Summary:

- Fiverr’s Q1 earnings showed growth in revenue and earnings, with progress in upmarket expansion and complex services, leading to higher spend per buyer and increasing profitability.

- FVRR continues to innovate its Fiverr Business Solutions by improving seller visibility and accountability, while adding flexible payment options for high-value buyers.

- At the same time, the management is doubling down on agencies to scale its presence in complex services which have higher transaction values.

- Although fundamentals are improving, the recent surge in the stock prices has squeezed its valuation from a risk-reward perspective, making it a Hold.

Images By Tang Ming Tung/DigitalVision via Getty Images

Introduction & Investment Thesis

I initiated a “buy” rating on Fiverr International (NYSE:FVRR) in early May before its Q1 earnings, where I believed that the worst had been priced in for the stock, as the management started seeing success with its progress upmarket and gaining market share in complex services, allowing it to expand its spend per buyer and overall profitability.

The company reported its Q1 FY24 earnings on May 9th, shortly after my post, where it saw its revenue and earnings grow 6.3% and 41% YoY, respectively. This led to the stock gaining approximately 19% during this period of time. In Q1, the company continued to show progress in growing upmarket, with high-value buyers who spend at least $500 annually growing 4% YoY, which led to an 8% YoY growth in spend per buyer, despite declining Active Buyers on the platform. At the same time, the management is doubling down on agencies to further penetrate into complex services, which contributed 33% to Total Revenue in Q1.

Although Fiverr raised their revenue and earnings guidance for FY24, I believe that the recent surge in the stock has capped the upside potential, relative to the first time, when I had issued a “buy” rating based on my estimate for an upside of roughly 38%. Taking the current earnings results into account, I believe that there is a possibility of another 15% from its current levels, which I don’t think looks attractive from a risk-reward standpoint, especially, as the S&P 500 making new highs with its PE ratio extended at 21.7, which is higher than the 5- and 10-year averages. Therefore, I will change my rating from a “buy” to a “hold” at the moment.

Building the bull case

Spend per buyer grows as Fiverr continues to progress upmarket

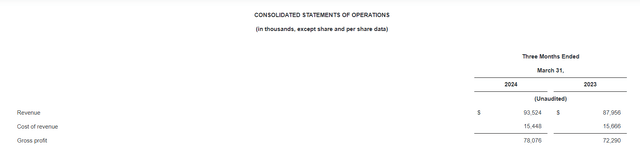

Fiverr is a digital services marketplace that connects businesses (buyers) with freelancers (sellers) in over 700 categories of services, known as Gigs, that include Graphics & Design, Digital Marketing, Programming & Tech and more. The company reported its Q1 FY24 earnings, where it saw revenue grow 6.3% YoY to $88M. Similar to the previous quarter, the company is experiencing a decline in its Active Buyers, which declined 6% YoY to 4.0M. However, spend per buyer continues to rise, growing 8% YoY to $284, as the company continued to scale their product innovation in Fiverr Business Solutions to target upmarket customers as well as drive investments in gaining market share in the complex services category.

Q1 FY24 Earnings Release: Fiverr’s revenue growth

Pertaining to the company’s strategic priority of moving upmarket, it saw high-value buyers who spend over $500 annually for 4% YoY, at a similar pace to the previous quarter, and contributing 64% to Total Revenue in Q1. In my previous post, I discussed how the company is rapidly innovating its Fiverr Business Solutions by leveraging AI to better match their business clients with talent in order to solve the skills gap and create a longer-lasting relationship with growing usage on the platform. During the earnings call, Micha Kaufman, CEO of Fiverr, discussed that they continued to onboard new Fiverr Enterprise clients in Q1, as Fiverr continued to drive product innovation to improve seller visibility and accountability through AI-powered ratings and verification processes, while adding flexible payment options for high-value buyers to remove friction and improve conversion for larger transactions on the platform. The management also shared a customer success story of Mighty & True, where the client saw a 50% reduction in expenses related to managing contractors and increased profitability per job by 20% after tripling the number of freelancer relations by using Fiverr Enterprise, which I believe showcases Fiverr’s strong value proposition as well as the opportunity to drive deeper adoption with their clients, given their strong product innovation.

Fiverr’s investment in complex services continues as they double down on agencies

Moving on to the second business priority of increasing market penetration in complex services, Fiverr saw a double-digit rate, with complex services contributing 33% of Total Revenue, as demand in chatbot development accelerated, given the proliferation of genAI technologies, as well as strong demand for website development and search engine optimization services. The management also discussed that they are doubling down on agencies in order to drive market penetration, especially as complex services tend to be longer-duration projects with average transaction sizes that are 4 to 5 times higher with an agency service provider than with an individual freelancer agreement. I believe that agencies will be key to building long-term relationships with customers, especially as Fiverr progresses upmarket, allowing companies to search and find full-service agencies for large and complex projects.

