Summary:

- Fiverr’s first quarter results were deemed quite positive at first glance, but when delving deeper, the picture is still gloomy.

- The marketplace is still stagnating, and no change is expected throughout 2024 as much of the Spend Per Buyer growth is offset by the Active Buyers decline.

- The $100 million stock buyback program may have a much less profound impact on the stock price, and may even negatively affect its earnings.

- Fiverr still needs to prove its growth story is intact. Until that happens, I maintain my ‘Sell’ rating for the stock.

damircudic/E+ via Getty Images

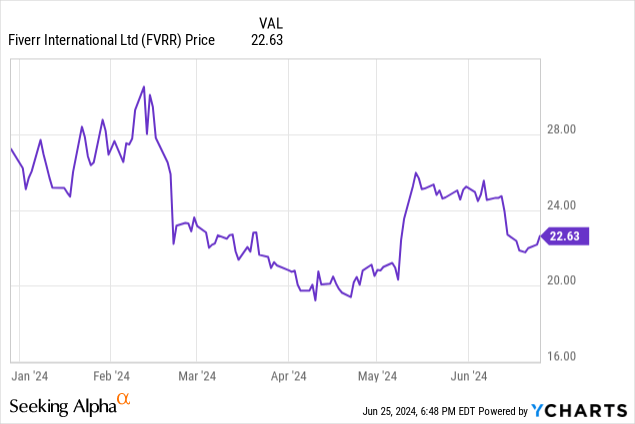

Fiverr International Ltd. (NYSE:FVRR), the online marketplace for freelance services, announced its Q1-2024 financial results on May 9th, enjoying approximately a 10% increase in its stock price in the subsequent trading session, on an above-average trading volume. In the following weeks, the stock continued to experience positive momentum, and by the end of May was up by more than 24%. However, the stock has cooled since then and is down by more than 10% in June, flirting with its post-earnings price of ~$22.00.

Judging by its reaction, the market interpreted Fiverr’s latest results and commentary as net positive. However, as we will see, nothing has really changed in the company’s underlying business, leading me to maintain my ‘Sell’ rating. In this article, I will provide an analysis of Fiverr’s latest results and discuss the recently announced $100 million stock buyback program.

The Marketplace Is Still Stagnating

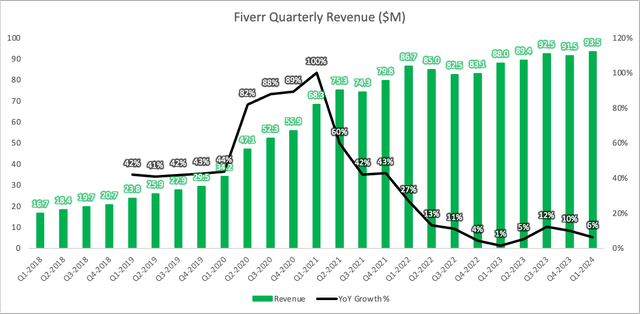

In Q1-2024, Fiverr generated $93.5 million in revenues, a 6.3% YoY growth, in line with its full-year revenue growth forecast. Moreover, Fiverr generated net income, this time of $0.8 million, yet again with the help of its financial income stream, generating $6.7 million during the quarter. I explained in my previous article how Fiverr’s large portfolio of marketable securities is contributing to this financial income boost. As of March 31st, Fiverr has had $466.8 million of those securities, roughly 44% of its total balance sheet. Later on, we will discuss Fiverr’s liquidity position, which led to the company’s decision to launch a stock buyback.

From a margin perspective, Fiverr’s gross margin was 83.5%, pretty much in line with previous quarters, although its adjusted EBITDA margin was 17.1%, a significant improvement from the Q1-2023 margin of 12.8%. As a quick reminder, Fiverr’s long-term adjusted EBITDA margin is 25.0%, so the company does make progress on that end, yet it’s still unclear when exactly the company will reach the 25.0% margin mark. When asked about it in its Q4-2023 earnings call, the management team refused to provide any specific timeline for reaching that target.

Source: Author’s Process of Fiverr’s Shareholders Letters

Moving on to the KPIs, perhaps the most important metrics for understanding the health of Fiverr’s business. Starting with Active Buyers, which represent the number of buyers who have ordered a gig on Fiverr within the last 12-month period. This number decreased by 6.2%, the third consecutive YoY decline for the company. More precisely, the last time Active Buyers increased was in Q4-2022, almost 18 months ago. On the other hand, the Spend Per Buyer (“SPB”) increased by 8.4%, its strongest YoY growth since Q4-2022. Per Fiverr’s management team, this dynamic is the result of the company’s focus on higher-value buyers, with larger budgets, which benefit SPB more than Active Buyers. While it sounds like a good step forward, the next KPI pours cold water over it.

