Summary:

- Fiverr’s performance has been worse than expected, with disappointing revenue and GMV growth.

- However, despite short-term challenges, Fiverr’s long-term narrative remains intact with potential for strong growth in the online freelancing industry.

- Actual AI impact has been a proof of its business model being technology-agnostic.

ridvan_celik/E+ via Getty Images

Almost two years have passed since my last evaluation of Fiverr International Inc. (NYSE:FVRR). In that initial analysis done in Aug 2022, I considered Fiverr a great idea for long-term investors who wanted to participate in the digitalization of the freelancing industry, an industry with a secular trend and attractive long-term growth perspectives. Since then, however, the shares have depreciated by c. 25% (c. 40% since the article was published) even though I found them undervalued with an intrinsic value of c. $60 per share. In between, there were tech layoffs, a more severe-than-anticipated post-COVID impact, higher-than-expected rates, and the rise of AI.

However, there are signs that expectations may have bottomed out. Now, the economy seems stronger than anticipated, the number of layoff rounds has decreased, and Fiverr is focusing on boosting spend-per-buyer by going through complex services and an up-market focus. Based on that, this article will share my updated vision of the company, looking at the industry, Fiverr’s latest results, and its outlook.

A disclaimer before starting: while I acknowledge the uncertainty surrounding the process, I’m a firm believer in the freelancing digitalization story. Therefore, this analysis represents an opportunity for me to revisit my story from a critical perspective. By examining it as objectively as possible, I will try to look for inconsistencies and potential signals that might lead me to reconsider my position.

Fiverr’s last two years’ performance

Being direct and concise, Fiverr has performed significantly worse than expected over the last two years. Back in Aug22, I assumed that after the post-COVID normalization, the digital freelancing industry would re-accelerate its growth at rates, although lower than those reported during COVID-19 (c.50% CAGR from FY19A to FY21A), still quite attractive. However, adopting online freelancing is more difficult than I first thought.

Actual results vs expectations

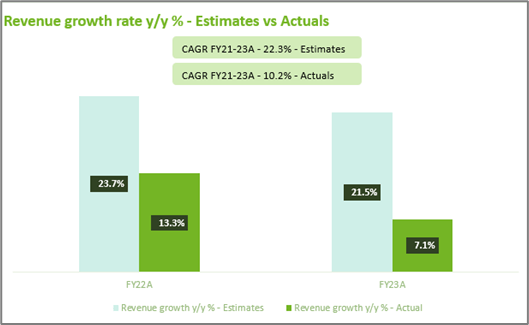

Actual results vs expectations Fiverr (Company financials and own analysis)

In fact, I assumed that Fiverr could make its business grow at a 22.3% CAGR during the next two years. However, the reported revenue CAGR for FY21-23A was just 10.2%, significantly lower than my estimates. Regarding the evolution of both Fiverr’s GMV and its take-rate, GMV grew significantly less than expected, but this was partially offset by a better-than-expected increase in take-rate.

- GMV (+5.4% vs. 21.8% CAGR estimated): no growth in active buyers and lower than expected spend per buyer. In fact, if we consider the inflation impact, the total real value of transactions (GMV) ordered through the platform declined during the period FY21A-FY23A.

- Take-rate (30.9% vs. 29.2% as of FY23A): In this case, Fiverr successfully managed to improve its take-rate thanks to the increase in advertising and other value-added services offered to freelancers, which more than offset the growth in large clients segment (with presumably lower take-rates).

In terms of margins, these were surprisingly better than expected. Considering the current context marked by decelerating revenue growth and a difficult macroeconomic situation, with tight financial conditions especially affecting SMEs, Fiverr demonstrated its capacity to improve its operating margins to investors. The company implemented cost-cutting initiatives, reduced marketing expenses, and generated positive cash flows, albeit with the help of SBC.

Reasons behind this underperformance?

