Summary:

- Fiverr reported Q2 FY24 earnings where revenue and adjusted EBITDA grew 6% and 16.8% YoY, respectively, as spend per buyer and take rate expanded from strong cohort behavior on the platform.

- Although active buyers declined along with weakness in complex services from macro volatility, the management is focused on driving robust product innovation with strong financial discipline.

- The company is expanding into the long-term freelance hiring space while simultaneously growing its footprint in dropshipping categories with the AutoDS acquisition.

- As the company unlocks new revenue opportunities along with expanding margins, I believe the stock is attractively priced to drive significant upside over the long term, making it a “Buy”.

Klaus Vedfelt

Introduction & Investment Thesis

I last wrote on Fiverr (NYSE:FVRR) in May, where I downgraded the stock from a “buy” to a “hold” after it rallied close to 19% post-Q1 earnings, thus leaving little to no upside for the stock based on the management’s forward guidance at the time. Since then, the stock has declined 7%, underperforming the S&P 500.

Fiverr is a digital services marketplace that connects businesses (buyers) with freelancers (sellers) in over 700 categories. It reported its Q2 FY24 earnings in late July, where revenue and Adjusted EBITDA grew 6% and 16.8% YoY, respectively, beating estimates. Although the company saw a decline in its Active Buyers once again along with weakness in its “complex services” category from macro volatility, it still managed to expand its spend per buyer, which grew 10% YoY to $290, while its take rate rose 230 basis points YoY to 33%.

During the earnings call, the management emphasized its focus on progressing upmarket while gaining market share in complex services through robust product innovation in their Summer Product Release. Simultaneously, the company is also expanding its product portfolio in the long-term freelance hiring space while growing its footprint in the fast-growing dropshipping-related categories with the acquisition of AutoDS, thus unlocking new revenue opportunities.

Although macroeconomic uncertainties persist, I believe that the management’s target of reaching an Adjusted EBITDA margin of 25% by FY27 is a positive sign. Assessing both the “good” and the “bad,” I believe that the stock is attractively priced from a risk-reward standpoint. Therefore, I will upgrade it back to a “buy” rating with a price target of $37.

The good: Spend per buyer and Take Rate expands, Robust Product Innovation, Expanding footprint in Dropshipping-related categories, Growing profitability

Fiverr reported its Q2 FY24 earnings, where it saw its revenue grow 6% YoY to $94.7M, beating estimates, as the company continued to expand customer wallet share while simultaneously expanding their take rate through effective monetization of their Seller programs that include Promoted Gigs and Seller Plus. During the quarter, the company expanded their spend per buyer by 10% YoY to $290, which indicates that the company’s strategy for attracting and engaging high-value customers is yielding results while driving robust product innovation.

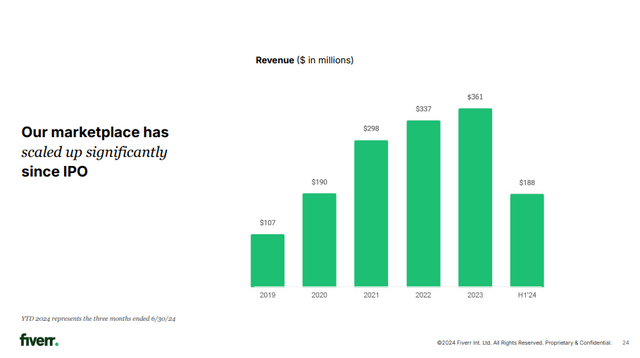

2024 Company Presentation: Revenue growth since IPO

In my previous coverage on Fiverr, I discussed that the company has two strategic priorities that include progressing upmarket to attract more businesses with higher lifetime value and increasing their market share in complex service categories where projects tend to have a longer duration with higher transaction sizes. While the management discussed that they saw some weakness in complex services during the quarter from macro volatility, they continued to drive robust product innovation with their Summer Product Release, where it introduced its professions-based catalog, allowing businesses to find profiles that exactly fit their job descriptions, especially as they look to capture the portion of the addressable market that lies in a long-term engagement with a freelancer. As the company increasingly moves upmarket and drives penetration into complex services, expanding into the long-term freelance market will open up growth opportunities by unlocking more freelance hiring budgets. In my opinion, this is a win-win for all parties involved, as businesses will get access to the best human talent around the world, while freelancers will get opportunities that empower their career and success.

Simultaneously, the company is also creating additional growth catalysts with their latest acquisition of AutoDS, which is a leading platform that provides an end-to-end solution for dropshippers. This acquisition will enable Fiverr to diversify its revenue model to include a new subscription-based revenue stream where AutoDS brings tens of thousands of dropshippers into the Fiverr ecosystem, thus expanding Fiverr’s footprint in categories where it is currently seeing strong momentum, such as dropshipping, website development, e-commerce management, and more. I believe this acquisition is in alignment with Fiverr’s ethos of empowering the creator community to be successful, while demand in dropshipping-related categories should continue to grow from rising trends in fast-fashion e-commerce sites and social media.

