Summary:

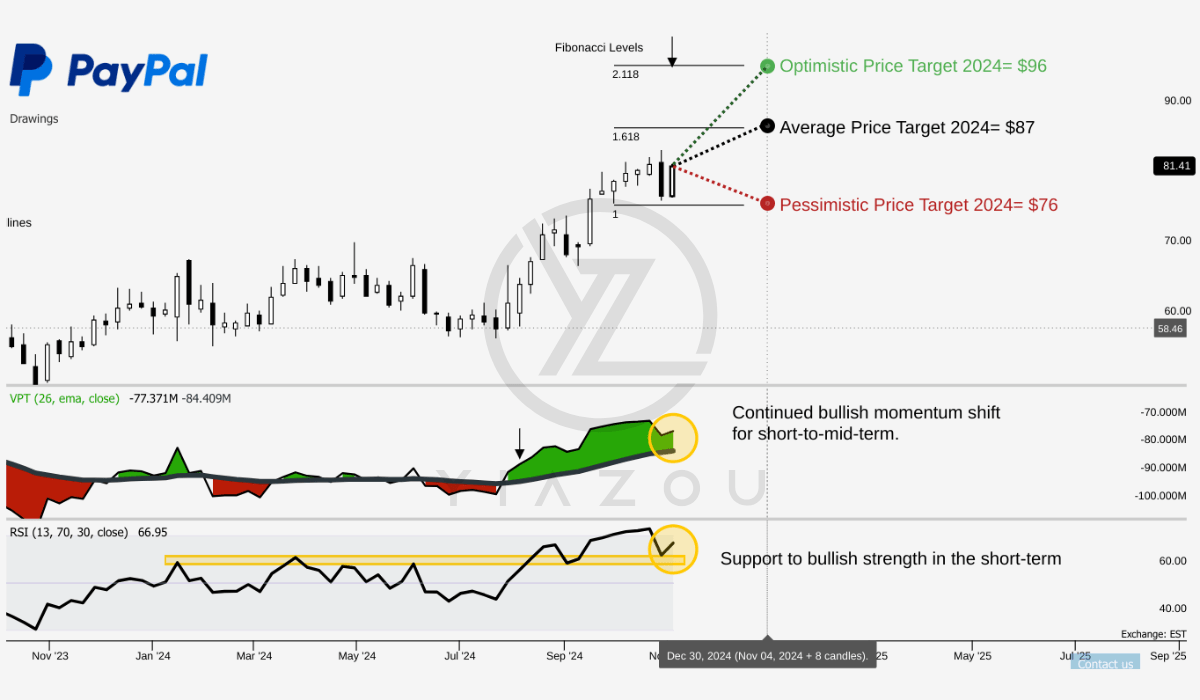

- PYPL’s technical target is revised to $96 by year-end, supported by recent earnings momentum and alignment with key Fibonacci levels.

- PayPal’s transaction volume grew by 1.47 billion from Q1 2022 to Q3 2024, showing stable user growth and engagement.

- EPS increased 146% from Q1 2022 to Q3 2024, reflecting effective cost management and improved profitability margins.

- The forward price-to-sales ratio of 2.5 is 58.52% below its five-year average, highlighting significant undervaluation potential.

- Non-GAAP operating income grew by 18% YoY in Q3 2024, despite a slight revenue growth deceleration to 6%.

JasonDoiy

Investment Thesis

Since our last coverage, PayPal Holdings, Inc. (NASDAQ:PYPL) has appreciated by 11%, surpassing our prior short-term target of $80. We revise our year-end technical target to $96 in light of continued fundamental improvements. Further supporting its bullish case, PayPal’s forward price-to-sales ratio of 2.5 trades at a 58.52% discount to its five-year average, highlighting a significant undervaluation.

Despite slight revenue and margin deceleration, PayPal’s strategic cost management has delivered a remarkable 146% increase in EPS, reflecting strong profitability momentum. This stability in transaction growth, resilient margins, and favorable valuation reinforce PayPal’s positioning as an attractive opportunity heading into year-end.

Technically, PayPal Stock May Hit $96 In 2024

PYPL stock is currently trading at $81 and aligns with the Fibonacci levels in its projected price targets for 2024. The optimistic price target is $96, corresponding with the 2.118 3-point Fibonacci level, suggesting a possible recovery in line with recent price consolidation.

The average price target of $87 aligns with the 1.618 Fibonacci level, signaling a moderate upward potential if bullish momentum strengthens. Meanwhile, a pessimistic target of $76 aligns with the 1.0 Fibonacci level, which may act as critical support if bearish pressure increases.

Moreover, PayPal’s RSI is 66.95, close to the overbought threshold of 70. This upward RSI trend suggests sustained buying momentum, although the absence of bullish or bearish divergence indicates no clear reversal. If RSI crosses overbought territory, a temporary pullback could occur as the street looks to capitalize on gains.

