Summary:

- Boeing and Airbus announced big airplane deals during the Farnborough International Airshow.

- Boeing announced 118 orders and commitments valued at $17.1 billion, while Airbus covered 234 airplanes valued at $18.8 billion.

- Airbus emerged as the winner of the airshow with 164 firm and tentative deals, compared to Boeing’s 76 orders.

Yatrik Sheth/iStock Editorial via Getty Images

The Farnborough International Airshow took place between 22nd and the 26th of July, with the last day of the airshow being open to the public whereas the first four days of the airshow are for trade professionals. The airshow is used by companies in the aerospace and defense industries to present and discuss new technologies, trends and products. The airshow is also used by original equipment manufacturers to announce new airplane orders. In this report, I will be discussing the order announcements, which are not just limited to Boeing and Airbus, but given that these are the two biggest airplane OEMs they will be dominant in the discussion.

How We Track And Categorize Airplane Orders To Determine A Winner

While each order and each announcement are important all by itself, we tend to see investors being extremely interested in knowing who tallied more orders during the show. That is not just a task of adding up all totals. We already need to keep in mind that a single aisle airplane costs less than a wide body airplane, to the tune that one wide body airplane order equals around three single aisle orders. So, while we look at ordered units, we will most definitely keep the value of the orders leading. Moreover, that value is not the list price value but represents the actual average base price of the airplane. That is important to keep in mind, since standard discounts are around 50% of the list price.

The next thing we keep in mind is that some orders are firm, which directly are added to the backlog and some orders are tentative, meaning that they are pending finalization and provide an insight in the order pipeline. Both figures are deemed important as they both provide a numeric answer to a different question. What we do exclude from our assessment is customer reveals. The reason is that these do not add value to the order book. These are announcements where the customer is identified. We also do not count options in our final tally as the timeframe of firming these options is unknown and options do not always get firmed. So, it is nice to look at, but the optional nature doesn’t drive me to add these to the final tallies.

Boeing Signs Tentative Boeing 777X and Boeing 787 Orders

The Boeing Company

For Boeing, I already noted that the company would have some announcements, but it would be a very measured and humble airshow for the US jet maker with an emphasis on safety. That is exactly what happened as the manufacturer did not send commercial airplanes for static display or flight demonstrations, focusing its efforts on quality and safety. I can understand that the company made this decision, even more so with the Boeing 777X having started the next phase of its flight test campaign. In total, Boeing announced 118 orders and commitments valued at $17.1 billion.

The first thing we do is removing the following customer reveals:

- Qatar Airways was revealed as the customer for an order placed for 20 Boeing 777-9 airplanes earlier this year.

This already brings the orders and announcements to 98 airplanes, valued at $13.5 billion. The next step is the removal of the portion of tentative and firm deals that are under option:

- Luxair has two Boeing 737 MAX 10 options under firm contract.

- Korean Air has 10 Boeing 787- 10 options under tentative contract.

- Japan Airlines (OTCPK:JAPSY) has 10 Boeing 787-9 options under tentative contract.

That brings the tally to 76 orders and commitments valued at $10.2 billion. There were 54 orders under tentative agreement with a value of $9 billion:

- Japan Airlines tentatively signed for 10 Boeing 787-9s.

- Korean Air tentatively signed for 20 Boeing 777-9s and 20 Boeing 787-10s

- National Airlines tentatively signed for 4 Boeing 777Fs.

That leaves 22 orders under firm contract with a value of $1.2 billion:

- Luxair ordered two Boeing 737 MAX 10 airplanes.

- Macquarie AirFinance ordered 20 Boeing 737 MAX 8 airplanes.

In comparison, the Paris Airshow last year brought Boeing 232 orders and commitments valued $15.9 billion driven by a big order from Air India and the previous edition of the Farnborough International Airshow brought 179 orders and commitments valued $10.5 billion. For Boeing, it was definitely not a bad airshow, with announcements for firm and tentative deals valued at $13.5 billion. Looking back at the airshow, we see what stuck is the message the company brought on quality and safety but in between the company still logged some important orders and tentative deals that underscored confidence in it its key commercial airplane programs and that is the way the company most likely would have wanted it to be: Emphasize the focus on quality and safety while still scoring deals. It is also interesting to note that all firm deals were for the Boeing 737 MAX, and the tentative orders were for the wide body and freighter jets.

Airbus Books Wins In The Wide Body Airplane Arena As Well

Virgin Atlantic

Airbus had a somewhat simpler announcement flow, covering 234 airplanes valued at $18.8 billion. There were no customer reveals, which already makes processing the orders a bit easier. There were options for 15 A330neo airplanes and 55 A320neo airplanes valued $4.7 billion as part of a tentative order from Flynas.

The following 51 firming of commitments valued $6.1 billion were announced:

- Vietjet finalized an order for 20 Airbus A330-900s.

