Summary:

- Fiverr stock surged 20% after Q2 results, despite only slightly raising its full-year outlook.

- The company does offer a cheap valuation, but that’s a reflection of slowing growth and nascent risks from the increased AI-driven automation of tasks often assigned to freelancers.

- The company’s active buyer base continues to decline, and given Fiverr’s exposure to the SMB segment, this trend is set to continue.

gorodenkoff/iStock via Getty Images

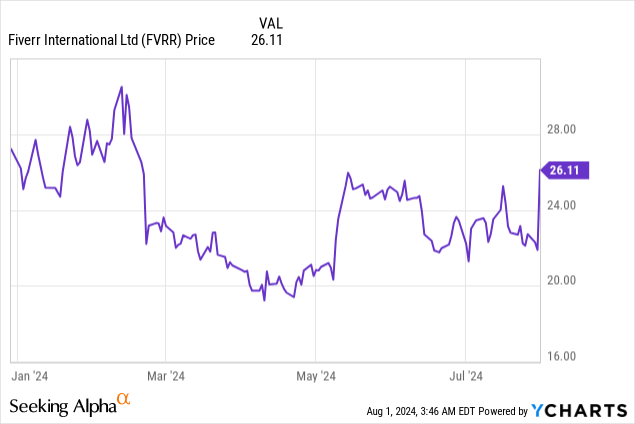

For the most part, many companies have disappointed so far in the Q2 earnings season, but a lot of small and mid-cap companies have managed to buck the recent volatility. Fiverr (NYSE:FVRR) is one of these fortunate names: the freelance marketplace surged nearly 20% after reporting Q2 results, despite barely beating current quarter expectations and similarly barely raising its outlook for the full year.

Fiverr has struggled in the post-pandemic era to defend its niche. While rival Upwork (UPWK) has continued to find success by primarily targeting enterprise buyers, Fiverr still remains more of an individual user and SMB story: and in a climate where everybody is watching spending levels, the company’s buyer base has continued to shrink. The post-earnings rally has taken Fiverr’s stock to roughly flat YTD (underperforming the S&P 500 by quite a bit), but I think this will be a short-lived relief rally that will give way to further losses.

Despite a slight guidance boost and still-cheap valuation, Fiverr doesn’t have enough fundamental excitement to drive a sustained rally

I last wrote a bearish article on Fiverr in June, when the stock was trading lower at ~$24 per share. I’m unconvinced that Fiverr is on a materially stronger trajectory following Q2 earnings, and in my view the sharp rally that the stock has enjoyed since then makes the likelihood of a reversal even more daunting. As such, I’m reiterating my sell rating on Fiverr.

The only appeal I see to Fiverr, and the main “upside risk” I see to the bear case here, is the stock’s rather cheap valuation. At current share prices near $26, Fiverr trades at a market cap of $1.01 billion. After we net off the $704.0 million of cash and $456.6 million of convertible debt off Fiverr’s most recent balance sheet, the company’s resulting enterprise value is $763 million.

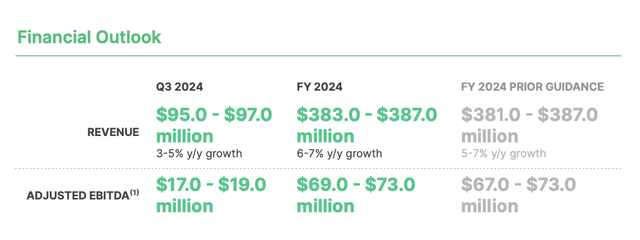

Meanwhile, the company has raised its latest full-year FY24 outlook by a smidge to $383-$387 million in revenue (or 1 point of growth higher on the low end of the range, with the high end maintained) and $69-$73 million in adjusted EBITDA, or an 18% margin at the midpoint.

Fiverr outlook (Fiverr Q2 shareholder letter)

This puts Fiverr’s valuation multiple at:

- 2.0x EV/FY24 revenue

- 10.7x EV/FY24 adjusted EBITDA

But in my view, despite a cheap valuation, Fiverr lacks the fundamental catalysts to spark an upward multiples re-rating. In fact, the company is shouldering quite a number of red flags and risks:

- AI risks. While Fiverr also tries to emphasize the fact that it’s embedding AI across its platform, there can be no doubt that AI’s increasing ease of use is a threat to many core Fiverr functions. For example – there is much less need to pay a logo designer on Fiverr now when free AI tools can craft a professional-looking logo in seconds.

- Highly competitive landscape for freelance work. Fiverr is far from the only game in town when it comes to freelance marketplaces, with competition from companies like Upwork, Toptal, Freelancer, and TaskRabbit.

