Summary:

- Fisker fell well short of its 2023 production and delivery goals, producing only 10,142 units of its Ocean SUV.

- The company’s revenue for 2023 is expected to be around $376 million, significantly lower than the initial estimate of nearly $2 billion.

- FSR’s overall demand is in question, and it may require another capital raise to continue its growth plans.

Victor Golmer

As we start the new year, electric vehicle companies are reporting their 2023 production and delivery totals. Many of the sector’s leaders fared mostly as expected, but today I’m here to focus on the name that perhaps disappointed the most last year. Fisker (NYSE:FSR) fell dramatically short of its production and delivery goals for the year, and despite the stock falling as a result, things may be even worse in 2024.

Fisker ultimately produced 10,142 units of its Ocean SUV during the year, less than a quarter of the original hope for around 42,400 vehicles. Throughout the year there were multiple excuses for falling short, whether it was supplier issues, factory holidays, or cutting production to align with delivery logistics. When the year started, street analysts were looking for almost $2 billion in revenue from the company in 2023, but current estimates call for just about $376 million.

That current revenue average might be cut a little more as analysts digest the latest numbers from the company. Total deliveries of the Ocean came in at around 4,700 for the year, and while most were the most expensive variant, revenues have missed at Fisker’s quarterly report for each of the past four periods. The large disparity between production and deliveries for Q4 will also have some serious cash flow implications, and the cheapest Ocean variant is already being sold very early on. The company fell well short of delivering close to all production as CEO Henrik Fisker had hoped to do as stated on the Q2 conference call:

Now talking about how many cars can we deliver? Let’s say we do 20,000 vehicles. How many of those can we deliver? Like Geeta mentioned, the strategy we have is that probably, in November, is the last shipment that goes out to the US. So we can still deliver all these vehicles in late December. And then all the vehicles that are produced in December are going to be delivered in Europe. And the very last vehicles probably made just before Christmas are going to be delivered in Austria and Germany because you’re talking about, like Geeta said, a couple of days to deliver those cars. So I would say our target would be to get up to about a 95% delivery rate of all volume.

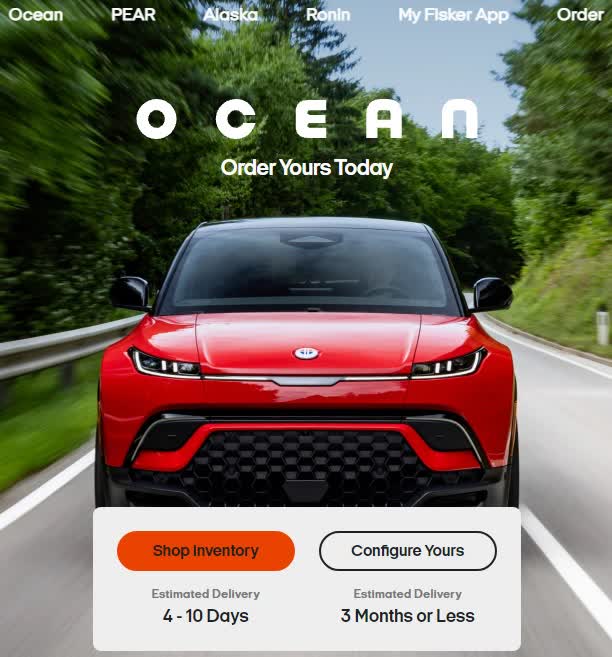

My biggest question currently has to do with overall demand. Just eight months ago in early May 2023, Fisker stated that it had roughly 65,000 reservations for the Ocean. Given that it has produced less than one-sixth of that through the end of 2023, you would think the waiting list would be quite long still. However, if you go to the company’s page seen below, a 3-month or less estimate is shown for a custom-built vehicle.

Ocean Delivery Estimates (Fisker Website)

Even if most of those reservations were for the cheapest variant, something doesn’t add up here. I don’t know if we’ll get another reservation count from the company anytime soon, so I’m hoping one analyst asks about it on the Q4 call. Fisker has already lowered US pricing on the Ocean Extreme trim from $68,999 to $61,499 which is not a good sign, although it did raise pricing on two of the lower-priced variants. With analysts currently calling for $2.15 billion in revenue during 2024, the company is going to need to boost its production and deliveries quite significantly to avoid further disappointment.

Fisker finished Q3 with a little more than half a billion in cash, but it also had nearly $1.2 billion in principal debt on the balance sheet. The company’s earnings release stated it could raise another $550 million in proceeds through debt as part of one of last year’s agreements. However, cash burn in Q3 was over $330 million alone, and that was with a much smaller inventory build. With the company also looking to launch multiple new vehicles over the next couple of years, it seems likely that another capital raise will be needed.

Street analysts continue to be extremely bullish on Fisker shares despite all of these potential issues. The average price target is currently $3.75, which represents more than 150% upside from current levels. However, that number is down another $5 plus since my previous article, and it was over $25 in early 2022. With only about a dozen analysts covering the name, that current street average is also being propped up a bit by the $11 high target.

When looking at valuation, Fisker currently goes for 0.27 times currently expected 2024 revenues. That puts it around the likes of Ford (F) at 0.27 and General Motors (GM) at 0.29 times their expected sales for this year. However, those two industry giants have very profitable ICE vehicle businesses that kick off plenty of free cash flow. Fisker trades at a large discount to names like Polestar (PSNY) at 0.96 times and Chinese player NIO (NIO) at 1.29 times. If you group those four competitors, the unweighted average is about 0.70 times, so Fisker’s valuation is certainly depressed. Fisker also lacks access to the key US Federal EV tax credit that competitors like the Tesla (TSLA) Model Y still have, putting it at a pricing disadvantage currently.

Given the continued struggles at Fisker, I am therefore downgrading the stock to a sell today. The company only produced about a quarter of its goal last year and didn’t even deliver half of those vehicles. Despite huge reservation numbers cited last spring, delivery estimate timelines seem rather low, and analyst estimates just keep coming down. With Fisker struggling to ramp things, cash burn has been quite high, and that might result in another capital raise. While the valuation here isn’t terrible, more disappointment could easily send shares lower still. If the stock finds a way to fall below $1, the possibility of a reverse split could become another negative catalyst as well.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.