Summary:

- Fiverr’s stock has plummeted but now trades at a more reasonable valuation, presenting a buying opportunity with a potential upside of 28%.

- FVRR has matured, showing improved gross margins, increased spend per buyer, and a strategic focus on high-value clients despite a decline in active buyers.

- Long-term growth prospects are promising, driven by investments in AI, freelance Pros, and expanding market opportunities, with management targeting a 14% FCF CAGR from 2024-2027.

- Risks include market volatility, potential regulatory changes, and competition, but Fiverr’s improved cash flow and strategic buybacks indicate a more stable future.

azerberber/iStock via Getty Images

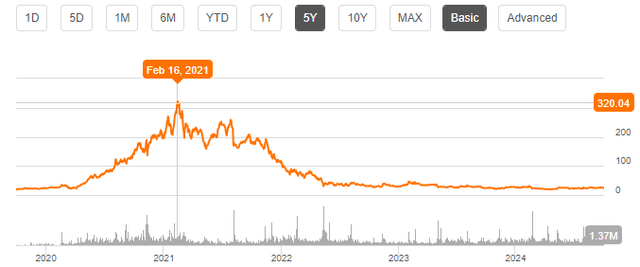

It has been almost two years since my last article on Fiverr (NYSE:FVRR), and many things have changed. At the time I believed that the stock was highly overvalued despite the 92% collapse, and my hunch turned out to be right.

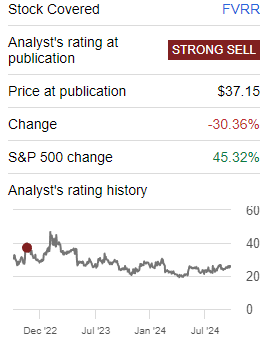

Seeking Alpha

Since then, the stock has plummeted 30%, largely underperforming the S&P500. Ironically, the stock bottomed out at $20 per share, which is the fair value I had calculated for Fiverr at the end of 2022.

It is absurd to think that in 2021 Fiverr was trading at $336 per share, not even the highest expectations could justify such a valuation. In any case, that period has ended, and today Fiverr is trading at only $25 per share. Investors have scaled back their enthusiasm for this company considerably, but in my opinion they are erring once again: in the past they were too optimistic, today too pessimistic.

Why I Changed My Opinion About Fiverr

The main reason I considered Fiverr a strong sell lay in its overvaluation for its growth prospects. Gross margin was deteriorating as was free cash flow, there was no more growth in users and spend per buyer, and the platform’s fees remained high. In short, it was a disaster and the Fiverr that was growing in triple digits was long gone.

However, two years later, taking a look at Fiverr again, I was particularly surprised at its performance in recent quarters, even though the price per share is still very depressed. Fiverr has matured a lot as a company in this time frame; it will no longer grow in triple digits, but the stock is no longer trading at $336 per share, so it is not necessary for it to be a great investment.

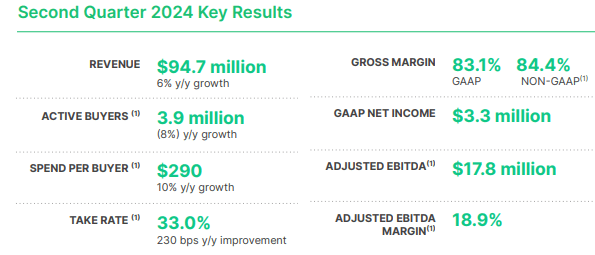

Fiverr Q2 2024

Last quarter’s results were not that bad, in fact, gross margin reached 83.10%, spend per buyer increased by 10%, and take rate improved by 230 basis points. However, market sentiment remains negative toward this company, as revenues grew only 6% and active users decreased 8%.

Fiverr is still paying the price of having grown extremely fast thanks to the pandemic, and investors today have lost interest in this company. Year-on-year growth is no longer exciting, but if we extend the time horizon, the discussion changes.