Further, the Volume Price Trend (VPT) line, at -77.37 million, shows an upward trajectory that contrasts with its moving average of -84.91 million, signaling a positive shift in volume flow. This suggests accumulating investor interest and increasing buying pressure, further reinforcing potential upward movement.

Yiazou (trendspider.com)

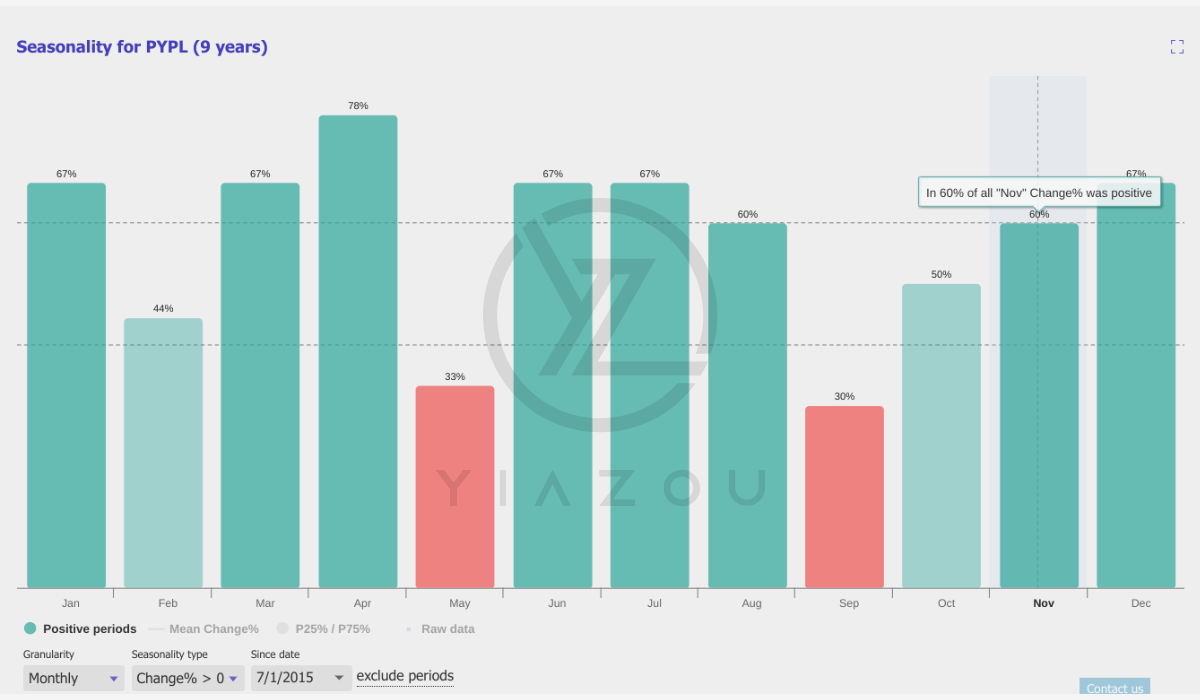

Finally, a nine-year seasonal analysis also supports a bullish view, with a 60% and 67% probability of positive returns if an investment is made in November and December, respectively.

Yiazou (trendspider.com)

Transaction Surge and Earnings Growth: An Undervalued Giant Ready for Takeoff

PayPal’s growth potential is evident in its stable transaction volume. Payment transactions rose from 5,161 million in Q1 2022 to 6,631 million in Q3 2024, representing a consolidated gain of 1,470 million transactions. This trend points to PayPal’s business capability to attract and retain users. The year-over-year (YoY) transaction volume growth rate has shown minor fluctuation.

Growth slowed slightly from 18% in Q1 2022 to 13% in Q4 2022 but remained at a stable 10% for later quarters. This suggests that PayPal has maintained a loyal user base and stable transaction frequency. Such growth leads to considerable cross-selling opportunities, allowing PayPal to derive more revenue as it expands its ecosystem.

