Summary:

- XOM’s RSI is at 46.85, indicating neutral momentum, while the VPT suggests stable accumulation and moderate buying interest.

- XOM is trading below its historical P/E and price-to-free-cash-flow metrics, presenting an attractive entry point.

- ExxonMobil generated $25.2 billion operational cash in H1 2024, supporting a $20 billion share repurchase plan through 2025.

- Q2 2024 earnings reached $9.2 billion, partly due to 15% production growth from the Pioneer acquisition.

- ExxonMobil plans to double sales of high-value products by 2027, enhancing earnings with high-margin performance products.

StevenStarr73/iStock Editorial via Getty Images

Investment Thesis

Following Exxon Mobil’s (NYSE:XOM) strong bull run in 2022, we initiated a hold rating due to concerns about long-term revenue declines amidst the global transition toward low-carbon solutions. However, the company’s recent strategic pivot and performance justify reassessing its rating, signaling a change in its performance that potential investors should consider.

XOM is currently trading below its historical normalized P/E and price-to-free-cash-flow metrics. This undervaluation, relative to longer-term averages, presents an opportunity. Technically, XOM’s RSI indicates that the stock is neither overbought nor oversold, and the VPT shows stable accumulation, signaling moderate buying interest.

In addition, ExxonMobil’s Q2 2024 earnings surprise is also supported by strong cash flow and low leverage. Because of this, management believes in the financial stability of this company to the extent that it plans to repurchase $20 billion in shares through 2025. Carbon capture, hydrogen, and lithium are rare areas of emerging focus as ExxonMobil positions itself for growth in the energy transition. Consistent with these plans, ExxonMobil continues stabilizing its core oil and gas production operations through the Permian Basin and Pioneer acquisition expansions.

All in all, ExxonMobil offers a balanced opportunity for traditional energy production and sustainability-driven growth, supported by favorable fundamentals and technical indicators. Hence, XOM trades at an attractive entry point for investors looking to invest in a diversified energy leader with long-term prospects.

