Summary:

- Fiverr concluded 2023 with its first-ever full-year net profit and a record free cash flow, further fortifying its strong balance sheet.

- FVRR is growing at its slowest-ever rates, with marketplace revenues stagnating and Active Buyers decreasing for the first time, raising concerns about its growth narrative.

- The focus shift to more ‘complex services’ seems like scaling back from Fiverr’s original addressable market, which included a lot of ‘simple services’, now prone to AI disruption.

- While 2024 is projected to be pretty much the same as 2023, eyes should be on 2025 onwards and how the Company can reignite its business.

- My weighted average DCF valuation for Fiverr implies a price target of approximately $19, leading me to downgrade the stock to ‘Sell’.

vinnstock/iStock via Getty Images

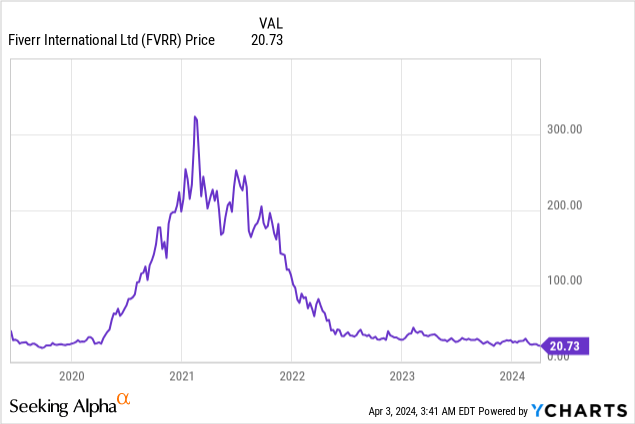

Fiverr International Ltd. (NYSE:FVRR), the online marketplace for freelance services, announced its latest financial results on February 22nd, which led to a roughly 14% drop in its stock price in the subsequent trading session. Since then, the stock has lost approximately another 5%. The company, which during COVID traded at a nosebleeding valuation of $11.7 billion on less than $200 million in revenues and a negative net income, is flirting these days with its public offering valuation of just $800 million. As I wrote in my previous article about Fiverr, the company has too many question marks, leaving investors to recalibrate their investment thesis about the gig economy powerhouse. Fiverr’s latest results and commentary have provided more insights into the health of its marketplace and the effects of AI, leading me to downgrade the stock to a ‘Sell’.

Despite achieving its first-ever full-year net profit of $3.7 million, driven by three consecutive quarters of bottom-line profit, Fiverr is exhibiting signs of weakness in its growth narrative. While the company’s management team attributes this to the challenging macroeconomic environment (including high inflation, a weak job market, and geopolitical uncertainties), investors may question whether Fiverr has reached its peak growth stage and is now transitioning into a new chapter of its corporate lifecycle as a more mature company.

Let’s start with a recap of Fiverr’s financial results for Q4 2023 and the full fiscal year of 2023.

Fortress Balance Sheet, Profitable Company

You don’t have to be Warren Buffett to examine Fiverr’s balance sheet and recognize its strength at the moment. The company has a little more than $1 billion in assets, with more than 70% of these assets, totaling $745.7 million, comprised of cash, cash equivalents, bank deposits, short-term, and long-term marketable securities. Indeed, the balance sheet is not debt-free, given the zero-coupon convertible note amounting to $455.3 million due in 2025 (which is significantly out of the money), but repaying this at maturity shouldn’t be a challenge for Fiverr. Total shareholders’ equity stands at $335.8 million, implying a price-to-book (P/B) ratio of 2.3x for the Israel-based company