Gross Merchandise Value (“GMV”), which is a multiplication of the former two metrics, increased by just 1.7% on a YoY basis. This number is within the 1-2% range of Fiverr’s full-year forecast for GMV growth in 2024. Remember, Fiverr charges 25.5% of each $1 of GMV. This 25.5%, which can also be named “marketplace take rate”, generated ~80% of Fiverr’s revenues in 2023, while the rest of the revenues were generated from other ancillary services. In my opinion, this makes the GMV Fiverr’s most important KPI to follow, as it summarizes the whole marketplace story. As long as Fiverr’s GMV is stagnating, which it is, then marketplace revenues will stagnate as well. And as those revenues stagnate, Fiverr’s entire growth story remains in question.

| $M | Q1-21 | Q1-22 | Q1-23 | Q1-24 |

| GMV (TTM) | $823 | $1,066 | $1,117 | $1,136 |

| Marketplace Take Rate | 25.0% | 25.5% | 25.5% | 25.5% |

| Marketplace Revenue | $206 | $272 | $285 | $288 |

| Change YoY % | – | 32.1% | 4.7% | 1.7% |

(**) In Q2-2021 Fiverr increased its take rate by 50 bps to 25.5%.

On a positive note, Fiverr expanded its overall Take Rate to 32.3%, up 190 basis points from a year ago. As the company’s management team explained during the earnings call, this expansion is again attributed to value-added services such as Promoted Gigs and Seller Plus, which continue to demonstrate strong growth. I do expect this overall take rate to surpass 33% in 2024, yet with an important caveat that the value-added services may contract very fast if the buyers’ side hits the brakes. Judging by the stagnating marketplace, such a scenario cannot be ruled out.

Fiverr also provided updated guidance for 2024. However, it just raised the low end of its revenue and its adjusted EBITDA by a negligible $2 million each:

| 2024 Outlook | 2023 Actual | YoY Growth | |

| GMV | $1.14 – $1.16 billion | $1.13 billion | 1% – 2% |

| Revenue | $381.0 – $387.0 million | $361.4 million | 5.4% – 7.1% |

| Adjusted EBITDA | $67.0 – $73.0 million | $59.2 million | 13.1% – 23.3% |

| Adjusted EBITDA Margin | 17.6% – 18.9% | 16.4% | 120 bps – 248 bps |

| Take Rate | 33.3% – 33.5% | 31.8% | 148 bps – 168 bps |

Although a better midpoint is positive, the high ends remain the same across the board. Hence, I don’t find this update to have any meaningful impact on my thesis.

Trying to sweeten things up, Fiverr authorized a share repurchase program of up to $100 million in April, and stated during the earnings call that it finds its current stock price an “attractive opportunity”. While on the surface such a move may sound like an immediate tailwind for the stock, I believe investors should consider the flip side of it.

Stock Buyback Program Is A Positive Market Signal But May Be Value Dilutive

In my previous article, I raised a scenario in which Fiverr may consider paying small dividends to its shareholders or doing equity buybacks. Fiverr chose the latter and announced a share repurchase program of up to $100 million. On the face of it, this decision makes a lot of sense as there is a ton of cash and marketable securities on the balance sheet; $766.5 million or roughly 72% of the balance sheet. In other words, Fiverr has too much cash on its balance sheet, as demonstrated by its current ratio, which stands at 3.1. Yes, the company does have a zero-coupon convertible note of $460 million due 2025 which is way out of the money, but with an average free cash flow of $40 million per annum since 2020, I don’t believe there is a material credit risk.

With a current market cap of approximately $875 million, and assuming the buyback has yet to begin (it didn’t, as of May 9th, per the management team), this translates into a gross buyback yield of 11.4%. However, this is where things are beginning to get more tricky. You see, Fiverr is considered to be a growth, tech company, and like many other companies in the sector, is using stock-based compensation as part of its compensation package for its employees, officers, directors, and consultants. We shall focus on two types of stock-based compensation – share options and RSUs – and explain why they may offset a significant portion of the stock buyback;

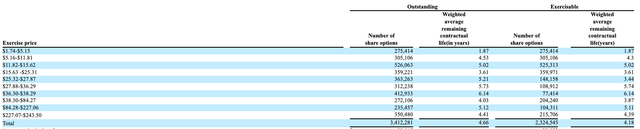

Fiverr provides us with a detailed table showing how many options are exercisable as of December 31st, 2023, and divides them into different exercise price groups;

Source: Fiverr Annual Report 2023

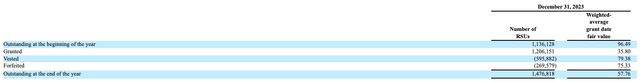

As you can see, around 1.4 million options are in the money (“ITM”) considering Fiverr’s current share price of $22.64. More than 75% of these options, or 1.1 million, are exercisable below $15.62, implying a high probability they will be exercised throughout 2024. Moreover, Fiverr’s 20-F also shows that there are as many as 0.6 million RSUs that have been vested in 2023;

Source: Fiverr Annual Report 2023

For simplicity, we assume that the number of RSUs vesting in 2024 will grow proportionally as the number of RSUs outstanding, implying that 0.8 million RSUs might be vested in 2024.

