Summary:

- Tesla’s CEO Elon Musk’s reputation has been damaged, in my view, leading to a change in sentiment towards the company.

- Tesla’s shrinking margins and declining financial position raise concerns about its long-term sustainability.

- The current sentiment shift and financial challenges suggest that Tesla’s stock is overvalued.

Sky_Blue

Full disclosure, I never liked Tesla (NASDAQ:TSLA) as an investment, but I always thought it was a great company. I think TSLA should be admired for transforming the auto market, making electric vehicles accessible, and starting the major conversion away from fossil fuel vehicles. You have to be impressed with what TSLA’s CEO has accomplished.

However, as an investor, I’ve never been fully convinced about Tesla as a viable investment. I never liked the hype that surrounds the company’s CEO Elon Musk. As a battleground stock, the company’s valuation has often seemed detached from traditional fundamentals and been extremely volatile, making it difficult to gauge its true worth. I really dislike being unable to understand a company’s value.

I always believed the cult of personality is really what drove TSLA’s excessive value and the cult is in trouble. This is the primary thesis of this article.

Now that Musk’s reputation has been slightly dinged which I discuss below, TSLA shares will suffer. Of course there are other solid reasons to short TSLA that I will cover below.

Everyone knows that the competitive landscape in the electric vehicle market is rapidly evolving, with established automakers and emerging players vying for market share, adding further uncertainty to Tesla’s future position. The increased cost of capital. The unpredictability of Elon Musk’s actions and communication style has occasionally led to market disruptions and heightened risk for investors. I believe these past lapses were warning signs of bigger more problematic events for Musk in the future.

It has proven to be a dangerous short in the past, and the stock price has grown 2436% over the previous 10 years; more than 100% per annum. Even though I believed Tesla was a bad investment, I never thought it was a good short because of the hype, the technicals, and the rabid fan base. But times have changed and I now believe the sentiment towards TESLA and Musk is changing.

This incredible growth that has been engineered by its controversial CEO, Elon Musk might be coming to an end.

Recently Musk is in the news for all the wrong reasons. It appears as though sentiment regarding TSLA and Elon Musk is beginning to change. Elon has been under heavy fire for his mismanagement of Twitter which you can read more about here. The controversial renaming of the company to X has been a firestorm according to the New York Times and you can read about that here. A 2022, Rolling Stone’s article alleges numerous cases of sexual harassment and the creation of a misogynist culture at TSLA and all of Musk’s businesses. Everything used to just bounce off Musk like bullets off superman. A few mishaps at TWTR later seems to have created the possibility of failure and failure more than anything else acts like kryptonite to Musk.

TSLA fanboys and shareholders need to maintain the illusion of perfection or the whole cult of personality starts to crumble. Anything less than awesome and the image of Elon Musk as a world beater begins to look more and more like a facade. Recently, Musk hasn’t looked very awesome.

As someone that focuses on trends and shifts in sentiment let me tell you that cool becomes uncool pretty quickly in the social media universe that Musk now travels in, and uncool doesn’t sell as many cars as sexy does.

A Change of Focus

I also assess that Musk has been less laser focused on TSLA after he guaranteed himself receiving the last tranche of options once TSLA was worth over $650 billion dollars. At this point there really isn’t much for Musk to gain at TSLA. He’s off to play other games. It’s game over at TSLA and he hit the high score. If that doesn’t scare shareholders, I don’t know what will.

He got 127.7 million options vested to him over the last decade according to this Forbes article. He literally has almost nothing left to gain at TSLA. Sure a higher price benefits him but not as much as creating a new company might earn him. Although he might attempt to do more at TSLA, I wouldn’t count on it for these reasons.

There are more victories for Musk to have and more companies to build and better opportunities to get more options elsewhere. If I was a TSLA investor this would concern me. Which is ironic because one would think that having Musk slow down his excessive compensation would help the company. I would argue that it is possible that because Musk doesn’t benefit from TSLA growth TSLA won’t grow that fast anymore and might even go in the opposite direction. I believe the shares are less protected than they used to be. Combine that with Musk’s apparent vulnerability and it appears the negative sentiment might just catch up to him unless he can run faster than the flash.

