Summary:

- There’s a reason why I never owned Disney’s stock in the past.

- While I’ve considered buying the Mickey Mouse Kingdom, Disney’s high valuation has always turned me off.

- Until now, that is. Disney trades at only 17 times forward EPS estimates, and the stock is around a 10-year low now.

- Also, Disney’s streaming segment could perform better than anticipated, leading to better-than-expected revenue growth and improved profitability in the coming years.

- Disney’s stock has a high probability of appreciating considerably as we move forward.

Wirestock

I’ve never been a giant Walt Disney Company (NYSE:DIS) fan or owned Disney’s stock. Well, until now, that is. Recently, I began warming up to Disney for several reasons. Disney’s streaming business has excellent potential and could become increasingly profitable in future years. We’ve also witnessed an excellent rebound in Disney’s theme park business, and future progress is likely. Another significant factor is that the company’s share price decreased substantially during the bear market period and is yet to make a noticeable rise.

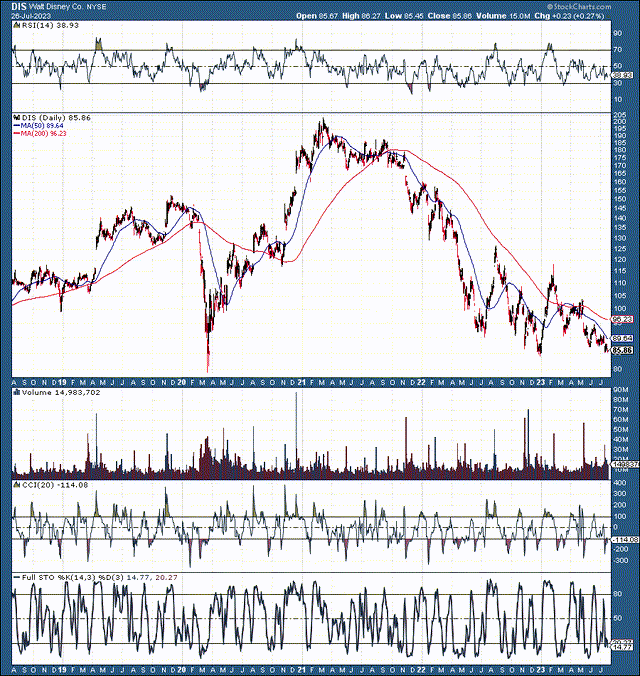

Disney: 5-Year Chart

DIS (StockCharts.com )

Disney’s stock is still hovering around a multi-year low, about 58% below its all-time high achieved in 2021. Moreover, Disney’s stock appears neglected here, and the valuation is highly compelling. Disney’s stock trades at only 17 times next year’s consensus EPS estimates, and Disney’s EPS growth should continue to expand. Furthermore, Disney could report higher-than-anticipated growth and better-than-expected profitability in future quarters. Thus, Disney’s stock has become dirt cheap (14 times forward higher-end EPS estimates) and could appreciate considerably as Disney recovers in the coming years.

Technically Speaking – Disney’s stock trades around a crucial support level ($80-$85). We’ve seen Disney’s stock rebound off this support point around the 2020 Coronavirus-induced panic and more recently around the start of this year. If we look further back, Disney’s stock has remained above $80 since 2013. Disney’s stock could stage a robust long-term comeback from this critical level, and the downside is likely minimal from here.

Why Disney’s Profitability Should Increase Soon

Unfortunately for many shareholders, Disney’s costs surged in recent years. As a result, Disney’s net income for the TTM period is about 33% lower than its 2013’s results ($4.1B vs. $6.1B), despite revenues nearly doubling since then ($45-$87B). Some of the lost profitability is attributable to the challenging post-COVID-19 atmosphere surrounding Disney’s theme park business. Nevertheless, most of the company’s increased costs are due to Disney’s expansion into streaming.

Disney’s operating expenses have ballooned recently, from just $10.6B in 2013 to approximately $21.5B last year. Moreover, Disney’s operating costs were stable until spiking in 2019, coinciding with Disney’s expansion into streaming. However, it’s understandable that Disney’s profitability decreased temporarily. Moreover, Disney’s expenses became exacerbated due to the transitory economic slowdown and the higher-than-expected inflation in recent quarters. Nevertheless, Disney may be sitting on a gold mine, and it could be time to cash in.

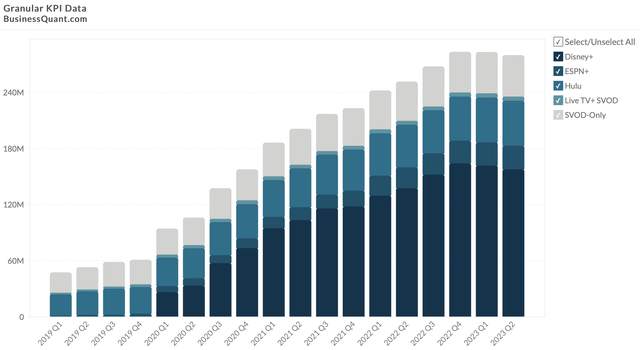

Disney Streaming – 280 Million Paid Subscribers

Disney streaming (BusinessQuant.com )

Disney has amassed a formidable streaming business in recent years. In addition to nearly 158 million Disney Plus subscribers, Disney has Hulu with 48 million subscribers, ESPN+ with 25 million, and another 48 million subscribers with SVOD. Disney closed out Q2 with about 280 million paid subscribers, and it can turn the profitability from here.

Also, seeing a consolidation phase in subscriber growth here is understandable. The subscriber count expanded rapidly recently, and it’s expected that Disney’s subscribers could stagnate or move sideways temporarily, especially considering the economy is going through a transitory slowdown.