Now moving on to the catch. At a share price of $22.64, Fiverr can buy approximately 4.4 million of its stock, assuming it doesn’t affect the price and buy all at the current price. On the other hand, assuming 2.2 million new shares will be issued by the company (1.4 million options and 0.8 million RSUs), we get a ‘net’ buyback of just 2.2 million shares, valued at $49.3 million, implying a net buyback yield of just 5.6%, underscoring that the stock buyback may have much less profound impact than initially thought, or in simple words, 50% less of an impact.

| Current Share Price | $22.64 |

| Shares Outstanding (As of December 31, 2023) | 38.6 million shares |

| Implied Market Cap | $875.1 million |

| Buyback Program | $100.0 million |

| Gross Buyback Yield | 11.43% |

| Stock Buyback | 4.4 million shares |

| Stock Issuance | 2.2 million shares |

| Net Buyback | 2.2 million shares |

| Net Buyback Value | $49.3 million |

| Net Buyback Yield | 5.63% |

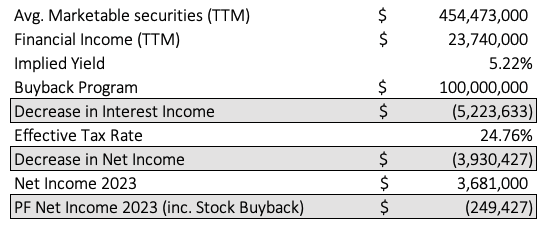

Another important aspect to consider is that the $100 million designated for a stock buyback might be ‘sucked’ out of Fiverr’s marketable securities. During the past 12 months, Fiverr generated $23.7 million in financial income. That income is comprised of many sub-items such as derivatives, exchange rate fluctuations, and others. Still, the vast majority of it is coming from interest income from those marketable securities. Based on an average of $454.5 million in marketable securities Fiverr held during that period, we get to a yield of 5.2% on those investments. In other words, ‘sucking out’ those $100 million for stock buyback will result in an alternative cost of approximately $5.2 million in interest income in 2024, or, assuming a 24.8% effective tax rate, a decrease of $3.9 million in net income, which in 2023 would have completely wiped out Fiverr’s bottom line.

Author Calculations

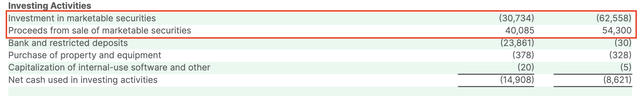

One of the bullish thesis behind stock buyback is that net income will be split among fewer shareholders, increasing the earnings-per-share and even if the P/E ratio stays the same, the stock price will go up because of the former dynamic. The problem with Fiverr, and the reason these drivers are not relevant for it besides the market signaling, is that Fiverr’s net income without the financial income boost may de facto be negative. In other words, by ‘sucking’ $100 million out of its marketable securities, Fiverr may suffer from an alternative cost that will offset any positive impact stemming from a shrinking shareholders’ base. As we can see in Fiverr’s Q1-2024 financial statements, the company was a net seller of marketable securities, reinforcing this option.

Source: Fiverr Shareholders’ Letter Q1-2024 (middle column)

Of course, Fiverr may not pull the entire $100 million from its marketable securities and may choose to pull some of it from its bank deposits ($109.8 million) or cash balance ($190.1 million), yet I find it hard to believe that a major chunk of these marketable securities will not be used for that buyback, to maintain a healthy liquidity position.

The Verdict

Fiverr’s Q1-2024 results showed no signs of reaccelerating in its marketplace. On the contrary, it continues to stagnate, despite the management team’s claims that AI has a net positive impact on the business, with complex services accounting for a larger portion of the marketplace. As long as the marketplace stagnates, as reflected through the GMV metric, I don’t see any other driver that can push the top and bottom lines of the P&L that is not related to ancillary services. Although the Spend Per Buyer (“SPB”) metric does show a slight sign of acceleration, the decrease in Active Buyers offset most of it, raising further questions regarding Fiverr’s growth story and the impact AI really has on its business.

In addition, the $100 million buyback announcement may indeed be a positive market signal, underscoring the management team’s confidence in the company and their undervaluation presumption regarding the stock price. However, the buyback yield may end up being much lower than thought due to the company’s intensive SBC activity. In addition, such buyback may probably weigh on Fiverr’s ability to generate real value for its shareholders through bottom-line profits because of the company’s dependency on marketable securities to generate interest income. Don’t get me wrong, I don’t fancy interest income from cash-rich companies; on the contrary, it’s too easy and gives no edge in the long run. I would expect a company like Fiverr to find value-accretive projects that will reignite its growth and shoot up its GMV again. By choosing to do the buyback, Fiverr may incur the alternative cost of interest income, weighing on its ability to generate tangible value for its investors.

Due to the above, I maintain my ‘Sell’ rating for the stock, and will closely monitor the company in the next quarter as well.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.