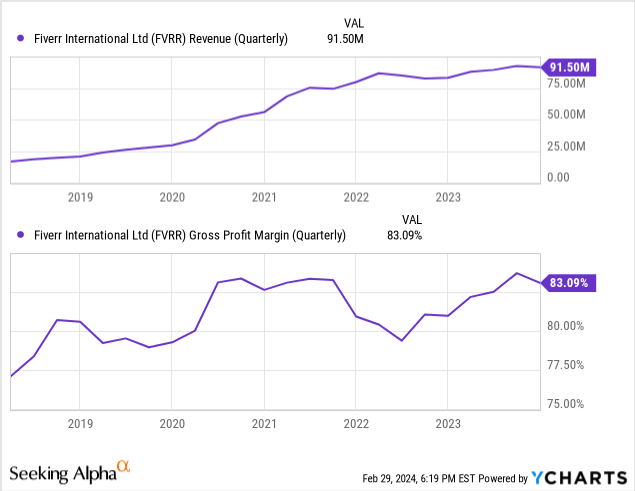

Switching to the income statement, you see a company that has remained committed to its strategic decision, made in mid-2022, to prioritize profitability, and has indeed realized profits. In Q4’23 Fiverr generated total revenues of $91.5 million (+10% YoY), a record net profit of $4.7 million, and a second-best adjusted EBITDA of $16.1 million (+71% YoY) while maintaining a near-record gross margin of 83.1% and an adjusted EBITDA margin of 17.6%. Overall, Fiverr concluded 2023 with total revenues of $361.4 million (+7% YoY), a first-ever net profit of $3.7 million, and an adjusted EBITDA of $59.2 million (+142% YoY), while achieving a full-year adjusted EBITDA margin of 16.4%. Still a long way to go until the 25% adjusted EBITDA margin target that was set in 2022, but a massive improvement since the single-digit margin a year ago. On top of that, Fiverr generated a free cash flow of $82.1 million in 2023, its highest ever, and an 184% increase on a YoY basis.

However, it’s important to highlight an intriguing aspect of Fiverr’s P&L statement from 2023. The company reported $20.2 million in financial income. Put simply, without this income, Fiverr would have concluded its fiscal year with a net loss of $16.5 million. Where did this income originate? – Throughout 2023, the average value of Fiverr’s marketable securities was $453.6 million. Dividing $20.2 million by $453.6 million yields a return of 4.44%, which aligns closely with the yields of U.S. treasuries during that year.

While Fiverr’s management may attribute the company’s growth slowdown to the challenging macroeconomic environment (a topic we’ll delve into later), it’s noteworthy that this same environment, characterized by elevated interest rates, played a pivotal role in Fiverr’s profit generation. However, this boon may not persist if the Fed decides to pivot and begin cutting rates.

No Growth No Glory

Although Fiverr’s value factors may be considered strong, concerns emerge when examining the company’s growth metrics more closely.

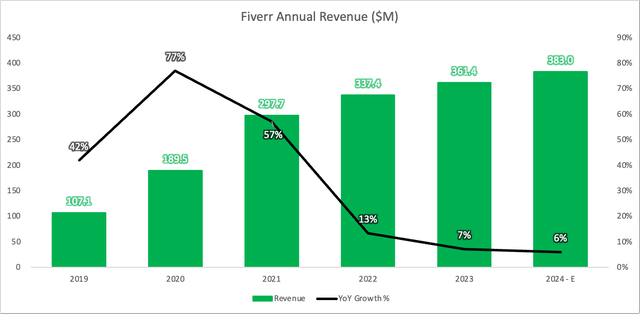

First, Fiverr’s annualized revenue growth has been only 7% in 2023, its slowest revenue growth since going public in 2019. Yes, COVID’s staggering growth rates are probably long gone (77% in 2020 and 57% in 2021), but a decelerating single-digit growth rate for a company like Fiverr is not something to brag about. The company also provided an outlook for 2024 which in its midpoint implies a disappointing 6% revenue growth.

Source: Author’s Process of Fiverr’s Shareholders Letters

The company’s management team reiterated more than once during the earnings call that growth remains a top priority. However, an in-depth analysis of the revenue growth raises concerns over Fiverr’s marketplace health.

