Summary:

- NextEra Energy is an attractive option with a balanced portfolio of conventional and renewable energy sources.

- The company’s subsidiary, Florida Power & Light Company, benefits from Florida’s rapid population growth, ensuring a steadily increasing customer base.

- NextEra Energy’s focus on renewable energy through NextEra Energy Resources illustrates its initiative to stay ahead of global trends and lead the clean energy transition.

Lorraine Boogich/iStock via Getty Images

Investment Thesis

NextEra Energy (NYSE:NEE.PK) (NYSE:NEE.PK) (NEE.PR.R) is an attractive option having a good combination, especially with a balanced portfolio of conventional and renewable energy sources. As of 2023, the organization has shown impressive financial records with adjusted earnings increasing but a dip in net income. Its subsidiary, Florida Power & Light Company (FPL), benefits from Florida’s rapid population growth, ensuring a steadily increasing customer base. Additionally, NextEra’s focus on renewable energy through NextEra Energy Resources (NEER) illustrates the initiative to stay ahead of global trends and at the forefront of the clean energy transition. While there may be some intrinsic risks in the renewable energy market, NextEra’s corporate strategy and solid performance balance these risks. Considering these factors, alongside NextEra’s strategic positioning and growth potential in both traditional and renewable energy markets, I believe NEE is a strong buy.

Intro (Background on NextEra & The Relationship to $NEP)

NextEra Energy, Inc., established in 1925 and headquartered in Juno Beach, Florida, is a major player in the North American energy sector. The company’s extensive operations include generating, transmitting, distributing, and selling electric power. It utilizes a diverse array of energy sources, including wind, solar, nuclear, coal, and natural gas. NextEra Energy had an impressive 32,100 megawatts of net generating capacity and significant transmission and distribution infrastructure, including approximately 88,000 circuit miles of lines and 871 substations.

The company’s primary subsidiary, FPL, is a notable name in the U.S. utility sector, catering to over 12 million people in Florida through approximately 5.8 million customer accounts. This makes it one of the largest electric utilities in the country. NEER, another key subsidiary, focuses on renewable energy, particularly in wind and solar power generation, aligning with global trends towards sustainable energy practices.

NextEra Energy’s historical growth includes several strategic attempts to acquire other companies, for example, Constellation Energy Group, Hawaiian Electric Industries (my analysis is here), and Oncor Electric Delivery. One of its significant expansions occurred in 2018, with the acquisition of Gulf Power Company from Southern Company, a deal valued at $6.4 billion, which notably increased NextEra Energy’s residential customer base in Florida.

The relationship between NextEra Energy and NextEra Energy Partners, LP (NEP) is a vital component of its business model. I recently wrote a piece on NEP, emphasizing the company’s dedication to clean energy through ownership of diverse renewable energy projects with healthy finances. I believe this partnership is in line with NextEra Energy’s strategic focus on sustainable energy, reinforcing its position as a leader in the energy transition.

Financials

NextEra Energy’s third-quarter 2023 results affirm my strong buy stance. The company’s 10.6% year-over-year growth in adjusted earnings per share reflect solid management and operational efficiency. FPL, a core part of NextEra, outperforms with customer-friendly billing and a focus on reliability, reinforcing my bullish outlook.

Energy Resources, another NextEra division, excelled in renewables and storage origination, reinforcing its leadership in the renewable sector. The backlog of over 21 gigawatts in renewables and storage signals significant future growth potential. Thanks to its solid balance sheet and access to global banking relationships, NextEra enjoys adequate capital as well as cost advantages, positioning it for sustained shareholder value.

FPL’s earnings per share increased by $0.04 year-over-year, driven by a 13.6% rise in regulatory capital employed. This growth, indicative of strategic efficiency, supports a stable financial foundation. The expected 9% average annual growth in regulatory capital employed through 2025 further highlights this stability.

Energy Resources showcased a 21% increase in adjusted earnings year-over-year, a commendable achievement given the competitive renewable energy landscape. The record quarter in renewables and storage origination not only meets the clean energy demand but leads the sector’s progression.

Acknowledging risks like higher interest costs and project backlog fluctuations is essential for a balanced view. However, NextEra’s strategic positioning and operational strengths significantly outweigh these concerns. Measures like interest rate swaps and effective supply chain management showcase the company’s proactive risk mitigation strategies.

