Summary:

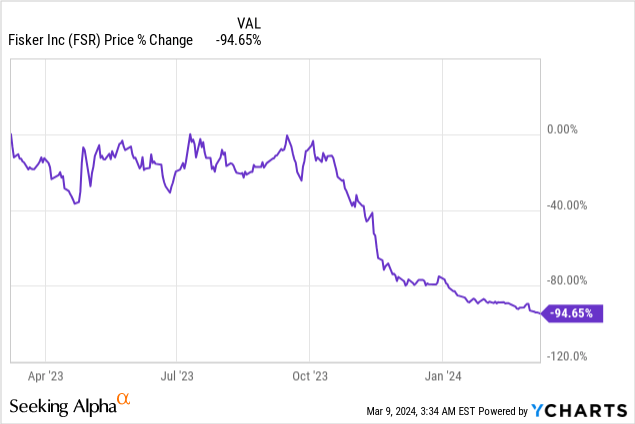

- Fisker’s shares dropped significantly after warning about its ability to survive.

- The company reported disappointing fourth-quarter earnings, with higher losses and lower revenues than expected.

- Fisker’s balance sheet is not well-capitalized, leading to the need for capital raising and a potential strategic partnership.

- Shares trade at a distressed valuation multiplier as bankruptcy risks are growing.

Lemon_tm

Shares of Fisker (NYSE:FSR) lost about half of their value after the electric vehicle company submitted its fourth-quarter earnings sheet at the end of February, delayed its 10-K and management warned about its ability to survive. A strategic partnership with a large legacy automaker is now the most likely outcome for Fisker which is quickly running out of cash. Fisker has been a promising electric vehicle start-up in 2022 and 2023, but slowing demand for electric vehicles and an increasingly competitive industry environment are weighing on the company’s production potential. I do not recommend growth investors to establish a position anymore and down-grade my rating to hold considering that Fisker may attract a strategic investor!

Previous rating

I rated shares of Fisker a strong buy after the company’s third-quarter earnings release because the company did make progress in terms of reducing its operating losses and Q3’23 delivery momentum. Shares of Fisker have widely underperformed my expectations — they have declined 85% since November — chiefly because Fisker further lowered its guidance for FY 2023 deliveries after my last update. The EV maker ultimately only achieved a delivery volume of slightly more than 10k units. Fisker will need to raise capital urgently or risk going out of business.

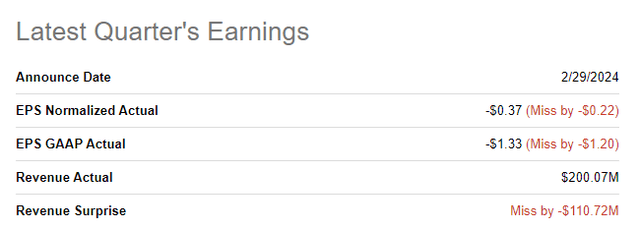

Fisker reported mixed earnings

Fisker’s fourth-quarter earnings sheet (Source) was not great: the EV maker bombed on both the bottom and the top line as it is running out of cash and EV demand is not as strong as initially predicted. It reported a much higher than expected loss of $0.37 per-share ($0.22 per-share worse than the consensus expectation) while revenues came in $110.7M below the prediction.