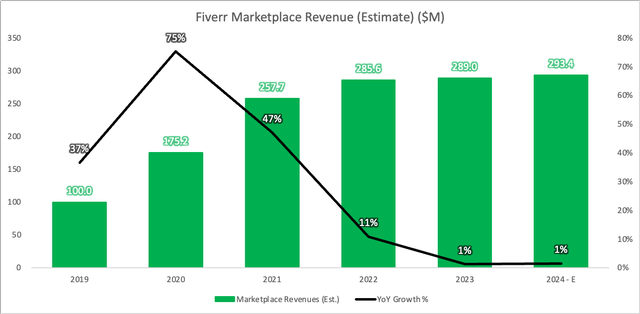

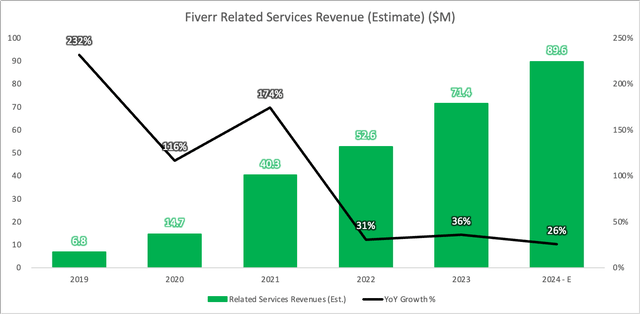

Fiverr’s Take Rate increased by 160 bps on a YoY basis to 31.8% in 2023. This is the best Take Rate in the industry, no doubt about that. For comparison, Fiverr’s main competitor, Upwork (UPWK), registered a Take Rate of just 17.2% in 2023. Nevertheless, during the earnings call, the company’s EVP Strategic Finance disclosed that the Marketplace Take Rate, which is essentially what Fiverr charges from each transaction on its marketplace, hasn’t changed; 20% from the seller side and 5.5% from the buyer side, i.e. 25.5% in total. That means that 6.3% of the overall Take Rate in 2023 (31.8% – 25.5%) can be attributed to related services Fiverr offers such as the Promoted Gigs and Seller Plus, which grew by 80% and 150% on a YoY basis, respectively. If we use that Take Rate breakdown to analyze Fiverr’s revenues, we understand that 80% (25.5/31.8) of Fiverr’s revenues came from its marketplace and 20% from related services. Moreover, because we know what Fiverr’s Marketplace Take Rate has been in recent years (25% until mid-2021 and 25.5% since then) we can estimate Fiverr’s revenues from the marketplace and the related services, and this is where things become concerning.

Revenue is calculated by multiplying the Take Rate by the GMV (Source: Author’s Process of Fiverr’s Shareholders Letters)

As you can see, Fiverr’s marketplace, the core of its business, was stagnating in 2023 and is projected to continue and stagnate in 2024 as well (we will delve into the 2024 outlook later). As you can also see in the graph below, the related services stream has been the primary driver of the company’s revenue growth in recent years, experiencing a double-digit growth rate. This trend is expected to continue in 2024, albeit at a more moderate pace, per the company’s outlook.

Revenue is calculated by multiplying the Take Rate by the GMV (Source: Author’s Process of Fiverr’s Shareholders Letters)

While those related services are very important to Fiverr’s ecosystem, the Promoted Gigs and Seller Plus that Fiverr colors as Take Rate drivers are both sellers’ monetization programs, not buyers’ monetization programs. I will continue to argue that it is the buyers, not the sellers, who drive Fiverr’s platform. If buyers come, sellers will follow, but necessarily not vice versa. If buyers come, sellers will have the right incentives to purchase all the seller-related products. However, if sellers sense there is less demand for their services and that buyers are starting to leave the platform or are willing to pay less for their gigs, those sellers will eventually stop purchasing the related services. Put simply, Fiverr’s marketplace revenue growth may be the harbinger for the related services revenue growth. The key takeaway is that investors need to closely monitor the marketplace revenues to gain a clearer understanding of the overall health of Fiverr’s platform.

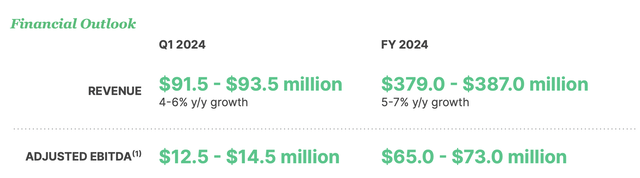

2024 Outlook Reinforces Growth Problems

Fiverr also provided investors with its outlook for 2024, comprising total revenues of $379-387 million (5-7% YoY growth) and an adjusted EBITDA of $65-73 million (10-23% YoY growth). Moreover, its management team expects to accelerate the GMV by 1-2% compared to 2023, driven by Spend Per Buyer growth and “similar” Active Buyers trends as in 2023.

