Summary:

- Cash is now a competitive asset, and rising interest rates are causing companies to focus on reducing debt and increasing profit margins.

- Fiverr, a growth firm, has seen its value decline due to a decline in sales growth, but its focus on higher profit margins is more critical today.

- Fiverr faces potential competitive threats and risks from AI, but its dominance in the freelancer marketplace may secure its position.

- AI may be a significant net benefit for the company as it creates more freelance job opportunities that it renders obsolete.

- With excellent growth potential, a healthy balance sheet, and a forward P/E below 10X, FVRR is among my favorite GARP stocks today.

Gary Yeowell/DigitalVision via Getty Images

Since the rise in interest rates in 2022, a key factor has shifted in financial markets: cash is now worth something. Cash is a competitive asset, offering over 5% risk-free when many riskier bonds and dividend stocks hardly pay more. Before 2022, ultra-low rates encouraged companies to burn through cash, take on debt, and incentivize higher-growth investments. Companies and investors could afford to focus on long-term profits without much emphasis on balance sheets and short-term cash-flows, giving way to the rise of many chronically negative cash-flow “growth” stocks.

With interest rates much higher, even after inflation, the opposite is true today. Companies are racing to reduce debt burdens and increase profit margins, even if that means losing long-term growth. This is a simple function of discounted cash flows. As interest rates rise, future cash flows are worth less than present cash flows. Thus, the aim for most companies is to raise present cash flows.

The growth firm Fiverr (NYSE:FVRR) is an excellent example of this issue. Going into 2022, it had stellar revenue growth, mainly driven by the work-from-home shift in 2020. However, its cash flows and income were very weak as it compromised its bottom line to improve its top line. Since then, its focus on shifting to higher margins has hampered its value. FVRR is down by over 90% from its 2021 to early 2022 levels.

It trades at $20 per share, which is about the same as it did in 2020, shortly after its IPO. Thus, while it has terrible momentum, it is fundamentally not much lower than its initial public offering price. Given this, it is essential to analyze the company to determine if it may rebound or continue to sink.

Fiverr’s Transition Shows Positive Signs

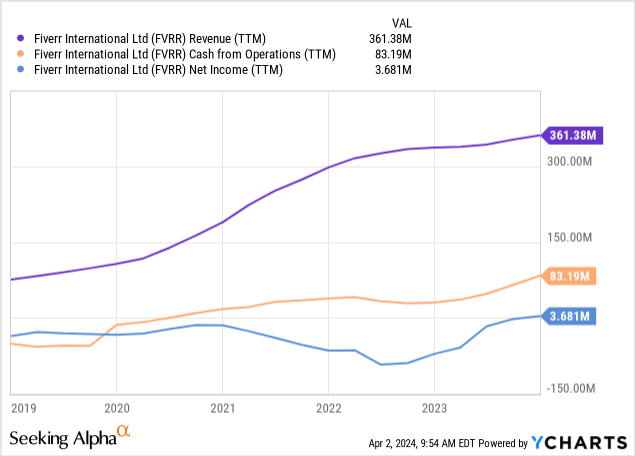

Fiverr sank 15% in February after its fourth-quarter earnings report disappointed investors. The company’s EPS beat consensus, but its revenues were disappointing, with a particularly alarming decline in simple services. Still, its overall sales continued to rise in 2024. Its operating cash flows and net income did as well. See below:

Fiverr is trading at just below its IPO price but has sales that are nearly 3X as high and vastly superior operating cash flows. The primary issue is the stagnation in its sales growth rate since 2022. However, we must remember that 2020-2021 was very atypical in that many people shifted to freelancing or working from home. Indeed, Fiverr is lucky in that it has not seen a reversal of the clients it received in 2021. Further, its sales trajectory mirrors 2019, indicating its sales growth rate is in line with pre-COVID norms.

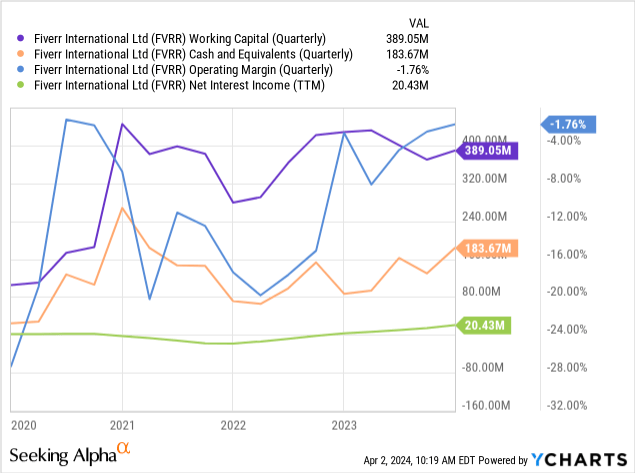

The company’s working capital and cash base are also solid, with positive liquidity of $389M. Its operating margins are nearly positive, indicating it may break even in 2024. The company also earns money on its cash, giving it a net interest profit of ~$20.5M. See below:

Overall, these are all trends that I believe are understandable and indicative of wise management decisions. The company is making an active effort to increase its operating margins and is managing to keep its net liquidity level flat, which does not indicate bankruptcy risk.