Seeking Alpha

Fisker’s production, revenue achievements, guidance for FY 2024

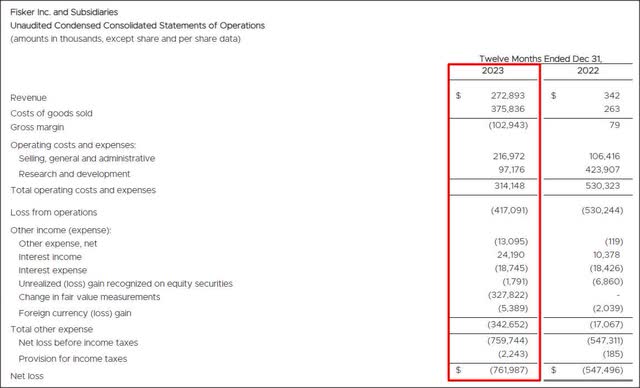

Fisker ramped up production for its Ocean SUV in FY 2023 which led to the start of major revenue-generating operations. However, Fisker had to walk back its production target multiple times in FY 2023: in Q3’23, the EV maker guided for a production volume of 13,000-17,000, but updated the guidance again to just 10k units in December. Fisker ended up producing 10,142 Fisker Oceans in FY 2023 due to production and certification delays in Europe as well as supplier issues. In terms of production accomplishments, FY 2023 was a very disappointing year.

Fisker did, however, make progress in terms of ramping up revenues which reached $272.9M in FY 2023, showing significant growth from a prior-year revenue volume of only $342k. As the EV maker grew its production footprint, Fisker also managed to lower its operating loss from $530.2M in FY 2022 to $417.1M, showing a decline of 21% Y/Y.

Fisker

Fisker has been suffering, like other EV makers did, from waning demand for electric vehicles in FY 2023, resulting in multiple EV companies cutting their production outlooks. Rivian Automotive (RIVN), as an example, submitted a disappointing production forecast for FY 2024 that also caused a major stock sell-off.

Lucid Group (LCID), another embattled EV maker, has guided for only a 9k production volume this year. Slowing EV demand is mainly to blame for these disappointing trends in the electric vehicle market. For the same reason, Ford (F) recently cut back on its F-150 Lightning production.

Fisker’s management expects to produce and sell between 20k and 22k Fisker Oceans this year which the company called conservative. It would represent, however, 107% year over year growth, at the mid-point of guidance. Given Fisker’s multiple guidance down-grades in FY 2023, I am at this point very skeptical about Fisker’s projections.

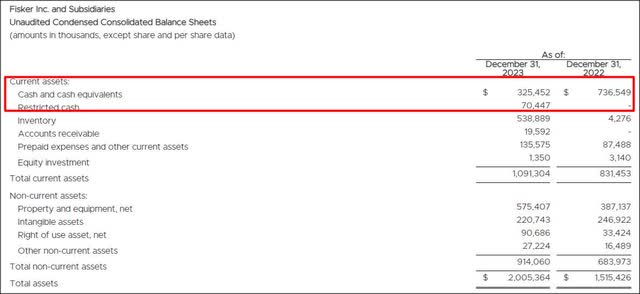

Balance sheet, expectations for FY 2024

With production growth disappointing in FY 2023, EV demand slowing and Fisker not having a very well-capitalized balance sheet, management has warned that it may not continue as a going concern and that it’s pursuing a strategic OEM partnership. The company also announced a new dealership partnership model at the beginning of the year that will see the addition of 100 dealers (50 in the U.S./Canada and 50 in Europe). The move away from direct sales is expected to help streamline distribution and sales.

Fisker had $325.5M cash available on its balance sheet (not counting restricted cash) at the end of FY 2023 which is equal to about one year’s worth of operating expenditures. Given that Fisker’s demand situation is not as great as expected and that the company is seeing its cash pile dwindle — Fisker’s cash accounts fell 55% Y/Y in FY 2023 — the EV maker will have to raise capital to ensure that it can operate as a going concern.

Fisker

This means that the EV maker is under pressure to raise capital quickly which may be raised in one of three ways: 1) Convertible senior debt, 2) Equity, or 3) Via a strategic partnership.

Considering how much the share price has fallen lately — it is down to just $0.38 — the most likely outcome is that a legacy automaker will step in, become a strategic investor and provide a cash infusion, in my opinion. Legacy automakers have cash and could potentially use Fisker’s EV technology for their own production lines.