- Digital freelancing adoption: transitioning businesses’ workforce from traditional staff to digital freelancers is a significant change that requires adaptation processes and, more importantly, overcoming profound cultural/psychological barriers, which are the main reasons why this change is not going as fast as I could think. The industry is still in its first stages, and online freelancing, as offered by this type of company, is still being evaluated and used on a project-by-project basis to solve specific needs. If success is proven, as it seems, it might be happening as demonstrated by cohorts’ behavior, freelancers should become an option for additional projects and end up being a core product or tool used by companies to get work done. However, it is a long way.

- Going up-market: Fiverr’s customer base used to be skewed towards one-time, basic services, with individuals representing a significant part of the company’s volumes. This worked well during COVID times with people at home and when new businesses rapidly saw online freelancing as a temporary solution to restrictions and labor force scarcity. Nonetheless, now that COVID has passed, those one-time services have significantly decreased, and the industry value resides on the corporate side. Fiverr is conscious of that and one of its key objectives is to move up-market.

- Macroeconomic conditions: while general macroeconomic indicators seem to suggest that we are in a very good situation, with a no-landing narrative spread all over the market (unemployment rates near historic lows, salary growth at rates over 4% y/y and companies margins and GDP growth rates at recent highs) there are some exceptions, and a closer look to details reveals potential challenges for platforms like Fiverr. Specifically, the tech/startup world, a key source of clients for these platforms, is experiencing difficulties with recent news about restructuring, cost-cutting, and funding difficulties raising concerns. Consequently, it is understandable that these factors translate into lower personnel expenses and delayed project launches, impacting Fiverr’s growth rates.

- AI: Fiverr’s management has been persistent about assuring that AI is not a problem. However, numbers don’t show that. According to the Company, AI generated a net 4% positive effect on GMV, but this does not account for inflation. When inflation is considered, the impact of AI becomes less clear. Even if we believe that the demand for new AI services might act as a push for its GMV, it has been largely offset by a decrease in demand for basic services. This decline is particularly concerning given Fiverr’s customer base, which used to be skewed towards one-time, basic services. Therefore, so far, I consider that AI has had a net negative effect on Fiverr, at least in value terms, as it has hurt the company’s growth rate capacity in the short term, becoming a significant factor explaining the business’s temporary deceleration.

In short, these are quite disappointing results that are not explained by a single factor but by a mix of them. While current stock prices are far from the highs of the COVID-19 peak, it is somewhat understandable as the growth component in the valuation of Fiverr is still very significant, and two years have already passed without it.

Having said that, the key question is: does this change my view of its long-term story?

Fiverr’s long-term narrative

As I explained at the beginning of the article, my narrative of Fiverr revolved around an industry with a secular trend and attractive long-term growth perspectives. Thus, it is essential for me to assess whether this has changed or not over the last two years.

Digital freelancing industry potential

The growth of the industry can be attributed to two key drivers: (i) the digitalization of freelancers, as only digital jobs can be performed throughout these platforms, and (ii) the share of online freelancers compared to traditional workers in the overall workforce.

Regarding the first point, I find no reason to change my belief that the freelancing industry will continue its digitalization process. As is the case of many other industries, the impact of technology is unavoidable. Digital-related jobs will keep advancing over physical ones, and freelancers will need to adapt.

However, with regard to the increase in the share of online freelancers, I believe that we should be cautious when talking about the “seismic shift” in the workforce that some of the industry leaders have claimed. As the deceleration post-COVID has demonstrated, this change has resulted to being less structural than expected or at least it is going to take much more time to occur. Although, I believe that this “shift” makes sense for both businesses and workers, it still has a lot of barriers to face.

In conclusion, here are two findings from the past two years: (i) it seems that the industry’s potential remains substantial, but (ii) the speed at which it can be exploited may be lower than anticipated.

Artificial Intelligence

I previously argued that the net impact of AI on Fiverr has been negative in the short term. However, it is also true that this impact has been limited and that, for the medium/long-term, it represents very good news to the extent that it is clear evidence of its business model being technology-agnostic. The core idea is to understand that the platform is not dependent on any technology but on the growth of online/digital freelancers. There might be temporary turbulences from technology disruptions like AI, but as soon as supply adapts again to market demands, growth will follow.

This fact, which, I think, has not been well tackled by Fiverr’s management, is key to arguing that the long-term story is still strong and valid.