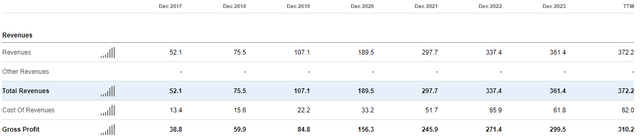

Let me remind you that before the pandemic, total revenues amounted to $107.10 million, in the last 12 months they reached $372.20 million: if we calculate the 2019-2024 Revenue CAGR, it would be 28.29%, not bad for a company with a P/E (FWD) of 11.05x. As far as I am concerned, the mere fact that it has managed to sustain pandemic demand and not decrease revenues is already a major achievement. The market probably expects too much from Fiverr, and this is a mistake because it has already shown so much improvement in recent years. The 2019 IPO was done at $31.49 per share, today it generates a 3.50x higher gross profit, but you can buy it at $25 per share. Only poor growth prospects would justify this divergence in the two valuations, but as we will see in the next session, management is already set for a new growth cycle.

Overall, it seems that Fiverr is either loved or hated; there is no middle ground. Investors may expect linear growth of 30-40% per year, but these expectations do not represent the reality in the investment world. Even the best companies in the world have downtimes, the important thing is to recover over the long term. Fiverr has never stopped growing, it simply does so less than before because the same social-economic environment is no longer there. The pandemic is thankfully over and Fiverr has benefited a lot from it, although from its current price per share it looks like it was just the opposite.

As for the decrease in active buyers, this is a strategic move adopted by management. It certainly never pleases when they decrease but behind this trend lies a plan to focus primarily on growth in spend per buyer:

I think on the spend per buyer versus active buyer, I think we’ve made the conscious choice in the last few quarters and years to really focus on higher-value buyers. These the segment of buyers with better engagement, better retention longer term. And in the current macro where overall demand is not very strong. I think leaning into the product is really focused on that segment gives us the ability to be more efficient and really growing the spend, and you’ve seen that in the growth of spend per buyer.

Jinjin Qian, EVP, Strategic Finance, Technology Conference September 9.

Accepting a decrease in active buyers to retain the most important ones on the platform sounds like a good trade-off to me, especially in the current economic environment. Interest rates are still high, and until recently inflation was still an issue.

In essence, two years later I have reevaluated the company’s strategy, and the new data at hand have led me to totally change my rating. After all, it is true that growth at this stage is low, but the valuation multiples are too low: just think that the NTM Market Cap / Free Cash Flow is only 9.35x.

Fiverr Has Not Stopped Growing

As anticipated, Fiverr’s growth has stalled in the past two years, but that does not mean the company is not interesting. The macroeconomic environment has not helped, and the pandemic has thrown smoke in the eyes of investors regarding their long-term growth expectations.

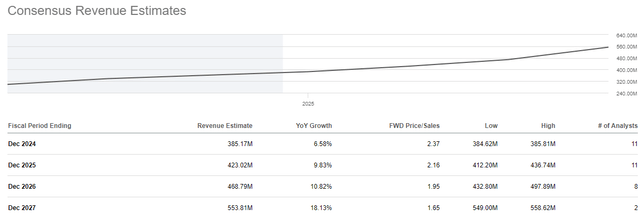

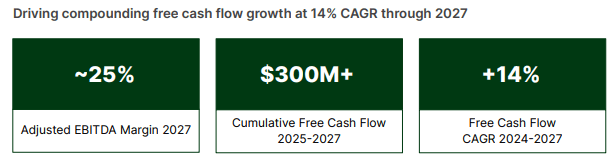

At the current price, Fiverr does not need to grow 30-40% per year to be a great investment, growth around 10% would be enough, which, I believe, is feasible. In fact, management is also quite optimistic about it since they have released these long-term targets.