Legacy makers have also been willing to fund operating losses of innovative start-ups in FY 2023. This is what happened in the case of both NIO (NIO) and XPeng (XPEV) which received strategic equity investments from CYVN Holdings and Volkswagen last year. Reuters reported last week that Nissan, the third-largest Japanese car brand by revenue, could be a potentially interested party.

Nissan, or another major car brand, could become a strategic anchor investor in Fisker and make a cash infusion in order to ensure Fisker’s going concern. Such an agreement would likely go hand-in-hand with additional lay-offs — Fisker already announced a 15% headcount reduction — and possibly a reduced production line-up in order for the EV maker to concentrate on a smaller number of products, thereby saving operating expenses.

Fisker’s valuation

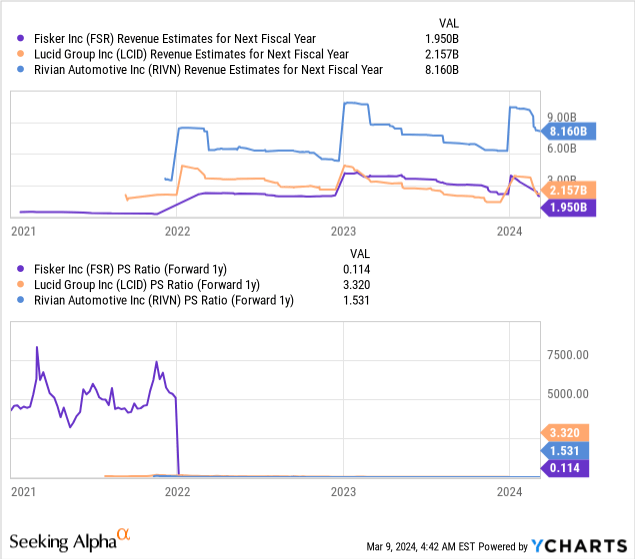

Fisker is trading at a distressed valuation multiplier that reflects growing odds of a potential bankruptcy. Shares of Fisker trade at only 0.11X FY 2025 revenues and top line estimates for U.S.-based EV companies have reset sharply lower this year, showing that investors (including me) have overestimated the demand for electric vehicles.

Shares currently trade at 2.8X book value with Fisker having a book value of $0.14 per-share as of Q4’23. Higher than expected losses have eroded Fisker’s equity value quite significantly in the last year. This book value, $0.14 per-share would be my fair value estimate for Fisker given the current, challenging business setup and need for additional capital. However, Fisker’s shares have a positive catalyst if the EV maker manages to get a major cash infusion from a strategic investor.

Rivian, in my opinion, represents the best value in the U.S.-based EV start-up group because the EV maker has a very strong balance sheet and the least amount of risk, given its much higher annual production volume (Rivian has guided for 57k electric vehicles to be produced this year). I believe Lucid still manages to trade at an inflated valuation given its multiple disappointments with regard to its production ramp.

Risks with Fisker

The obvious risk here is that Fisker may not survive if it can’t entice a large, cashed-up car brand to throw the EV maker a lifeline. As a result, there is a very real risk that Fisker may follow in the footsteps of Lordstown and go out of business. Should Fisker secure a strategic anchor investment from a larger legacy automaker, the company’s share price could be good for a very sharp move to the upside. If such a move fails, Fisker is likely to run out of cash in FY 2024 in which case equity investors would get wiped out.

Closing thoughts

Fisker is in a challenging situation and the writing for this EV maker may be already on the wall. I believe the mistake that everybody made (including me) was that we overestimated demand for electric vehicles and underestimated how difficult it would be for EV makers to grow their production footprints in an increasingly competitive market. Fisker’s last hope at this point may be an equity investment from Nissan or another major car manufacturer which to me, given the decline in the firm’s market cap, is the most sensible outcome. In any case, the situation has clearly deteriorated since my last update and since Fisker is also running low on cash, I am downgrading my rating to hold!

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.