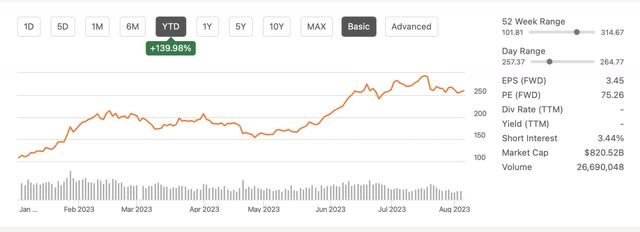

Not only has Musk appeared vulnerable but so has TSLA. This year the momentum has stalled. Sure year to date TSLA is up 139% but over the last year TSLA is down 16%.

Seeking Alpha

Recent trading since the July shows that the balloon appears to have hit the ceiling and Elon is too busy recreating Twitter or X to notice. Investors however are noticing and the sentiment is changing.

These factors make TSLA’s forward P/E of over 100 harder to swallow than in the past. The recent discounted prices of its cars highlight its upcoming margin issues, but cutting costs does not mean they will grab enough market share. It appears impossible to predict how much market share Tesla can get given the current competition but it appears that the current answer is not enough to justify its current price.

It means the slim margins of the auto industry have finally become a reality for TSLA’s future earnings whereas previously they were thought to be only the competition’s problem. It means gravity is just beginning to wear on TSLA’s shares. The pendulum swings and in TSLA’s case it appears to be swinging lower.

But don’t mistake these numbers as evidence. The only thing that I think matters here is sentiment.

TESLA’s Shrinking Margins and the Return of Gravity

TSLA stock price has long ignored gravity because of hype and cheap capital. The Government subsidies have been a major boon but how long can TSLA count on them? Tesla’s recent Q2 earnings report has raised concerns among investors, and created a chink in its armor. The decline in margins during Q2 has triggered red flags, but the vulnerability of Musk has been more like flashing neon danger signs. These factors led me to consider shorting Tesla’s stock.

One of the glaring concerns is the shrinking operating margins. Tesla’s GAAP operating margin fell to 9.6% in Q2, a significant drop from 14.6% a year ago. Even more concerning is that this margin metric was at an impressive 20.8% just two years ago. The decline in gross margin is also worrying, coming in at 18.2% in Q2 compared to 25.0% a year ago. Such a decline signals a weakening financial position.

The margin contraction can be attributed, in part, to Tesla’s decision to lower prices during the quarter. A Reuters report titled, “Tesla cuts U.S. prices for sixth time this year ahead of quarterly results” shows how price cuts have cut into margins.

These moves raise questions about the company’s ability to maintain profitability, especially in the face of ongoing cost pressures. Elon Musk’s statement during the earnings call, indicating further price cuts if economic conditions worsen, adds to the uncertainty.

From a deep value perspective, it’s vital to consider the long-term sustainability of a company’s financials. Although some may argue that Tesla has a bright future, I believe caution is warranted. The reliance on continuous price reductions to drive sales and maintain market share may not be sustainable in the long run, potentially leading to a downward spiral in profitability.

Furthermore, the mention of Tesla being open to licensing full self-driving software to other auto companies may raise concerns about the company’s competitive edge. If Tesla’s technology becomes widely available, it could diminish the uniqueness of their offerings and potentially erode their market position.

While the emphasis on AI and autonomous driving technology can be seen as a positive aspect for the company’s long-term prospects, the current financial challenges overshadow these potentials.