Fiverr Q2 2024

The 2024-2027 FCF CAGR is expected to grow by 14% and the EBITDA margin is expected to be around 25%, an impressive figure for a company whose main goal remains expansion. Today’s Fiverr is a more mature company than in my last article, and in addition to its future it is also thinking about its present.

Recently, shares worth $100 million were purchased, the first buyback in its history. When a company gets to this point, it means that its cash flows have become more predictable, and it has enough liquidity to be able to reduce its shares outstanding: the Fiverr that diluted shareholders and was unprofitable is an old memory. At the same time, growth prospects are nevertheless bright, and I have identified three main drivers.

The first concerns the possibility of getting bigger in a huge market. Fiverr does not even generate half a billion in revenue, yet the freelance market in the United States is worth $247 billion. There is ample room to expand, and the company’s business model I believe can benefit from the new work dynamics of the future. In the past, it was uncommon to be an online freelancer; today, it is not so unusual. The main advantage of Fiverr is that it allows companies to be more flexible in terms of their workforce. Through Fiverr, they can delegate individual projects without directly hiring new staff, and thus not be too dependent on fixed costs.

Delegating individual work to them is more convenient/cheaper than hiring an employee (and training them in some cases). By the way, Fiverr is increasingly meeting the needs of employers; in fact, the latest innovations include the integration of new labor contracts. For example, to encourage long-term labor relations, it has been included the possibility of hourly contracts. It is like a kind of fixed-term contract, but the person doing the task is self-employed and not an employee of the company.

In the past, Fiverr targeted anyone, today its focus is increasingly directed toward clients who can provide larger revenues, typically companies. To attract more and more of them, it is investing in the quality of its freelancers, the best of whom are identified as Pros. These Pro freelancers are not ordinary people who have made many sales, but professionals in their field, typically invited by Fiverr itself. In order for the Pros to try out their services, discounts of 5% on the total cost of the order were offered, and the results have been positive to date.

The labor market is set to evolve, and Fiverr seems to be one of the pioneers of this change.

The second growth driver concerns the platform’s improvement in matching active buyers with freelancers. The company has made many investments in AI, particularly to improve the “search with Neo” function. When a potential buyer browses through Fiverr’s catalog, he or she may be overwhelmed given the breadth of choice, but thanks to Neo, it will be easier to figure out whom to trust. Facilitating the user experience is critical, as buyers are more likely to make the right choice and rely on Fiverr again.

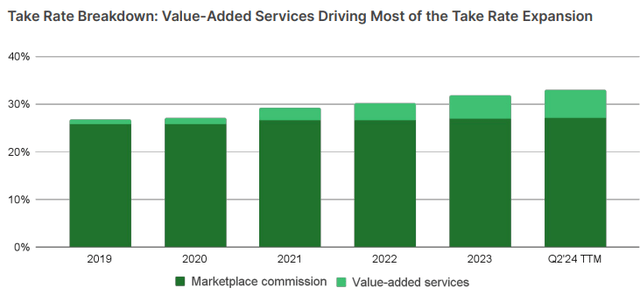

Last, but not least, driver of growth is the increase in take rate, or the ratio of revenue to GMV: compared to the previous year, it improved by 230 basis points and reached 33%.

This is important because it shows that Fiverr is able to grow even without increasing marketplace commissions, which have been firm at 26% since 2021. Value-added services are a key component for the company’s future as it allows it to diversify its revenues. In particular, these services are especially popular with sellers who want to expand their businesses and pay Fiverr to advertise their Gigs within the platform and beyond. I have worked with Fiverr in the past, and based on my personal experience I can tell you that leveraging advertising services can make all the difference. As far as I am concerned, I believe that more and more companies/people will use them to increase their orders.

In a way, there are some similarities with Amazon (AMZN), where to be at the top of the list you have to advertise your product. By the way, another curious similarity between the two companies is reflected in the huge collapse that both have experienced, albeit at different historical periods. Amazon collapsed more than 90% during the peak of the tech bubble in early 2000, the same for Fiverr but 24 years later. The two companies are totally different, but this example is to point out that even if a company collapses more than 90% does not mean it is dead. I think many people thought that for Fiverr, just as many others thought that for Amazon.