ExxonMobil Stock May Hit $135 By The Conclusion Of 2024

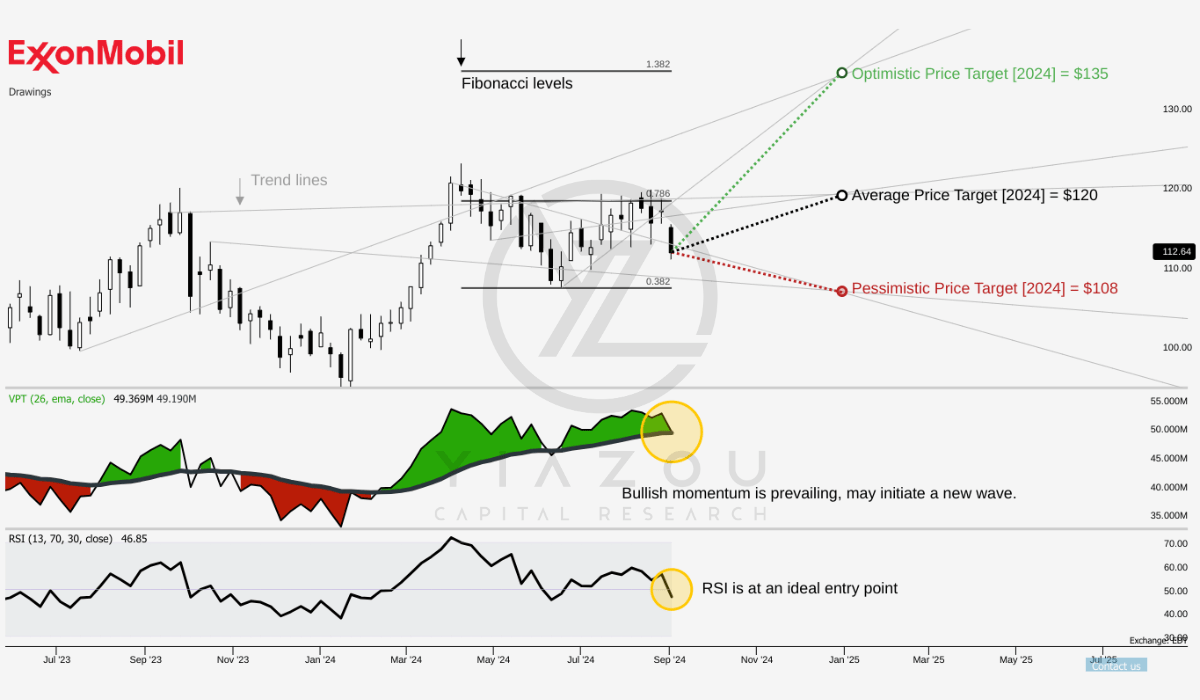

XOM is trading at a current price of $113 and is juxtaposed with three distinct price targets ($120, $135, and $108). Each reflects different Fibonacci retracement levels over trendlines. The average price target of $120 aligns with the 0.786 Fibonacci retracement level, indicating a significant level of resistance or support that the price will likely encounter.

The optimistic target of $135 aligns with the 1.382 Fibonacci extension level, based on a potential for substantial upward movement beyond typical retracement levels. Conversely, the pessimistic target of $108 is based on the 0.382 Fibonacci retracement level, which suggests a possible decline that might test lower support levels if bearish conditions prevail.

Moreover, the RSI is currently at 46.85, indicating that the stock is neither overbought nor oversold. The absence of bullish and bearish divergences, coupled with a downward RSI trend, suggests that the stock might experience downward pressure followed by consolidation. Despite the RSI being near a key threshold of 50, indicating a neutral market sentiment, the downward trend implies potential challenges in the near term.

Further, the Volume Price Trend (VPT) line is currently at 49.37 million, with a moving average of 49.19 million. The line is trending down but is situated just above the moving average. This suggests a stable accumulation phase with moderate buying interest. Hence, the long setup signal of a bottom touchdown indicates that the current VPT level supports potential upward movement.

Yiazou (trendspider.com)

