Summary:

- The long-term gig work thesis remains strong, with Fiverr well-positioned to capitalize on the shift towards flexible work arrangements.

- Fiverr’s new professions catalog and AI tool Neo enhance its competitive edge, while the AutoDS acquisition strengthens its dropshipping capabilities.

- Financial performance shows growth in sales and gross margins, but declining active buyers and challenging macro conditions pose risks.

Morsa Images/DigitalVision via Getty Images

I first reviewed Fiverr (NYSE:FVRR) back in January. I liked that the company was founder-led and thought the organization seemed well positioned to take advantage of the growing trend of remote and freelance work.

Since that article, the stock is down nearly 10% and year-to-date, the company is still underperforming compared to the S&P 500 as Fiverr is slightly down.

Despite the mediocre returns of 2024, I still am bullish on the company as I feel they are set up for success in the years to come.

Let’s dig into recent events and the company’s recent financial performance.

Gig Economy is Here to Stay

One reason I remain bullish on Fiverr’s long-term prospects is because work is changing. I believe the COVID-19 pandemic uprooted the standard 9-5 job and brought to light the possibilities of remote work.

In the years following the pandemic, numerous companies had mandated employees go back to the office. However, I think more companies have created hybrid working models and many have gone fully remote. I believe if a company is looking for the best talent, you’ll work out an arrangement beneficial for both parties. One recent example is Starbucks poaching Brian Niccol from Chipotle, and they have stated Niccol doesn’t need to relocate or exclusively work in the company’s Seattle headquarters. Now, I know this might be an exaggerated example as these are CEOs leading from afar, but I believe in the years to come this eventually will be more of the norm as companies who want top talent will need to offer flexible arrangements.

This is the type of freedom employees will be looking for in the years to come, and there’s where the gig economy comes into play. Recently, LinkedIn co-founder Reid Hoffman stated he believes the 9-5 workday will become a thing of the past.

Hoffman went on to say, “You may not do a lot of your work fully as an employee, you may actually be working in the gig economy where you may have two or three gigs. These are the directional changes from what we’ve seen in the workforce for the last few decades.”

I don’t think the 9-5 we see today will disappear, but I do think remote work has led to individuals wanting more freedom and if their current employer doesn’t allow such flexible arrangements, the gig economy will.

Acclaimed investor and entrepreneur Naval Ravikant shared statements similar to Hoffman as he believes more individuals are looking at the benefits the gig economy allows, such as flexibility and more creativity. Ravikant stated, he thinks, “In 50 years, everyone will be working for themselves.”

Again, I doubt “everyone” will be working for themselves, but I certainly think it’s trending that way as more individuals want what gig work can provide and as a leader in this particular space Fiverr is in an excellent position to assist both buyers and sellers in the gig economy.

Lastly, Product Release and New Acquisition

One of the key additions to Fiverr’s business associated with their Summer Product Release was the addition of the professions catalog. As I noted in my prior article, it seemed like Upwork (UPWK) was doing a better job of hiring professionals and enabling businesses to hire freelancers for longer periods. I think this addition will help round-out Fiverr’s offerings and compete more directly with Upwork. The company’s CEO, Micha Kaufman had this to say about the professions catalog, “With the introduction of a professions-based catalog and the ability to initiate time-based transactions and contracts, we are enabling businesses to hire long-term freelancers who act as part of a team with ongoing tasks and goals. This is not an area we competed in historically, but as we increasingly go upmarket and lean into complex service categories, it becomes essential to round up our offerings. We believe it will significantly expand our direct addressable market, allowing us to open up top-of-funnel, specifically for traffic with long-term hiring intentions.”

The other big component of Fiverr’s summer product release was the further integration of the company’s AI tool, Neo. The company is hoping customers can more easily navigate through Fiverr’s massive catalog with the help of Neo and provide more relevant recommendations.

Fiverr also recently acquired AutoDS in July. AutoDS is a dropshipping software provider. Fiverr has had dropshipping as a category for numerous years and has seen recent growth in this category, which is why the company decided to acquire AutoDS. On the Q2 earnings call, Kaufman had this to say about the acquisition, “AutoDS is practically in the software space related to dropshipping, is the number one player in the world. It’s a fast-growing company, we love the team, it’s extremely synergic with our business for a number of reasons. It allows us to double down on dropshipping, e-commerce, social media, user-generated content, and video categories, which is, as I’ve said, some of the fastest growing categories on Fiverr. It’s a community that we know very well and feel very strongly about.”