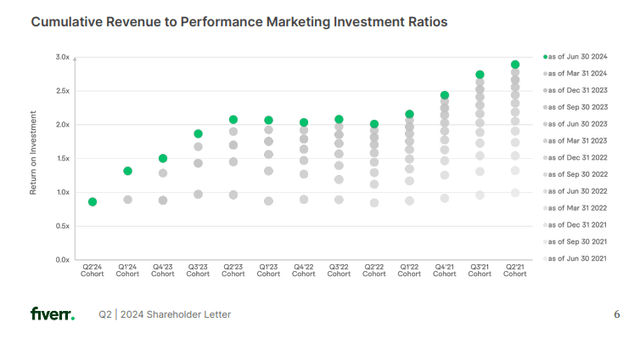

Shifting gears to profitability, Fiverr generated $17.8M in Adjusted EBITDA, which grew 16.8% YoY, with a margin improvement of 180 basis points to 18.9%. The company continued to showcase its commitment towards its 2027 Adjusted EBITDA margin target of 25% as it streamlined its operating expenses, which grew at 3.5% (on a non-GAAP basis), a much slower rate than overall revenue growth, allowing the company to unlock operating leverage. Simultaneously, the company is also benefiting from strong cohort behavior, with 67% of core marketplace revenue coming from repeat buyers, while its payback periods continue to become more efficient, with the LTV to CAC ratio reaching over 2.1x, much higher than previous years, as businesses deepen their adoption of the Fiverr platform.

Q2 FY24 Shareholder Letter: Growing efficiency from marketing spend

The bad: Active Buyers continue to decline, Weakness in complex services from macro volatility

However, its Active Buyers continued to decline both year-over-year and on a sequential basis to 3.9M. Although the company is focusing on driving wallet share among high-quality buyer cohorts with a larger lifetime value, it is slightly concerning to me that the decline in Active Buyers has not yet troughed.

Plus, the company also saw some pullback in traffic in June as macro volatility persisted in the SMB segment with poor NFIB sentiment and declining job openings, particularly in the Information Sector. In my previous posts, I have discussed the company’s strategic priority to increase market share in complex services that have generally benefited from the large capex spend in GenAI, where they have been seeing a double-digit growth rate with longer-duration projects along with higher transaction values. However, the management outlined that they saw weakness in higher-ticket projects during the quarter from macro volatility and thus did not provide the figures for revenue contribution from complex services and the rate of growth in its high-value buyers cohort that spend at least $500 annually (like it did until the prior quarter). However, the management continues to remain positive about the long-term prospects of AI and expects it to be a tailwind for businesses demanding access to AI talent and services, which should benefit Fiverr in gaining greater market share in the complex services category.

Revisiting my valuation: Fiverr is back to “buy”.

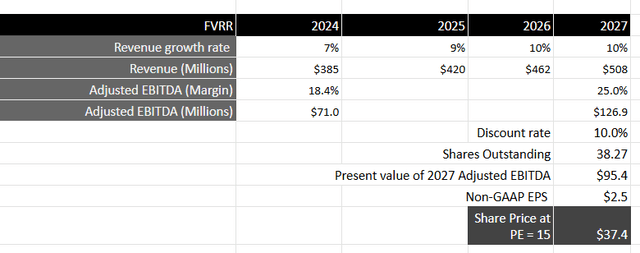

Looking forward, the management has raised its FY24 revenue guidance from $384M to $385M, which represents a growth rate of 6.5% on a year-over-year basis. As the company continues to move upmarket and push into complex services that benefit from genAI through robust product innovation, it should be able to gain a higher market share as macro volatility subsides from interest rate cuts in the coming quarters. Simultaneously, I am optimistic about the company’s expansion into the long-term freelancer hiring space, while the addition of subscription-based revenue from its latest AutoDS subscription will help it diversify its revenue model. As it continues to gain a higher customer wallet share while expanding its value-added product portfolio, it should grow in the high single-digit to low teens over the next 3 years to generate approximately $508M in revenue by FY27.

From a profitability standpoint, the management raised guidance to an Adjusted EBITDA of $71M, which represents a margin of 18.4%. Given the management’s commitment to reach an Adjusted EBITDA margin of 25% by FY27 as it unlocks higher operating leverage from greater spend per buyer across customer cohorts and efficient payback periods, it should generate close to $126M in Adjusted EBITDA, which will translate to a present value of $95M when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18, I believe that Fiverr should trade at least on par with the index. This will translate to a PE ratio of at least 15, or a price target of $37, representing an upside of 55% from its current levels.

My final verdict and conclusions

Although the company saw a decline in Active Buyers along with macro volatility leading to weakness in complex services, where it did not provide revenue contribution from complex services as well as growth rate in high-spend buyers, I believe that the weakness will likely be temporary. In the latest reading, the NFIB Optimism Index rose to 93.7, the highest level since February 2022. Meanwhile, the Fed’s interest rate easing cycle should spur growth in the economy, leading to further improvement in business confidence and spending cycles. Moreover, I believe that demand for AI talent and services is likely to remain strong, especially as we move from the infrastructure-building phase towards deploying AI applications. To this, I will also add that I am optimistic about Fiverr’s initiative to expand its TAM into the long-term freelance hiring space, especially as they move upmarket and into complex services, enabling it to capture a higher share of the total freelance hiring budget. Simultaneously, its revenue expansion opportunity with the acquisition of AutoDS will also help it diversify its revenue model.

Although macroeconomic uncertainties persist, I believe that the management’s commitment to reach 25% Adjusted EBITDA by FY27 demonstrates their financial discipline when it comes to driving efficient marketing programs to streamline payback periods while driving higher spend per buyer across customer cohorts. Assessing both the “good” and the “bad,” I believe that the stock is attractively priced at current levels, with sufficient upside for long-term investors. Therefore, I will upgrade my rating from “hold” to “buy” with a price target of $37.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in FVRR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.