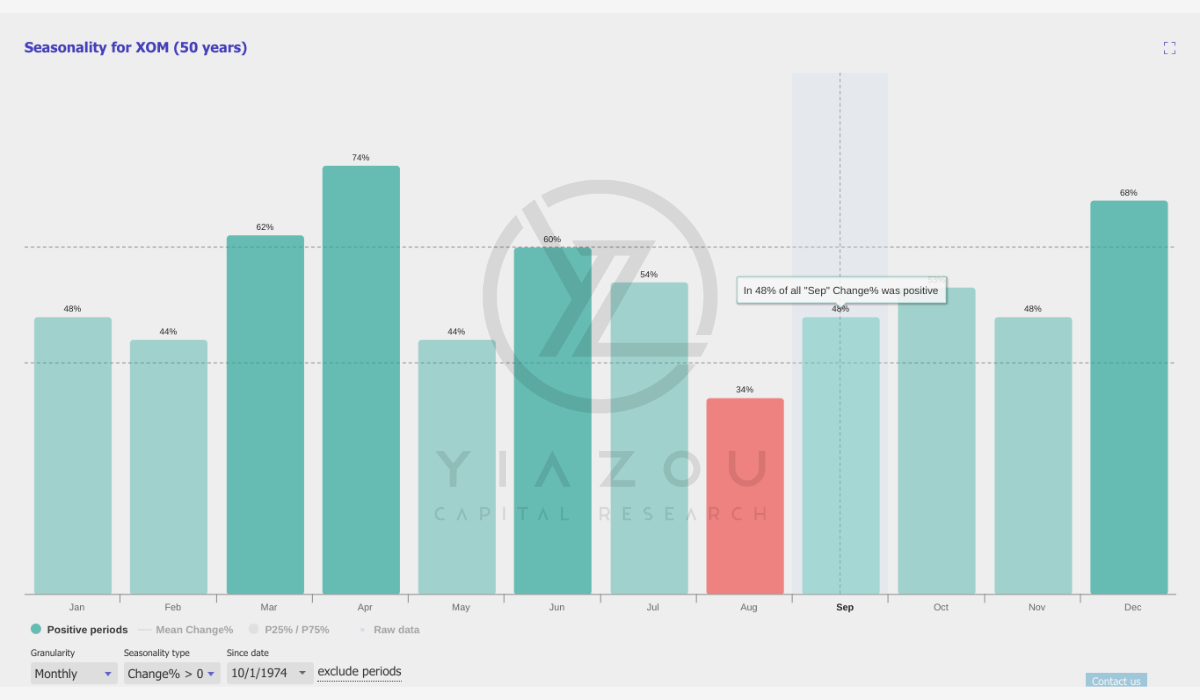

Given the current month of September and historical data showing a 48% chance of positive returns based on 50 years of seasonality, there is a slightly favorable environment for investment for the rest of the year. From September to December, XOM shows improving performance. On the contrary, October and December are more robust, with a higher likelihood of positive returns. Historically, the stock gains momentum towards the end of the year, offering a favorable entry for investors.

Yiazou (trendspider.com)

ExxonMobil’s Pioneer Merger Fuels Record Q2 Earnings and Production Surge

ExxonMobil’s Q2 2024 earnings hit $9.2 billion, reflecting the company’s asset portfolio’s diversified strength and improved earnings power after acquiring Pioneer. Based on operational edge and strategic investments, the earnings mark the second-highest 2Q result ExxonMobil has seen in the past decade. A significant contribution to these earnings came from the Pioneer merger, which closed five months faster than similar transactions of its kind. This merger brought an additional $0.5 billion in earnings in just the first two months post-closing, indicating a progressive integration that yielded a synergistic boost to the upstream portfolio.

For instance, this merger, combined with record production from Guyana and the heritage Permian, led to a solid 15% growth in total net production. This translates to an increase of 574K oil-equivalent barrels per day (boe/d) from Q1 2024. The capability to ramp up production at such a pace may solidify ExxonMobil’s operational agility (on production growth) by securing strategic assets that deliver high production at low costs.

In detail, the acquisition is one of the most productive moves in ExxonMobil’s upstream portfolio. This deal was completed in a short period of six months (against an industry norm of +11 months). As a result, the Pioneer acquisition has created the largest high-return unconventional resource development potential globally, which may continue to bolster ExxonMobil’s production capabilities significantly.

In the quarter immediately following the acquisition, ExxonMobil set record production levels from its advantaged assets in Guyana and the Permian Basin. For instance, Permian production surged to 1.2 million barrels per day (bpd), pointing to the Pioneer merger’s strategic benefits. The integration of Pioneer is already exceeding expectations, and ExxonMobil expects to deliver even more synergies than initially forecasted over the long term.

In addition to the Pioneer acquisition, ExxonMobil achieved record production from its Guyana operations. Production in Guyana reached 633K bpd in Q2 2024 against zero production just five years ago in 2019. This rapid growth in Guyana has contributed to a 9% year-to-date (YTD) increase in overall net production, equivalent to an additional 352K oil-equivalent barrels per day.

ExxonMobil’s focus on these advantaged assets ensures that more than 60% of its production by 2027 will come from such high-return ventures. This may boost the overall profitability of ExxonMobil’s upstream operations. For instance, ExxonMobil’s shift toward liquids, 70% of its upstream portfolio, particularly oil, is a strategic move given that 80% of its LNG sales are tied to long-term contracts indexed to crude prices. This liquid-centric portfolio strategy has directly led to ExxonMobil doubling its unit earnings per oil-equivalent barrel from $5 in 2019 to $10 in 2024.