Source: Fiverr’s Q4-2023 Shareholders Letter

This outlook allows us to generate a broader outlook for the company, putting all the pieces together and also generating a forecast for the adjusted EBITDA margin and the Take Rate:

| 2024 Outlook | 2023 Actual | YoY Growth | |

| GMV | $1.14 – 1.15 billion | $1.13 billion | 1% – 2% |

| Revenue | $379.0 – $387.0 million | $361.4 million | 4.9% – 7.1% |

| Adjusted EBITDA | $65.0 – $73.0 million | $59.2 million | 9.8% – 23.3% |

| Adjusted EBITDA Margin | 17.2% – 18.9% | 16.4% | 76 bps – 248 bps |

| Take Rate | 33.1% – 33.5% | 31.8% | 131 bps – 168 bps |

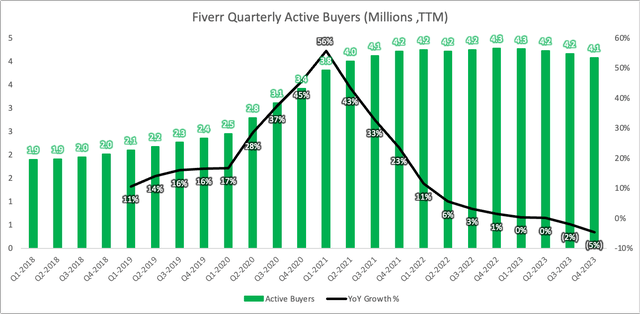

A rough estimate of the GMV growth is the Active Buyers change plus the Spend Per Buyer (or ‘SPB’) change. For example, in 2023 the Active Buyers figure decreased by 5%, the SPG increased by 6%, and the GMV increased by 1%. The actual relationship between these two metrics and the GMV is multiplicative rather than additive. However, grosso modo, this simplification gives us a better ‘feeling’ for the drivers of the GMV. Back to the 2024 outlook, if the GMV is expected to grow at 1.5% (at the midpoint), driven by SPB growth and “similar” Active Buyers trends as in 2023, it means that Active Buyers will decrease by more than 5% in 2024 (as it did in 2023). For example, a 7% SPB growth would imply a decline of 5.5% in Fiverr’s Active Buyers (1.5% = 7% – 5.5%).

Furthermore, Fiverr’s revenue is projected to grow by only 6% (at the midpoint), marking the company’s slowest revenue growth since going public. Again, assuming a constant 25.5% Marketplace Take Rate, we end up with another stagnating year for the marketplace revenues, growing approximately by only 1.5% (at the midpoint), implying that it will be the related services again that propel Fiverr’s top-line growth, and not the core marketplace.

| 2023 | 2024 – E | YoY % | |

| GMV | $1.13 billion | $1.14 – 1.15 billion | 1% – 2% |

| Marketplace Take Rate | 25.5% | 25.5% | – |

| Marketplace Revenue | $289.0 million | $291.9 – 294.8 million | 1% – 2% |

| Related Services Take Rate | 6.3% | 7.8% | – |

| Related Services Revenue | $71.4 million | $87.1 – 92.2 million | 22% – 29% |

On the bright side, the company is expected to continue and improve its adjusted EBITDA margin from 16.4% in 2023 to 18.0% in 2024, using the midpoint number. It’s still behind the 25% ambitious target set by the company in 2022, but it’s a positive step forward.

However, one critical question remains: what is driving this stagnation in the marketplace? To address this issue, it’s essential to revisit the pressing concern I highlighted in my previous article-the AI revolution and its impact on Fiverr.

The Disruptor Is Being Disrupted

A key bearish argument against Fiverr is that AI disruption will cannibalize many of the gigs offered on Fiverr’s marketplace. With the advent of AI-based applications like ChatGPT, Dall-E, Gemini, and Midjourney in the past 24 months, creativity-related gigs, such as content writing, video editing, and advertising, have encountered a considerable threat of disruption.

Although Fiverr’s management team has argued and is continuing to argue that AI is a multi-year tailwind for their business, the company did disclose some very interesting insights regarding the impact on the platform. During the latest earnings call, CEO Micha Kaufman provided a new breakdown of Fiverr’s gigs; the first group, called ‘Complex Services’, was defined as gigs that require human skills to deliver the desired outcome and usually command higher prices and longer-term engagement. In other words, those gigs have a better moat against AI disruption. Such gigs may be mobile app development, e-commerce management, financial consulting, and AI development. According to Kaufman, that group’s share of the total GMV increased from 25% in 2022 to 32% in 2023. The second group, called ‘Simple Services’, was defined as gigs that are prone to AI disruption such as translation and voice-over services, and are usually associated with lower prices and shorter-term engagement. That group’s share decreased from 28% in 2022 to 23% in 2023. The third group is NFT-related gigs, which almost evaporated in 2023 to only 0.5% of the GMV, versus 2.5% in 2022. The fourth and last group is all the other gigs, which remained steady at ~44% of the GMV in 2022 and 2023.

