Summary:

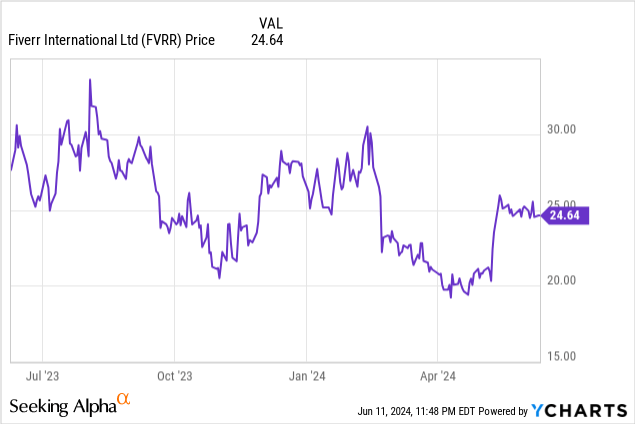

- Fiverr stock has lagged the market this year with a 5% decline, despite a recent rally fueled by a $100 million buyback plan and Q1 earnings beat.

- Fiverr’s Q1 results showed revenue growth deceleration and a shrinking buyer base, which may get worse with increased proliferation of AI.

- The only positive to Fiverr is a cheap valuation at ~9x current-year adjusted EBITDA, but this discount factors in a plethora of fundamental risks.

Gary Yeowell

The stock market continues to dance around all-time highs, and now more than ever is a time for careful stock picking and caution with fundamentally choppy names. Fiverr (NYSE:FVRR) is one stock to be careful on: the freelance work marketplace has struggled with a massive slowdown in its growth rates, even as profitability has improved.

Year to date, Fiverr has lagged the market with a ~5% decline. To bolster confidence in the stock, management announced a new $100 million buyback plan: which, at Fiverr’s current <$1 billion market cap, covers just over 10% of its outstanding shares. This news, plus a Q1 earnings beat, have sparked what I view to be a temporary rally in the stock over the past month.

I last wrote a neutral article on Fiverr in March, when the stock was still trading in the low $20s. Since then, the company has released Q1 results, which were positively received. In light of the jump in the stock price since then, however, and the worrying metrics I’m finding in the company’s results, I’m downgrading Fiverr to sell.

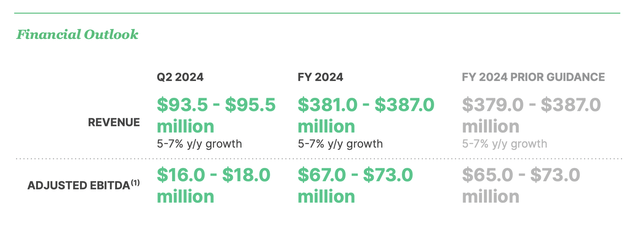

I will acknowledge, upfront, some of the strengths that Fiverr is able to tout. The company’s adjusted EBITDA margins are certainly improving, and the company is generating positive operating cash flow – enough to finance its relatively small buyback program. We note as well that the fact that Fiverr boosted its guidance for the current year is positive, especially on the adjusted EBITDA front:

Fiverr outlook (Fiverr Q1 shareholder letter)

We do have to ask ourselves though: is a ~$1 million midpoint boost to adjusted EBITDA (~2% higher than the prior outlook) and revenue (~30bps of growth) enough to justify the ~20% rally that Fiverr has sustained since its earnings release?

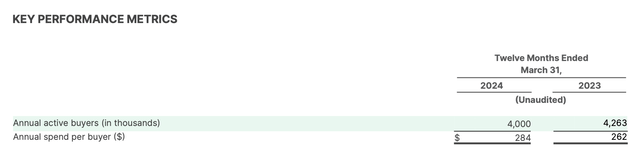

The company is putting a positive spin on things by saying that spend per buyer is accelerating. While this is true, this reality is also a function of the fact that Fiverr’s upmarket strategy is also leaving smaller customers in the lurch. Active buyers are shrinking on the lower end of the spectrum, providing an optical boost to spend per buyer. On the whole, however, revenue is decelerating.

Beyond the shrinking buyer base, here are some other red flags to keep in mind:

- AI risks. While Fiverr also tries to emphasize the fact that it’s embedding AI across its platform, there can be no doubt that AI’s increasing ease of use is a threat to many core Fiverr functions. For example – there is much less need to pay a logo designer on Fiverr now when free AI tools can craft a professional-looking logo in seconds.

- Competition. Fiverr is far from the only game in town when it comes to freelance marketplaces, with competition from companies like Upwork, Toptal, Freelancer, and TaskRabbit.