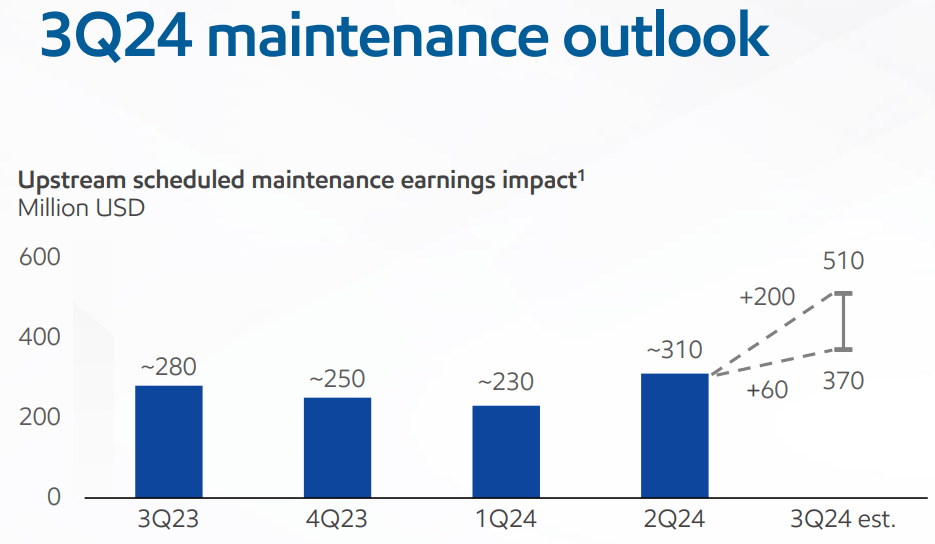

For Q3 2024, ExxonMobil projects a reduction of gross production volumes by 80K barrels per day (kbd) in Guyana due to scheduled maintenance work on the Liza Phase 1 and Phase 2 Floating Production Storage and Offloading (FPSO) units. This maintenance will enable the tie-ins for the Gas-to-Energy project, which may boost the top-line and production efficiency.

However, the upstream scheduled maintenance may cost ExxonMobil $60-$200 million out of earnings in Q3. By 2024, Exxon Mobil expects total production (eight months of contribution from Pioneer) to reach around 4.3 million oil-equivalent barrels per day (Moebd). Permian Basin production alone may account for 1.2 Moebd, indicating Permian operations’ (and Pioneer’s) vital proportion in Exxon Mobil’s overall production capacity.