The management showcases commitment to driving profitability

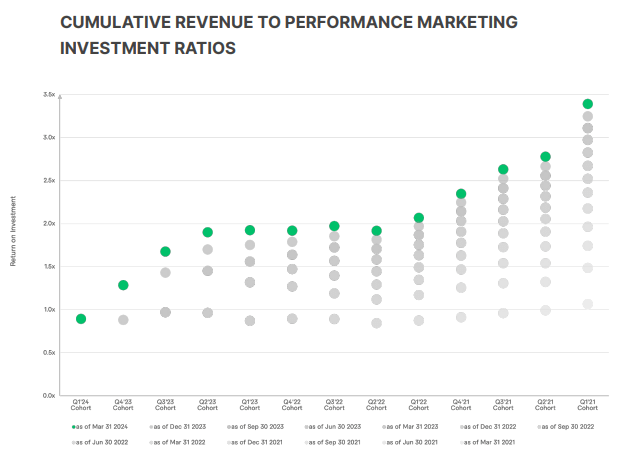

Fiverr generated an Adjusted EBITDA of $16M, up 41% YoY, with a margin of 17.1%, which grew 430 basis points YoY. The management continues to remain highly disciplined in driving profitability, with Sales & Marketing spend remaining flat YoY while R&D spend grew 4%, lower than the rate of revenue growth. I am also optimistic about how the company is focusing their buyer mix towards higher lifetime value customers, with repeat buyers contributing 67% of Total Revenue, which grew sequentially from 66% in Q4. Plus, the company also announced its first-ever stock repurchase program of $100M, which I believe showcases the management’s confidence in the long-term opportunity of its business model and commitment to shareholder value.

Q1 FY24 Earnings Report : Growing LTV/CAC for buyer cohorts

Building the bear case

A continuing drop in Active Buyers can spell trouble for Fiverr’s growth trajectory

Although Fiverr is showing progress by increasing spend per buyer as it drives its efforts growing the market and penetrating in complex services, overall Active Buyers continue to decline on the platform. If the rate of decline in Active Buyers grows, relative to the pace in which Fiverr adds new upmarket customers, it will lead to a slowdown in revenue growth. While I believe that the push in complex services is a strategic move, as these jobs are less likely to be affected in the event of a macroeconomic slowdown, there is an uncertainty of how a weakening labor market in the US and globally will impact Fiverr’s top-line growth. At the same time, Fiverr needs to continually invest in innovating its solutions to maintain its competitive positioning, which could lead to further margin pressures down the line, if the decline in Active Buyers continues, coupled with a slowdown in its upmarket segment.

Fiverr’s valuation shows that the upside may no longer be attractive from a risk-reward standpoint

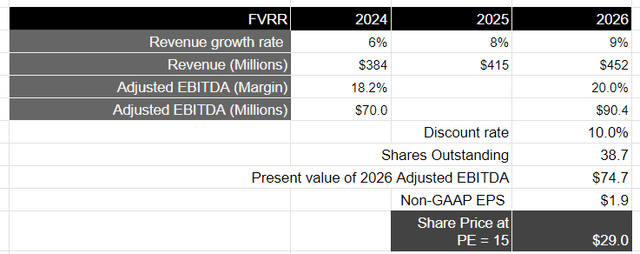

Looking forward, the management raised the lower bound of their guidance for both revenue and earnings in FY24. The company is now expected to grow 6% YoY to $384M, compared to $383M in the previous guidance, while simultaneously projecting to generate an Adjusted EBITDA of $70M, with a margin of 18.2%. I believe that Fiverr should be able to reach its FY24 revenue and profit targets as it progresses upmarket with its continuous set of product innovations, while penetrating further into complex services, thus allowing it to increase spend per buyer while unlocking operating leverage.

Over a 3-year time horizon, I will maintain the same set of assumptions as I did in my first coverage, where I expect Fiverr to return to growing in at least the high single digits over the next couple of years, as it continues to gain traction growing upmarket and into complex services, thus unlocking higher spend per buyer, generating $452M in revenue by FY26. Assuming the company continues to streamline its operating expenses as it focuses on buyers with a higher lifetime value, I believe margins should expand from a projected 18.2% in FY24 to at least 20% in FY26. This would translate to an Adjusted EBITDA of $90M in FY26, which is equivalent to a present value of $75M when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period with a price-to-earnings ratio of 15-18, I believe that Fiverr should trade at par with the index given the growth rate of its earnings, which would translate to a price target of $29, or an upside of 15%. Please note that my price target has not changed between the two writings.

When I wrote about the stock before its earnings, I firmly believed that it was attractively priced from a risk-reward perspective. However, post its earnings result and a spike of 19% during a short period of time, I believe that the upside looks capped, especially as the PE ratio of the S&P 500 is extended from its 5 and 10-year average of 19.1 and 17.7, respectively, increasing the odds of a sizable pullback of 10% or more to revert its PE to the 10-year average. Given that Fiverr has a beta of 1.69, a decline of 10% or more in the S&P 500 can translate into over a 16-17% decline for Fiverr, in which case there is no net upside for the stock at its current levels, making it a “hold”.

Conclusions

I am impressed by the execution of Fiverr’s management and remain optimistic about the company’s priorities in moving upmarket and gaining complex services. While the company’s fundamentals are improving with increasing spend per buyer and higher profitability, I believe the stock price doesn’t look attractive anymore from a risk-reward standpoint with limited upside, making it a “hold”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.