- Debt balance. Though Fiverr looks rich with cash, the company also has nearly $0.5 billion in convertible debt outstanding. With its buyback program in place, the company will be eating into its net cash balance to finance its repurchases.

All in all, I see downside for Fiverr coming off the recent rally. Steer clear here and maintain caution.

Q1 download

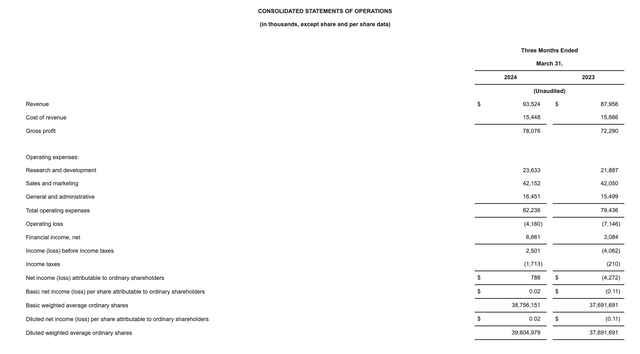

Let’s now go through Fiverr’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Fiverr Q1 results (Fiverr Q1 shareholder letter)

Fiverr’s revenue grew only 6% y/y to $93.5 million, only slightly beating Wall Street’s expectations of $92.4 million (+5% y/y). We note as well that revenue growth decelerated sharply from 10% y/y in Q4.

The company called out that the revenue beat in Q1 was driven by higher spend per buyer. There is an organic truth to this: the company is seeing success at “land and expand” efforts with larger enterprise buyers, proving out single use cases first before getting signed on for multiple projects.

Fiverr Q1 buyer metrics (Fiverr Q1 adjusted EBITDA)

However, as previously mentioned, total active buyers are also shrinking. As shown above, the company ended Q1 with 4.0 million active buyers: which is a -6% y/y decline. Fiverr defines an active buyer as any customer who has made a purchase within the trailing twelve months, which is a fairly loose definition. Spend per buyer, meanwhile, is revenue divided by the count of customers. So it’s natural that as smaller, non-habitual customers drop off, spend per buyer increases.

Here is further context from CEO Micha Kaufman’s remarks on the Q1 earnings call:

Active buyers for Q1 was 4 million and spend per buyer was $284 as we continue to double down on our upmarket efforts to attract high-value quality buyers. While overall active buyer growth was muted, high-value buyers who spend over $500 annually continued to show robust growth, up 4% year-over-year. Not only are we seeing more SMBs with deeper wallets come to Fiverr, we are also increasingly becoming a destination for mid to large sized companies to fulfill digital services.

Overall spend per buyer grew 8% year-over-year, the highest growth we’ve ever had in over a year. We are very encouraged with our progress on expanding customer wallet share, especially given its compounding impact on our cohorts and their long-term revenue streams.”

This isn’t purely a negative thing. By focusing on larger customers, the company is able to rein in its go-to-marketing and sales efforts on larger and more lucrative clients. In fact, sales and marketing expenses as a percentage of revenue in Q1 dropped to “only” 41.1%, which was a -240bps y/y reduction.

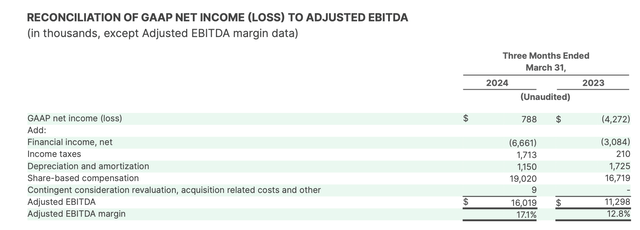

As a result of this plus a higher gross margin from an expanded take rate (as the company has been selling more Promoted Gigs and other premium features), Fiverr’s adjusted EBITDA grew 42% y/y to $16.0 million, while adjusted EBITDA margins expanded 530bps y/y to 17.1%:

Fiverr Q1 adjusted EBITDA (Fiverr Q1 shareholder letter)

Valuation and key takeaways

At current share prices near $25, Fiverr trades at a market cap of $953.6 million. After we net off the $766.6 million of cash and $455.9 million of convertible debt on Fiverr’s most recent balance sheet, the company’s resulting enterprise value is $642.9 million.

Against the midpoints of the company’s revenue ($384 million, 6% y/y growth) and adjusted EBITDA ($70 million, 18% margin) targets for the year, Fiverr trades at:

- 1.7x EV/FY24 revenue

- 9.2x EV/FY24 adjusted EBITDA

No doubt that Fiverr’s single-digit adjusted EBITDA multiple is compelling. But in my view, that’s a discount that factors in a variety of risks, including and especially customer shrinkage and Fiverr’s future compatibility with automated AI tasks. Especially at all-time market highs, I’m not willing to take this bet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.