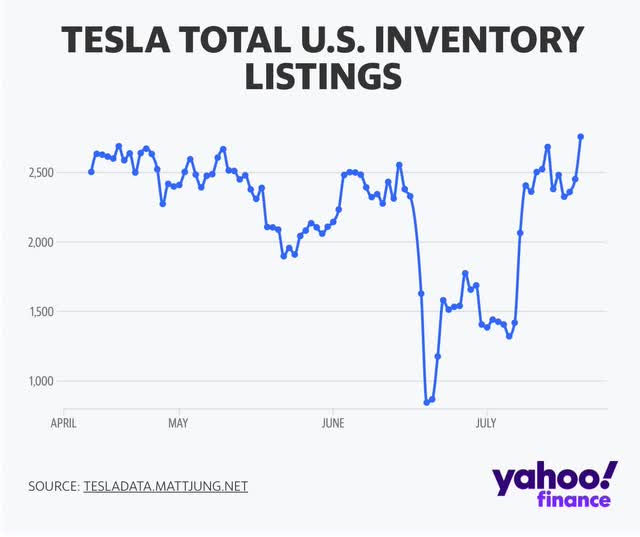

Current margin issues aside, inventories are starting to rise. Previously, TSLA sold everything it built. Now the company is building inventory.

Yahoo Finance

According to a recent report by Pras Subramanian, “A large buildup in inventory suggests Tesla could be upping its production volumes or is having a harder time selling new inventory.” The waiting list is getting shorter and TSLA appears less bold than it once was, less cool than it once was, and more like a normal auto company than it has ever been before.

Risks to the Short Thesis

Tesla could continue to dominate the car world and become the biggest in the world. TSLA might also lockdown charging and battery technology that could be licensed to other car manufacturers. Musk could regain his reputation as invincible and could renew his dedicated attention on TSLA again. TSLA could develop new technologies or products that no one has considered; after all TSLA is more than just a car company. At least this is what people always tell me.

Conclusion

Don’t get me wrong, I personally would love to drive a TSLA. I think it’s a great company. A fabulous car company. Maybe the best car company in the world and that certainly deserves a premium. I just think it’s incredibly overvalued. I think a premium of perhaps 25 times earnings would be reasonable.

They do receive 85% of their revenue as a car company though so I would prefer to value them as 85% a car company. This means I can no longer justify the 75 times price to earnings premium. I know that rational earnings multiples have been an old debate. I know people don’t think these numbers can be used to value TSLA, but I believe in Ben Graham’s philosophy, “In the short run, the market is a voting machine but in the long run it is a weighing machine.” I think we are beginning to see the weighing machine weigh down on TSLA’s stock price.

I would consider giving TSLA a rather generous 25 times earnings which would put TSLA at around $70.75. I would even consider adding a premium due to brand strength and raise the target to $100 but anything higher than $130 seems excessive, and probably has been excessive for over a year. Tesla’s are cool but not that cool. The previous highs of Tesla were fueled by the passion for the company, the love of its products and the admiration of its CEO. I believe the passion is beginning to fade, the love is becoming affection and the admiration is evaporating. For these reasons reality should start to set in. We have seen this play out in other high flying stocks before. Eventually the weighing machine has the final say.

As to multiples, let me just say they are difficult to predict which is why I prefer using a range of probabilities to determine value. A conservative multiple of 15 would put Tesla at $42.45 but I believe this is too low. If it traded with a P/E somewhere between Ford (F) and Toyota (OTCPK:TOYOF) of about 10x, you would get a stock price of $28.30. This would be way too low for me but that doesn’t mean they are not possible multiples in the future.

Luckily the current price of $254 leaves plenty of safety to the downside. I would never short Tesla directly. I have however bought puts which limits the potential loss if I happen to be wrong. I chose the 1/19/2024 puts with a strike price of $210 right after earnings. These options have already risen in value and might not be advisable by the time of publication but were relatively cheap and still have the ability to make significant profits if my short thesis is correct.

I believe TSLA is vulnerable right now because Musk is vulnerable right now. Current sentiment is shifting against both Musk and TSLA and sentiment reigns supreme over cult personality stocks in my opinion. Of course sentiment could swing back in Musk’s favor but I wouldn’t count on it happening before 2025.

Given the current sentiment I consider the reasonable trading range of Tesla to be somewhere between $28.30 and $70.75. If I give Tesla the benefit of the doubt, I could even see a price of $125 but I would prefer to just doubt. Given its current price of $254, we consider TSLA to be severely overvalued no matter the scenario.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.