24Q2 Earnings Presentation

ExxonMobil’s Cash Flow Power Fuels $20B Repurchase Plan and Long-Term Growth

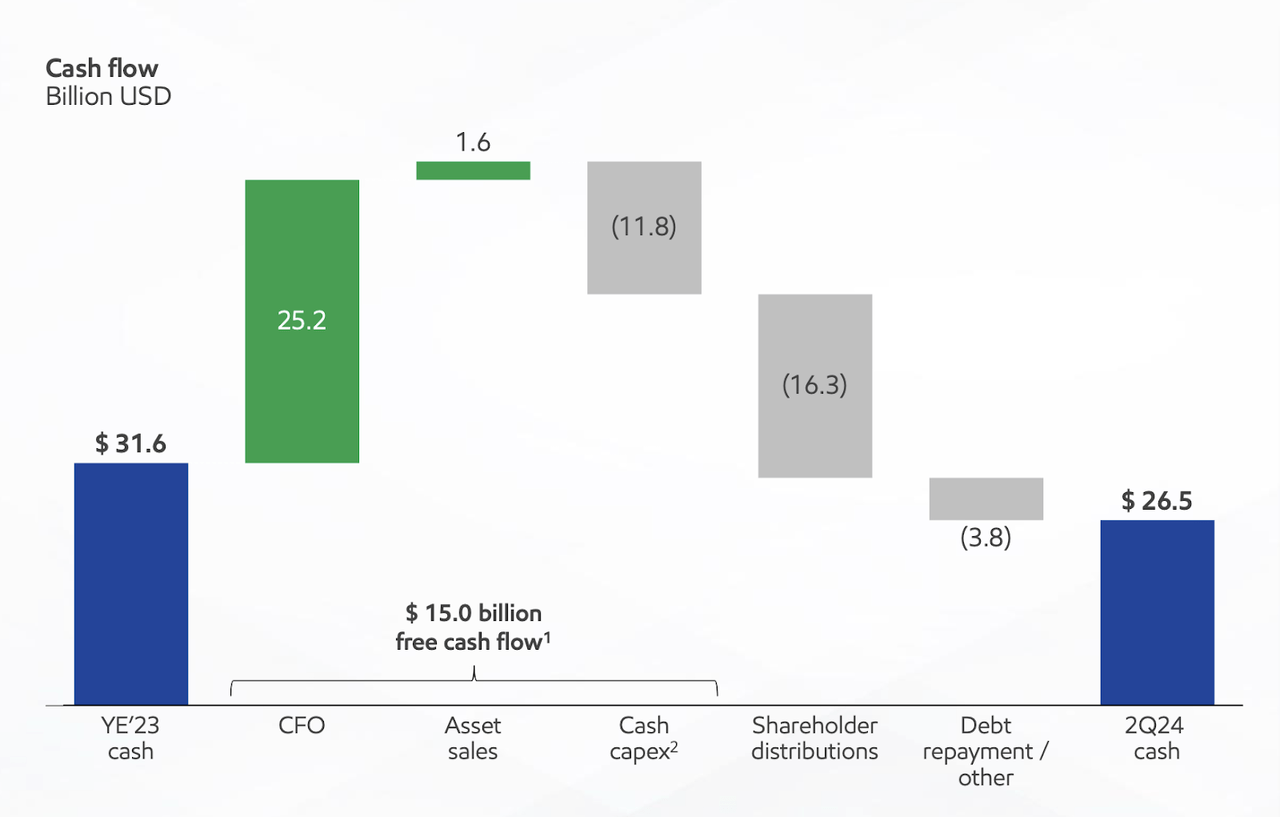

ExxonMobil’s capability to derive strong cash flow is one of the critical marks of its financial stability and market value growth potential. Moreover, in Q2, ExxonMobil distributed $9.5 billion, which included $4.3 billion in dividends and $5.2 billion in stock repurchases.

In H1 2024, the company generated operational cash of $25.2 billion with free cash flow (FCF) of $15 billion. Excluding working capital movements, the increase led to $27.8 billion in cash from operations and $17.6 billion in FCF. This is based on high production levels from its advantaged assets, strong operations, and cost control measures. Year-to-date shareholder distributions are $16.3 billion, with $8.1 billion in dividends and $8.3 billion in share repurchases.

Looking forward, ExxonMobil plans to boost its annual repurchases to $20 billion through 2025, boosting the stock price based on the company’s edge in cash generation capabilities and market demand outlook. Further, the company’s strong balance sheet holds a net-debt-to-capital ratio of just 6%, which suggests that ExxonMobil may continue to reward shareholders.

Structural cost savings also represent a progressive bottom-line fundamental of ExxonMobil. With $10.7 billion in cumulative savings since 2019 and an additional $1 billion in 2024, ExxonMobil has a long-term operational edge. The company is on pace to capture an additional $5 billion in savings by 2027 as it works to better underpin improved profitability and hold on to competitive margins.

24Q2 Earnings Presentation

ExxonMobil’s investment strategy targeted expanding its portfolio of high-value products. Sales of high-return performance products increased sequentially in Q2 2024 by 5% to a record, delivering earnings growth. This growth in high-value products includes performance chemicals and performance lubricants. This progress is enhancing ExxonMobil’s earnings power and diversifying its revenue streams.

Additionally, the company is making significant strides in developing new business ventures, such as Proxxima and carbon materials. ExxonMobil is targeting a total addressable market of $30 billion by 2030 for Proxxima. This is a high-margin business with anticipated returns exceeding 15%. Similarly, its carbon materials initiative may tap into segments with several thousand dollars per ton margins. These ventures align with ExxonMobil’s strategy to diversify earnings in emerging markets.

By 2027, ExxonMobil may double its sales of high-value products to over 20 million tons per year from 10 million tons in 2023. These strategic investments will boost profitability but make the dividends more sustainable through high-margin product top-line growth, a 49% average payout ratio, and a declining share count.

Takeaway

ExxonMobil’s strong cash flow, $20 billion share repurchase plan, and investment in high-margin ventures like Proxxima and carbon materials signal long-term growth potential. With record earnings of $9.2 billion in Q2 2024 and a diversified portfolio, ExxonMobil is well-positioned for both traditional and sustainable energy market expansions, enhancing shareholder returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in XOM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.