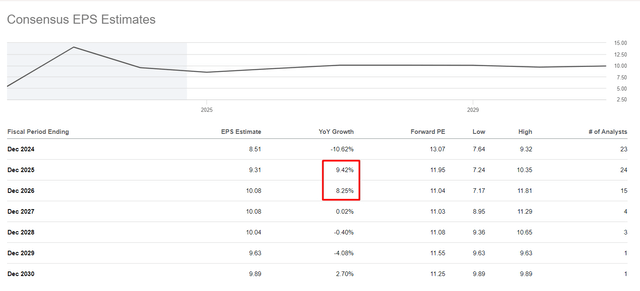

Given those low-cost assets, Exxon’s growth trajectory still looks promising, with earnings projected to grow at a high-single rate for 2025 and 2026 at least, according to Seeking Alpha Premium data:

Seeking Alpha Premium data, Oakoff’s notes

I suspect that these forecasts are quite pessimistic, as we have seen massive downward earnings revisions in the last quarter or so, apparently reflecting the negative sentiment in oil prices in general.

Seeking Alpha Premium data, Oakoff’s notes

I like Exxon’s capital allocation strategy, which focuses on maintaining dividends (currently 3.46% for the full year 2024), executing strategic buybacks (plans to repurchase $35 billion worth of shares through 2024), and investing in promising projects – all that provides a kind of comfortable conditions for long-term investors waiting for the sentiment in the oil industry to turn back to growth mode.

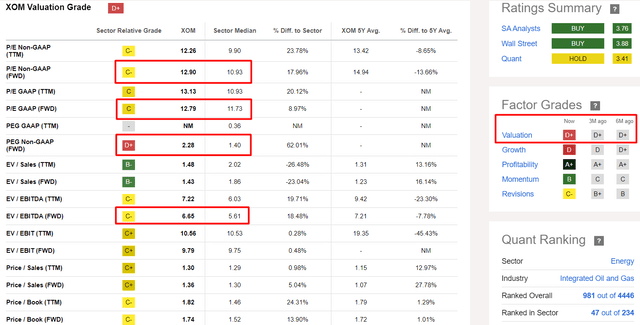

Now let me update my valuation assessment for XOM. I assume you have often heard that Exxon is an overvalued (or at best fairly valued) large-cap O&G stock with little upside potential in the coming months/years. I think this narrative was largely shaped by many research papers from the sell side. Also, according to Seeking Alpha Quant rating, XOM’s Valuation grade is also looking “ugly” with no improvement over the past 6 months.

Seeking Alpha Premium data, Oakoff’s notes

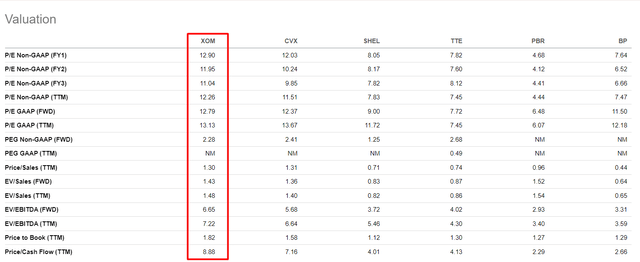

However, I think the current premium on XOM’s valuation is more than justified given the size of the company and the quality of the assets under its belt.

XOM is way higher than most of its global peers in terms of valuation multiples, but taking into account the buyback amount of $35 for the year, the total shareholders’ yield is now between 10-11%, which makes the stock at least fairly valued at today’s price.

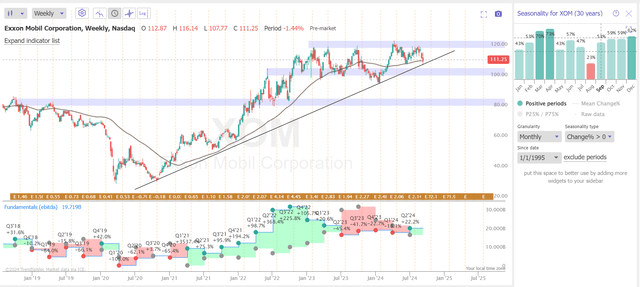

Speaking of technical analysis, it’s worth mentioning that XOM is still in a long-term bullish trend despite the correction of recent weeks. At the moment, the price is testing the 52-week SMA and consolidating – if this level of $105-109/sh holds, XOM will most likely go to the next supply zone at $120-124/sh. If XOM falls below $105/sh, all other things being equal, the stock will become quite cheap (unless financials continue to decline).

TrendSpider, XOM stock (weekly), Oakoff’s notes

All in all, I recommend holding XOM if you already have a position, and maybe even buying more if the current dip gets wider.

Risks To Consider

As was noted in my previous articles on XOM already, Exxon has some risks that could prevent higher growth and which can’t be explained by my today’s reasoning.

The most obvious risk is the high valuation. When I explain why I think XOM is fairly valued based on my assumption of sustained premium to its valuation (and potential discrepancy between its true forward growth and Wall Street’s growth projections), some skeptics can rightly point to a comparable valuation and claim that XOM is by far the most expensive large-cap O&G company in its peer group.

Seeking Alpha, Oakoff’s notes added

Also important to mention: Exxon, akin to its peers, operates in a commodity industry where product prices are beyond its control. The company operates in countries characterized by corruption and political instability, but its widespread presence mitigates the risks associated with individual countries. In addition, Exxon faces transaction risks related to its acquisitions, particularly Pioneer Natural – we can’t be certain now that Exxon will be able to successfully integrate Pioneer’s assets into its structure and that this acquisition will not result in increased costs and a disconnect from the company’s strategic plans for earnings growth.

Your Takeaway

Despite the obvious risks and the recent weakness in commodities, I’ve decided not to downgrade XOM today. I continue to believe that the company is worth buying in the long term, as I think many market participants are too quick to underestimate the importance of oil in the coming years. The company’s side projects also give reason for serenity – the attempts to diversify the business more broadly and the desire to reach profitability quickly on new projects is a sound corporate move. I’m also not afraid of high stock multiples, as they are offset by XOM’s shareholder yield (dividend yield + buyback yield) of currently over 10%. For this reason, I am sticking to my optimistic view today.

Good luck with your investments!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.