Revisiting numbers

After tackling the industry’s long-term trend, it is time to revisit Fiverr’s intrinsic valuation. To do that, I will focus on the following:

- TAM

- Fiverr’s growth rates

- Long-term sustainable operating margins

- Balance sheet

TAM

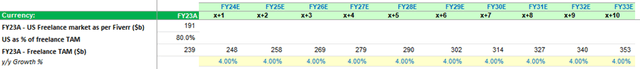

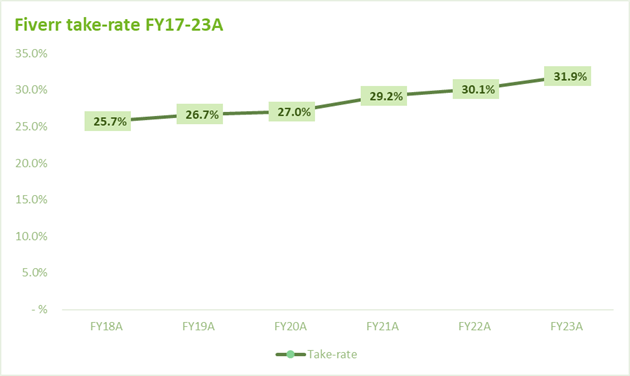

Consistent with my overall view, I limited Fiverr’s TAM to the size of the current freelancing market, measured as the total dollar earned in revenue in 2023 by independent professionals. According to the Company, this figure amounted to $191 billion in the US.

Using a back-of-the-envelope calculation and assuming the US represents roughly c.80% of the world’s freelancing market, I get to a total TAM of $239 billion. Considering Fiverr’s reported GMV of $1.1b in FY23A, that would imply its current market share is around 0.5%.

Fiverr’s TAM estimation (Company filings and own analysis)

From FY23A onwards, I will assume a constant annual growth rate of 4% to account for GDP growth and inflation.

Fiverr’s growth rates

Once the TAM’s size and its growth rate have been projected, the next step is to estimate Fiverr’s future growth. For that, I will estimate its future market share and its revenue share.

Market share: I assume that after some years of post-COVID digestion, the freelancing industry will resume its digitalization process, and Fiverr will benefit from it. I estimate that Fiverr’s market share will continue growing, moving from 0.5% in FY23A to 0.8% in FY28E and up to 1.3% in FY30E. This would imply Fiverr’s GMV to report a c.15% CAGR over the next 10 years, which seems reasonable to me given the current stage of the industry.

To ensure consistency, I propose one combination of “spend per client” and “# of clients” KPIs aligned with the previously stated assumptions about Fiverr’s future market share.

Fiverr’s projected market share (Fiverr’s projected market share)

This combination assumes that due to Fiverr’s strategy of going upmarket, Spend-per-Buyer will increase at a 13% CAGR over the next decade, increasing from $278 to $964. While this represents significant growth, it is still below Upwork’s (UPWK) current average ratio of c. $4,700k per client. Similarly, the number of clients will increase at a 1.6% CAGR over the same period from 4.1m to 4.8m.

Please note that this is just one possible scenario and that the core idea is that Fiverr’s penetration within the freelancing market will increase over time.

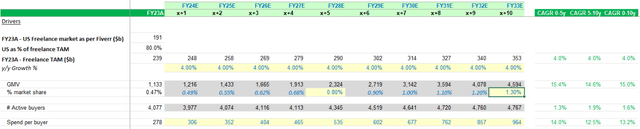

Revenue share: to estimate Fiverr’s future revenues, it is necessary to make an assumption about the evolution of its take-rate.

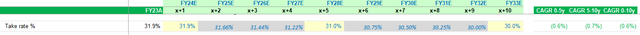

Fiverr’s take-rate evolution (Company filings and own analysis)

While Fiverr has successfully increased its take rate over the historical period, the growth in the large-client segment, which presumably has lower take-rate, will likely push this KPI down in the medium to long term. Consequently, I assume a progressive decline over the period from 31.9% to 30%.