Furthermore, despite the temporary slowdown, Disney’s total subscriber count increased by nearly 12% YoY. Therefore, Disney’s subscriber stats could return to growth as the slowdown concludes and the economy improves in future years. Also, Disney is just starting to scratch the surface regarding advertising online.

Therefore, Disney’s margins should improve, leading to higher profitability. In fiscal Q2, Disney’s direct to consumers operating loss narrowed to $659M, better than the anticipated $841M loss ($5.5B total revenues). As we advance, we can continue seeing the trend of substantially better-than-expected profitability in Disney’s online segments.

Another factor to consider is that Disney’s revenue per user is not at its full potential and could continue rising as we advance. Global Disney+ ARPU came in at just $4.44 last quarter, below the $4.52 projected mark. This dynamic implies Disney could achieve a substantially higher ARPU, especially as the transitory slowdown concludes and the economy returns to a healthy growth environment.

Disney’s parks are doing just fine – Disney reported an impressive $7.78 billion from its Disney parks, experiences, and products segment, a 17% YoY gain. We’re still seeing the COVID-19 rebound here, but revenues and profitability should continue increasing as the economy improves and discretionary spending expands.

Additionally, Disney should improve its operating costs to keep its comeback on track. The dual dynamic of better-than-expected revenue growth and improved profitability should lead to higher-than-expected EPS for Disney in the future. Moreover, the increased profitability should lead to multiple expansion, enabling Disney’s stock to move much higher in the coming years.

Disney – Finally Dirt Cheap

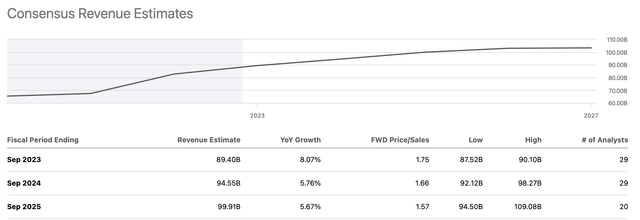

Revenues – Could Increase Faster Than Expected

Revenue estimates (SeekingAlpha.com)

Disney’s revenues have taken off since the introduction of its streaming business. Moreover, theme parks and other crucial components rebounded recently. Despite the economic slowdown, Disney’s revenues should be about $90 billion this year, 34% higher than its $67.4 billion revenues in 2021. The recent revenue growth is impressive, but consensus estimates could be too low.

Disney is still expanding its streaming empire and can monetize the business much better in the years ahead. Moreover, optimizing its streaming segment should be the company’s top goal in the near term. Disney’s streaming business could become profitable by 2024, leading to significantly more revenue and higher profitability than current estimates suggest.

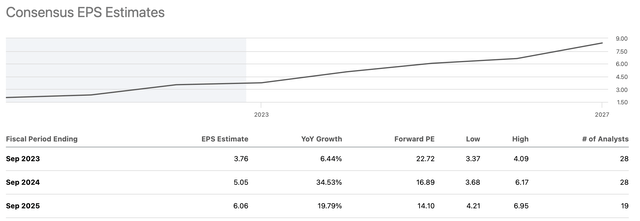

EPS Estimates – May be Too Low Now

EPS estimates (SeekingAlpha.com )

Disney’s EPS estimates were adjusted sharply lower during the recent downturn. 2024/2025 consensus EPS estimates dropped by about 25-30%. However, estimates may have decreased too much due to the economic slowdown and other transitory factors. Disney could deliver higher revenue and better profitability metrics than current EPS estimates suggest.

Nevertheless, the badly beaten-down EPS projections illustrate that Disney trades at only 17 times forward estimates (consensus). While this forward P/E estimate is based on about $5 in EPS next year, Disney’s EPS could be toward the higher end of current estimates, $6. If Disney earns $6 in fiscal 2024, its stock is dirt cheap, around 14 times forward earnings. The combination of better-than-anticipated revenue growth and higher-than-expected profits could lead to multiple expansion, enabling Disney’s stock to move considerably higher in the long term.

Where Disney’s Stock Could Be In Future Years

| Year (fiscal) | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $90 | $97 | $105 | $112 | $120 | $127 | $135 |

| Revenue growth | 8% | 8% | 8% | 7% | 7% | 6% | 6% |

| EPS | $4 | $6 | $7.5 | $9 | $10.6 | $12 | 13.5 |

| EPS growth | 13% | 50% | 25% | 20% | 18% | 15% | 13% |

| Forward P/E | 14 | 17 | 18 | 20 | 19 | 18 | 17 |

| Stock price | $85 | $128 | $162 | $212 | $228 | $245 | $275 |

Source: The Financial Prophet

I use a relatively modest growth trajectory regarding Disney’s revenues and EPS growth. Revenue growth may eclipse the 6-8% range as we advance. Thus, Disney could achieve the expected revenue range faster than current estimates imply. Also, Disney could improve its profitability more quickly than projected, leading to more substantial EPS growth in the years ahead. Additionally, as Disney displays better-than-expected revenue growth and enhances profitability, its forward P/E multiple could expand higher than 20, enabling the stock to move higher than my projections suggest long-term.

Risks to Disney

One of Disney’s most significant risks is the competition from Netflix (NFLX) and others in the streaming segment. Several major companies now offer streaming services, and there’s a constant battle for content in the space. While Disney has quality content, it may become repetitive for some subscribers, leading to volatility in Disney’s subscriber growth.

Also, Disney’s streaming service is yet to become profitable, and we must see how this dynamic plays out in the quarters ahead. Additionally, Disney may not become as profitable as envisioned due to the lack of effective cost-cutting, inflation, and higher prices ahead. Also, there’s a risk of less profitability from Disney’s streaming operations and other segments, especially if the economy slows and demand for “the Disney experience” decreases in the years ahead.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!