Valuation And Risks

What most convinced me to invest in Fiverr was its valuation, which was excessively depressed even discounting reasonable expectations: the stock fell too far and this created a buying opportunity.

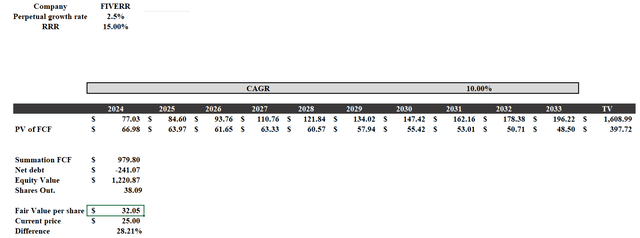

To calculate Fiverr’s fair value, I used a discounted cash flow model, whose RRR is 15%. I intentionally entered a huge discount rate given the riskiness of the investment, but as you will see the stock will still be undervalued; I also entered a perpetual growth rate of 2.50%.

As for the expected cash flows, I have made several assumptions.

The figures entered from 2024 to 2027 were calculated using a 20% free cash flow margin from Street Estimates of revenues. From the last estimate of 2027 onward, I considered a growth rate of 10% per year until 2033.

The result is a fair value of $32.05 per share, a potential upside of 28% from the current price, in addition to an RRR of 15% per year. In short, should Fiverr succeed in achieving these results, I could be confident that I have made a smart investment.

By the way, I don’t think my estimates were that unreasonable. The 2023 free cash flow margin was even higher, 22.70%, and a 10% growth rate seems conservative to me given the company’s potential. In all this, the model does not consider new buybacks that could give an additional boost to fair value.

As far as I am concerned, there are the premises for Fiverr to be a successful investment, but it is important to point out the risks as well.

First of all, Fiverr represents a very small percentage of my portfolio, being a highly speculative company. Compared to a few years ago, it has matured a lot and its cash flows are more predictable, but it is still very small and subject to high volatility. The fact that Fiverr has collapsed by 90% does not mean that the bottom has been reached. Certainly, as long as free cash flow stays positive and net debt negative it cannot go bankrupt, but it can still collapse as low as $10-$15 per share. There is no brake on market crashes, and even if a stock is undervalued, it may continue to be so for years. Are you willing to be that patient?

Another risk may be due to new regulations regarding freelancing platforms, as well as over-saturation of the industry. The labor market is constantly evolving, and we do not know what role Fiverr will play in the long term, as well as major competitors such as Upwork (UPWK). The addressable market is still large enough for everyone, but competition may increase in the future, reducing profit margins. After all, we are still in the early stages: 15 years ago, Fiverr did not even exist.

The last risk is that my estimates of future growth are wrong, so the fair value is lower; I think I have been conservative, but I don’t have a crystal ball. The growth rate may no longer reach double digits, and Fiverr may have been just a passing fad and not a pioneer.

Conclusion

Fiverr is a company that has probably gone through the most difficult period in its short history: from being loved by everyone to being disregarded. The collapse of the price per share is comparable to that of a company on the verge of bankruptcy, which I, personally, find absurd.

The growth rate shrank a lot, but because the whole sector had been inflated by the pandemic. Compared to a few years ago, everything has changed, including the macroeconomic environment: after years of very strong growth, I can justify a few subdued years.

I expect that investments in freelance Pros and AI can increase spend per buyer in the long term, just as I expect more and more companies to rely on platforms like Fiverr rather than increase their staff.

In April 2024, the stock was trading at $18.83 per share, a 94.40% collapse from its all-time high; from that low, the stock began a rapid ascent that brought it to its current price.

Just like a phoenix in ancient Egyptian legend, Fiverr is poised to rise from its ashes.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FVRR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.