Risks

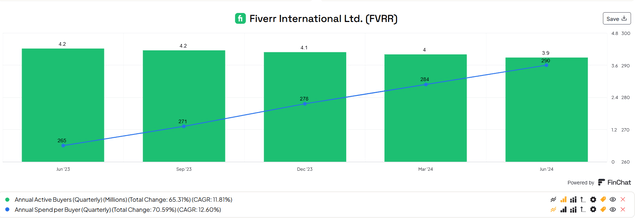

As the graphic below illustrates, Fiverr’s active buyers have continued to decline. However, annual spend per buyer continues to grow:

Finchat.io

As management has noted, the company’s focus currently isn’t to get more buyers, but to continue to increase buyer spend. If the number of active buyers continues to drop without the offset of additional buyer spend, this would certainly impact the business.

Also, management did note current macro conditions with are impacting small and midsize business (SMB) On the earnings call, Kaufman stated,

“First, macro environment continues to be challenging in terms of SMB and the sentiment of hiring. And I think that there’s a few stats that are worth calling out here. So we have the small business index that continues to linger at the lowest levels in a decade. You have the job opening that are down 7% year-over-year and in the tech sector, specifically they’re down 17% year-over-year and you have professional staffing that is tracked through staffing hours that is also down 7% year-over-year, which is slightly worse than it was a year ago.”

While there seems to be less probably of a hard landing occurring in the United States, worsening economic conditions would surely continue to hurt SMB.

Financials

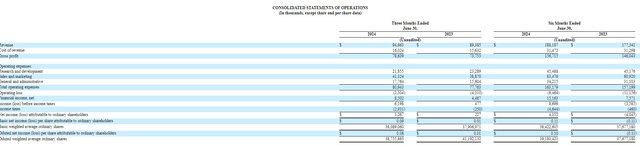

In Q2 2024, Fiverr delivered sales of roughly $94 million, which is an increase of 6% compared to the prior year quarter. GAAP gross margins were 83.1% for the quarter, which is slightly better than 82.5% in Q2 2023. Also, as you can see, the company posted a profit for this quarter and YTD compared to net losses in the prior year:

SEC.gov

However, as operating expense have increased as well, I believe financial income is ultimately why the company is posting net income in 2024.

From a cash flow perspective, the company had free cash flow of $20.7 million for the second quarter of 2024, which is an increase of 12% compared to Q2 2023. Fiverr used their cash to repurchase $100 million of stock in April in accordance with the company’s buyback program.

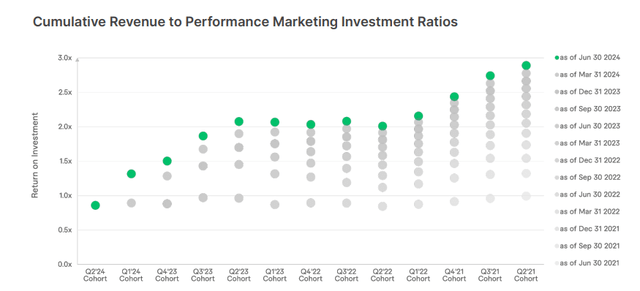

For the quarter, active users did decline by 8% as the company had 3.9 million as of June 30, 2024, compared to 4.2 million users in the prior year second quarter. However, buyer spend did increase by 10% compared to the prior year. Relating to buyers, the company is seeing strength in cohort behavior. The below graphic illustrates the efficiency of the company’s strategy as the LTV to CAC ratio continues to improve:

Investor Shareholder Letter

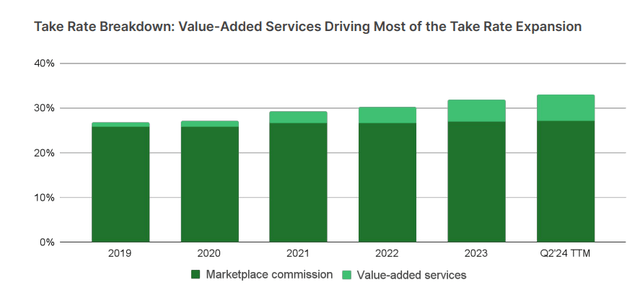

In Q2 2024, Fiverr’s overall take rate was 33% and as you can see in the below graphic, the company has increased their take rate over the last several years, largely due to the monetization of value-added services:

Investor Relations Shareholder Letter

This is certainly another positive as the company looks to continue to increase buyer spend.

