Summary:

- Fisker’s stock has declined by 75% since my hold coverage on April 2023 due to successive disappointments and risks as an early-stage car company.

- Many EV companies are in the same boat; and have faced financial difficulties and production challenges, presenting an opportunity for Fisker.

- Fisker has positive factors such as delegating manufacturing, diverse vehicle range, unique features, and demand in a global market. Fisker Ocean is finishing 2023 with multiple design and EV awards under its belt.

- There is a chance that Fisker becomes one of the last EV upstarts still standing and this may provide us an investment opportunity here with asymmetric rewards.

praetorianphoto/E+ via Getty Images

My first coverage of Fisker (NYSE:FSR) was back in April of 2023. I had been observing the EV space for a while and pretty much explained the space as a playground for the Darwinian theory of “Survival of the fittest” being played out in real-time. Even though I liked Fisker’s chance of survival, I was not sure of the path it would take, and hence my rating was a Hold. At the end of the day, its risks as an early-stage car company (not a single car had been delivered yet) and its valuation made me cautious, and I am glad that I held off on investing! The reward for the risk was simply not there and the stock is down 75% since publication as successive disappointments from the company have punished the stock severely.

I believe now that the price has started to reflect the risks and there is some potential for a speculative investment here. In this article, we will revisit and reexamine the landscape, and I will briefly mention how I typically handle my speculative investments.

Re-examining the landscape

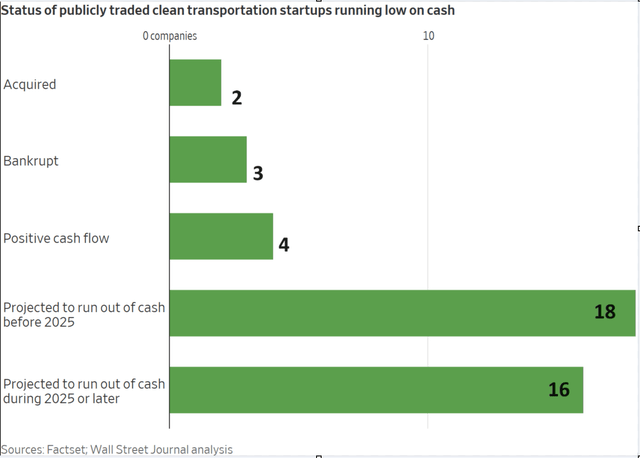

2020, 2021, and 2022 saw multiple EV companies going public, and many preferred the SPAC route as the companies could paint the picture they wanted for the projection of revenues. Fast-forward to the present, in an analysis that has about 43 companies, multiple companies have already declared bankruptcy or have been acquired for a fraction of their IPO valuation. Over 30 companies are projected to run out of cash within the next few years.

What is interesting here is the fact that even among the companies that have the cash to continue the business for the next few years, many have not seen the needed success in production. This is where I believe our core opportunity lies.

The good, bad, and ugly

First, let us get the negatives out of the way. Sure, there is a lot of pessimism about the viability and the difficulty of production, but let’s separate the noise and look at the facts.

- The company revised its delivery estimates downward multiple times and could not and will not meet original production expectations for 2023. So far, it has delivered more than 1000 vehicles for Q3 and was only able to hit deliveries of more than 100 per day in November.

- Reported revenues of $71.8M for Q3, which was far short of the consensus expectations of $100.8M

- Still needs to find strategic partners for PEAR and ALASKA models

- Declining cash means capital raises and increased dilution for the shareholders. Currently, it has a debt-to-equity ratio of 3.2 and at the end of Q3 had about 180 days of cash left.

The good

Compared to the EV companies that are still in their early stage or a similar stage as Fisker, it has several positives.

- Delegates the manufacturing process to companies with decades of experience, which means it can sidestep many of the manufacturing missteps an early-stage car manufacturer could potentially make

- Focused on expanding its range of electric vehicles to include a diverse selection catering to various preferences and price tags (Alaska: pick-up truck, Pear: compact budget-friendly SUV, Ronin: four-door GT, Ocean Force-E: off-road version of Ocean)

- Features that truly distinguish the car from the rest of the pack (SolarSky: Panoramic sunroof that can add additional range, bi-directional charger: Can provide power during emergencies, California mode: turns the car into a convertible, etc.)

- Pricing of its current product Fisker Ocean is similar to comparable premium petrol SUVs ($39K – $61K)

Additionally, the company has been working to provide and expand its lounges and centers in multiple countries, which will aim to help prospective customers in experiencing the company’s products. For existing customers, it is rapidly expanding service capabilities in the U.S. and Canada and hiring mobile service technicians nationwide. Even though the company has not been able to stick to its originally set delivery targets, the demand and excitement still exist in a large global addressable market. It also began implementing over-the-air software updates, delivering product improvements, and introducing new features to owners in response to customer feedback. And finally, rounding off 2023, Fisker Ocean snagged multiple awards across Europe related to product design and the best full Electric Vehicle.

All in all, it is hard to dismiss the positives going on for this company. The company has hit several speed bumps this year, but the core thesis remains strong. It has a working product that has demand, its features make it quite distinguishable from the competition, its go-to-market strategy has clearly resonated with the customers and they have an exciting product line-up!

Making speculative bets

The current stock price may have mispriced the rewards should the company continue to ramp up its deliveries and the demand continues to stay strong for its Ocean product. The cherry on the cake would be the new models also going into production sticking to the timeline and the demand remains strong there as well.

In evaluating speculative plays, I mainly check the investment for its upside (highly asymmetric for early-stage growth companies), and then make it part of my barbell portfolio. Fisker would be a perfect example of a candidate that would go into a barbell portfolio. For such a portfolio, you would have extremely safe investments on one end and extremely risky ones on the other end. The safe investments would carry no risk, even in the face of extreme market drawdowns (Ex: US Treasury bonds). The aggressive side of the barbell while it has the full risk of losing your entire investment, it also has unlimited upside. The aggressive side also has its risk distributed between “N” such entities (where “N” is the number of investments an investor is comfortable with)

In this situation, I would be comfortable using a minute percentage of my portfolio to take a long position in Fisker at this time and hope for this to pay out well over the longer term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in FSR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.