Summary:

- Ford’s Model e division continues to drag down the performance of the overall company.

- Despite high warranty costs and pricing pressures, Ford’s nearly 6% yield and forward PE of under six make it worth a deeper dive.

- Ford’s EV segment faces significant challenges, including lower pricing and competition, while its traditional business segments show mixed performance.

- With a forward P/E of 5.8 and the potential for protective tariffs, Ford presents a decent covered call trade opportunity despite industry and internal pressures.

Artistic Operations/iStock Editorial via Getty Images

Shares of automaker Ford (NYSE:F) fell after the company posted its 3Q24 financial report that featured a downward revision to its FY24E adjusted EBIT to reflect supplier disruptions at its Ford Pro segment. The company’s Model e division is still a major drag on performance, with expectations for it to generate FY24 adjusted EBIT of negative $5 billion after scrapping its plans for a three-row SUV. Yielding nearly 6% and trading at a forward P/E of under six, yet held back by high warranty costs and pricing pressure, the potential for lower interest rates and potentially less focus on EV mandates by the new administration make Ford worthy of a deeper dive. An analysis follows below.

Seeking Alpha

Company Overview:

Ford Motor Company was America’s top-selling internal combustion engine brand and number two electric vehicle [EV] manufacturer in 3Q24, buttressed by its market leading position in pickup trucks. Globally, its output is sold through a network of ~9,500 dealerships. Famous for the invention of the assembly line and the introduction of the $5 workday, Ford was founded in 1903 and went public in 1956 in what was (at that time) the largest IPO in history. The stock trades just over $10.50 a share currently, translating to an approximate market cap of just over $42 billion.

Operating Segments

Management assesses its performance through five segments: Ford Blue; Model e; Ford Pro; Ford Credit; and Ford Next.

Ford Blue is primarily the sale of Ford and Lincoln internal combustion engine and hybrid vehicles, parts, and related services to retail customers. In the first nine months of 2024 (YTD24), it generated Adj. EBIT of $3.7 billion on revenue of $74.7 billion versus adjusted EBIT of $6.7 billion on revenue of $75.7 billion in YTD23, representing declines of 44% and 1% (respectively) as unfavorable sales mix, higher warranty costs, and higher material costs negatively impacted performance.

Model e is chiefly comprised of EV sales, as well as that of related parts, accessories, and digital services. It generated YTD24 adjusted EBIT of negative $3.7 billion on revenue of $2.4 billion, as compared to YTD23 adjusted EBIT of negative $3.1 billion on revenue of $4.3 billion, representing declines of 18% and 43% (respectively) as competitive market conditions drove down unit sales and net pricing to the point of a negative 151% EBIT margin.

Ford Pro largely consists of sales of Ford and Lincoln vehicles, parts, accessories, and services to commercial, government, and rental end markets, including Super Duty pickup trucks and Transit vans. It generated YTD24 adjusted EBIT of $7.4 billion on revenue of $50.7 billion vs. adjusted EBIT of $5.4 billion on revenue of $42.7 billion in YTD23, representing improvements of 36% and 19% (respectively) as higher sales and pricing combined with a favorable mix to produce excellent results.

Ford Credit is primarily vehicle-related financing and leasing activities. It contributed YTD24 adjusted earnings before taxes (EBT) of $1.2 billion, representing a 15% improvement over a challenging YTD23 as higher financing activity and margins more than offset lower auction values.

Ford Next is essentially a cost center that includes expenses and investments regarding initiatives in vehicle-adjacent market segments. Its financial impact is de minimis.

Putting it altogether with corporate overhead, Ford generated YTD24 adjusted EBIT of $8.1 billion on revenue of $136.8 billion, as compared to YTD23 adjusted EBIT of $9.4 billion on revenue of $130.2 billion, representing a decrease of 14% on a top-line improvement of 5%, as better pricing and a 1% uptick in unit sales (sans EV) did not translate to the mid-line, which was negatively affected by higher warranty expenses, as well as challenges at its Model e segment.

Operating and Share Price Performance

A cursory review of the segments suggests Ford’s troubles lie in its EV unit and (with a longer-term view) its in-house financing arm, which has seen its EBT fall from $4.72 billion in FY21 to a ~$1.6 billion forecast in FY24. That oversimplifies matters on several fronts. First, it appears as if the Model e segment’s performance is understated as the compliance credits it receives from manufacturing EVs vehicles are essentially applied to Ford Blue. Second, in theory, the profitability of Ford Credit should be relatively consistent – a function of volume given steady default rates as the unit would look to make a stable spread over its cost of capital. However, with 0% or close to 0% financing still available when the Fed Funds rate has risen from near zero in early 2022 to its current target range of 4.50% to 4.75% implies that the company has artificially overstated the selling price of its cars by a collective $3.2 billion vs. FY21, which benefits Ford Blue and Ford Pro segments, since they sell the vast majority of vehicles.