One might assume that the growth of the ‘Complex Services’ at the expense of the ‘Simple Services’ – given their higher prices and longer engagements – would significantly boost Fiverr’s GMV. However, Fiverr’s GMV grew by only 1% in 2023, its slowest growth ever. CEO Kaufman mentioned during the earnings call that this growth is on the backdrop of weak U.S. job openings and professional staffing, hence it’s something to be encouraged by. To be honest, I would expect a soft “traditional” job market, or God forbid, a possible recession, to benefit Fiverr to a larger extent. Those of you who remember Kaufman’s first interview on CNBC after the IPO in 2019 may recall the ambitious CEO suggesting that Fiverr may be a counter-cyclical business and benefit from a recession. Something must have changed that paradigm since then, and AI seems like the usual suspect.

To understand what drives this mere growth in GMV, we need to go back to ‘Fiverr 101’ and recall the two factors that propel the GMV; Active Buyers and Spend Per Buyer (or ‘SPB’).

During 2023, the company’s Active Buyers fell by 5%, indicating that Fiverr is suffering from an alarming churn within its platform. This was the first year ever (at least since going public in 2019) that Fiverr experienced a YoY decrease in Active Buyers. Although CEO Kaufman and his team attribute this to the macroeconomic environment, saying they focus on the quality of the buyers rather than the quantity, investors may ask themselves whether the macro narrative is the only culprit to blame. By contrast, Fiverr’s competitor Upwork registered a decent 5% growth in its equivalent metric of Active Buyers during 2023.

Source: Author’s Process of Fiverr’s Shareholders Letters

The second driver of GMV is the Spend Per Buyer, the ‘SPB’. In 2023 the SPB grew by 6%, a modest growth, yet marking a 77% increase since June 2019, when the Israel-based company went public. I consider the single-digit SPB growth to be acceptable, given the scale of the gigs on Fiverr’s platform, which are known to be smaller and more straightforward tasks than those offered, for example, on Upwork’s platform.

Bulls will highlight Fiverr’s management team notes from the earnings call that it’s targeting buyers with larger budgets, shifting its focus to SPB growth rather than Active Buyer growth, and doubling down on the complex categories, at least in this market environment.

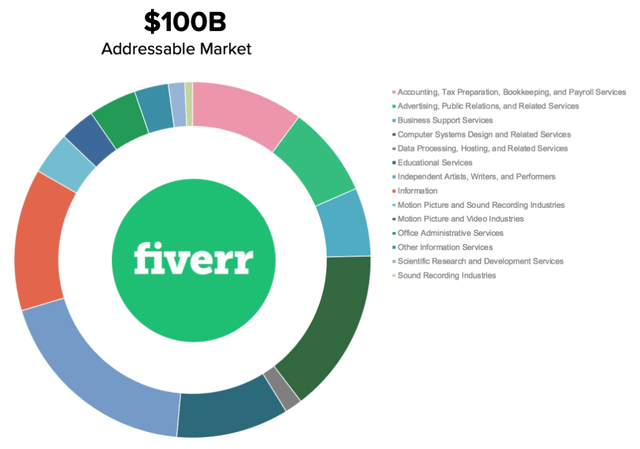

Now, investors can take Fiverr’s commentary at face value, but the problem with that is the current GMV is stagnating and is expected to continue to stagnate in 2024, per Fiverr’s outlook. In other words, for now, the SPB growth is only offsetting the Active Buyers’ decline, and nothing more than that. My main concern is that Fiverr may eventually suffer from a double-whammy of becoming a marketplace for ‘complex services’ yet at relatively very low prices. What do I mean? – For comparison, you can look at Upwork, which is known as the go-to-marketplace for large, complex projects, and see its version of SPB, called ‘GSV per Active Client’, reaching more than $4,800 in 2023. Upwork achieves this with only ~850K Active Clients and a Take Rate of just 17.2%, implying that Fiverr’s efforts to capitalize on the ‘complex services’ domain may turn out too ambitious based on its current market positioning and value proposition to stakeholders. Fiverr started with the idea of people buying and selling digital services the same way as physical goods on an e-commerce platform, becoming a one-stop shop for digital services while democratizing access to freelancing services. Many times Fiverr’s model has been compared to the one of Amazon. Perhaps this is inevitable due to AI disruption, but becoming a go-to platform for primarily ‘complex services’ seems like scaling back from Fiverr’s original $100B TAM inspirations which included a lot of ‘simple services’, now prone to AI disruption.