Overall, there are many indicators that indicate a buy rating for NextEra’s current situation and future prospects. My confidence lies in its continued growth potential stems from its navigational ability in overcoming obstacles, expansion into new strategic areas, and strong fiscal management. The present performance of NextEra is not only impressive, but it also implies that this company will be a leader in the energy sector (if not already) in the near future, representing one of the most attractive options for investments.

NextEra’s Unique Outlook With Combination of Traditional Utilities vs. Renewables

I believe NextEra’s unique strategy, which combines traditional utilities with renewables, is the defining feature of the company’s plan to drive strong performance. The company, renowned as the world’s largest wind and solar power firm through NEP, has been capitalizing on the surge in renewable energy, partly fueled by the clean energy investment push following the 2022 U.S. Inflation Reduction Act (IRA). The IRA, which includes significant provisions for cutting carbon emissions, has provided robust support for NextEra’s affiliated renewable initiatives.

The company’s renewable energy division, NextEra Energy Resources, has been particularly pivotal in this regard. Despite a net loss in Q3 2023, this division added a record 3.2 gigawatts (GW) to its backlog, highlighting a significant expansion in its renewable and storage projects. These additions are part of NextEra’s larger goal, as the company has revealed a staggering 250 GW pipeline of renewables and storage projects to help lower its carbon footprint and capitalize on the wave of change in the utilities sector. This includes green-energy projects supported by approximately 145 GW of secured interconnection queue positions, which is a testament to NextEra’s commitment to leading the clean energy transition.

An integral part of NextEra’s renewable strategy involves wind repowering projects. By 2026, the company plans to repower 740 megawatts (MW) of wind facilities. Repowering involves refurbishing existing wind turbines with newer technology and commissioning new turbines, using existing infrastructure. NEE’s strategy here not only enhances the cost curves and production efficiency of these projects, but also enables NextEra to take advantage of 10-year production tax breaks. It’s the best of both worlds.

These upgrades are expected to significantly boost turbine performance and contribute to the company’s broader renewable energy goals.

Why Its Operations In Florida Are A Big Deal

The rapid population growth in Florida significantly benefits NextEra Energy, particularly through its subsidiary FPL. As of early 2023, Florida’s population was estimated at 22.6 million and has been one of the fastest-growing states in the U.S. This growth trend is expected to continue, with the state’s population projected to reach approximately 23.015 million by mid-2023. Florida’s growth rate has consistently outpaced the national average, with annual increases ranging from 1.0% to 2.0% since 2010. In 2022, the state’s growth rate was approximately 1.9%, making it the fastest-growing state in the country for the first time since 1957.

This demographic expansion is a significant boon for NextEra Energy, as it implies an increasing demand for energy and utility services. As the primary utility provider in Florida, FPL is strategically positioned to meet this growing demand. The company’s extensive infrastructure and capacity to generate, transmit, and distribute electric power are crucial in catering to the needs of Florida’s expanding population.

Moreover, the state’s growth aligns well with NextEra Energy’s focus on renewable energy sources. As more residents move into Florida, there is an increasing need for sustainable and clean energy solutions, which NextEra Energy, through NEER, is well-equipped to provide. This synergy between demographic trends and NextEra Energy’s business model strengthens the company’s prospects for continued growth and profitability in the coming years.

Risks

Investing in NextEra Energy and NextEra Energy Partners comes with distinct advantages but also specific risks that investors should consider. One of the primary concerns is the reliance on renewable energy sources, which, while growing, have yet to become mainstream compared to traditional sources like natural gas. The renewable energy sector, especially in areas such as storage technology, is still evolving. This situation entails a risk of current power plants becoming outdated if newer, more efficient technologies emerge. Another critical risk is the non-regulated status of NextEra Energy Partners, which, unlike a regulated utility monopoly, faces competitive pressures. This means there is less certainty regarding dividend security and potential fluctuations in share price volatility.

Additionally, funding growth poses a challenge in a high-interest-rate environment. For NextEra Energy Partners, sourcing funds for new projects may become more expensive if reliant on debt, leading to possible shareholder dilution if more shares are issued. The higher interest rates can also negatively impact share prices through the discounted cash flow valuations. Moreover, NextEra Energy’s financial health indicators, particularly its low Altman Z-score, suggest potential financial distress. This metric, combined with declining ratios in retained earnings to total assets and asset turnover, underscores potential operational and financial challenges. The low Altman Z-score indicates a higher risk of bankruptcy and reflects issues with asset utilization and revenue generation efficiency.