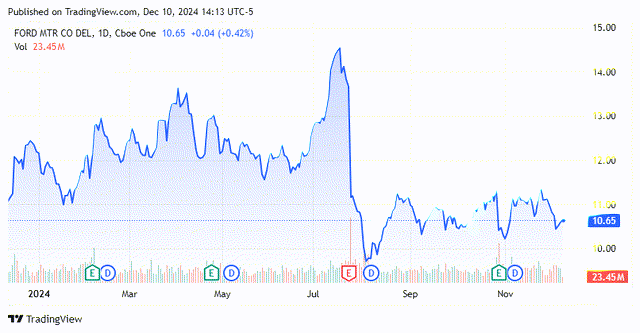

Ford’s internal accounting approach that does not fully cost out its segments and props up its Ford Blue division notwithstanding, the company is beholden to a population-growth driven, low-margin industry that’s captive to interest rates, as every purchase in the Western world has been put into a monthly payment. As such, excepting for the pandemic selloff and subsequent low-interest-rate-fueled rally to a 20-year high of $25.87 in 2022, shares of F have more or less traded in a range of $10 to $15 for more than a decade, somewhat anchored in place by a regular quarterly dividend of $0.15 per share that’s further enhanced by episodic supplemental dividends.

3Q24 Financials and Outlook

Ford’s stock was exploring the bottom end of that range after it reported 3Q24 earnings on Oct. 28, 2024, posting earnings of $0.49 a share (non-GAAP) and adjusted EBIT of $2.6 billion on revenue of $46.2 billion vs. $0.39 a share (non-GAAP) and adjusted EBIT of $2.2 billion on revenue of $43.8 billion in 3Q23, representing gains of 43%, 18%, and 5%, respectively. Excluded from the non-GAAP earnings was a previously announced $1 billion EV-related charge that reflected the scrapping of its previously planned three-row SUV. Dealer inventory was 68 days, higher than management’s target of 50 to 60 days.

October 2024 Company Presentation

Even though the bottom line beat expectations, the market focused on Model e revenue, which was down 33% year-over-year to $1.2 billion, driven by lower pricing and an 11% decrease in unit sales as Chinese competition hurt. Furthermore, Ford lowered its FY24 adjusted EBIT outlook from a range midpoint of $11 billion to $10 billion, citing supplier disruptions at its Ford Pro division, industrywide pricing pressure, and continued elevated warranty costs. Shares of F fell 8% to $10.41 in the subsequent trading session. They have rebounded slightly since the election results triggered a rally in the overall market.

October 2024 Company Presentation

Balance Sheet and Analyst Commentary:

That said, management did not lower its FY24 adjusted free cash flow estimate, which remains at a range midpoint of $8 billion. Excluding Ford Credit, which generated operating cash flow of $3.2 billion in YTD24, the company held cash and securities of $27.7 billion against debt of $20.6 billion as of Sept. 30, 2024, providing it more than sufficient cash to fund its aforementioned quarterly dividend of $0.15 a share, translating into a yield of 5.9% before supplemental dividends are factored into the algebra. The supplemental dividends are essentially a true up of the company’s policy to return 40% to 50% of its adjusted free cash flow to shareholders annually – usually paid in February. Ford does not repurchase shares, except to prevent dilution.

October 2024 Company Presentation

With its EV, warranty, and competitive pressure woes menacing, it isn’t surprising to see the Street lean meaningfully negative on automaker, featuring two sell and 15 hold ratings against eight buy or outperforms. On average, they expect the company to earn $1.81 a share (non-GAAP) on revenue of $176 billion in FY24, followed by $1.72 a share (non-GAAP) on revenue of just under $176 billion in FY25.

Verdict:

The FY25 Street forecast (vs. FY24) somewhat encapsulates the auto industry. As the second-most sensitive vertical to interest rates, analysts are collectively suggesting that they’re unsure of the economic and interest rate environment over the upcoming year. The industry is caught in between a rock of EV manufacturing mandates that compel their production from traditional internal combustion engine manufacturers – or the purchase of offsetting compliance credits – and the hard place of lower than anticipated demand for said EVs. These dynamics have triggered a price war in the EV space with volumes growing by 35% during the past 18 months while revenues have been flat at $14 billion. With 150 new EV nameplates expected to hit the North American market by YE26, the ending of these competitive pressures is unlikely around the corner.

It also does not help that higher warranty costs are another way of saying that Ford is producing substandard vehicles. As such, Ford should be treated as a trade, but with its recent pullback to a forward P/E of 5.8, the company’s propensity to pay its supplemental dividend in February and the potential for protective tariffs that could stem some of the competitive tide in the incoming presidency – especially from Chinese EVs – Ford sets up as a decent covered call candidate. Using this simple option strategy provides one to get some downside protection from the position as well as picking up the option premium in addition to the dividend payouts.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have a small covered call position in F

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author’s note: I present an update my best small and mid-cap stock ideas that insiders are buying only to subscribers of my exclusive marketplace, The Insiders Forum. Our model portfolio has more than doubled the return of its benchmark, the Russell 2000, since its launch. To join our community and gain access to our market beating returns, just click on our logo below.