Summary:

- Fiverr International’s current 10x forward EBITDA valuation already factors in a best-case scenario, limiting potential upside.

- Despite a strong balance sheet and meaningful free cash flow, Fiverr’s growth rates are slowing to single digits, with expectations of around 6% for 2024.

- I believe Fiverr is already fairly valued at its current price.

Filmstax

Investment Thesis

Fiverr International Ltd. (NYSE:FVRR) stock has the illusion of being cheap. Indeed, I can easily understand why someone would believe it to be so.

After all, this stock is down 90% from its highs, and at some point, it has to become undervalued. Right? I recognize this facet. In fact, when I started investing, I would also think along those lines.

But I know that it never matters what the business did. All that matters is what a business will do, relative to investors’ expectations.

So, even though paying 10x forward EBITDA may appear cheaply valued, I contend that this is already pricing in the best-case scenario. As such, I argue that in the next several months, investors will look back to $22 per share as a price to aspire towards, rather than a cheap entry point.

Rapid Recap

Back in February, I said:

Even if the company looks cheap, I don’t believe this stock is a compelling buy.

And yet, to be clear, it’s not all bad. For one, Fiverr has a relatively strong balance sheet. Also, the business is evidently generating meaningful free cash flow.

But at the same time, the unavoidable fact is that its growth rates are fizzling out. Altogether, I find it difficult to cheer for this stock. Therefore, I’m sticking to the sidelines.

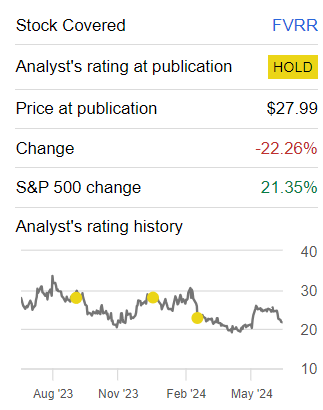

Author’s work on FVRR

I’ve been neutral on Fiverr for a while. And thus far, this has been the right call to make, with the stock down more than 20% while the S&P 500 (SP500) continues to press head and is up more than 20%. Looking ahead now, I remain resolute that this stock isn’t worth chasing. Here’s why.

Fiverr’s Near-Term Prospects

Fiverr is an online marketplace that connects businesses with freelancers offering a wide range of digital services, from simple tasks to complex projects. It caters mostly to small businesses as well as larger organizations as it strives to accommodate higher high-value services.

As we’ve read widely of late, the macroeconomic environment remains challenging, which impacts companies’ appetite for freelancers.

Additionally, Fiverr operates in a highly competitive sector with ample competition from other freelance platforms. Two notable competitors are Upwork (UPWK), which offers a similar range of freelance services but with more focus on professional and technical projects, and Freelancer.com, which connects businesses with a global network of freelancers across diverse industries. Both platforms challenge Fiverr in terms of attracting both freelancers and clients, pushing Fiverr to continually innovate and enhance its offerings.

In short, we have a tough microenvironment and a competitive industry. Given this background, let’s now discuss its fundamentals.

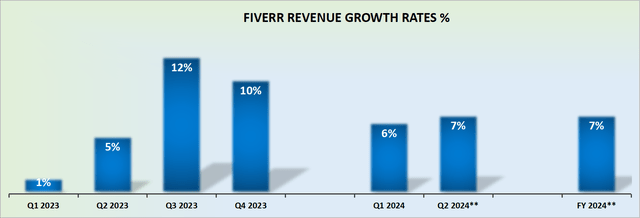

Revenue Growth Rates Moderate to Single Digits

Fiverr’s revenue growth rates will come in this year at sub-10s%. What’s more, I wouldn’t be surprised to see Fiverr’s revenue growth rates in fact moderating down to around a 6% y/y increase for 2024.

Moreover, consider the fact that H2 2024 will see Fiverr having to compare against very tough quarterly comparisons.

So what will investors think, when Fiverr’s Q3 2024 guidance is posted, and management notes that in Q3 the business will barely eke out 2% to 3% top-line growth?

At that juncture, will investors consider this business to still be a growth business? I don’t believe so. And if it’s not a growth business, but rather a business that is striving to survive, this will mean that the multiple that investors will be willing to pay for the stock will also compress. And that is the topic we discuss next.

FVRR Stock Valuation – 10x Next Year’s EBITDA

For 2024, Fiverr’s EBITDA margins are expected to expand by approximately 260 basis points. This compares with the 920 basis point expansion on Fiverr’s EBITDA margin line in the prior year. Let’s think about this for a moment. What this should signal to investors is that the bulk of Fiverr’s profitability improvements have already been enacted this year.

Hence, as we look ahead to 2025, investors should not expect to see yet another year of strong EBITDA margin expansion. After all, you can only cut back so far on a business. After a while, there’s nothing left to cut.

This implies that in the best-case scenario, Fiverr’s 2025 EBITDA margins reach 20%. Hence, if everything goes well in 2025, Fiverr’s EBITDA is guided to around $85 million. That is with all the good news and then some factored in.

Yes, Fiverr carries approximately $150 million of net cash once its convertible notes are factored in, but still, does it really make sense to 10x next year’s EBITDA for Fiverr? A business that has no significant competitive advantage and meager growth rates? I don’t believe so. In the absolute best case, this stock is already fairly valued.

The Bottom Line

Fiverr’s stock, trading at 10x forward EBITDA, may appear undervalued at first glance, especially given its significant decline from previous highs.

However, this valuation already reflects a best-case scenario for the company. Despite Fiverr’s strong balance sheet and meaningful free cash flow generation, its growth rates are moderating significantly, with expectations of sub-10% growth, possibly even as low as 6% y/y for 2024. This slowdown, coupled with a challenging macroeconomic environment and intense competition, suggests that Fiverr’s future growth prospects are limited.

Additionally, the bulk of Fiverr’s profitability improvements have likely already been realized, leaving little room for further margin expansion.

Thus, given Fiverr International Ltd.’s modest growth and competitive pressures, its current valuation of 10x forward EBITDA is fair.

The market has recently opened up and there are so many opportunities, but FVRR isn’t one.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.