Summary:

- McDonald’s has significant debt and negative shareholder equity, but maintains a current ratio above 1.0, indicating responsible capitalization for now.

- The company faces risks from high debt, competition, and inflation, which could impact profitability and credit rating.

- McDonald’s generates steady income with a growing dividend yield of 2.27%, but its P/E ratio is higher than the sector median.

- I rate McDonald’s a hold due to its high debt and current price levels, recommending caution and potential profit-taking if bought at a lower price.

M. Suhail

One of my earliest memories was going to McDonald’s. It was the early 80s, New Coke was just becoming a thing, and going to get fast food was a special treat we did probably more often than would be advisable. Still, it was a fond memory, and every once in a while, getting a few McNuggets is still something to do for nostalgia’s sake.

Today, I want to look at McDonald’s (NYSE:MCD), a global enterprise with an immediately recognizable brand, to see if the company is selling at a price which would make it appealing for investors. We’ll be looking at the company’s balance sheet, it’s growth prospect, and importantly its growing dividend payout, which may make it appealing as a flight-to-safety investment for those looking for steady income.

Consolidated Balance Sheet – The Good and the Bad

|

Cash and Equivalents |

$792 million |

|

Total Current Assets |

$4.2 billion |

|

Total Assets |

$53.8 billion |

|

Total Current Liabilities |

$3.9 billion |

|

Long-Term Debt |

$38.5 billion |

|

Total Shareholder Equity |

($4.8 billion) |

(source: most recent 10-Q from SEC)

McDonald’s is a huge fast food enterprise with a lot of real estate assets and a big presence on the credit market. Unfortunately, they’ve amassed quite a lot of debt right now, though I don’t necessarily think it is so much debt as to be unmanageable.

At present, McDonald’s has negative shareholder equity, which is not a good sign, though they do have a current ratio of slightly above 1.0, which suggests that they are at least responsibly capitalized so long as they don’t come upon some near-term issue which requires them to spend a lot more money that they simply don’t have.

The Risks – Debt and Credit Rating

McDonald’s has a lot of risks, not the least of which is the $38.5 billion in long-term debt, which exceeds their practical assets as a company. They have a long history of generating profits, but if that starts to be thrown into doubt, the company may find its credit rate weakening, which could create a serious problem for their future profitability.

Also, important is the company’s relevance in an ever-changing fast food market. There are a lot of companies competing with McDonald’s for your fast food dollar, and historical reputation aside, there are many people who are looking for healthier, or at least more interesting, options.

McDonald’s is as much an investment in real estate as it is a franchised restaurant chain. The company owns a lot of locations, and its ability to manage that real estate portfolio will go a long way toward justifying its current price.

Inflation is also a challenge for McDonald’s. The company uses a lot of commodities with variable prices, and passing the costs on to their customers is always a risky proposition, one that might scare off valuable business.

Statement of Operations

|

2021 |

2022 |

2023 |

2024 (1H) |

|

|

Total Revenues |

$23 billion |

$23 billion |

$25.5 billion |

$12.6 billion |

|

Operating Income |

$10.3 billion |

$9.4 billion |

$11.6 billion |

$5.6 billion |

|

Net Income |

$7.5 billion |

$6.2 billion |

$8.5 billion |

$3.9 billion |

|

Diluted EPS |

$10.04 |

$8.33 |

$11.56 |

$5.46 |

|

dividend |

$5.25 |

$5.66 |

$6.23 |

$3.34 |

(source: most recent 10-K and 10-Q from SEC)

McDonald’s is not exactly a growth company, and in many cases has as many locations in any given market as it will support. The company does generate a nice amount of income on a slowly growing basis.

Estimates are that the current trend will more or less continue. The company is expected to generate revenue of $26.08 billion this year, and will earn $11.81 per share. That’s a P/E ratio at present prices of 24.87, which is a bit higher than the sector median. Next year, the company will generate $27.39 billion in revenue and earnings per share of $12.74, which is still higher than the sector median’s forward P/E.

If there’s one thing to like about the company, it’s that the dividend paid per share has been steadily growing in recent years. At present, they’re up to 2.27% yield, and they have earnings which should support further growth in years to come. That’s roughly in line with the sector median in this regard, so it’s good news for those looking for growing income.

Conclusion

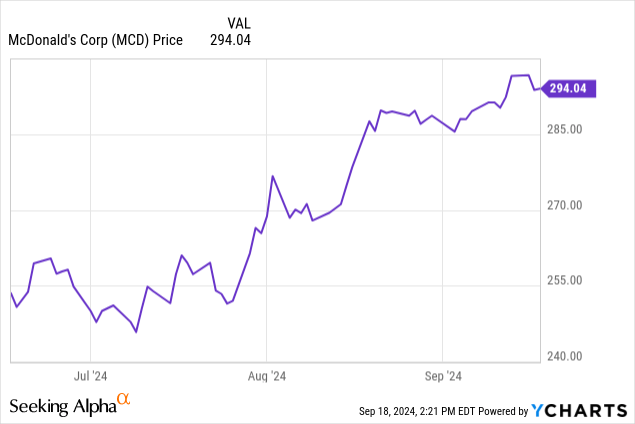

McDonald’s is an excellent company with a strong market presence. That said, I don’t love the company at these levels. The price has gone up more than is seemingly justified, and it’s just not worth gambling on a company with so much debt to have a 2.2% dividend yield.

I’m going to be rating the company a hold at present, with a bias toward maybe taking some shares off the table if you got in at the right price. There is little to justify a level much beyond where the stock is trading right now, and plenty that could yet go wrong with the company in the future.

For investors, I would keep a close eye on the company’s prices, and how the market is accepting them. Higher prices put them in direct competition with better quality foods, and people aren’t necessarily going to show enormous brand loyalty if they have to pay too much to get lunch.

Debt is also a concern, and I tend to shy away from companies that are so heavily leveraged toward their current operations. Paying down the debt would be a good sign, and anything that increases the debt more is something to be seriously concerned about.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.