Valuation

In the realm of forward-looking valuation metrics, it is vital to understand the stock’s potential. The FWD Price to Earnings (P/E) at 17.13, on par with the sector median, suggests that investors are expecting similar earnings from this company compared to its peers.

The FWD Price to Sales (P/S) of NEE at 4.80 towers over the sector median of 1.99, which raises questions. The Seeking Alpha grade of D- indicates skepticism about the stock’s sales translating into future profitability. It could imply that the stock is overvalued, or that analysts, like myself, believe there’s something special about this company’s sales quality.

On the contrary, the FWD Price to Book (P/B) at 2.50, when compared to the sector median of 1.65, and its D grade, suggest that the market is cautious about how the company’s assets are valued. It’s a signal to look closer at what’s behind the book value and whether it justifies the premium.

Lastly, the FWD Price to Cash Flow (P/CF) is 11.80, significantly higher than the median of 7.44. The D grade here might reflect concerns over the company’s ability to generate cash, though it could also mean that the market has not yet recognized the company’s cash-generating potential. Overall, the chart below provides a visual for better comparison across specified metrics.

| FWD P/E | FWD P/S | FWD P/B | FWD P/CF | |

| NextEra Energy | 17.13 | 4.80 | 2.50 | 11.80 |

| Sector Median | 17.06 | 1.99 | 1.65 | 7.44 |

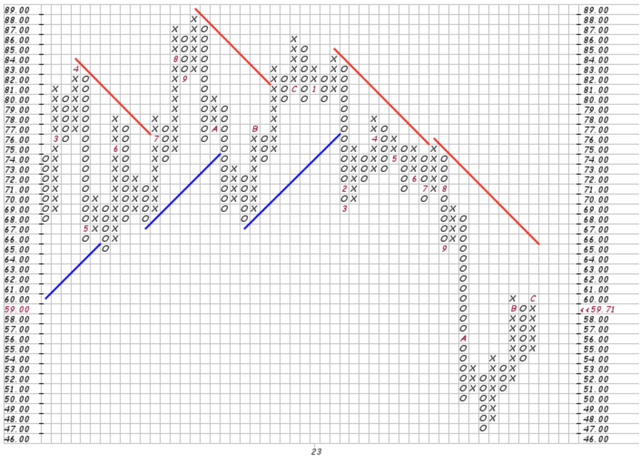

Following, according to the following graph I have provided below, a point and figure chart in a traditional 3 box reversal method, I see NEE in a great position for upside. If we bring our attention to the bottom right section of the chart, we can see that NextEra has made a rebound in the last month or so from a low of $47. Going forward, technically speaking, I think NEE has great momentum to push higher as they are much lower (approx. $18) than the average $68.00 to $88.00 range that this chart has predominantly fluctuated between. I am optimistic that NextEra will continue to trend higher, which creates great opportunity for investors looking to enter now.

NEE Point & Figure (Stock Charts)

In short, these metrics and chart analysis, together with their Seeking Alpha grades, are not just individual data points. They convey that the stock is poised for growth, but with certain aspects that investors are cautious about. These grades, comparisons to sector medians, and point and figure explanation serve as a reality check against the optimism of raw numbers: reinforcing my strong buy rating.

Conclusion

NextEra Energy, Inc. stands out as a strong buy in the energy sector, leveraging its extensive operations in traditional and renewable energy. The company’s growth is evident by FPL, which serves Florida’s rapidly expanding population, and its partnership with NextEra Energy Partners LP, enhancing its clean energy initiatives.

Financially, NextEra Energy surpasses sector medians in key growth metrics, demonstrating robust operational efficiency and strategic growth. Despite some risks related to its renewable energy focus and financial indicators like the low Altman Z-score, NextEra’s strengths in specific valuation metrics such as P/E GAAP (FWD) and EV/EBITDA underscore its solid investment potential.

NextEra Energy’s commitment to renewable energy, combined with demographic growth in Florida, positions it well for sustained success. NextEra Energy Partners LP’s financial performance and strategic renewable energy plans further reinforce this positive outlook. Overall, the comprehensive analysis of financial and operational aspects solidifies NextEra Energy stock as a strong buy, with NEP also being a favorable investment choice, aligned with current energy trends and market dynamics.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Thomas Potter is an independent investor as this publication has been produced for informational purposes only. This is not investment advice. Please do your own due diligence and invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.