Source: Fiverr’s Investors Presentation (July 2019)

Valuation: General Assumptions

Many market participants will usually prefer to value a company like Fiverr using the relative approach, also known as ‘pricing’. It’s much easier than the intrinsic value approach, but in this article, I would like to explore the value case for Fiverr. Looking at the company’s cash flow statement and balance sheet, Fiverr may look like a solid candidate for a value stock; positive free cash flow for the last four years, positive book value, tons of cash on its balance sheet, and for the first time in 2023 – a bottom line GAAP profit. On the other hand, Fiverr’s financial results are not stable at all, so I will provide a few scenarios as part of my DCF valuation.

But first, a few general assumptions; I assigned a cost of equity of 11.8% and a synthetic cost of debt of 10% (Fiverr’s current debt is zero-coupon). Moreover, I assumed a terminal tax rate of 25%, which altogether generated a weighted average cost of capital, or WACC, of 10.3%. In addition, I assumed a conservative perpetuity growth rate of 2.0%.

From Capex’s perspective, Fiverr’s requirements are extremely low, with an average of just $1.4 million since 2017. In my DCF, I assumed $1.3 million per annum throughout the forecast period. I also calculated the value of Fiverr’s equity options to be worth $20.1 million, using the Black-Scholes model. These options have an equity claim on the firm, so we need to subtract them from the implied equity value to generate the common stock equity value. Finally, I added to the number of shares outstanding (~38.6 million shares) the restricted stock units as well (~1.5 million).

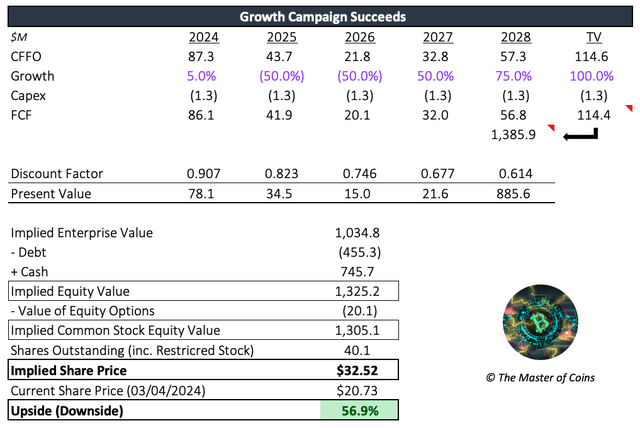

Scenario #1: New Growth Campaign Succeeds

In this scenario, I’m assuming that Fiverr will steadfastly adhere to its modest growth plans throughout 2024, aligning with the management team’s conservative outlook for that year. However, starting in 2025, Fiverr will spend much more heavily trying to reignite the business again, so it will generate 50% less cash flow from operations (or ‘CFFO’) in 2025 and 2026, back to the levels seen in 2020 and 2021. Because I do not expect an immediate tailwind like COVID again, I assume that Fiverr will successfully bear fruit from 2027 onwards, growing its CFFO at a very high double-digit rate.

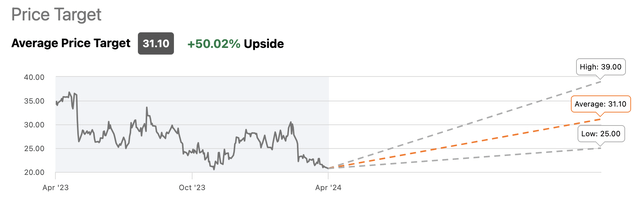

As you can, this scenario implies a share price of ~$32.5, almost a 57% upside from the current price level, which is also pretty much in line with Wall Street analysts’ average price target of $31.10.