- Volatile traffic metrics. Fiverr itself has noted that traffic trends tend to be quite volatile, and one quarter’s success doesn’t mean that better traffic can be sustained.

- SMB exposure. Fiverr has a heavy concentration of smaller individual and SMB clients, which have been the biggest source of churn across the software industry this year. Fiverr’s own active buyer base is shrinking, a testament to tougher macroeconomic conditions for smaller firms.

Steer clear here and resist the temptation to ride this rally.

Q2 download

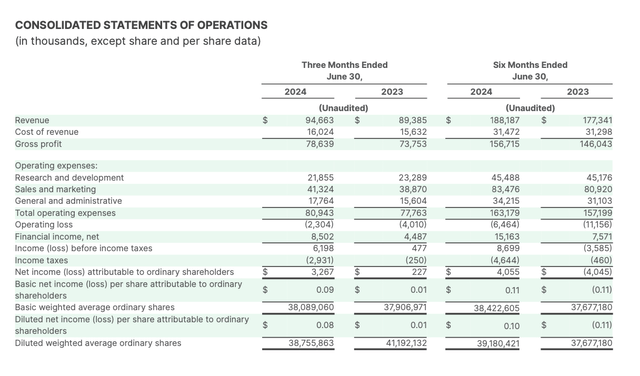

Let’s now go through Fiverr’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Fiverr Q2 results (Fiverr Q2 shareholder letter)

Revenue grew just 6% y/y to $78.6 million, in-line with Wall Street’s expectations and also in-line with Q1’s 6% y/y growth rate.

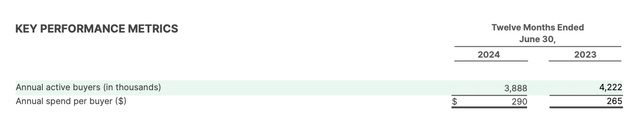

The fact that Fiverr isn’t seeing revenue growth rates slip is comforting. What’s worrying, however, is the continual slippage that we’re seeing in the active buyer base. As of the end of Q2, Fiverr’s active buyers declined to 3.89 million, which represents a -8% y/y reduction versus the prior-year Q2.

Fiverr active buyers (Fiverr Q2 shareholder letter)

And against Q1 (where Fiverr ended with 4.00 million buyers), the company lost ~112k active buyers and the y/y decline accelerated (versus a -6% decline in Q1).

It’s a worrying picture of a company that has quite a bit of reliance on smaller customers. The company itself acknowledged that while trends were stronger in the first half of FY24, traffic trends have moderated somewhat in June – which calls into question whether Q3 and the remainder of FY24 truly deserve a guidance lift.

During the Q2 earnings call, CFO Ofer Katz noted as follows:

Both were impacted by a slowdown in traffic started in June as the strength we saw in the earlier part of the year proved to be more of a pull-forward rather than a sustainable turn of trends. These trends serve as a reminder for us that we are still in the middle of a macrocycle, where higher inflation and interest rates impact the immediate cash flow of small businesses, erode their confidence in spending, as they try to preserve more cash and delay large projects for potentially rainy days ahead.

As we enter into the second half of this year, we are expanding our product portfolio both organically and inorganically to create additional growth catalysts, as Micha covered extensively in his remarks. Our seller monetization programs such as Promoted Gigs and Seller Plus continued to show strong growth momentum and the addition of AutoDS will further strengthen our overall take rate. We believe these efforts will keep us on track to deliver the targets we set at the beginning of the year.”

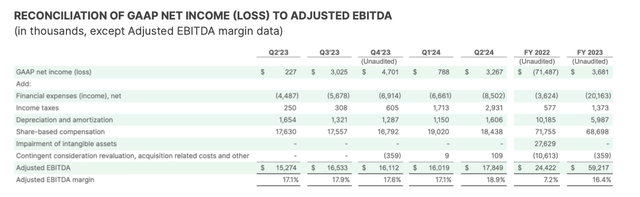

The one positive note we can mention is the company’s continued boost in adjusted EBITDA margins, which have jumped to 18.9% in Q2: up 180bps y/y.

Fiverr adjusted EBITDA margins (Fiverr Q2 shareholder letter)

Still, amid slower top-line expansion, we worry that the company’s pace of EBITDA growth may also slow down.

Key takeaways

With slowing growth, a weakening active buyer base in a tough macro environment, and sharp competition from both automation of freelancer tasks as well as other freelancer marketplaces, Fiverr’s future is incredibly uncertain: which is the core justification we can offer against the stock’s seemingly cheap valuation. Continue to steer clear here and invest elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.