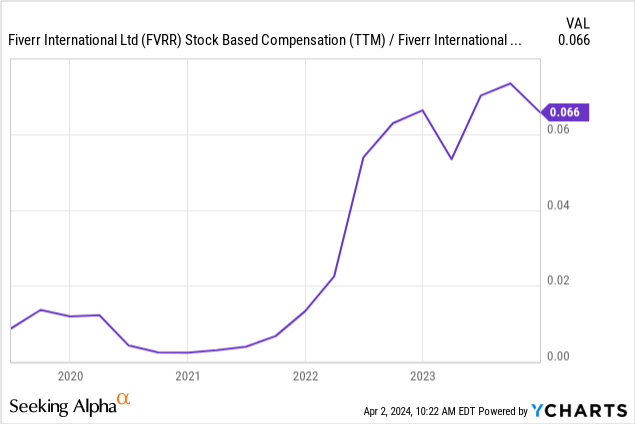

One key issue I see is its high stock-based compensation rate. The company maintains positive cash flows despite negative operating income through a generous stock-based compensation program. As its market capitalization has crashed, this now accounts for 6.6% of its valuation per year, giving Fiverr ample dilution risks. See below:

Put simply, this 6.6% dilution rate from stock-based compensation would likely otherwise come from lower operating cash flows. I think that it is good the company is operating in a manner that gives it steady liquidity by using stock-based compensation. That said, it is still a long-term determinant of its valuation, particularly now that its market capitalization is much lower.

AI Proliferation Augment’s Fiverr

One of the significant topics in Fiverr’s recent earnings call is the risks and rewards posed by AI. This technology is already being employed at scale in translation and graphic design services, a significant segment of Fiverr seller’s services. As the company loses sales in those categories, it gains from its AI services and the other potential undiscovered uses for AI services. The company believes AI created a net positive impact of 4% in 2023.

Indeed, as with most new technologies, I tend toward the view that the number of jobs rendered obsolete will inevitably be outnumbered by creating new jobs that use AI, many of which are likely just starting to proliferate today. Undoubtedly, AI is a risk to Fiverr. Still, it will likely result in long-term benefits as AI usually augments or improves job performance but, in most cases, does not replace the need for a human operator. In other words, I expect many sellers on Fiverr to learn to utilize AI in a manner that results in improved sales. Using AI tools still requires a degree of human skill that most buyers are unlikely to know.

Competitive Pressures Loom

Fiverr faces potential competitive threats. It is a middleman between buyers and sellers, taking a 20% cut on most projects. Compared to peers like Upwork, Fiverr is better suited for smaller projects. There are numerous other competitors to Fiverr, but none appear to be direct competitors with the same market size. In my view, there is some risk that another company looks to undercut Fiverr, causing some preferences to shift away from it. Online-based companies have significant pressures that competition will lower profit margins toward zero, and despite its strong growth, Fiverr has not proven it can deliver stable profits.

Most likely, Fiverr’s dominance for buyers is enough to secure a moat. Service buyers know Fiverr and can usually find a vast supply of sellers for any project. Much like Amazon, if Fiverr can secure itself as the primary freelancer marketplace and maintain that even as it raises its profit margins, then I believe it should retain this moat. Still, as the company pushes toward profitability, there is a degree of risk that Upwork looks to grab market share.

The Bottom Line

I believe Fiverr is oversold today and represents an attractive, bullish opportunity. However, due to its terrible stock price momentum, there is a significant risk that FVRR will continue to slide in the short term. Investors are buying a falling knife today, which is a dangerous bet.

That said, although FVRR stock appears to be headed toward failure, its balance sheet is solid. It has great cash and working capital and is likely to see higher cash flows this year than last. The company is also expected to earn a profit this year, giving it a forward P/E of 9.8X, which is very low for a growth stock.

Its sales are expected to accelerate to around $500M by 2026, with an EPS outlook of $2.6 by then. If it can manage that, then an even higher EPS by 2030 is likely, giving FVRR tremendous “growth at a reasonable price” today.

In my view, the company’s most significant issue is that it grew so fast in 2021 that investors wrongly assumed that the one-off situation would continue. Realistically, that year pushed a lot of growth forward, accelerating the seemingly inevitable and unstoppable trend toward more freelance work. The freelance economy is vast today and is likely the driving factor behind economic growth, adding $1.27T to the US economy, with ~38% of US workers doing freelance work. That rate is 52% for Gen Z and 44% for Millennials, indicating a strong demographic trend for freelancing, particularly with over 85% of freelancers reporting positive sentiment. That is according to Upwork’s data, so it may be biased, but as a Gen Z freelance worker, I agree with it.

FVRR is a risky bet today due to its momentum and widespread negative sentiment. That said, I believe it is significantly oversold and represents an excellent risk-reward tradeoff today from a growth-at-reasonable price perspective. In other words, I am not bullish on FVRR with a short-term horizon, as I somewhat expect it to decline over the coming months. However, by 2030, I expect FVRR will likely be trading much higher than it is now. Further, I think that AI proliferation may be a significant catalyst for rapid growth over the coming years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in FVRR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.