Fiverr’s projected take-rate (Company filings and own analysis)

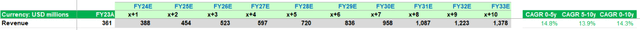

The final result is a topline growing at a c. 14% CAGR over the next decade. This would exceed industry growth of 4% CAGR, thanks to the increase in the penetration of online freelancing.

Fiverr’s projected revenue growth rate (Company filings and own analysis)

As explained at the beginning of the article, as the economy recovers and Fiverr’s focus on boosting spend-per-buyer begins to pay off, revenue growth will start to trend up.

Long-term sustainable operating margins

My narrative considers Fiverr as a scalable, capital-light business model. Consequently, as the business grows, its margins will benefit from low direct costs and operating leverage. Nevertheless, this improvement will take time, and it will be directly related to revenue growth.

For our valuation purposes, we estimate operating margins will steadily improve, reaching levels of 22.5% over revenue in the long term. Even though this may be at the lower end compared to more mature software businesses, it should be considered the early stage of the industry in which revenue growth should be prioritized, requiring significant reinvestment levels.

Balance Sheet

As already explained, Fiverr has demonstrated it can adapt its business to the current industry context. In addition, it has a capital-light business model with no significant working capital needs and no need for high-value physical assets.

Consequently, Fiverr’s current net cash position of c. $200m as of Mar 24 allows the Company to properly manage its future operating needs. Unless there is a significant growth acceleration or a drastic change in its stock compensation strategy, there should be no further funding needs.

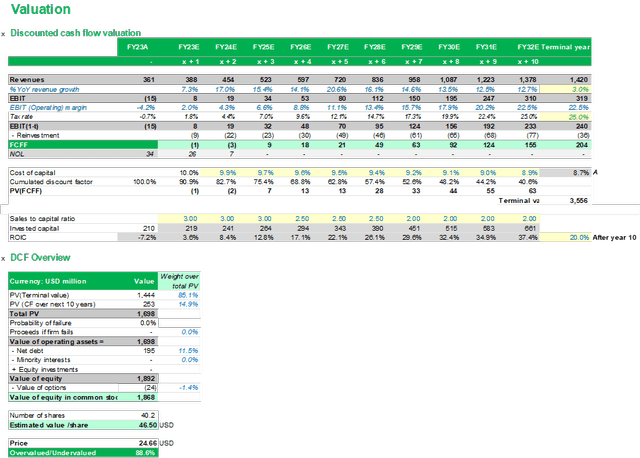

Valuation

Based on my narrative, I arrived at an intrinsic value of $46.5 per share, which is lower than the $60.8 per share I estimated in my previous valuation almost two years ago, on Aug 10, 2022. As explained before, this results from updating my estimates based on Fiverr’s actual results.

Fiverr’s updated valuation (Company filings and own analysis)

Downside risks

Fiverr is an example of a story-driven valuation in which small differences in estimated probabilities can cause significant differences in prices. Consequently, given the early stage of the company and the industry, downside risks are mostly concentrated in factors that may change the long-term narrative.

Fiverr’s inability to grow up-market, the impact of AI (already commented), regulatory issues, or higher-than-expected competition from the big-tech or specialized platforms are some examples of downside risks that should be monitored when investing in this company.

Nevertheless, as Fiverr continues to grow, the risk of a complete failure diminishes. That’s why, compared to our initial valuation on Aug 22, we have assumed a 0% probability of failure.

Conclusion

In my view, the long-term narrative of Fiverr continues to hold, despite the fact that the results of the last two years might suggest. I believe these are affected by temporary problems, and I found no fundamental reasons to make me change my view. I still consider that the freelancing industry will continue its digitalization process and that Fiverr is well-positioned to benefit from it.

Looking at Upwork’s results, Fiverr’s main competitor, one could infer that it is a widespread problem as, although with exceptions explained by their different go-to-market approach, both Fiverr and Upwork’s actual results and 2024 outlook look very similar.

Consequently, my conclusion is that if you are a long-term, diversified investor who believes that the online freelancing industry will continue growing, Fiverr still represents a very well-balanced risk/reward stock to invest in. The current stock price offers an attractive opportunity with high optionality to be successful in a growing market with immense potential.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FVRR, UPWK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.