- Japan Airlines finalized an order for 11 Airbus A321neo airplanes and 20 Airbus A350-900s.

The following 13 firm orders were announced with a value of $1.1 billion:

- Berniq Airways ordered 6 Airbus A320neo airplanes.

- Virgin Atlantic ordered 7 Airbus A330-900s.

There were tentative agreements covering 100 airplanes valued at $6.8 billion:

- Drukair tentatively signed for 3 Airbus A320neo airplanes and two A321XLRs.

- Abra Group tentatively signed for five Airbus A350-900s.

- Flynas tentatively signed for 75 Airbus A320neos and 15 A330-900s.

Airbus had a strong flow of announcements. It was not spectacular by any means, but we saw the usual single aisle orders, and more importantly, we saw announcements for the Airbus A350 and A330neo. The latter is not a fast seller, so seeing announcements either firm or under tentative contract for this airplane is very welcome.

Other Jet Makers Had Little Order News During The Airshow

Embraer

Going into the airshow, I had high hopes that Embraer would see some solid order inflow for the Embraer E2 as the jet makers aim to increase production levels in a sustained and sustainable way. However, during the airshow, Embraer solid 9 C-390 military transport airplanes to The Netherlands and Austria as well as the Super Tucano light attack aircraft to Paraguay. Other than that, the company had no order announcements, leaving it without any order announcements for its commercial airplane portfolio.

Looking at turboprop orders, we saw Air Tahiti sign for four firm orders for the ATR 72-600 while de Havilland Canada signed orders for eleven Twin Otters. This brought the orders announcements for ATR, Embraer, and de Havilland Canada to 30 airplanes valued $1.6 billion.

Who Won Most Orders During The Farnborough International Airshow?

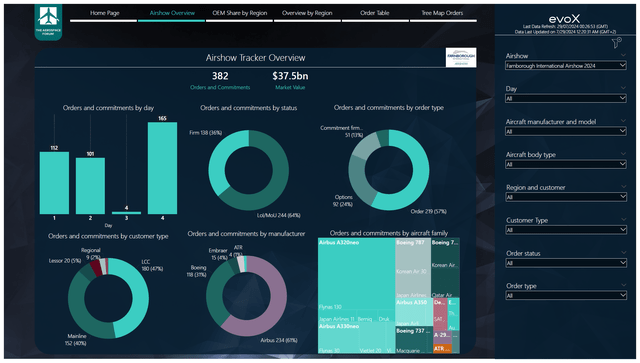

The Aerospace Forum

Our airshow order tracker showed 375 orders and commitments valued $37.5 billion at market value and 362 orders and commitments valued $33.8 billion at market value when removing customer reveals. We saw that the orders were concentrated in the first two days and Airbus ended the airshow with a big announcement, which is what we see the European jet maker doing often during airshows. In terms of units, Airbus signed 234 firm deals, tentative deals and options compared to 98 for Boeing after subtracting customer reveals covering 20 airplanes. In terms of value, it was $18.8 billion for Airbus and $13.5 billion for Boeing. What we are actually seeing is that the difference is made by Boeing missing one major announcement, which could have been an order from Riyadh Air or Turkish Airlines.

When removing options, we get the same 164 orders and commitments for Airbus and 76 orders and commitments for Boeing. Measured by value, our detailed order tables show $10.2 billion in orders and commitments for Boeing and $14.1 billion for its European rival Airbus. With that, Airbus can most definitely be seen as the winner of the airshow measured by value as well as airplanes on order.

Conclusion: Boeing and Airbus Both Had A Good Airshow

On any day normal day, Boeing and Airbus will be competing for the airshow order crown in the same way both manufactures compete in the annual order and delivery race. However, this year’s airshow was not about winning for Boeing. It was about showing a better focus on safety and quality to the world and in the process also bag some orders and commitments that underpin customer confidence in Boeing products, and I believe the company did quite well in that regard and that is a win by itself for the troubled jet maker.

It should also be noted that it is not easy for either jet maker to finalize deals. Both OEMs are not delivering as many airplanes as contracted due to continued supply chain challenges and with uncertainty creeping up in the delivery schedule of the committed order book, it also becomes more challenging to finalize new airplane orders. In the end, we saw that order lacked in the aircraft category of the E2 and the Airbus A220, but we saw very good order momentum for the Boeing 787, Boeing 777X, Airbus A350 and Airbus A330 and I believe that the stock of both OEMs remain long-term buys on solid and growing demand for airplanes. The big question remains how fast Airbus and Boeing can actually deliver. These two aerospace giants are not really battling each other for every order now, but they are battling a common headwind which is the aerospace supply chain health for commercial airplanes, which is less strong than initially anticipated. To book a combined total of nearly $25 billion worth of firm and tentative agreements is strong when we consider the challenging production environment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA, EADSF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.