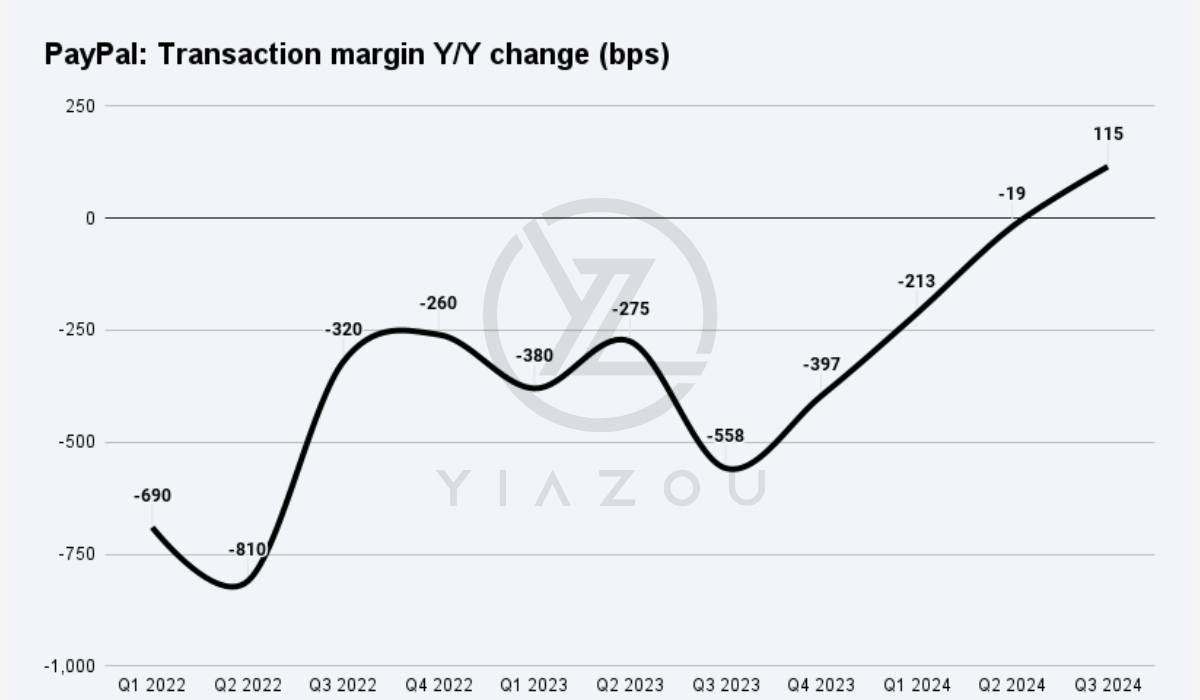

Fundamentally, transaction margins present a vital positive to PayPal’s profitability. The transaction margin moved from 50.9% in Q1 2022 to 46.6% in Q3 2024, showing minor margin compression. However, the recent quarters stabilize this margin, averaging around 45-46%. The YoY change in transaction margin basis points ((bps)) has improved.

For instance, after a sharp 380 bps decline in Q1 2023, Q3 2024 displayed positive growth of 115 bps. This trend shows that PayPal has sharply managed cost pressures, boosting its profitability margins. For transaction margin, PayPal has revised its annual guidance upwards to mid-single-digit growth. Previously, it had low to mid-digit growth. However, since Q1 2022, the stock dropped by ~30% despite the considerable growth in business activity.

Yiazou

Moreover, Revenue growth also marks PayPal’s stable performance, as revenue rose from $6,483 million in Q1 2022 to $7,847 million in Q3 2024. This is a 21% increase over the period, showing PayPal’s success in customer acquisition and engagement. YoY revenue growth has remained fairly constant, though it shows a bit of deceleration. Revenue growth peaked at 10.74% in Q3 2022, with the following quarters maintaining a stable range between 7% and 9%, indicating market maturity while still marking solid expansion. PayPal’s stable revenue gains and expanding user base mark a core strength in deriving income across its platform.

PayPal’s Rollercoaster Marketing Spend: Boost or Barrier to Growth?

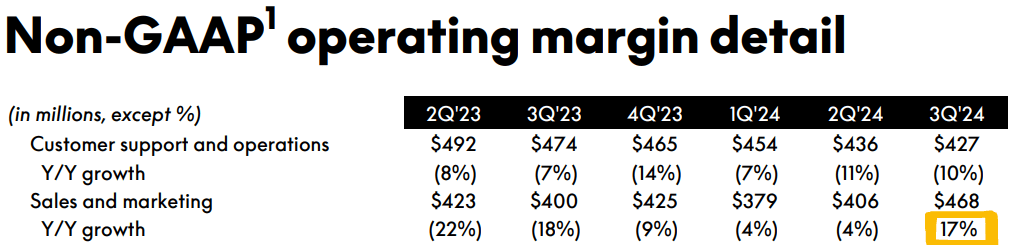

PayPal’s spending on sales and marketing has fluctuated significantly, which may impact its capability to attract new users and increase engagement. Sales and marketing expenses dropped considerably YoY from Q2 2023 to Q2 2024. For example, PayPal spent $423 million in Q2 2023, yet by Q1 2024, this had dropped to $379 million. This YoY decline of 22% in Q2 2023 and 18% in Q3 2023 indicates a constant reduction in marketing investment. Although Q3 2024 saw an increase in marketing spending to $468 million, marking a 17% YoY rise, this growth may reflect an attempt to regain prior momentum rather than a stable, constant investment in growth.