Seeking Alpha Wall St. Analysts’ Rating

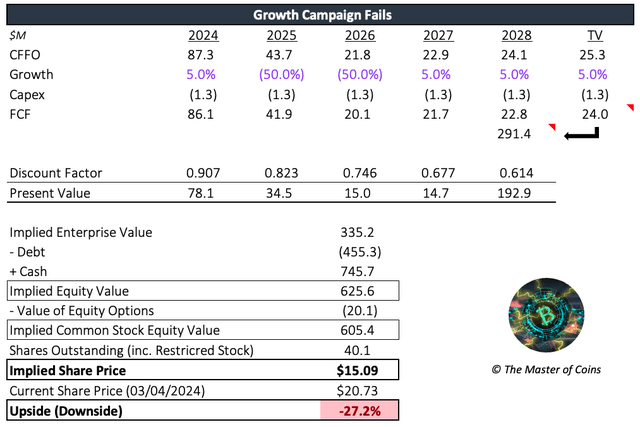

Scenario #2: New Growth Campaign Fails

In this scenario, I’m assuming again that Fiverr will steadfastly adhere to its modest growth plans throughout 2024 and try to reignite its business in 205 and 2026, but this time the new growth campaign fails, whether because of poor business execution or extended AI cannibalization. As a result, the CFFO will stabilize in 2027 onwards, but at a very low rate.

As you can see, this scenario implies a downside of more than 27% from the current price level. This means that Fiverr’s current stock price, which many investors consider ‘cheap’, might still be expensive if Fiverr is unable to reignite its business again.

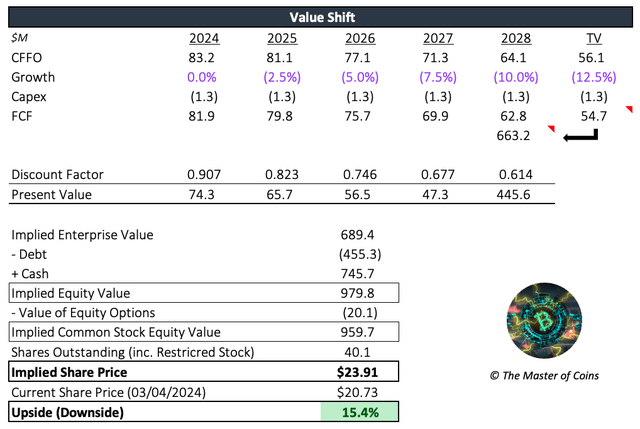

Scenario #3: Long-Term Shift To Value Preservation

In this scenario I explore a possibility that many market participants, and perhaps even Fiverr’s management team, might find highly unlikely; however, I believe it’s important to present. Suppose Fiverr’s management decides to take a drastic step by abandoning their ambitious growth and TAM capturing plans, and instead focusing on value preservation. Here, I will assume that Fiverr’s 2024 results will be even worse than expected, leading the management team to decide on cutting their growth expenses throughout the forecast period, focusing on maintaining the current Active Buyers base of more than 4 million buyers, end eventually experiencing only a slow decline in CFFO. Fiverr may also consider paying small dividends to its shareholders or doing equity buybacks (I would be cheering for the former).

This scenario implies more than ~15% upside from the current price level, but I will be fully honest with you the only way I can see this scenario playing out is if an activist investor initiates a position in Fiverr and starts shaking things up. The reason for that is what I consider to be the DNA of Israeli tech companies and Fiverr’s DNA in particular. I find it hard to believe that CEO Kaufman will agree to change the strategy of the business so dramatically.

This scenario suggests a potential upside of over 15% from the current price level. However, I must candidly share that in my opinion, such a shift is likely only if an activist investor initiates a position in Fiverr and pushes for that move. This skepticism stems from what I perceive as the inherent characteristics of Israeli tech firms and, more specifically, Fiverr’s organizational culture. I find it hard to envision CEO Kaufman agreeing to such a radical change in the company’s strategic direction.

The Verdict

With 2024 anticipated to be very similar to 2023 for Fiverr, the focus automatically shifts to 2025 and beyond and the potential of Fiverr to revitalize its business. While Fiverr’s bulls will argue that the company will eventually manage to reignite its marketplace without suffering significant disruption from AI technologies, bears will argue that Fiverr’s high growth days are behind it, as the 2024 outlook only reinforces, with AI disruption being a permanent threat to its business model, and not a transitory one. I tend to go with the bearish thesis for now, and assuming we are only in the first innings of an AI revolution, Fiverr may be subject to much more disruption than anyone can foretell. This leads me to assign the following probabilities to each of my valuation scenarios:

| Growth Campaign Succeeds | Growth Campaign Fails | Value Shift | |

| Price Target | $32.52 | $15.09 | $23.91 |

| Probability | 20% | 75% | 5% |

Using the probabilities I assigned for each scenario, my weighted average price target is $19.02, implying an 8.3% downside for Fiverr’s stock. In other words, I believe Fiverr is still overvalued considering its threats, therefore I would downgrade it to a ‘Sell’ rating.

Google

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.