Valuation

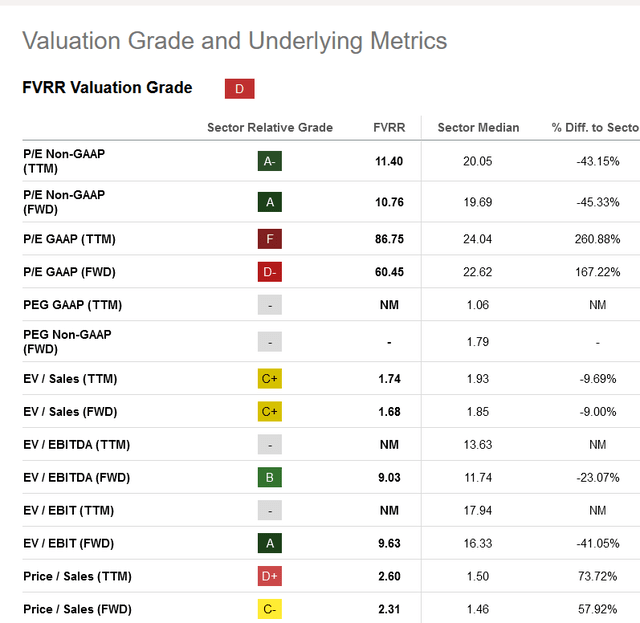

Fiverr has a valuation grade of a “D” at Seeking Alpha:

Seeking Alpha

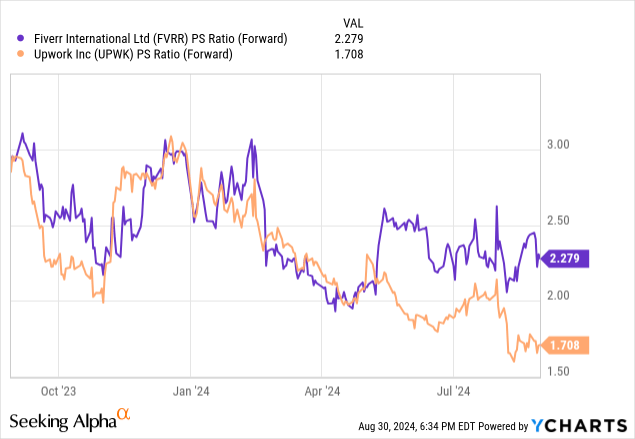

I believe price to sales is likely the best metric for this organization. Despite forward-looking price/sales of 2.31 beating the sector median, the company’s ratio has come down compared to where it started the year:

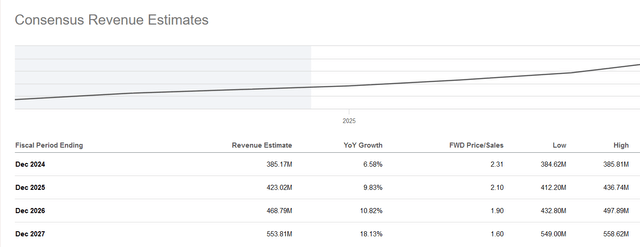

Although Fiverr’s forward P/S is higher than Upwork’s ratio of 1.708, I believe that’s justifiable as analysts are projecting growth of 10% or greater in the coming years:

Seeking Alpha

This projected growth is higher than Upwork’s projected growth and given Fiverr’s move to sell more upmarket I think Fiverr’s outlook is brighter and is the stock I’d prefer to own of the two. Given these various factors, I think Fiverr’s current valuation is reasonable.

Conclusion

I do believe the long-term thesis for gig work remains strong, as more workers are looking for flexibility and freedom that a standard 9-5 job no longer allows.

I think the launch of a profession-based catalog will allow Fiverr to move upmarket and complete for more opportunities within the gig economy.

I will keep an eye on active buyers because if buyer count continues to drop, Fiverr must continue to get their number of frequent active buyers to spend more.

Fiverr’s current valuation remains reasonable, and I think investors can feel comfortable adding shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.