Relative to a 5.78% revenue growth, the larger jump in sales and marketing expenses points to the fact that the top-line growth became costly this quarter and unsustainable with cuts in expenses in upcoming quarters. The sporadic nature of marketing expenditures could pose a challenge to PayPal’s user acquisition and engagement efforts. This fluctuating investment in sales and marketing may impact PayPal’s capability to effectively bring in new users and retain existing ones, making it harder to sustain.

PYPL Q3 Earnings

Undervalued Growth with Strong Earnings Potential

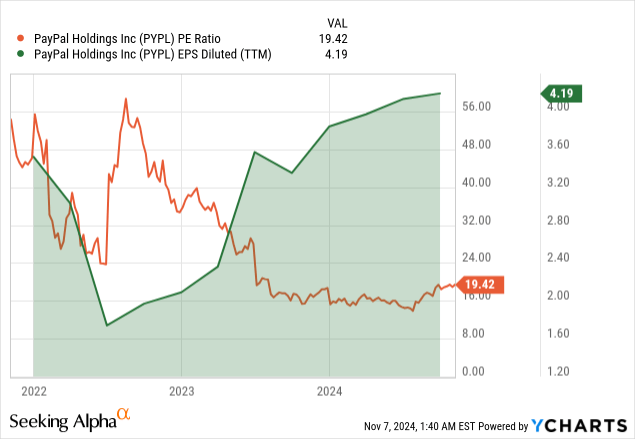

Further, PayPal’s EPS trend signals considerable earnings growth. Normalized diluted EPS climbed sharply, rising from $0.37 in Q1 2022 to $0.91 in Q3 2024, while the price-to-earnings (P/E) ratio remains low. This is a 146% boost, marking PayPal’s sharp growth in earnings, suggesting sharp operational advances or effective cost management. The YoY growth rate for EPS also shows solid profitability momentum. EPS growth spiked sharply to 78.79% in Q1 2023, marking PayPal’s boost in earnings. In the following quarters, the YoY growth remained high, at 28.97% in Q3 2024, demonstrating PayPal’s sustained, strong profitability.

Finally, PayPal’s valuation metrics strengthen its growth potential by showing an attractive price level. Its forward price-to-sales (P/S) ratio stands at 2.5, 15.47% below the sector median of 2.96. This undervaluation points to PayPal’s potential in the market relative to competitors. PayPal’s current P/S ratio is at a 58.52% discount compared to its five-year average P/S ratio of 6.03.

However, PayPal’s forward non-GAAP P/E ratio tells another story. With a P/E of 17.32, PayPal stands 41.73% above the sector median of 12.22, reflecting an edge in PayPal’s projected earnings. Compared to its five-year average P/E ratio of 30.89, this current figure marks a 43.97% discount. Though higher than peers, this valuation remains below the company’s average. These metrics show that PayPal holds considerable growth potential and is undervalued relative to its consolidated five-year average.

Moreover, PayPal’s diluted forward EPS growth rate has significantly reduced compared to its five-year average. Currently, PayPal’s forward EPS growth rate stands at 5.79% relative to its five-year average of 13.99%, representing a 58.63% decrease, pointing to a considerable gap in growth compared to past performance.

Although PayPal’s forward EPS growth rate is still above the sector median of 4.16%, this outperformance (39.04%) may not be enough to reassure stockholders who have come to expect double-digit growth rates. This deceleration could reflect underlying challenges, such as increased competition, saturated markets, or rising operational costs, that PayPal has yet to overcome. Reduced EPS growth dampens PayPal’s undervaluation and potentially impacts its stock price in the near term.

In short, PayPal’s revenue and EPS growth rates reflect constant underperformance against its long-term (five-year) averages. The drops in forward revenue and EPS growth signal a fundamental slowdown in PayPal’s core metrics moving forward. This decline in performance relative to its five-year averages could indicate that PayPal may struggle to sustain the growth rates and justifies the undervaluation against historical levels.

Additionally, PayPal’s forward revenue growth rate reflects a considerable slowdown compared to its longer-term growth average. It stands at 6.93%, which is higher than the sector median of 5.43% but considerably lower than its five-year average of 14.05%.

This discrepancy marks a 50.71% drop relative to its average growth rate and reflects that PayPal’s top-line growth has sharply decelerated. This underperformance against its past revenue growth is a core weakness in its growth trajectory. While PayPal’s forward revenue growth still outpaces the sector median by 27.55%, the sharp decline from its prior performance could signal that PayPal’s growth potential may be slowing in the maturing digital payments market.

Takeaway

PayPal’s fundamentals showcase a solid growth trajectory, with a 146% EPS increase and resilient transaction volume, signaling strong profitability and user retention. Despite slight revenue deceleration, effective cost management and a low forward price-to-sales ratio position PayPal as an undervalued growth opportunity with robust earnings potential.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.